Let’s be honest: in the fast-paced world of business and personal agreements, things rarely go exactly according to plan. Projects shift, circumstances change, and sometimes, for the sake of all parties involved, an agreement needs to end sooner than anticipated. This is where a well-crafted early termination of lease agreement template becomes not just useful, but absolutely essential for maintaining clarity, professionalism, and positive relationships.

Think of this document as your professional parachute, allowing you to exit a binding agreement gracefully and legally. Whether you’re a small business owner, a freelancer managing client contracts, a landlord, or a tenant, having a clear, pre-defined process for ending a lease or any service agreement prematurely can save you a world of headaches, potential disputes, and even legal fees down the line. It ensures that expectations are managed, responsibilities are clearly outlined, and everyone knows the next steps, minimizing friction and maximizing efficiency.

The Importance of Organized Planning and Professional Documentation

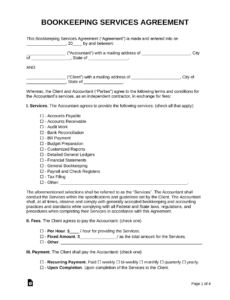

In any professional endeavor, clarity is king, and organization is its loyal subject. Relying on verbal agreements or hastily scribbled notes when it comes to ending a significant commitment is a recipe for disaster. Professional documentation, like a meticulously designed contract template, serves as a single source of truth, offering an unambiguous record of what was agreed upon. This isn’t just about covering your back; it’s about fostering trust and demonstrating competence.

When you present a professionally structured document, it immediately conveys a sense of seriousness and respect for the other party’s time and interests. It shows you’ve thought things through, you understand the implications, and you’re committed to a fair and transparent process. This level of professionalism reduces misunderstandings, strengthens business relationships, and, crucially, provides a solid legal framework should any disagreements arise. A well-organized business file containing such essential forms speaks volumes about your operational excellence and attention to detail.

Key Benefits of Using Structured Templates and Agreement Layouts

Why bother with a structured agreement layout when you could just write something up on the fly? The benefits are immense and directly contribute to productivity and peace of mind. Firstly, consistency. A template ensures that every time you need to terminate an agreement, all the necessary legal and logistical points are covered, leaving no critical details to chance or memory. This standardization minimizes errors and ensures compliance across all your operations.

Secondly, efficiency. Instead of drafting a new document from scratch each time, you simply fill in the blanks, saving precious hours that can be better spent on core business activities. This speed doesn’t compromise quality; instead, it leverages pre-approved language and a proven structure. Furthermore, using a reliable contract template significantly reduces legal risk. By incorporating clauses designed to protect both parties, it helps prevent costly litigation by clearly defining terms, liabilities, and obligations upon termination. It also serves as an excellent compliance record, proving that proper procedures were followed.

How This Template Can Be Adapted for Various Purposes

While the name "early termination of lease agreement template" might suggest it’s solely for property rentals, its underlying principles are incredibly versatile. The core structure of defining terms, effective dates, outstanding obligations, and mutual releases can be adapted to a wide array of professional and personal scenarios. It’s about having a clear exit strategy for any binding commitment.

Consider its application for business contracts, for instance. A service agreement with a vendor might need to end prematurely due to a change in strategic direction. Freelancers often need to gracefully exit projects when scope creep becomes unmanageable or client communication breaks down. Business partnerships sometimes dissolve, requiring a memorandum of understanding for an amicable separation. Even for service providers, establishing clear terms of service that include termination clauses, and then formalizing the actual termination with a custom form, is vital. This document provides the framework, and with minor adjustments, it transforms into a powerful tool for maintaining order across diverse contractual relationships.

Examples of When Using an Early Termination Of Lease Agreement Template Is Most Effective

