In the fast-paced world of business, efficiency and clarity are not just buzzwords – they’re essential tools for success. Whether you’re a seasoned entrepreneur, a busy freelancer, or managing a growing team, the sheer volume of transactions and communications can quickly become overwhelming. This is where professional documentation, like a well-crafted wire transfer agreement sample, truly shines. It’s more than just a piece of paper; it’s a foundational element for secure, transparent, and hassle-free financial interactions.

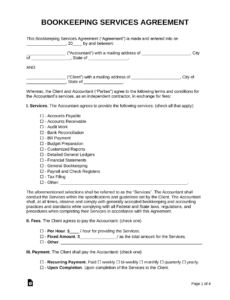

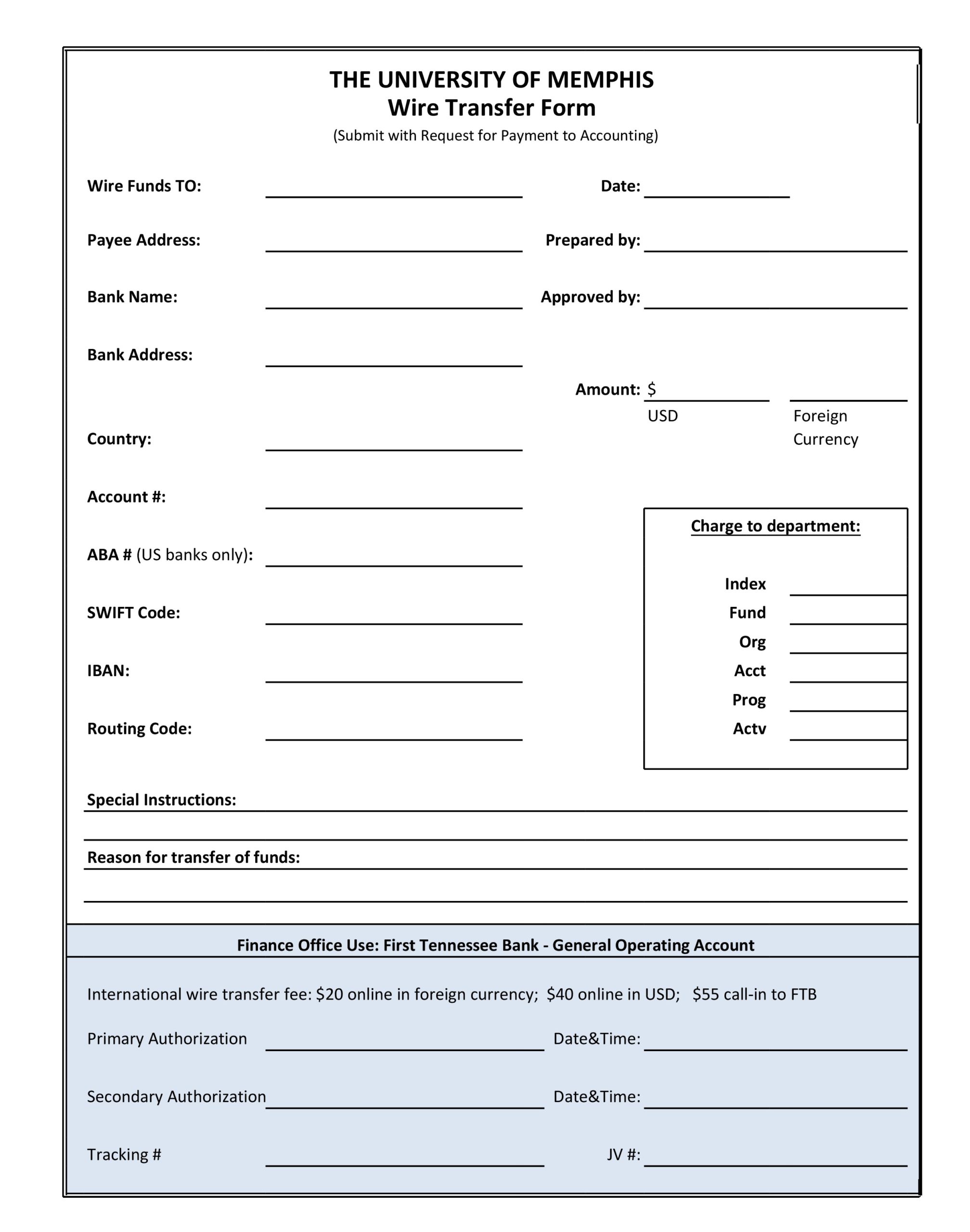

The purpose of having a reliable wire transfer agreement sample is to provide a standardized, clear, and legally sound framework for sending or receiving funds via wire. It helps both parties understand the terms, conditions, and responsibilities involved, minimizing misunderstandings and protecting everyone’s interests. Anyone who regularly deals with significant financial transactions – from small business owners and property managers to international traders and service providers – stands to benefit immensely from incorporating such a document into their operational toolkit.

The Importance of Organized Planning and Professional Documentation

Think of professional documentation as the blueprint for your business operations. Just as you wouldn’t build a house without detailed plans, you shouldn’t conduct significant financial transactions without clear records. Organized planning, underpinned by robust business documentation, brings a multitude of advantages that impact clarity, legality, and trust. It ensures that every party involved understands their obligations and expectations from the outset.

When you invest time in creating or adapting a professional layout for your agreements, you’re not just being neat; you’re building a reputation for reliability. Clear documentation acts as an unambiguous reference point, eliminating ambiguity that can lead to disputes or delays. This clarity fosters greater trust among partners, clients, and vendors, strengthening your professional relationships and enhancing your overall business credibility. Furthermore, in the event of any legal query or audit, having a comprehensive compliance record readily available can save immense time, stress, and potential financial penalties. It demonstrates due diligence and a commitment to transparent practices.

Key Benefits of Using Structured Templates and Forms

