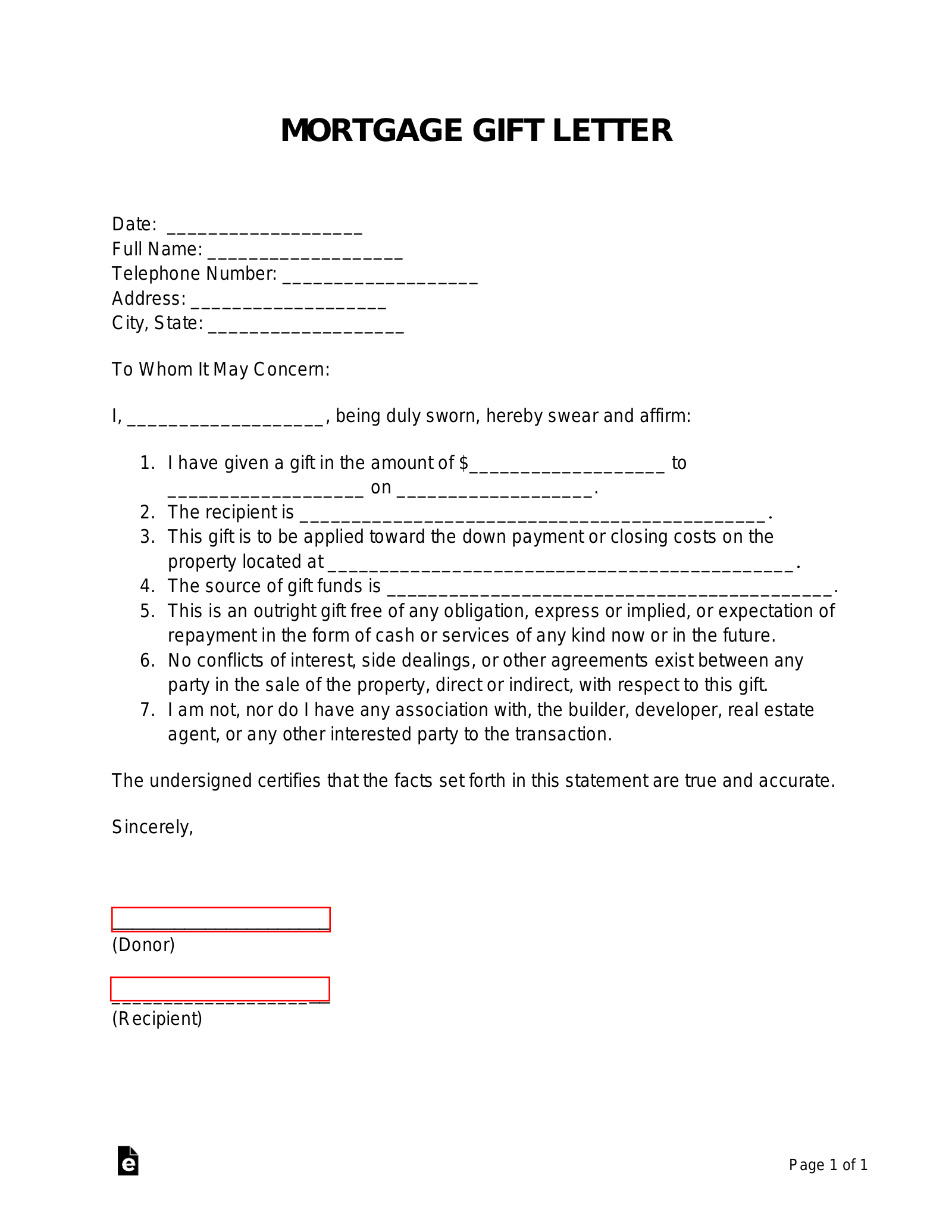

Securing a mortgage is often a complex financial undertaking, requiring meticulous documentation and adherence to stringent guidelines. Among the various documents lenders may request, a gift letter holds a significant place, especially when a portion of the down payment or closing costs is provided by a third party, such as a family member or friend. This critical piece of formal correspondence serves to verify that the funds are indeed a gift, not a loan, and therefore do not require repayment, which could impact the borrower’s debt-to-income ratio.