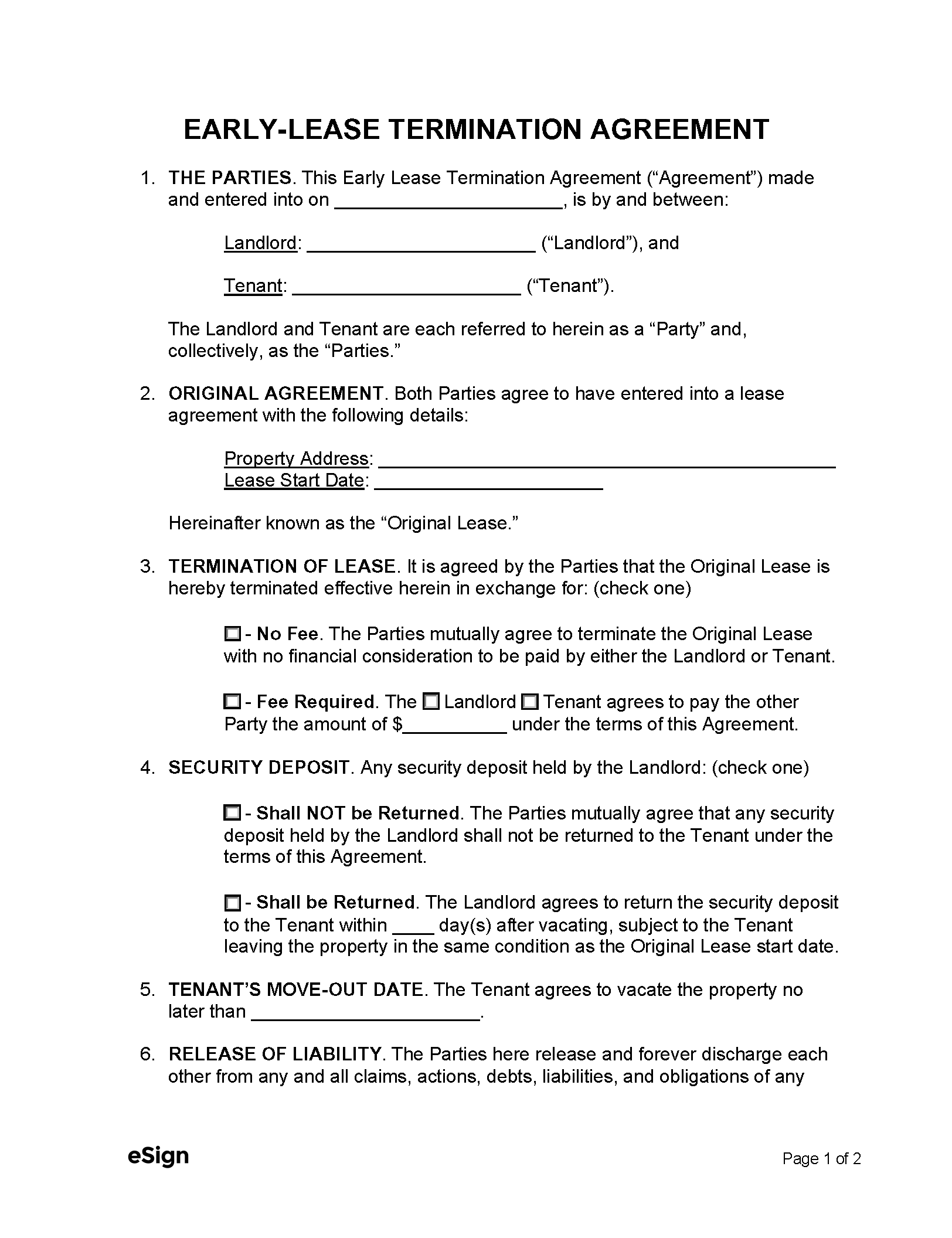

Having a robust early termination of lease agreement template at your fingertips is invaluable for countless situations. It ensures that regardless of the circumstances, the process of ending an agreement remains professional, clear, and legally sound. Here are a few common scenarios where this form proves indispensable:

- Residential Lease Termination: A tenant needs to relocate for a job, or a landlord decides to sell the property. This document outlines lease break fees, notice periods, and key handover procedures.

- Commercial Lease Exit: A business outgrows its space or needs to downsize. The template details the return of the premises, removal of fixtures, and any penalties or pro-rated rent adjustments.

- Service Provider Contract Conclusion: A client relationship with a marketing agency or IT consultant needs to end. This agreement specifies outstanding deliverables, final payments, and intellectual property transfers.

- Vendor Agreement Dissolution: A supply chain partner is no longer meeting quality standards, or a more cost-effective alternative emerges. The template covers inventory return, final invoices, and non-disclosure obligations.

- Business Partnership Separation: Partners decide to go their separate ways. The document clarifies asset distribution, debt responsibilities, and the cessation of shared liabilities, often serving as an addendum to an existing business partnership agreement.

- Freelance Project Disengagement: A freelance designer and client realize the project is not a good fit. This form specifies payment for work completed, return of materials, and agreement on usage rights of partial work.

- Memorandum of Understanding Revocation: Parties initially agreed on a preliminary understanding that no longer holds true. The template confirms the mutual cessation of the MOU’s intent and any minor obligations incurred.

- Subscription or Membership Cancellation for Businesses: While often simpler, for high-value B2B subscriptions, a formal record can confirm the end date, final billing, and data handling for compliance.

Tips for Better Design, Formatting, and Usability

A well-designed document is more than just aesthetically pleasing; it’s inherently more usable and less prone to misinterpretation. When creating or customizing your early termination of lease agreement template, consider these design and formatting tips to maximize its effectiveness for both print and digital versions.

Firstly, prioritize clarity and conciseness. Use clear, unambiguous language. Avoid jargon where possible, or define it explicitly. Each section should have a distinct purpose and be easily scannable. Employ headings and subheadings (<h3> if necessary within sections) to break up dense text, guiding the reader through the document logically.

Secondly, focus on visual hierarchy. Use bolding, italics, and varying font sizes (sparingly) to highlight critical information, such as effective dates, termination fees, and key obligations. Ensure sufficient white space around text and between paragraphs; a cluttered page is overwhelming and makes it harder to absorb information. For digital versions, ensure the file is easily editable (e.g., a Word document or a fillable PDF) but also includes a locked version for final document signing.

Thirdly, consider accessibility. Use a legible font, ideally sans-serif, like Arial or Calibri, at a minimum of 10-12 points. For print, ensure margins are generous enough to allow for stapling or binding without obscuring text. For digital, test the document on different devices to ensure responsiveness and readability. Include clear fields for signatures, dates, and contact information, making it obvious where each party needs to interact with the record. Finally, always include a version number and date in the footer; this is crucial for version control, especially when multiple revisions of the business documentation are exchanged.

In conclusion, the goal is to create a professional layout that is intuitive to navigate, easy to complete, and crystal clear in its intent. Whether it’s viewed on screen or printed out, a thoughtful design enhances its legal standing and promotes better communication.

The Practical Value of a Professional Termination Tool

In an environment where agility and clear communication are paramount, having a professionally developed contract template for early termination is more than just a convenience – it’s a strategic asset. It embodies smart business communication by providing a structured, empathetic, and legally sound pathway to end agreements when circumstances demand. It removes the guesswork and emotional stress from potentially delicate situations, allowing all parties to move forward with confidence and clarity.

Ultimately, this specialized form is a testament to proactive planning and a commitment to professional excellence. It saves time by streamlining a complex process, ensures legal clarity by leaving no room for ambiguity, and fosters trust by demonstrating respect for contractual obligations even in their cessation. By integrating such robust business documentation into your operational toolkit, you’re not just preparing for the unexpected; you’re building a more resilient, organized, and professional enterprise.