Let’s be honest, the thought of budgeting can sometimes feel like a chore, right? We’re all busy, juggling work, family, and personal goals, and the idea of sitting down to meticulously track every dollar might seem overwhelming. But what if I told you that organized financial planning doesn’t have to be a stressful ordeal, but rather an empowering act that brings clarity, control, and peace of mind?

For those who value productivity, organization, and smart financial moves, understanding where your money goes isn’t just a good idea – it’s a game-changer. That’s where a well-crafted yearly budget template comes into play. It’s more than just a spreadsheet; it’s your roadmap to financial freedom, designed to help you make informed decisions, achieve your savings goals, and reduce financial stress. This isn’t about restriction; it’s about intentionality and setting yourself up for success throughout the entire year.

The Unsung Hero of Financial Clarity: Why Organization Matters

Imagine trying to navigate a dense forest without a compass. That’s often what managing your finances feels like without a proper system. Disorganized financial records can lead to missed payments, overspending, and a constant underlying anxiety about your money situation. It’s hard to save, invest, or even enjoy your hard-earned cash when you’re not sure what your true financial picture looks like.

Bringing structure to your financial life is akin to clearing a path through that forest. It provides an immediate sense of clarity and control that can trickle down into all other aspects of your life. When you know your income log and expense tracker are up to date, you can make confident decisions about purchases, investments, and future plans. This level of organization not only frees up mental space but also empowers you to be more proactive, strategic, and ultimately, more successful in achieving your financial aspirations. It’s about building a robust financial organizer that serves your goals.

Unlocking the Power of Structure: Benefits of a Dedicated Financial Spreadsheet

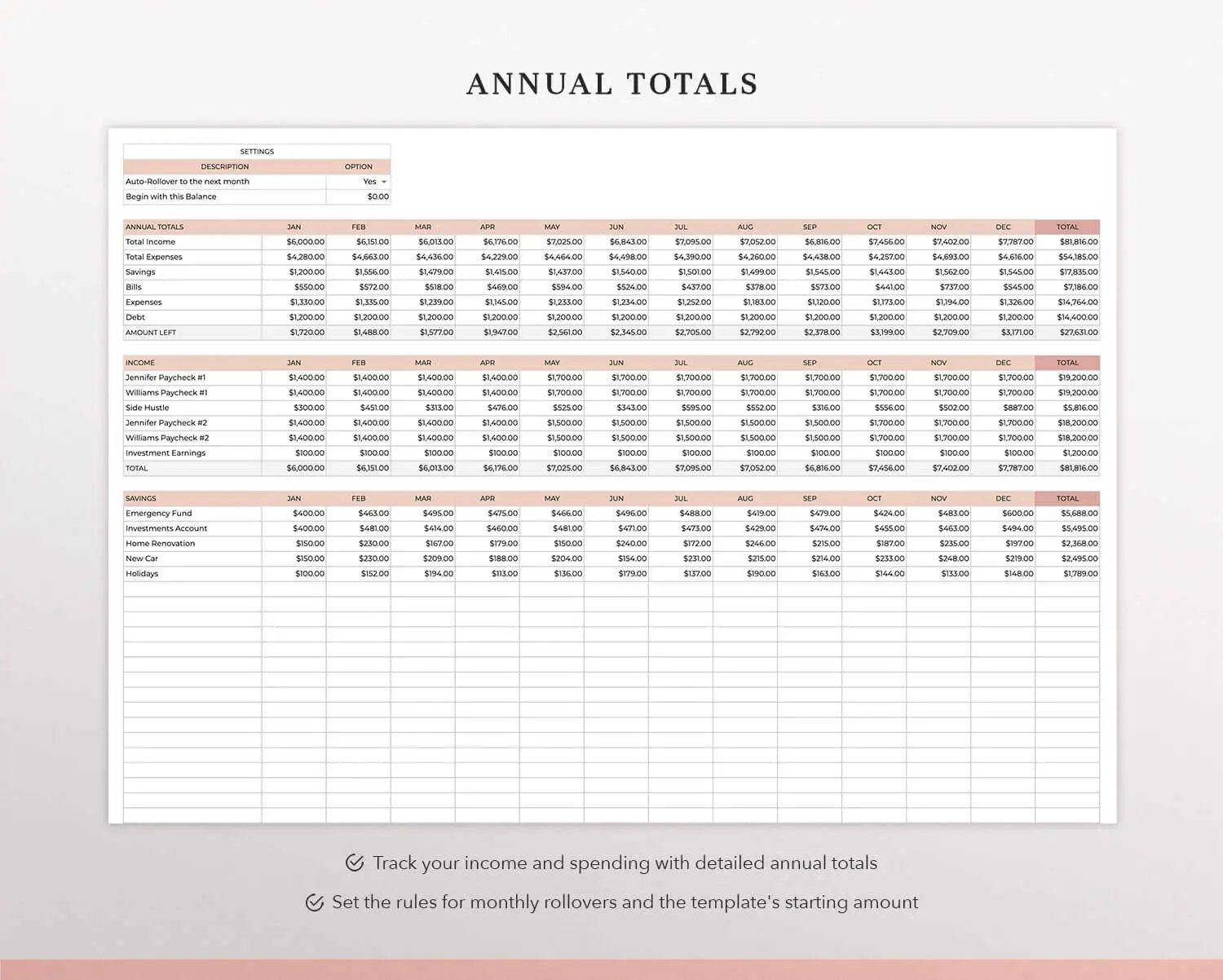

So, why bother with a structured template when a simple notepad or mental tally might seem easier? The answer lies in the profound benefits that only a dedicated financial spreadsheet can provide. Firstly, it offers a comprehensive overview, allowing you to see your entire financial year at a glance, rather than just month-to-month. This holistic perspective is crucial for identifying long-term trends and making sustainable changes.

