Planning a wedding is an incredibly exciting journey, brimming with dreams, decisions, and delightful anticipation. However, amidst the joy of choosing venues and tasting cakes, there’s a practical side that often evokes a touch of anxiety: managing the finances. It’s easy for costs to spiral out of control, turning a joyous occasion into a source of stress. That’s precisely why having a robust financial organizer from the outset is not just helpful, but essential. Imagine a comprehensive wedding budget sheet Excel template that puts you firmly in the driver’s seat of your financial planning.

This isn’t just about crunching numbers; it’s about gaining clarity, maintaining control, and ultimately, enjoying your engagement period without the constant worry of unexpected expenses. Whether you’re a couple looking to meticulously track every dollar, a diligent planner aiming for transparency, or someone who values efficiency and organization, your wedding budget sheet Excel template will become your most trusted companion. It transforms what can feel like a daunting task into an empowering process, allowing you to allocate funds smartly and achieve your dream wedding within your means.

The Importance of Organized Financial Planning and Record-Keeping

In any significant life event, especially one as financially involved as a wedding, meticulous financial planning and record-keeping are non-negotiable. It’s the bedrock upon which all your decisions are made, offering a clear snapshot of your financial landscape at any given moment. Without this clarity, you’re essentially navigating uncharted waters, making guesses about what you can truly afford. This often leads to overspending, last-minute compromises, and unnecessary stress.

Organized records provide more than just a tally of expenses; they offer insights into your spending patterns, highlight areas where you might be overbudgeting, and help identify potential savings. Think of it as your financial GPS, guiding you toward your goals while avoiding detours into debt. It allows for proactive adjustments, ensuring that your financial strategy remains aligned with your overall vision for the big day. This diligent approach not only safeguards your bank account but also fosters open communication and shared responsibility between partners.

Key Benefits of Using Structured Templates, Planners, or Spreadsheets for Budgeting

When it comes to managing finances, a structured template or spreadsheet is a game-changer. These tools offer a standardized, systematic approach that eliminates guesswork and promotes consistency. Instead of scattered notes or mental calculations, you have a centralized hub where all your financial data resides, easily accessible and updateable. This structured approach simplifies the entire budgeting process, making it less intimidating even for those who aren’t naturally inclined towards numbers.

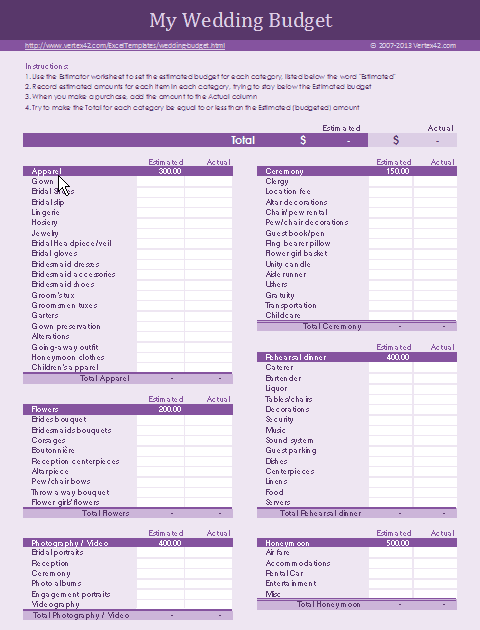

One of the primary benefits is the ability to easily track income and expenses. A good financial spreadsheet provides dedicated sections for everything, from initial deposits to final payments, ensuring nothing falls through the cracks. Furthermore, these planners often come with built-in formulas, automating calculations like total expenditure, remaining budget, and percentage spent. This saves an immense amount of time and reduces the risk of human error, allowing you to focus on the more enjoyable aspects of planning. The visual representation of data, often through charts or color-coding, also provides instant insights, making complex financial information digestible and actionable.

How This Template Can Be Adapted for Various Purposes

While specifically designed for nuptial celebrations, the underlying principles of a well-structured financial template are universally applicable. Its core functionality—tracking income, logging expenses, and managing cash flow—makes it an incredibly versatile tool. You can easily adapt this spreadsheet to suit a myriad of other financial planning needs, leveraging its robust design for diverse scenarios.

For personal finance, it transforms into a comprehensive monthly expenses tracker, helping you monitor your income log against household bills, savings goals, and discretionary spending. Small businesses can utilize a modified version as a simple balance sheet or cost management system, tracking operational expenditures, revenue, and profit margins. Even for event planning beyond weddings, such as large parties, conferences, or family reunions, the layout offers an invaluable framework. Finally, for household management, it becomes an excellent tool for budgeting groceries, utilities, and home maintenance, fostering better financial habits across the board. The beauty of the template lies in its flexible framework, ready to be customized for any project requiring diligent financial oversight.

