The accurate and timely documentation of charitable contributions is a critical component of responsible financial management for individuals and organizations alike. In the context of United States tax regulations, proper substantiation is not merely a formality but a mandatory requirement for claiming deductions. This article delves into the utility and structure of a well-crafted tax write off donation letter template, exploring its purpose, beneficiaries, and the strategic advantages it offers in maintaining financial integrity and compliance.

This type of template is an invaluable tool for anyone involved in charitable giving, from the individual donor seeking to document their generosity to the non-profit organization providing official receipts. Its primary purpose is to standardize the communication process, ensuring that all necessary information for tax purposes is consistently and clearly conveyed. By leveraging such a structured document, both parties can confidently navigate the complexities of tax law, ensuring that contributions are correctly acknowledged and eligible for their intended deductions.

The Indispensable Role of Professional Documentation

In both business and personal realms, written communication serves as the backbone of accountability and transparency. Professional documentation, encompassing everything from contracts to formal correspondence, establishes a clear official record of transactions, agreements, and acknowledgements. This meticulous approach to record-keeping is not just good practice; it is often a legal necessity, safeguarding all parties involved from potential misunderstandings or disputes.

The importance of well-structured professional communication extends beyond legal compliance. It reflects an organization’s commitment to professionalism, fostering trust and credibility with its stakeholders. Whether it’s a business letter to a client or a notice letter to an employee, clear and consistent documentation reduces ambiguity, streamlines operations, and provides a reliable reference point for future interactions. This commitment to detail is especially vital when dealing with financial matters, where accuracy directly impacts legal and fiscal outcomes.

Key Benefits of a Structured Tax Write Off Donation Letter Template

Utilizing a structured tax write off donation letter template offers a multitude of advantages that transcend mere convenience. Foremost among these is the assurance of professionalism. A well-designed template ensures a consistent presentation, maintaining a professional image for the sender and demonstrating a serious approach to financial administration. This consistency builds confidence and clearly conveys important information without error.

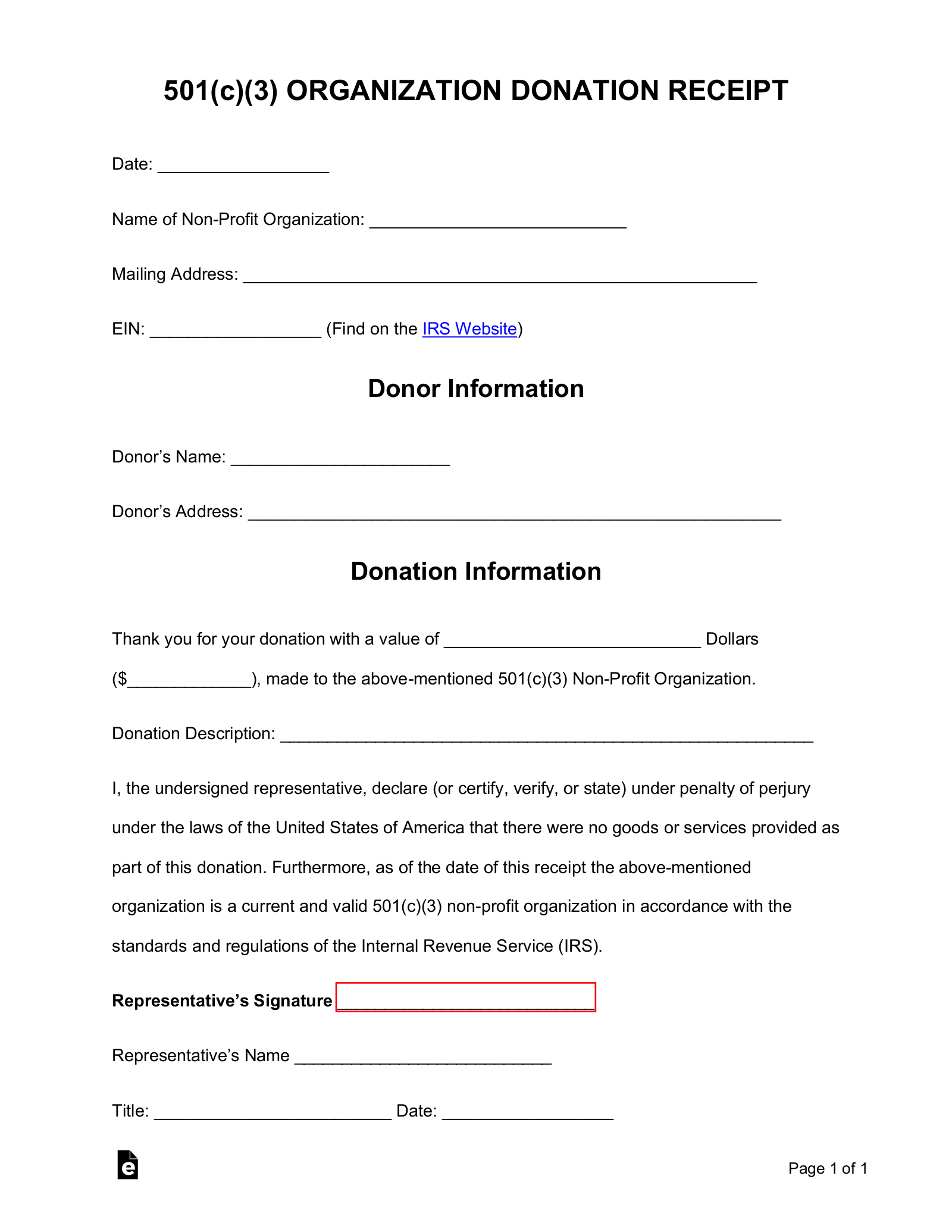

Furthermore, a standardized template promotes exceptional clarity in communication. By outlining specific fields for essential data—such as donor name, donation amount, date, and charitable organization details—it minimizes the risk of omitted information or misinterpretation. This systematic approach significantly enhances the letter’s readability and ease of understanding for all recipients, including tax authorities. Critically, a robust tax write off donation letter template helps ensure compliance with Internal Revenue Service (IRS) regulations, which often require specific information to be present for a donation to qualify as a deduction.