The purpose of a mortgage gift letter template is to provide a standardized, clear, and legally compliant framework for this essential communication. It streamlines the process for both the donor and the recipient, ensuring all necessary information is accurately captured and presented in a format acceptable to mortgage lenders and financial institutions. Beneficiaries include prospective homeowners who rely on gifted funds for their purchase, as well as the donors themselves, who gain clarity on the required information and the implications of their generous contribution.

The Importance of Written Communication and Professional Documentation

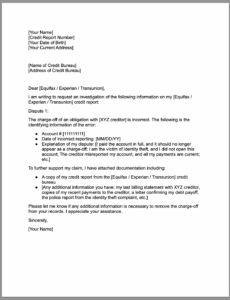

In both business and personal realms, the significance of precise written communication and professional documentation cannot be overstated. Formal correspondence acts as an official record, mitigating misunderstandings and providing a clear point of reference for all parties involved. Whether dealing with contractual agreements, financial transactions, or critical administrative notifications, well-crafted documents are indispensable for establishing credibility and ensuring transparency.

Professional documentation, such as a well-structured business letter or a meticulously prepared official record, reflects an organization’s or individual’s commitment to accuracy and accountability. It serves as a verifiable account of facts, intentions, and agreements, forming the bedrock of sound decision-making and legal compliance. In high-stakes situations like property acquisition, where substantial sums of money and long-term commitments are involved, the integrity of every document is paramount.

Key Benefits of Using a Structured Mortgage Gift Letter Template

Utilizing a structured mortgage gift letter template offers numerous advantages, fundamentally enhancing the efficiency and reliability of the mortgage application process. This type of carefully designed document provides a consistent framework, ensuring that all requisite details are included without oversight. It serves as a guide for both the gift giver and the recipient, simplifying what could otherwise be a confusing and error-prone task.

This template actively helps maintain professionalism, consistency, and clarity in communication. By standardizing the format and content, it minimizes ambiguities that could lead to delays or rejections from lenders. A uniform layout reinforces the official nature of the document, instilling confidence in its validity and purpose. Furthermore, the use of a pre-defined structure ensures that the language used is appropriate and legally sound, reflecting the seriousness of the financial transaction it supports.

Customizing This Template for Diverse Formal Communications

While primarily designed for mortgage-related financial gifts, the underlying principles of this robust document layout can be effectively customized for various other formal communications. The core structure—which emphasizes clear identification of parties, a definitive statement of purpose, specific details of the transaction, and appropriate signatures—is universally applicable across different professional contexts. This adaptability makes the format a valuable asset for numerous types of official correspondence.

For instance, this comprehensive template structure can be adapted for formal employment notifications, such as an offer of employment or a notice of promotion. It can also serve as the basis for a formal business letter requesting specific information or resources, or even for official announcements requiring a standardized approach. The key lies in maintaining the document’s inherent clarity and professionalism, regardless of the specific content being conveyed. Tailoring the specific fields and narrative to match the unique requirements of each situation ensures that the communication remains impactful and accurate.

Examples of When Using the Template is Most Effective

The strategic application of a well-defined message template proves invaluable in numerous scenarios where clarity, legal compliance, and professional decorum are paramount. Leveraging a structured approach ensures that critical information is consistently communicated, reducing the potential for error or misunderstanding. Below are specific instances where using this form is exceptionally effective:

- Financial Gift Documentation: When a borrower receives a monetary gift for a down payment or closing costs on a home. This is the primary use case, ensuring lenders have a clear declaration that the funds are not a loan.

- Estate Planning Distributions: For documenting formal distributions of assets from an estate, ensuring that beneficiaries receive clear, written proof of the nature and amount of their inheritance.

