Embarking on a home remodeling project can be an exhilarating journey, transforming your living space into something new and exciting. However, without a clear roadmap, the financial aspect can quickly become a source of stress and confusion. This is where a robust and well-structured document like a home remodeling cost estimate template becomes not just helpful, but absolutely essential.

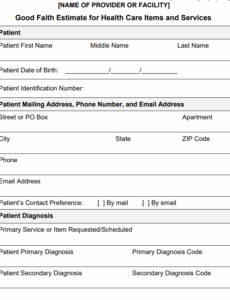

For contractors, designers, and service providers in the remodeling industry, presenting a clear, comprehensive cost estimate is paramount to building trust and securing projects. For homeowners, receiving a detailed estimate provides the clarity needed to make informed decisions and budget effectively. It’s the cornerstone of transparent communication, setting expectations right from the start for all parties involved in the process.

The Indispensable Role of Organized Planning and Professional Documentation

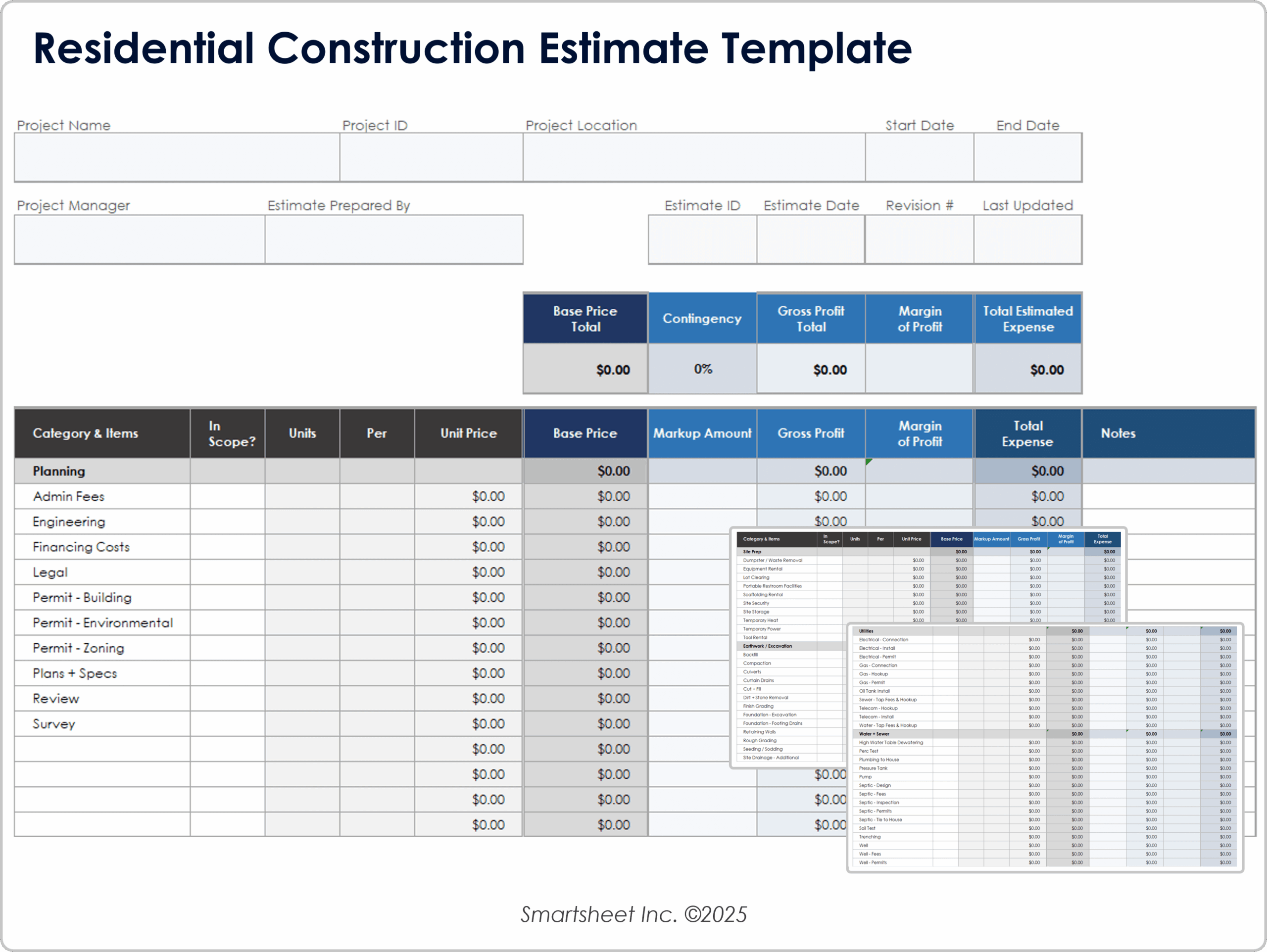

In any business, especially one involving significant financial investment and complex projects like home remodeling, clarity and organization are priceless commodities. Professional documentation is far more than just paperwork; it’s a commitment to transparency, a foundation for trust, and a safeguard against misunderstandings. An organized approach to project pricing ensures that every line item, every service, and every material cost is accounted for.

