Let’s be honest: managing money, whether for personal finances, a small business, or even just household expenses, can often feel like wrestling an octopus. Just when you think you’ve got one tentacle under control, another three pop up with unexpected bills, forgotten subscriptions, or new investment opportunities. It’s a common challenge for many of us who strive for clarity and control in our financial lives. We want to be productive, organized, and make smart financial decisions, but sometimes, the sheer volume of transactions and categories can be overwhelming.

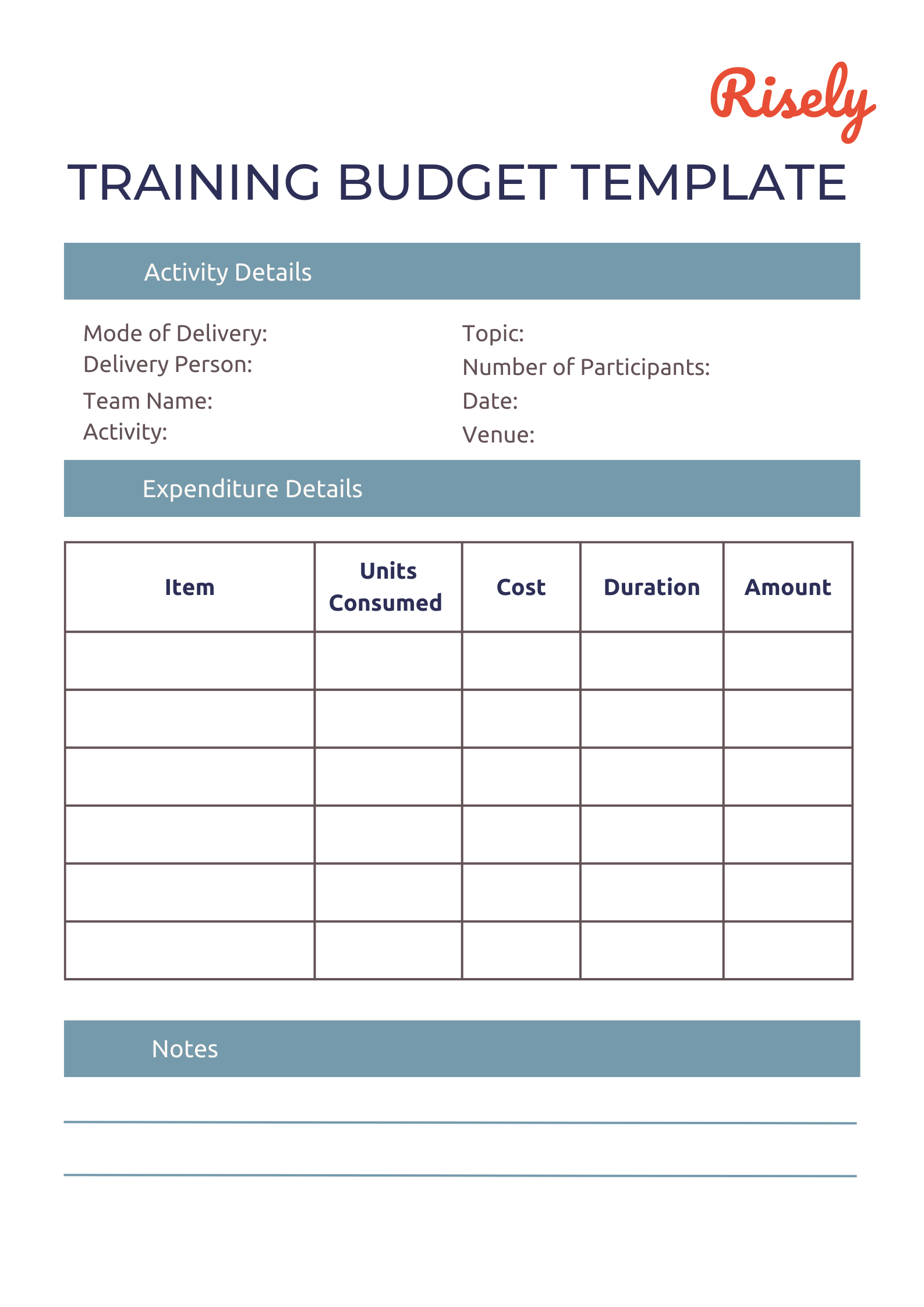

This is where a well-structured financial tool becomes not just helpful, but essential. Imagine having a clear roadmap for every dollar, a blueprint that outlines where your money is coming from and where it’s going. That’s the power of a dedicated financial template. Specifically, when it comes to planning for skill development, professional growth, or even just general learning initiatives, a robust training budget template can transform guesswork into clear, actionable financial planning, ensuring every dollar invested in growth is accounted for and optimized.

The Indispensable Role of Organized Financial Planning

Think about any major project you’ve ever undertaken – building a house, planning a vacation, or launching a new product. Success almost always hinges on meticulous planning and record-keeping. Financial management is no different. Without organized financial planning, you’re essentially sailing without a compass, hoping to hit your destination. This lack of direction often leads to overspending, missed savings opportunities, and a constant underlying stress about your financial health.

Having a clear system for tracking income and expenses provides unparalleled clarity and control. It allows you to see patterns, identify areas of waste, and make informed decisions about future spending and saving. This isn’t just about cutting costs; it’s about optimizing your resources to achieve your goals, whether those are personal milestones, business expansion, or the professional development of a team. An effective expense tracker is the first step towards true financial empowerment.

Key Benefits of Structured Financial Templates

In a world overflowing with digital tools, why bother with a structured template, planner, or financial spreadsheet? The answer lies in their simplicity, adaptability, and immediate value. Unlike complex software that might have a steep learning curve, a well-designed template is intuitive and ready to use, allowing you to focus on the numbers rather than the navigation.

