Ever felt a knot in your stomach when tax season rolls around, or perhaps a constant low-level hum of anxiety about where your business’s money is actually going? You’re not alone. Many entrepreneurs and small business owners juggle countless tasks, and detailed financial planning often gets pushed to the back burner until it becomes an urgent, overwhelming chore. But what if there was a way to turn that stress into serene control, transforming a daunting task into a consistent, empowering habit?

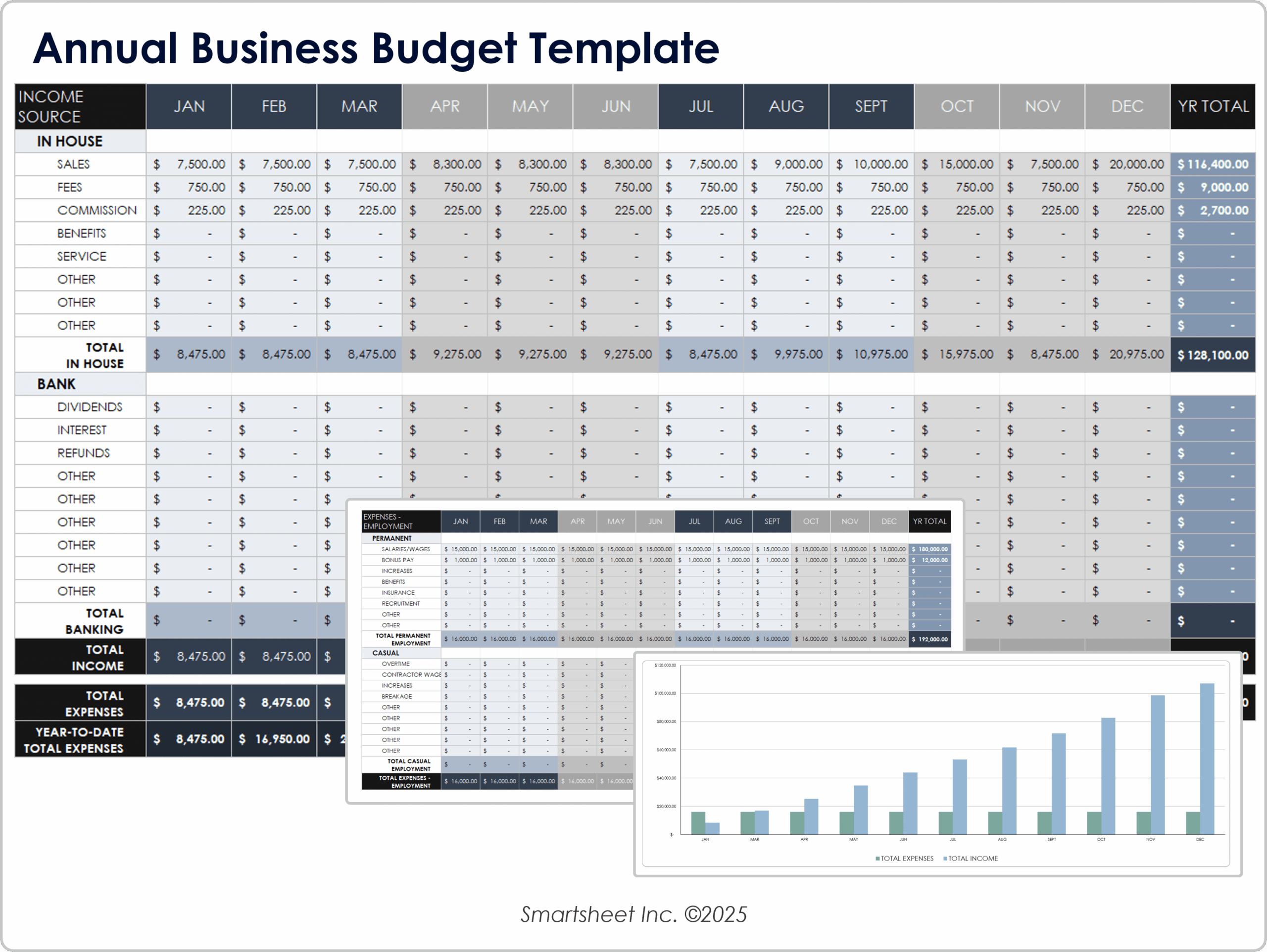

That’s where a well-crafted annual business budget template excel comes into play. Imagine a clear, organized document that not only tracks your past expenses and income but also helps you forecast your future financial landscape with confidence. This isn’t just about crunching numbers; it’s about gaining clarity, making smarter decisions, and ultimately, steering your business toward sustainable growth. Whether you’re a seasoned CEO or just starting your entrepreneurial journey, embracing a structured budgeting system is a non-negotiable step toward true financial mastery.

The Importance of Organized Financial Planning and Record-Keeping

In the fast-paced world of business, it’s easy to get swept up in daily operations, marketing efforts, and customer service. However, neglecting your financial health is like sailing a ship without a compass. Organized financial planning and diligent record-keeping provide that essential compass, guiding your decisions and ensuring you stay on course. It’s not just about knowing how much money you have; it’s about understanding your cash flow, identifying spending patterns, and spotting opportunities for savings or investment.

Clarity is perhaps the most significant benefit. When your finances are meticulously recorded, you gain an unobstructed view of your business’s financial performance. This transparency allows you to make informed decisions, whether it’s adjusting pricing, negotiating with suppliers, or planning for expansion. Furthermore, robust financial records are crucial for compliance, simplifying tax preparation and safeguarding you in the event of an audit. Beyond the practicalities, there’s an immense psychological benefit: the peace of mind that comes from knowing exactly where you stand, fostering a sense of control and reducing financial stress significantly.