Customization and Versatility of the Document Template

The inherent strength of any effective message template lies in its adaptability. While a core structure provides a solid foundation, the ability to customize the document template for various applications dramatically expands its utility. This flexibility means that the underlying principles of clear, concise, and structured communication can be applied across a broad spectrum of formal correspondence needs.

For instance, the same organizational principles found in a donation acknowledgement can be mirrored in other official documents. This includes employment-related correspondence, such as offer letters or formal notifications regarding policy changes. Similarly, in business, this layout can inform proposals, invoices, or official requests for information. The core idea is to establish a clear, professional framework that can be easily modified to suit specific content requirements, ensuring that every written request or formal communication maintains a consistent, authoritative tone and a logical document layout.

Optimal Scenarios for Utilizing This Formal Correspondence

The strategic deployment of a pre-formatted structure for official communication is most effective in situations demanding both clarity and adherence to established protocols. This formal correspondence serves as an indispensable tool across several critical scenarios, ensuring that all parties possess a complete and verifiable record.

- Acknowledging Significant Charitable Contributions: For any donation exceeding a statutory threshold (currently $250 for cash contributions to a single charity, requiring a contemporaneous written acknowledgment), this template provides the necessary details to satisfy IRS requirements for the donor to claim a deduction.

- Documenting Non-Cash Donations: When gifts in kind, such as goods, services, or property, are contributed, the template ensures that their description, estimated value, and recipient organization details are thoroughly documented, crucial for accurate valuation and substantiation.

- Providing Substantiation for IRS Audits or Inquiries: In the event of a tax audit, a professionally prepared and comprehensive letter serves as irrefutable proof of the donation, streamlining the verification process and minimizing potential discrepancies.

- Maintaining Clear Records for Personal Financial Management: Beyond tax compliance, using a consistent layout helps individuals and businesses keep an organized, accessible record of their philanthropic activities, aiding in budgeting and financial planning.

- Fulfilling Regulatory Requirements for Charitable Giving: Many jurisdictions or specific types of donations may have unique reporting requirements. A flexible message template can be adapted to include these specific clauses or data points, ensuring full compliance.

Best Practices for Formatting, Tone, and Usability

To maximize the effectiveness of any official record or communication tool, meticulous attention to formatting, tone, and overall usability is paramount. These elements collectively determine how professionally and efficiently the intended message is conveyed and received.

Formatting for Professionalism and Clarity

The document layout should adhere to standard business letter conventions. This includes using a clean, professional font (e.g., Arial, Times New Roman, Calibri), maintaining adequate white space, and ensuring consistent margins (typically 1-inch all around). Key elements like the sender’s and recipient’s addresses, date, salutation, body paragraphs, and closing should be clearly delineated. For print versions, choose high-quality paper. For digital distribution, saving the letter as a PDF is often preferred to preserve formatting and prevent unauthorized alterations, ensuring the integrity of the official record. When designing for digital use, consider fillable fields to enhance efficiency and reduce manual data entry errors.

Cultivating an Appropriate Tone

The tone of the letter must always be professional, respectful, and appreciative, especially when acknowledging donations. While maintaining formality, avoid overly stiff or impersonal language. The content should be factual, concise, and free of jargon that could confuse the reader. Express gratitude clearly and directly, but ensure the primary focus remains on providing the necessary information for tax purposes. A balanced tone conveys professionalism without sacrificing warmth, reinforcing a positive relationship with the donor.

Enhancing Usability for All Stakeholders

A truly effective communication tool is intuitive and easy to use for both the sender creating it and the recipient reviewing it. For those creating the letter, a clear message template with designated sections for variable information simplifies the process, reducing the likelihood of errors. Instructions for completing the template should be straightforward. For the recipient, the letter should be easy to read and understand, with key information readily identifiable. Using headings, bullet points, and bold text judiciously can improve readability. The goal is to make the process of documenting and understanding the donation as seamless and efficient as possible, solidifying its role as a reliable communication tool.

Professional communication, underpinned by structured and well-formatted documentation, is a cornerstone of effective financial stewardship and regulatory compliance. The diligent use of a standardized document, adapted for specific needs, not only streamlines administrative processes but also reinforces an organization’s commitment to transparency and accuracy. By providing a clear, consistent, and legally compliant framework for various formal interactions, these documents significantly mitigate risk and enhance operational efficiency.

Ultimately, investing in robust message templates and adhering to best practices in written communication empowers individuals and entities to navigate complex requirements with confidence. Such tools serve as indispensable assets, transforming potential administrative burdens into opportunities for clear, professional engagement. They stand as a testament to the value of precision in every official record, ensuring that all communications are not only received but also fully understood and acted upon with complete assurance.