Navigating the complexities of business financing, partnerships, or even simple contractual agreements can often feel like a tightrope walk. Whether you’re a burgeoning startup seeking seed investment, a freelancer collaborating on a large project with shared costs, or a small business securing a loan with a third-party guarantor, the need for absolute clarity is paramount. Misunderstandings in financial commitments can lead to costly disputes, damaged relationships, and significant operational delays, hindering the very productivity and organization you strive for.

This is precisely where a robust third party funding agreement template becomes an invaluable asset in your professional toolkit. It’s not just about having a piece of paper; it’s about establishing a clear, unambiguous framework that defines roles, responsibilities, and financial obligations from the outset. For anyone who values smart business communication and wants to protect their interests while fostering trust, understanding and utilizing such a template can dramatically simplify complex financial arrangements and streamline your workflow.

The Foundation of Trust: Why Professional Documentation Matters

In the fast-paced world of business, where agreements are often made with a handshake and a promise, the true value of professional documentation cannot be overstated. A well-crafted legal contract serves as the bedrock of any successful collaboration, providing a written record that prevents ambiguity and safeguards all parties involved. It translates verbal agreements into concrete, actionable terms, eliminating guesswork and potential misinterpretations down the line.

Beyond merely clarifying intentions, comprehensive business documentation also plays a critical role in legal compliance and risk mitigation. Should a dispute arise, a clear, signed agreement stands as a vital compliance record, offering irrefutable evidence of agreed-upon terms. This level of meticulousness not only protects your legal standing but also projects an image of professionalism and reliability, building stronger relationships based on mutual trust. Ignoring this crucial step is akin to building a house without a blueprint; eventually, the structural integrity will be compromised.

Streamlining Success: The Power of Structured Templates

Embracing structured templates, forms, or standardized agreement layouts is a smart move for any organization committed to efficiency and accuracy. One of the most significant benefits is the considerable amount of time saved; instead of drafting each new document from scratch, you begin with a pre-formatted framework that already includes the essential clauses and sections. This drastically reduces the drafting time, allowing you to focus on the unique details of each particular arrangement rather than reinventing the wheel.

Moreover, using a consistent contract template ensures uniformity and minimizes the risk of errors or omissions that can occur with ad-hoc documentation. Every crucial detail, from payment schedules to default clauses, can be systematically included, reinforcing legal soundness and operational clarity. This consistent approach also makes internal review processes more efficient and predictable, ensuring that all agreements meet your organizational standards and legal requirements, fostering a truly organized and productive business environment. Having a standardized third party funding agreement template ensures all critical elements are consistently addressed.

Versatility in Action: Adapting Your Agreement for Any Scenario

The true genius of a well-designed template lies in its adaptability. While a specific third party funding agreement template might seem tailored for a niche purpose, its underlying structure and core principles are remarkably versatile. It can be easily modified to suit a wide array of contractual needs, proving its value across various sectors and professional interactions.

Consider its application in numerous scenarios: for independent freelancers, it can be adapted into a robust service agreement outlining client obligations and third-party payment arrangements. For evolving business partnerships, it can serve as a foundation for a memorandum of understanding, detailing shared financial responsibilities and external investment. Even in less formal contexts, like landlord-tenant agreements involving a guarantor, or service providers managing sub-contractor payments, the fundamental layout provides an indispensable framework. The ability to customize this core document for diverse business contracts, from complex financial agreements to simple terms of service, makes it an indispensable tool for proactive communication and robust legal protection.