Adopting structured templates and forms, like a robust contract template, can revolutionize how you manage your professional engagements. These tools are much more than mere placeholders; they are productivity boosters designed to streamline your workflows. They provide a consistent framework that ensures all critical information is captured, every time, without fail. This consistency is invaluable for maintaining a high standard of professional communication.

One of the most significant benefits is the considerable time savings they offer. Instead of drafting a new agreement from scratch for each transaction, you simply fill in the specific details into a pre-approved layout. This frees up valuable time that can be redirected to core business activities or strategic planning. Moreover, these structured documents reduce the risk of oversight. Essential clauses, disclaimers, and required fields are already built-in, acting as a checklist to ensure nothing important is forgotten. This significantly reduces the potential for errors or omissions that could lead to future complications or legal challenges. They truly are an asset for efficient document signing.

How This Template Can Be Adapted for Various Purposes

While its primary application might be in financial transfers, the underlying principles of a well-structured agreement template are incredibly versatile. The same meticulous approach to detailing terms, responsibilities, and conditions can be adapted across a wide spectrum of professional and personal engagements. Consider how a simple wire transfer agreement sample informs the structure of other critical documents.

For instance, this robust framework can be customized to create comprehensive service agreements, clearly outlining project scope, payment schedules, and deliverables for freelancers or consultants. It can form the basis of a business partnership agreement, defining roles, contributions, and profit-sharing models, serving as a foundational memorandum of understanding. Property managers can adapt it for rental agreements, specifying payment terms, maintenance responsibilities, and tenant obligations. Even for personal transactions of significant value, modifying the document can provide peace of mind. The core idea is to establish a clear, documented understanding between parties, regardless of the specific nature of the transaction or relationship. The adaptable nature of a good contract template makes it an indispensable tool for diverse scenarios.

