Dreaming of sun-soaked beaches, majestic mountainscapes, or vibrant city adventures? Most of us are! A vacation is often the highlight of our year, a much-needed break from the daily grind. Yet, the excitement of planning can quickly turn into anxiety when thoughts drift to the dreaded "cost." How much will it really be? Will I overspend? Can I truly afford that extra excursion? These questions can dampen the spirit of any budding traveler.

This is precisely where an organized financial approach, spearheaded by a thoughtful vacation cost planner template, becomes your essential companion. It’s more than just a list of expenses; it’s a roadmap to financial peace of mind, ensuring your dream trip doesn’t turn into a post-vacation budget nightmare. For anyone who values productivity, organization, and smart financial planning – from the diligent saver to the savvy family budgeter – this document is designed to transform abstract travel dreams into concrete, affordable realities.

The Foundation of Financial Serenity: Organized Planning and Record-Keeping

In our fast-paced world, managing finances can often feel like a juggling act. Without a clear system, it’s easy to lose track of where your money is going, leading to stress and missed opportunities. That’s why organized financial planning and meticulous record-keeping are not just good practices; they are foundational pillars for clarity, control, and ultimately, peace of mind.

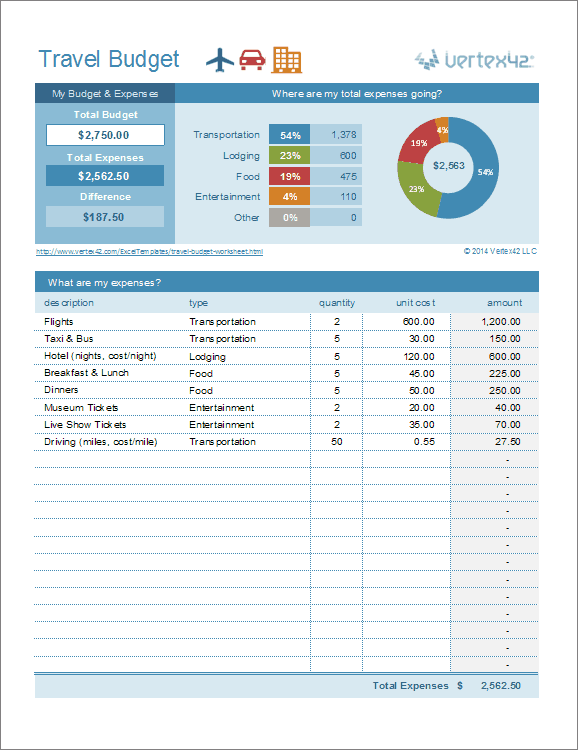

A well-structured financial organizer allows you to see your entire financial landscape at a glance. It helps you understand your cash flow, track your monthly expenses, and monitor your income log. This level of detail empowers you to make informed decisions, whether you’re building a savings planner for a down payment or simply trying to improve your daily cost management. By treating your vacation finances with the same rigor you would a balance sheet for a small business, you gain unparalleled control and prevent unwelcome surprises.

Unlocking Clarity: Key Benefits of Structured Budgeting Templates

While some might prefer a mental tally or scribbled notes, the benefits of using structured templates, planners, or spreadsheets for budgeting are undeniable. These tools move you beyond guesswork, offering a visual, tangible representation of your financial goals and progress. They provide a framework that clarifies your spending limits and helps you allocate funds effectively.

A dedicated financial spreadsheet acts as an expense tracker, letting you see exactly how much you’ve spent versus what you planned. This constant feedback loop is crucial for staying on track and adjusting as needed. Moreover, these templates act as a powerful budgeting system, making it easier to identify spending patterns, spot areas where you can save, and ultimately achieve your financial objectives with greater certainty. By applying the structured principles found in a robust vacation cost planner template, you can transform a complex financial endeavor into an achievable and stress-free process.

Beyond the Beach: Adapting the Template for Diverse Needs

The beauty of a well-designed financial template isn’t confined to its initial purpose. While our focus here is on travel, the underlying principles of tracking, categorizing, and managing funds are universally applicable. This adaptable framework can be seamlessly repurposed for a myriad of other planning scenarios, making it an incredibly versatile tool in your organizational arsenal.

For personal finance, the layout can become your go-to expense tracker for monthly expenses, ensuring you stick to your household budget. Small businesses can modify it into a project cost management sheet, meticulously monitoring expenditures and revenue for specific endeavors. Event planners will find it invaluable for organizing everything from wedding budgets to charity gala expenses, keeping every line item under control. Even for general household management, this sheet provides a clear way to track recurring bills, savings goals, and periodic purchases, proving its worth far beyond a single vacation.