- Scholarship or Grant Award Letters: Institutions can use a similar structure to formally notify recipients of scholarship awards or grant funding, outlining terms, conditions, and disbursement details.

- Formal Loan Forgiveness Letters: When a lender or individual formally forgives a debt, a structured letter provides legal documentation of the waiver of repayment obligations.

- Inter-Family Financial Agreements: For formalizing agreements concerning significant financial transfers within a family, ensuring clear understanding and preventing future disputes.

- Donations to Non-Profit Organizations: While often simpler, a formal template can be adapted for significant donations, providing robust documentation for tax purposes and organizational records.

- Proof of Funds Verification: In situations requiring verification of available funds for a major purchase or investment, a letter confirming the origin and non-repayable nature of funds can be adapted.

In each of these examples, the principle remains constant: clear, unambiguous written communication, supported by a formal template, serves as an indisputable official record, protecting all involved parties.

Tips for Formatting, Tone, and Usability

To maximize the effectiveness and professional impact of any formal correspondence, careful attention to formatting, tone, and usability is essential for both print and digital versions. These elements collectively contribute to the document’s legibility, credibility, and overall message reception.

Formatting:

- Clear Headings and Subheadings: Utilize

<h2>and<h3>tags (or bolded text in print) to break up content, making the document easy to scan and comprehend. - Professional Font Choice: Opt for standard, legible fonts such as Arial, Calibri, or Times New Roman, typically between 10-12 points for body text.

- Consistent Margins and Spacing: Maintain standard 1-inch margins and use single or 1.15 line spacing for readability, with an extra line break between paragraphs.

- Bullet Points and Numbered Lists: Employ these where appropriate to present information concisely and improve readability, especially for conditions, requirements, or lists of items.

- Signature Blocks: Ensure clearly demarcated signature lines with printed names and dates for all required parties, reinforcing the document’s authenticity.

Tone:

- Formal and Objective: Maintain a professional and impartial tone throughout the letter. Avoid colloquialisms, jargon, or emotional language.

- Concise and Direct: Get straight to the point, conveying information clearly and succinctly. Unnecessary embellishments can dilute the message.

- Respectful and Authoritative: The language should project authority and confidence without being arrogant. Show respect for the recipient and the gravity of the communication.

- Action-Oriented (where applicable): If the letter requires a response or action, clearly state expectations and deadlines.

Usability (Print and Digital):

- Accessibility: For digital versions, ensure the file is accessible (e.g., proper alt text for images if any, logical reading order).

- File Format: Provide digital versions in universally accepted formats like PDF to preserve formatting and prevent unauthorized alterations. For templates, editable formats like Word (.docx) are crucial.

- Print-Friendly Design: Ensure that the document prints cleanly on standard paper sizes (e.g., Letter or A4) without excessive blank pages or cut-off content.

- Clear Instructions: If the template requires completion by multiple parties, include simple, unambiguous instructions for filling out each section.

- Version Control: For templates used repeatedly, implement a version control system to ensure the most current and compliant iteration is always in use.

By adhering to these guidelines, any professional correspondence, whether a cover letter, a notice letter, or a specific financial declaration, becomes a powerful and efficient communication tool.

Leveraging Templates for Enhanced Professional Communication

In an environment where precision and accountability are paramount, the strategic utilization of a well-designed message template stands as a testament to effective business communication. This approach not only streamlines the creation of essential documents but also significantly elevates the overall standard of formal correspondence. By providing a consistent and robust framework, a reliable template ensures that every communication is both comprehensive and professional.

Ultimately, the value of employing a structured document layout extends beyond mere convenience. It is a critical component of risk management, ensuring that vital information is accurately conveyed and legally sound. For individuals and organizations alike, embracing such tools for official communication fosters an environment of clarity, trust, and efficiency, cementing their reputation for meticulousness and professional integrity.