These tools provide a standardized framework, ensuring no critical categories are overlooked. They force a level of discipline in record-keeping that can be hard to maintain otherwise, turning a daunting task into a manageable routine. From creating a detailed savings planner to monitoring monthly expenses, the consistency offered by a template can highlight cash flow trends, pinpoint areas for improvement, and ultimately, bring a sense of calm to your financial outlook. It’s an easy-to-digest financial organizer that puts data at your fingertips.

Adapting Your Financial Template for Various Purposes

One of the beautiful aspects of a well-designed financial template is its inherent flexibility. While this article focuses on a training budget template, the underlying structure can be easily adapted to suit a myriad of other financial needs. It’s not just a niche tool; it’s a versatile framework for cost management.

- Personal Finance: Transform it into a comprehensive personal budget, tracking your income log, discretionary spending, and savings goals. You can create categories for housing, utilities, groceries, entertainment, and debt repayment.

- Small Businesses: Use it to monitor operational costs, marketing expenditures, and revenue streams. It can help maintain a simple

balance sheetfor quick financial health checks. - Event Planning: Adapt the layout to manage expenses for weddings, conferences, or parties, ensuring you stay within your budget for venues, catering, decor, and entertainment.

- Household Management: For families, it can become a joint household budget planner, allocating funds for shared expenses, children’s activities, and future investments.

The core principle remains the same: define your income sources, categorize your expenditures, and track your actual spending against your planned figures. The specifics might change, but the clear, organized approach provided by the template remains invaluable.

When Using a Training Budget Template is Most Effective

A dedicated training budget template isn’t just a good idea; it’s a game-changer in specific scenarios where clarity and control over educational investments are paramount. It empowers individuals and organizations to make strategic decisions about skill development and professional growth. Here are some instances where using this tool shines:

- Annual Employee Development Planning: When a company allocates funds for employee upskilling, leadership training, or certification programs for the year, this sheet provides a central place to list courses, providers, costs per employee, and track actual expenditure against the budget.