Examples of When Using a Wedding Budget Sheet Excel Template is Most Effective

A structured financial tool like this truly shines in specific scenarios, transforming potential chaos into calm. Here are some prime examples of when using a wedding budget sheet Excel template is most effective:

- Initial Budget Setting: When you and your partner first sit down to define your financial boundaries and allocate funds across major categories like venue, catering, and attire, this template provides the perfect framework to start.

- Vendor Negotiations: As you gather quotes and negotiate with various vendors, the document allows you to quickly compare costs, track deposit due dates, and record payment schedules for each service provider.

- Tracking Ongoing Payments: From the moment you put down your first deposit to the final payment for the band, the spreadsheet helps you monitor every transaction, ensuring you never miss a deadline or overpay.

- Monitoring Overall Cash Flow: Throughout the planning process, you can get an instant overview of how much has been spent, how much is remaining, and if you’re on track to stay within your initial budget. This helps manage your overall cash flow effectively.

- Identifying Areas for Savings: By categorizing expenses, the layout makes it easy to spot where you might be overspending and brainstorm creative ways to cut costs without compromising your vision.

- Post-Wedding Financial Review: Even after the big day, the record serves as a comprehensive overview of your actual expenditures, valuable for personal financial analysis and future budgeting.

- Managing Contributions from Others: If family members are contributing financially, the planner can include sections to track these contributions, ensuring transparency and proper allocation.

Tips for Better Design, Formatting, and Usability (for Both Print and Digital Versions)

While the core functionality of a financial spreadsheet is about data, its design and usability significantly impact its effectiveness. A well-designed template is not just aesthetically pleasing; it’s intuitive and efficient, encouraging consistent use. For both digital and potential print versions, aim for clarity and logical flow.

For Digital Versions:

- Color-Coding: Utilize a consistent color scheme to differentiate categories (e.g., green for deposits, red for outstanding payments, blue for main categories). This provides quick visual cues.

- Conditional Formatting: Implement conditional formatting to automatically highlight cells based on their values, such as showing "Over Budget" in red or "Paid in Full" in green.

- Data Validation: Use data validation for consistent data entry, like dropdown lists for expense categories or payment statuses. This reduces errors and standardizes input.

- Freeze Panes: Freeze the top row and first column so headers remain visible as you scroll through extensive data.

- Clear Tabs/Sheets: Organize your data across multiple tabs (e.g., "Overview," "Venue," "Catering," "Attire") for better navigation. An "Overview" tab with a summary dashboard using formulas is highly recommended.

- Charts and Graphs: Incorporate simple charts (pie charts for budget allocation, bar graphs for actual vs. planned spending) to visualize your financial situation at a glance.

For Print Versions:

- Clean Layout: Ensure ample white space and clear section breaks. Avoid overly dense text or too many colors.

- Legible Fonts: Choose professional, easy-to-read fonts at a size that’s comfortable for the eye.

- Print Areas: Define specific print areas within Excel to avoid printing unnecessary data or blank cells.

- Headers and Footers: Include page numbers, the date, and the document title in headers or footers for easy reference, especially for multi-page printouts.

- Key Information First: Structure the sheet so that the most important information (e.g., total budget, total spent) is at the top, easily visible without extensive searching.

By applying these design and formatting principles, you transform a functional tool into an exceptionally user-friendly budgeting system, making your financial management process smoother and more enjoyable.

The journey to your wedding day is meant to be filled with joy and anticipation, not financial anxieties. By embracing the power of a well-organized financial spreadsheet, you equip yourselves with an indispensable tool for clarity and control. This template isn’t just about numbers; it’s about empowering you to make informed decisions, manage your resources wisely, and ultimately, bring your vision to life without compromising your financial well-being. It simplifies the complex task of cost management into manageable steps, transforming potential stress into confidence.

In the end, this financial organizer serves as a testament to smart planning and proactive financial habits. It’s a true time-saver, preventing frantic searches for receipts or last-minute budget re-calibrations. More importantly, it’s a powerful stress-reducer, allowing you to focus on the love, commitment, and celebration that define your wedding. Embrace the practical value of your dedicated budget planner, and you’ll find that financial empowerment is a beautiful foundation for your future together.