When you present a meticulously crafted quotation form, you immediately convey professionalism and attention to detail. This level of diligence fosters confidence in your clients, assuring them that you’ve thoroughly considered every aspect of their project. Such professional layouts minimize ambiguity, allowing both parties to have a shared understanding of the scope and financial implications before any work begins.

Key Benefits of Using Structured Templates and Forms

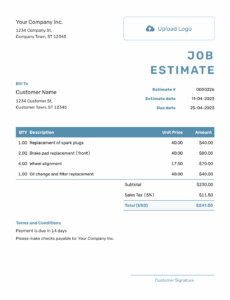

Adopting a structured template for your service estimates streamlines your operational workflow dramatically. It takes the guesswork out of creating each new quote, ensuring consistency and accuracy across all your client interactions. Think of the hours saved not having to draft a new layout from scratch every time you bid on a job.

Beyond efficiency, a standardized business file serves as a vital quote record, crucial for internal tracking and future reference. It helps in maintaining a transparent cost breakdown, which is essential for both your financial management and for client communication. This systematic approach also reduces the likelihood of costly errors, protects your business from disputes, and reinforces your reputation as a reliable and organized professional.

Adaptability for Various Purposes

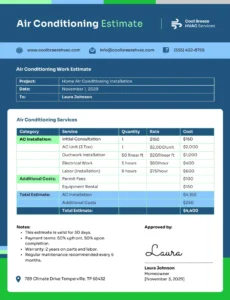

While we’re focusing on home remodeling, the underlying principles of a well-designed estimate are universally applicable. This foundational layout isn’t confined to a single industry; its structure can be easily adapted by a wide array of professionals. Freelancers can use it for project proposals, detailing their service fees and deliverables.

Small businesses, from landscaping companies to IT service providers, can modify the template to suit their specific offerings. Agencies can integrate their branding and service packages into the framework, transforming it into a compelling business proposal. The core elements – itemized costs, labor rates, material lists, and terms – are transferable, making this a versatile tool for anyone providing a service or product.

When Using This Template is Most Effective

Deploying a structured estimate form at specific junctures can significantly enhance client satisfaction and project success. It’s about leveraging its clarity to manage expectations and secure commitments at critical phases.

- Initial Client Consultations: Provide a preliminary, high-level service estimate to give clients an early understanding of potential costs, helping them decide if the project aligns with their budget.

- Detailed Project Bidding: Present a comprehensive cost breakdown when submitting a formal bid, ensuring all aspects of the job are explicitly itemized for transparency.

- Scope Changes and Additions: Use the template to clearly document and price any changes or additions to the original project scope, avoiding future disputes.

- Pre-Contract Agreements: Attach the detailed quote record as an integral part of your service agreement or contract, establishing a clear financial baseline for the project.

- Negotiation Phases: Refer back to the itemized sections of the document during negotiations to adjust specific costs or scope elements effectively.

- Post-Project Review: Use the final estimate for comparison against actual costs, helping to refine future project pricing and improve accuracy.

Tips for Better Design, Formatting, and Usability

A well-designed estimate isn’t just about the numbers; it’s about how those numbers are presented. Think of the template as a direct extension of your brand, reflecting your professionalism and attention to detail.

For both print and digital versions, prioritize a clean, uncluttered professional layout. Use clear headings, consistent fonts, and adequate white space to improve readability. Ensure your company logo and contact information are prominently displayed. Organize the information logically, perhaps starting with a project overview, followed by the cost breakdown, and concluding with terms and conditions. Highlight key totals clearly, perhaps in bold or a distinct color, so clients can quickly grasp the overall investment. For digital versions, consider interactive elements or embedded links to product specifications. Ensure the document is easily shareable and viewable across various devices without losing its formatting integrity. A well-formatted quote record significantly enhances client communication and reduces follow-up questions.

The Practical Value of a Solid Estimate Template

Ultimately, a robust estimate template is more than just a tool for calculating costs; it’s a strategic asset for your business. It transforms the often-daunting task of project pricing into a streamlined, consistent, and highly professional process. By saving you valuable time in drafting and revising quotes, it frees you up to focus on what you do best: delivering exceptional remodeling services.

Embracing this type of business file elevates your client communication, fostering an environment of trust and clarity that is essential for successful projects. It boosts your credibility, signaling to clients that you are organized, transparent, and dedicated to their satisfaction. In an industry where precision and professionalism are paramount, having a well-structured estimate isn’t just a convenience – it’s a competitive advantage that pays dividends in reputation, client relationships, and ultimately, your bottom line.