Secondly, a well-designed budgeting system transforms abstract goals into actionable steps. Want to build a substantial emergency fund? A savings planner integrated into your sheet helps you allocate funds consistently. Worried about your cash flow? The structured layout allows you to pinpoint exactly where money is coming in and going out, helping you anticipate shortfalls or identify opportunities for growth. It’s about leveraging a smart cost management tool to create a personalized financial blueprint that evolves with your life.

Beyond Personal Finance: Adapting Your Yearly Budget Template

One of the most remarkable aspects of a robust yearly budget template is its incredible versatility. While it’s a phenomenal tool for personal finance, its structured approach can be adapted to a wide array of other financial planning scenarios. It’s not just for tracking your household bills or personal savings goals; this powerful organizational tool can scale to meet diverse needs.

For small businesses, the layout can be transformed into an essential financial dashboard, helping to monitor operational costs, track revenue, and plan for future investments. Entrepreneurs can use it to manage project-specific budgets, ensuring profitability and controlling expenditures. Event planners, whether organizing a wedding, a corporate conference, or a major family reunion, can leverage the detailed categories to manage every aspect from venue costs to catering expenses. Even for household management beyond personal finances, like planning a major home renovation or budgeting for a significant family vacation, the template provides the necessary framework to keep everything on track and within limits.

When a Yearly Budget Template Shines Brightest: Practical Applications

While having a budgeting system is always beneficial, there are specific times and situations where using a yearly budget template truly excels. These moments often involve significant planning, a need for a clear overview, or a desire for greater financial control and foresight.

Here’s when using a yearly budget template is particularly effective:

- At the Beginning of a New Year: It’s the perfect fresh start to set financial resolutions, forecast income, and allocate funds for the entire year ahead.

- During Major Life Changes: Whether you’re buying a new home, getting married, having a baby, or starting a new job, a comprehensive yearly plan helps integrate new expenses and income streams seamlessly.

- Planning for Large Purchases or Projects: Saving for a down payment, a new car, a renovation, or an extended vacation becomes much more manageable when you can spread the cost and savings goals across 12 months.

- Managing Fluctuating Income: For freelancers, commission-based workers, or those with seasonal income, the template allows for a realistic projection and allocation of funds during lean and abundant periods.

- Preparing for Tax Season: Having a year-long record of income and expenses simplifies gathering documents and identifying potential deductions.

- When Tackling Significant Debt: A detailed yearly view helps you strategize debt repayment, see progress, and stay motivated toward becoming debt-free.

- Setting and Achieving Savings Goals: Whether it’s retirement, college funds, or a specific investment, the document provides a clear path to monitor and reach your targets.

Crafting Your Perfect Financial Record: Design, Formatting, and Usability Tips

To truly make this planner a powerful ally, its design and usability are paramount. A well-designed financial organizer isn’t just functional; it’s intuitive, encouraging consistent use. When you’re creating or customizing your financial spreadsheet, think about clarity first. Use clear, concise labels for all your categories and subcategories, avoiding jargon where possible. For instance, instead of just "Bills," break it down into "Utilities," "Rent/Mortgage," "Insurance," etc., for better cost management.

Formatting plays a crucial role in usability, whether you prefer a digital or print version. For digital spreadsheets, leverage formulas to automate calculations for monthly expenses, totals, and projected balance sheet figures. Use conditional formatting to highlight overspending or show when you’re nearing a savings goal. For a print version, ensure ample space for notes and clear, readable fonts. Color-coding different sections (income, fixed expenses, variable expenses) can also enhance readability and quick comprehension. The goal is to make the record easy to update and even easier to interpret, so you spend less time crunching numbers and more time making smart financial decisions.

Making “The Spreadsheet” Work for You: Practical Advice

Getting started with a comprehensive budgeting system might feel like a big step, but remember, consistency beats intensity every time. Don’t feel pressured to have every single detail perfect on day one. Start by logging your main income streams and your biggest fixed expenses. From there, gradually add more detail, refining your categories as you go. The most effective use of the layout comes from regular engagement, even if it’s just a quick check-in once a week to log recent transactions.

Reviewing the document regularly, perhaps at the end of each month or quarter, is just as important as initial setup. This allows you to identify spending patterns, celebrate successes, and make necessary adjustments to your financial planner. Life happens, and your budget should be flexible enough to adapt. Don’t view deviations as failures, but rather as opportunities to learn and refine your approach. This continuous feedback loop ensures that the template remains a living, breathing financial tool, perfectly tailored to your evolving needs and goals.

Empowering Your Financial Future

Ultimately, embracing a structured financial planner isn’t about deprivation; it’s about liberation. It liberates you from financial anxiety, empowers you with knowledge, and provides a clear pathway to achieving your deepest financial aspirations. By investing a little time upfront to set up and regularly maintain this record, you’re not just tracking money – you’re building a foundation for a more secure, less stressful, and financially intelligent future.

This powerful financial organizer acts as your personal financial compass, guiding you through the complexities of modern money management. It simplifies expense tracker duties, clarifies your cash flow, and ensures you’re always aware of your financial standing. Embrace the power of organization, and watch as your financial clarity grows, bringing with it a profound sense of peace and control.

So, take the leap. Start building your personalized budgeting system today. You’ll be amazed at the practical value and the profound impact this simple yet powerful tool will have on your financial well-being, proving itself to be a true time-saving, stress-reducing, and financially empowering asset for years to come.