- Departmental Training Initiatives: For specific departments (e.g., Sales, IT, Marketing) needing specialized training, the document helps departmental heads plan and justify their spending, ensuring alignment with departmental goals.

- New Hire Onboarding & Training: Managing the costs associated with bringing new team members up to speed, including orientation materials, software training, and mentorship programs, becomes streamlined with this sheet.

- Conference & Workshop Attendance: For individuals or teams planning to attend industry conferences, workshops, or seminars, the planner can itemize registration fees, travel expenses, accommodation, and per diems.

- Personal Professional Development: Individuals investing in their own career growth, whether through online courses, coaching, or professional memberships, can use the record to track their personal investment in skills.

- Grant-Funded Projects: For projects with specific grant requirements for training and development, the spreadsheet ensures precise allocation and reporting of funds to meet compliance standards.

- Skill Gap Analysis & Investment: When a company identifies specific skill gaps within its workforce and needs to strategically invest in training to close those gaps, the template helps prioritize and manage those targeted investments.

In each of these situations, the layout provides a clear, actionable overview of potential costs versus actual spend, allowing for adjustments and informed decision-making.

Tips for Better Design, Formatting, and Usability

Creating a highly effective financial tool isn’t just about the numbers; it’s also about its design and usability. Whether you’re building your own or customizing an existing one, thoughtful formatting can significantly enhance its practical value, making it a joy to use rather than a chore.

For Digital Versions (Excel, Google Sheets):

- Clear Headings: Use bold, distinct headings for categories like "Income Sources," "Planned Expenses," "Actual Expenses," and "Variance."

- Conditional Formatting: Leverage this feature to visually highlight important data. For example, automatically color cells red if actual expenses exceed planned, or green if you’re under budget.

- Formulas for Automation: Set up formulas for automatic calculations. Sum totals for each category, calculate variances, and track cumulative spending. This reduces manual effort and minimizes errors.

- Data Validation: Use data validation to create dropdown lists for common expense categories (e.g., "Software License," "Travel," "Course Fee"). This ensures consistency and makes data entry faster.

- Separate Tabs for Clarity: If the planner becomes extensive, consider using separate tabs for different types of training or different departments, consolidating a summary on a main tab.

- Freeze Panes: Freeze the top row and/or first column so headings remain visible as you scroll through long lists of data.

- Protect Important Cells: Protect cells containing formulas to prevent accidental deletion or modification.

For Print Versions (if you prefer physical copies):

- Ample Writing Space: Ensure columns are wide enough for clear handwritten entries. Nobody likes cramped handwriting.

- Clean Layout: Avoid overly decorative fonts or busy backgrounds. Simplicity and readability are key.

- Logical Flow: Design the record so information flows naturally from left to right, or top to bottom, mirroring how you’d process financial data.

- Clear Labels: Use large, readable fonts for all labels and instructions.

- Bound vs. Loose-Leaf: Consider if a bound journal or a loose-leaf binder with tabs would work better for your record-keeping style. Loose-leaf allows for easy additions and rearrangements.

Remember, the goal is to make the template intuitive and efficient. The less effort required to use the document, the more likely you are to stick with it consistently.

At its heart, any robust financial system, be it an intricate budgeting system or a simple expense sheet, serves a single, powerful purpose: to provide clarity. By diligently tracking your financial inputs and outputs, you transform abstract numbers into concrete insights. This empowers you to make proactive choices, avoid reactive panic, and steadily work towards your financial objectives. It’s an integral part of good financial organization.

Whether you’re looking to invest in new skills for your team, manage your personal development journey, or simply gain better control over your cost management across the board, a well-structured template is your ally. It’s more than just lines and columns; it’s a commitment to financial responsibility, a tool for growth, and a source of peace of mind. Embrace the power of organized financial planning, and watch your financial clarity grow.