Key Benefits of Using Structured Templates, Planners, or Spreadsheets for Budgeting

While some might see budgeting as restrictive, using a structured financial spreadsheet or a dedicated planner is actually incredibly liberating. It takes the guesswork out of money management, replacing it with data-driven insights. Think of it as your personal financial organizer, streamlining a complex process into a manageable, repeatable routine.

One of the primary advantages is the time it saves. Instead of creating a new system from scratch every year or month, a pre-designed template provides a ready-to-use framework. This consistency also reduces the likelihood of errors, as formulas are pre-built and categories are standardized. Such a system serves as an excellent expense tracker, allowing you to quickly categorize and analyze where your money is going. Moreover, a good budgeting system acts as a savings planner, helping you allocate funds for future investments, emergencies, or specific business goals. You can easily visualize your income log against your monthly expenses, providing a dynamic overview of your financial health. By having a clear balance sheet and understanding your cash flow, you’re empowered to manage costs effectively and proactively plan for the future.

How This Template Can Be Adapted for Various Purposes

While its name highlights business, the underlying principles of an annual business budget template excel are incredibly versatile. The core structure—tracking income, categorizing expenses, and projecting future finances—is applicable across a surprising range of scenarios. It’s not just for the typical brick-and-mortar or online business; its adaptable nature makes it a powerful tool for virtually anyone needing organized financial oversight.

For instance, individuals can transform this sheet into a comprehensive personal finance planner, managing household income, utilities, groceries, and personal savings goals. Small businesses, from freelancers and consultants to local shops and service providers, can tailor the categories to fit their specific operational costs and revenue streams. Even non-profit organizations or event planners can utilize the layout to manage grants, donations, and project-specific expenditures, ensuring every penny is accounted for. The beauty of the template lies in its flexibility: you can customize categories, add or remove rows, and adjust formulas to perfectly match your unique financial landscape.

When Using an Annual Business Budget Template Excel Is Most Effective

The power of a dedicated financial record truly shines in specific situations, transforming potential chaos into structured control.

- Launching a New Venture: Before you even open your doors, a robust annual business budget template excel helps you project startup costs, initial revenue, and break-even points, providing a crucial roadmap.

- During Periods of Rapid Growth: When income and expenses are escalating quickly, this planner ensures you maintain control, prevent overspending, and strategically reinvest profits.

- Preparing for Tax Season: Having all your income and expense data categorized throughout the year makes tax filing a breeze, reducing stress and ensuring accuracy.

- Applying for Loans or Funding: Lenders require clear financial projections and historical data. A well-maintained financial spreadsheet demonstrates your fiscal responsibility and foresight.

- Making Major Investment Decisions: Before purchasing new equipment, expanding operations, or hiring staff, the template allows you to model different scenarios and assess their financial impact.

- Identifying and Addressing Financial Leakage: Regularly reviewing the document helps pinpoint unnecessary expenses or areas where cost management can be improved.

- Setting and Tracking Financial Goals: Whether it’s hitting a specific revenue target, reducing debt, or building an emergency fund, the record provides a tangible way to monitor progress.

Tips for Better Design, Formatting, and Usability

A budget is only effective if you actually use it, and usability is key to consistent engagement. Designing your template thoughtfully, whether for digital use or print, can make a significant difference. Here are some tips to enhance your financial organizer:

Firstly, clarity is paramount. Use clear, concise labels for all your categories (e.g., "Marketing Expenses," "Office Supplies," "Client Revenue"). Avoid jargon or overly complex terms. Secondly, leverage Excel’s features. Use different colors to distinguish between income and expenses, or between actuals and projections. Conditional formatting can highlight cells that exceed budget limits or indicate positive/negative cash flow at a glance.

Automate with formulas as much as possible. Sum up categories, calculate totals, and even integrate simple formulas for calculating percentages or variances. This minimizes manual entry errors and saves a lot of time. Implement data validation for specific cells, like dropdown lists for expense categories, to ensure consistency and speed up data entry.

Consider creating separate tabs within the spreadsheet for different aspects: one for monthly income/expenses, another for annual summaries, a balance sheet, and perhaps a dedicated tab for major assets/liabilities. This helps keep the overall layout clean and navigable. For better usability on print, ensure your print areas are set correctly and that fonts are legible. Avoid overly wide tables that require multiple pages to view horizontally.

Finally, version control is crucial. Save dated copies of your spreadsheet periodically (e.g., "Budget_Q1_2024," "Budget_Q2_2024") or use cloud storage with version history. This safeguards your data and allows you to refer back to previous financial snapshots without overwriting current information. A well-designed planner encourages interaction and makes the budgeting process much more enjoyable and efficient.

Embracing Financial Empowerment with Your Annual Budget

Taking control of your business’s finances can feel like a monumental task, but it doesn’t have to be. By adopting a well-structured annual business budget template excel – or rather, by diligently using this robust spreadsheet – you’re not just tracking numbers; you’re building a foundation for sustainable growth and peace of mind. This isn’t just a document; it’s a strategic partner that empowers you to make proactive decisions, anticipate challenges, and seize opportunities.

Ultimately, the goal isn’t just to save money or track expenses, but to foster a deeper understanding of your financial ecosystem. This template becomes your trusted financial organizer, a tool that minimizes stress by providing clarity, confidence by offering foresight, and freedom by enabling smart choices. So, dive in, customize the layout to fit your unique needs, and watch as this simple, yet powerful, record transforms your approach to money management, turning daunting tasks into a streamlined path toward financial empowerment.