Examples of When Using a Wire Transfer Agreement Sample is Most Effective

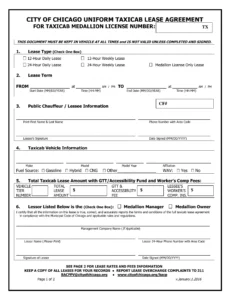

Having a clear agreement is paramount in situations where funds are transferred, especially when dealing with large sums or international transactions. It formalizes the understanding between parties and provides a safety net. Here are some examples of when incorporating a wire transfer agreement sample is particularly effective:

- International Business Payments: When sending or receiving large sums across borders, currency conversion, varying bank regulations, and transfer fees can complicate matters. A detailed wire transfer agreement sample clarifies all these points, ensuring both parties are on the same page regarding the exact amount, currency, and who bears which fees.

- Real Estate Transactions: Buying or selling property often involves significant wire transfers for down payments or closing costs. This document can specify the exact amount, the beneficiary account, the purpose of the transfer, and any conditions that must be met before the transfer is initiated, offering a clear legal contract.

- Large Service Provider Payments: If you’re paying a contractor, consultant, or agency a substantial fee for their services, this form can ensure that the payment schedule, amount, and the specific services tied to each payment are clearly documented, serving as a robust service agreement.

- Investment Transfers: For investments that require funds to be wired to a brokerage account or a specific investment vehicle, the template ensures all details, including account numbers, fund names, and investor identification, are correctly captured and agreed upon, creating an essential compliance record.

- Loan Disbursements/Repayments: Whether you’re a private lender or borrowing from one, using this form for loan disbursements or scheduled repayments provides a clear record of the transaction, protecting both the lender and borrower with explicit terms.

- High-Value Goods Purchases: For purchasing expensive items like vehicles, machinery, or custom-made goods, where a wire transfer is the preferred payment method, the document can stipulate the item being purchased, its cost, and the conditions under which the payment is finalized.

Tips for Better Design, Formatting, and Usability

A professional document isn’t just about the content; its design and usability play a crucial role in how effectively it communicates. Thoughtful formatting makes a significant difference, whether for print or digital versions. For a document like this, clarity and ease of understanding are paramount.

First, focus on a clean, uncluttered layout. Use ample white space to prevent the document from looking dense and overwhelming. Employ clear headings and subheadings to break up information and guide the reader’s eye through the content. For headings, a slightly larger font size and bolding are effective, but avoid excessive use of different fonts or colors, which can detract from professionalism. Consistency in font choices (typically one sans-serif for headings and one serif for body text, or a single professional sans-serif) improves readability.

Paragraphs should be concise, ideally two to four sentences long, to facilitate easy digestion of information. Use bullet points or numbered lists for items like responsibilities, conditions, or required information, as they are much easier to scan and comprehend than dense blocks of text. Ensure all critical fields for information entry are clearly labeled and have sufficient space for manual or digital input. For digital versions, consider using fillable PDF forms to enhance usability and reduce errors. Include clear instructions for document signing, specifying methods (e.g., electronic signature, wet signature) and any witnessing requirements. Finally, always include version control and a date stamp to keep track of revisions, ensuring everyone is working from the most current agreement. This attention to detail elevates the business file from a simple form to a highly functional and professional layout.

In the realm of professional communication, a well-structured agreement is not merely an optional extra; it’s a foundational element for secure, transparent, and efficient operations. By leveraging a comprehensive template, you empower your business with a clear roadmap for financial transactions, mitigating risks and fostering trust. This robust business documentation tool ensures that every wire transfer, whether domestic or international, is handled with precision and professionalism, aligning with your commitment to smart business practices.

Embracing the use of a professional document for your wire transfers ultimately translates into tangible benefits: saving valuable time, enhancing legal clarity, and projecting an image of organized reliability. It’s an investment in smoother operations, stronger relationships, and greater peace of mind. So, make it a standard practice in your workflow; your future self, and your business partners, will thank you for the clarity and security it provides.