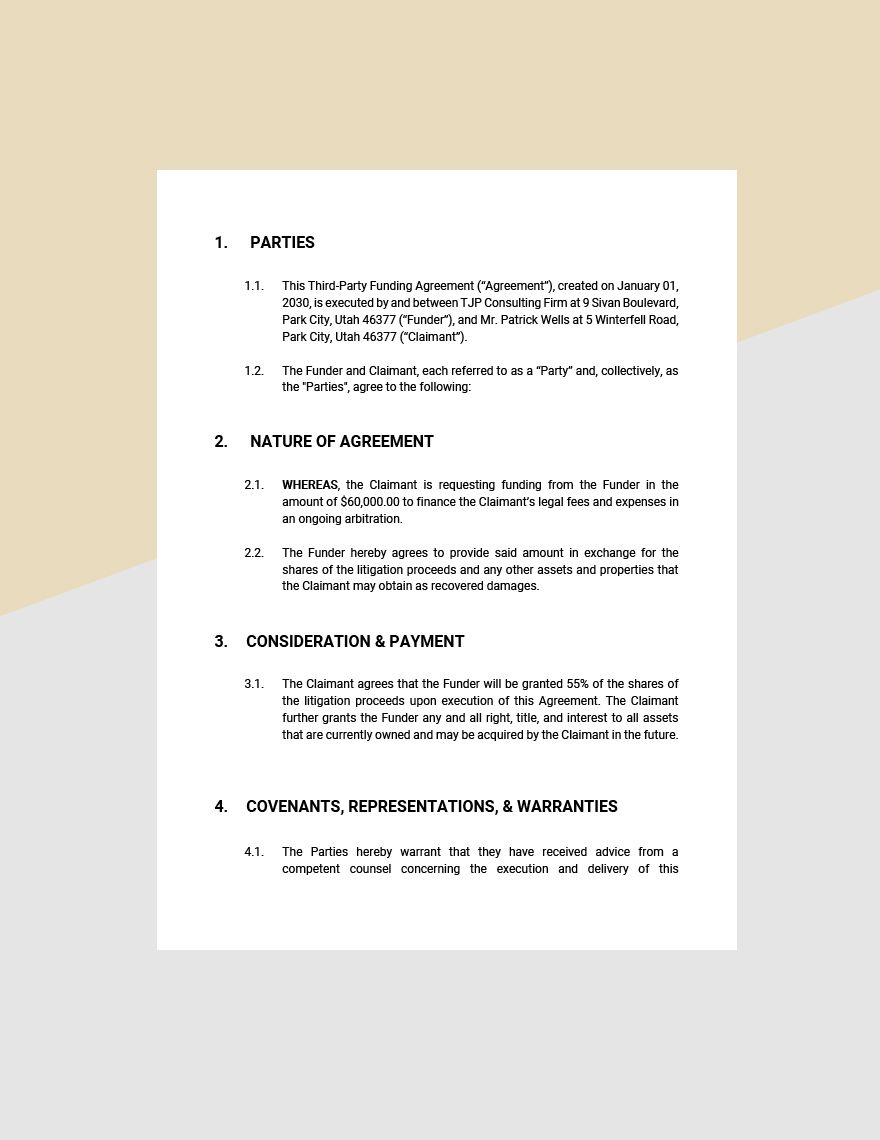

When Clarity Counts: Practical Applications of a Funding Agreement Template

Understanding when and how to deploy a structured agreement can make all the difference in safeguarding your business interests and fostering seamless collaboration. The instances where a clear third party funding agreement template proves most effective are varied, but all share the common thread of requiring precise financial and relational definitions.

Here are some key scenarios where leveraging such a document is highly recommended:

- Startup Seed Funding: When an external investor or funder provides initial capital to a startup, clearly defining repayment terms, equity stakes, and the involvement of any other stakeholders is critical for future growth and investor relations.

- Project Collaboration with External Funding: For joint ventures or projects where one party secures funding from a third source that benefits all collaborators, detailing how those funds are disbursed, managed, and accounted for among the primary partners.

- Vendor Payment Schedules with Third-Party Involvement: In cases where a vendor’s payment is guaranteed or directly facilitated by an entity other than the primary client, ensuring all three parties understand their financial obligations and timelines.

- Royalty Agreements with Multiple Beneficiaries: When intellectual property is licensed, and royalties are to be distributed among various creators or rights holders, especially if a funding source (e.g., a publisher) acts as the central disbursing entity.

- Loan Guarantees: Any situation where a third party agrees to guarantee the repayment of a loan for another entity, clearly outlining the conditions under which the guarantor becomes responsible and their rights.

- Charitable Donations with Specific Conditions: For large donations or grants where funds are channeled through an intermediary, establishing the terms of their use, reporting, and eventual transfer to the end recipient.

These examples highlight the diverse utility of the document, ensuring all parties are on the same page regarding financial flows and responsibilities.

Beyond the Wording: Designing for Clarity and Usability

The effectiveness of any contract template isn’t solely dependent on its legal wording; its design, formatting, and overall usability play a significant role in how well it’s understood and adopted. A professional layout makes the document less intimidating and more accessible, encouraging thorough review rather than a hasty glance. Prioritize readability by choosing clear, legible fonts and appropriate font sizes, avoiding overly ornate or small text that strains the eyes.

Strategic use of white space, distinct headings, and bullet points can break up dense legal text into manageable, digestible sections. This not only improves comprehension but also makes it easier to locate specific clauses quickly. For digital versions, ensure the document is easily fillable, preferably in a universally accessible format like PDF, and supports digital document signing solutions. This facilitates a smooth, paperless workflow, aligning with modern productivity practices. For print versions, consider margins that allow for binding or stapling without obscuring text, and ensure that the structure remains coherent when printed, maintaining the professional appearance and functional integrity of the record.

Your Smart Business Ally: The Enduring Value of a Well-Structured Agreement

In the complex tapestry of modern business, the reliance on robust, clear, and professionally structured documents cannot be overstated. A meticulously crafted contract template, such as one designed for third-party funding, moves beyond being a mere formality; it becomes a powerful ally in your pursuit of operational excellence and dispute prevention. It’s a testament to smart business communication, demonstrating foresight and a commitment to transparency that resonates with all parties involved.

By consistently utilizing such a template, you not only save invaluable time on document creation but also infuse your agreements with a legal clarity that protects your interests and fosters enduring trust. This proactive approach minimizes future headaches, strengthens compliance records, and ensures that every financial understanding is unambiguous. Ultimately, embracing a well-designed and adaptable agreement layout empowers you to navigate complex financial arrangements with confidence, securing your peace of mind and solidifying your reputation as a highly organized and trustworthy professional.