Navigating the complexities of lending or borrowing money, especially when property is involved, can feel like walking through a legal minefield. Whether you’re a small business owner extending credit for a substantial purchase, an individual formalizing a personal loan to a family member, or even a landlord establishing a security deposit agreement, the need for clear, legally sound documentation is paramount. That’s precisely where a well-crafted property loan agreement template becomes an invaluable asset, transforming potential headaches into streamlined, professional interactions.

This article is for anyone who values productivity, organization, and smart business communication. We’re going to dive deep into why having a reliable, adaptable template for such critical financial arrangements isn’t just good practice—it’s essential. Think of this as your guide to mastering the art of professional documentation, ensuring clarity, protecting your interests, and building trust in every financial interaction, without getting bogged down in legal jargon or starting from scratch every single time.

The Foundation of Trust: Why Professional Documentation Matters

In today’s fast-paced world, relying on verbal agreements or casual emails for significant financial transactions is a recipe for disaster. Professional documentation serves as the bedrock of clarity, legality, and mutual trust between parties. It eliminates ambiguity, sets clear expectations, and provides a tangible record that can be referenced by everyone involved.

For businesses and individuals alike, organized planning extends beyond daily tasks to foundational agreements. A robust legal contract ensures that all terms, conditions, and repayment schedules are explicitly detailed, leaving no room for misinterpretation down the line. This proactive approach significantly reduces the risk of disputes, saving you invaluable time, money, and emotional energy. It also demonstrates a commitment to transparency and professionalism, which naturally fosters stronger relationships and a solid compliance record.

Beyond Blank Pages: The Strategic Advantages of Structured Templates

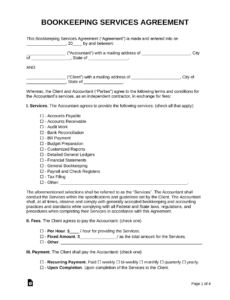

Imagine having to draft every single legal document from scratch. It would be an exhaustive, error-prone, and incredibly inefficient process. This is precisely why embracing structured templates, forms, or agreement layouts is a game-changer for anyone dealing with contracts. They provide a standardized framework that ensures consistency across all your agreements.

Utilizing a comprehensive contract template streamlines your workflow, allowing you to focus on the specific details of each agreement rather than the foundational structure. It minimizes the risk of overlooking critical clauses or legal requirements, providing a built-in safety net. Furthermore, a professional layout enhances readability and comprehension for all parties, making the document signing process smoother and more confident. Ultimately, these tools empower you to manage complex documentation with remarkable ease and precision.

More Than Just Loans: Adapting This Framework for Diverse Agreements

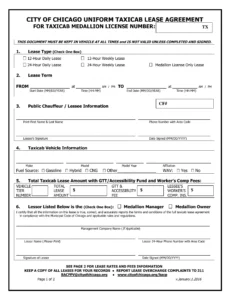

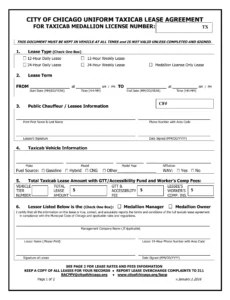

While our focus here is on property loans, the principles and structural elements found in a robust property loan agreement template are remarkably versatile. The underlying architecture—clear identification of parties, detailed terms, conditions, payment schedules, default clauses, and dispute resolution mechanisms—can be adapted to a wide array of contractual needs. Think of it as a master key for professional communication.

This adaptability means you can repurpose the core concepts for various scenarios. A freelancer onboarding a new client might adapt elements for a service agreement, clearly outlining deliverables and payment terms. Businesses forming a new venture could use it as a foundation for a business partnership agreement or even a memorandum of understanding, detailing responsibilities and profit-sharing. Landlords often use similar structures for rental agreements, covering everything from rent to maintenance responsibilities. The common thread is a need for clarity and legal enforceability in any formal exchange.

When to Leverage a Property Loan Agreement Template

Understanding the specific scenarios where a structured property loan agreement template proves most effective can significantly enhance your operational efficiency and legal protection. It’s not just for banks; individuals and small businesses benefit immensely from this level of detail. Here are some key situations where deploying this business file is highly recommended:

- Intra-Family Loans: When lending or borrowing money among family members for significant purchases like a home down payment or a new car. A formal agreement prevents misunderstandings and maintains healthy relationships.

- Private Mortgage Loans: If you are acting as a private lender, perhaps to help someone purchase a property directly from you or a third party, bypassing traditional banks. This ensures all legal obligations and repayment terms are clear.

- Business Loans Backed by Property: When a business loan is secured by real estate, either personal or commercial. This provides crucial security for the lender and clear terms for the borrower.

- Financing Property Investments: For investors who lend money for renovation projects or real estate flips, where the loan is secured against the property being developed. Detailed clauses protect both the capital and the investment.

- Seller Financing Agreements: In situations where the seller of a property acts as the financier for the buyer. This contract details the purchase price, interest rate, payment schedule, and default remedies.

- Security Deposit Agreements for High-Value Rentals: Although often part of a broader rental agreement, a specific, detailed addendum for a substantial security deposit, especially for commercial properties, can be vital.

- Partnership Buyout Agreements with Property Involvement: When one partner buys out another’s share in a business where property is an asset, this template can form the basis of the financial arrangement.

Crafting Your Documents for Maximum Impact: Design & Usability Tips

A contract is only effective if it’s clear, easy to understand, and visually accessible. When working with any formal document, especially a comprehensive one like a property loan agreement template, design and usability are not mere afterthoughts—they are integral to its success. A well-designed document reflects professionalism and encourages thorough review from all parties.

First, prioritize readability. Use clear, legible fonts (like Arial or Calibri) at a comfortable size (10-12 points). Break up dense text with headings and subheadings, and use bullet points or numbered lists for complex details. White space is your friend; don’t cram too much information onto one page. Ensure margins are generous for notes or filing. For digital versions, optimize for screen viewing by using a logical flow, interactive checkboxes where appropriate, and ensure compatibility across different devices and operating systems. If you anticipate document signing electronically, verify that your chosen platform integrates seamlessly with the layout. Always save and share your final versions as PDFs to preserve formatting and prevent unauthorized edits, while also having an editable version for future adaptations. This meticulous approach to layout and formatting enhances comprehension and minimizes potential friction.

The Future is Organized: Your Tool for Clarity and Control

In an environment where clarity and efficiency are prized, having a reliable property loan agreement template isn’t just about fulfilling a requirement; it’s about strategically empowering your financial interactions. This isn’t just another form; it’s a testament to smart business communication and an investment in your peace of mind. By leveraging such a comprehensive template, you’re not just documenting a transaction; you’re setting a standard for professionalism and transparency.

Embrace the power of structured documentation to save time, reduce stress, and ensure every agreement is legally sound and crystal clear. Whether you’re a seasoned entrepreneur, a busy freelancer, or an individual navigating complex personal finances, a well-prepared template is your ally. It frees you from the tedious task of reinventing the wheel for every new agreement, allowing you to focus on what truly matters: building strong relationships and achieving your financial goals with confidence and precision. Make organization your superpower, and let well-crafted documents be your guide.