When the Vacation Cost Planner Template Shines Brightest

So, when is a vacation cost planner template truly indispensable? While beneficial for any trip, its power truly comes to the forefront in specific, often complex, planning scenarios. These are the moments when a detailed financial spreadsheet transforms from a helpful tool into an absolute necessity, providing clarity and control where it’s most needed.

- Multi-Country or Long-Duration Trips: When you’re crossing borders, dealing with different currencies, and staying for an extended period, the sheer volume of potential expenses can be overwhelming. The template helps categorize every flight, accommodation, activity, and meal across various destinations and timeframes.

- Family Vacations with Multiple Stakeholders: Coordinating a trip for an entire family, especially with different age groups and interests, means balancing diverse needs and costs. A robust vacation cost planner template simplifies budgeting for flights, hotel rooms, theme park tickets, dining, and souvenir allowances for everyone.

- Once-in-a-Lifetime Adventures: For those big-ticket items like an African safari, a cruise around the Galapagos, or a sabbatical abroad, the investment is significant. This document ensures every major and minor cost is accounted for, from permits and specialized gear to comprehensive travel insurance, allowing you to save strategically.

- Group Travel with Shared Expenses: When traveling with friends, splitting costs fairly can be a logistical headache. The planner can be adapted to track who paid for what, who owes whom, and ensure a transparent and equitable division of expenses, preventing awkward conversations later.

- Budget-Conscious Travel: If you’re on a strict budget, the template becomes your guide to finding savings opportunities. It helps you prioritize spending, identify areas for reduction, and ensure you can still enjoy your trip without breaking the bank.

Crafting Your Perfect Planner: Design and Usability Tips

An effective financial planner, whether for vacations or general budgeting, isn’t just about the numbers; it’s also about its design and usability. A well-formatted record is intuitive, easy to update, and provides immediate insights, whether you’re using a digital spreadsheet or a printed version. Here are some tips to enhance your document’s effectiveness:

First, keep it clean and uncluttered. Use clear headings and distinct categories for different expense types (e.g., "Flights," "Accommodation," "Food & Drink," "Activities," "Transportation," "Miscellaneous," "Pre-Trip Purchases"). Within each category, allow space for individual line items like "Airfare to Paris" or "Hotel in Rome – 3 nights."

For digital versions, leverage the power of formulas. Automate calculations for totals, estimated vs. actual cost differences, and remaining budget. Conditional formatting can be incredibly helpful; for example, highlight cells in red if actual spending exceeds the estimated amount. Consider using separate tabs for different legs of a multi-destination trip or for pre-trip expenses versus on-trip spending. Google Sheets or Excel offer excellent collaboration features if you’re planning with others.

If you prefer a print version, ensure there’s ample space for handwritten notes and actual expense entries. Use clear fonts and a logical flow from left to right, or top to bottom. Consider a landscape orientation if you have many columns, and perhaps a three-hole punch for easy binder inclusion. A laminated version can be great for on-the-go tracking with a dry-erase marker.

Regardless of format, include columns for "Estimated Cost," "Actual Cost," and "Difference." This comparison is crucial for understanding your spending habits and making adjustments. Don’t forget a "Notes" column for details like confirmation numbers, payment methods, or specific dates. The goal is for the spreadsheet to be a living, breathing financial organizer that adapts as your plans evolve.

Embark on Your Journey with Financial Confidence

Ultimately, the goal of creating and utilizing a comprehensive financial spreadsheet like this isn’t to restrict your enjoyment or turn your vacation into a tedious accounting exercise. Quite the opposite, in fact. It’s about empowering you with the knowledge and control to make the most of your travel budget, allowing you to relax and fully immerse yourself in the experience, free from financial worry.

By investing a little time upfront to populate and organize this record, you’re not just creating a budget; you’re building a foundation for stress-free adventure. You’ll gain a clear picture of what’s financially feasible, where you can splurge, and where you might save. This proactive approach saves time and reduces anxiety later on, transforming what could be a source of stress into a source of excitement and anticipation.

So, as you dream of your next escape, remember that organization is your best travel partner. With this powerful template in hand, you’re not just planning a trip; you’re orchestrating a delightful, financially sound experience that will create lasting memories, not lingering debt. Happy travels!