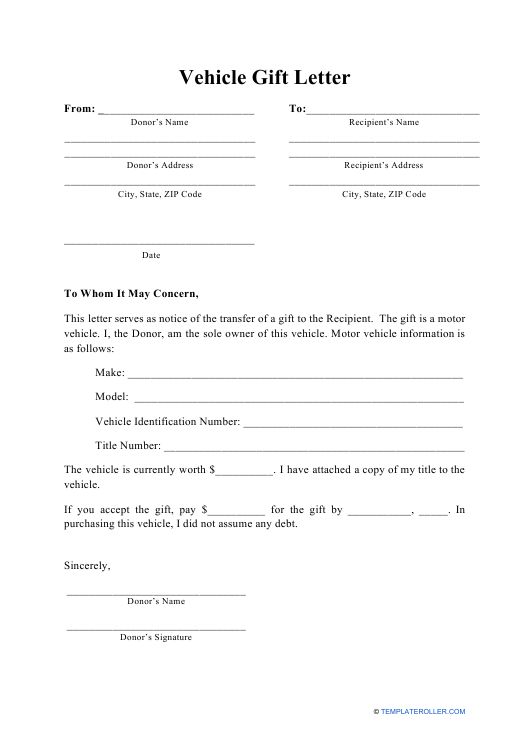

In both personal and professional spheres, the ability to communicate clearly and formally is paramount. Official documentation serves as a critical cornerstone for establishing records, clarifying intentions, and ensuring legal compliance. Among the myriad forms of essential correspondence, a specialized document often required for significant personal transactions is a formal car gift letter template. This particular document facilitates the lawful and unambiguous transfer of vehicle ownership as a gift, distinguishing it from a sale and outlining the terms for all involved parties.

The primary purpose of utilizing a structured car gift letter template is to provide a clear, legally sound, and comprehensive record of a vehicle being transferred without monetary exchange. Donors, typically individuals or sometimes organizations, benefit by formally documenting their intent and protecting themselves from future disputes regarding the transaction’s nature. Recipients, on the other hand, gain a crucial piece of documentation required for vehicle registration, titling, and insurance processes, proving that the vehicle was acquired as a gift and not purchased. Furthermore, government agencies, particularly motor vehicle departments and tax authorities, rely on such forms to correctly process transfers, assess any applicable taxes, and prevent fraudulent claims, ensuring transparency and adherence to regulatory requirements.

The Importance of Written Communication and Professional Documentation

Effective written communication forms the backbone of all successful interactions, whether in business or personal capacities. It provides a permanent record, eliminates ambiguity, and offers a reliable reference point for future inquiries. Professional documentation, in particular, adheres to established standards of clarity, accuracy, and completeness, thereby fostering trust and demonstrating adherence to due process.

In the absence of clear written records, misunderstandings can easily arise, leading to potential disputes, legal complications, and financial discrepancies. Formal correspondence, such as a business letter or a notice letter, serves to solidify agreements, convey official requests, and provide essential information in a verifiable format. This rigorous approach to documentation is not merely bureaucratic; it is a fundamental practice that underpins legal protection, regulatory compliance, and transparent operations across all sectors. It ensures that intentions are unequivocally stated and that all parties are fully informed of their responsibilities and entitlements within any given transaction.

Key Benefits of a Structured Car Gift Letter Template

The adoption of a structured car gift letter template offers numerous advantages that extend beyond mere formality. This type of document is meticulously designed to ensure clarity, consistency, and professionalism in a transaction that carries significant implications. By providing a standardized framework, it minimizes the risk of vital information being omitted or misrepresented, which is crucial for both legal and financial integrity.

Firstly, professionalism is maintained through the organized presentation of information, adhering to established conventions for formal correspondence. This conveys seriousness and diligence from both the donor and recipient. Secondly, consistency is ensured as the template guides users to include all necessary details, such as donor and recipient information, vehicle identification numbers (VIN), make, model, year, and a clear statement of gifting intent. This uniformity is particularly beneficial when dealing with state motor vehicle departments, which often have specific requirements for documentation. Thirdly, clarity is paramount, as the unambiguous language explicitly states that no monetary exchange occurred, which is vital for distinguishing a gift from a sale and can have significant implications for tax purposes, particularly regarding gift tax or sales tax exemptions. This formal declaration safeguards against potential misinterpretations by financial institutions, insurance providers, and tax authorities, providing a robust official record.

Customizing This Template for Different Purposes

While the primary focus of this article and the car gift letter template itself is the gifting of a vehicle, the underlying principles of a well-structured document allow for conceptual customization that mirrors broader applications of professional templates. A robust document layout provides a framework that can be adapted for various forms of formal correspondence. This adaptability underscores the value of using a template for any significant communication.

For instance, the structured format of a notice letter or a written request shares common elements with a gift declaration. It typically includes designated spaces for sender and recipient details, a clear subject line, a date, an unambiguous statement of purpose, supporting details, and appropriate signatures. These elements are universally applicable whether one is drafting a formal notification, an employment-related letter, a business agreement, or a specific type of legal correspondence like this file. The modular nature of a professionally designed message template allows users to modify specific content sections while retaining the overall integrity and formal tone required for official records. This ensures that the core components of effective communication—clarity, completeness, and professionalism—are consistently maintained across diverse communicative needs, thereby enhancing the utility and reach of the initial template design.

Examples of When to Utilize a Car Gift Letter Template

The use of a formal car gift letter template is not merely a suggestion but often a requirement in various scenarios to ensure a smooth and legally compliant transfer of vehicle ownership. It provides crucial documentation that clarifies the nature of the transaction to government agencies, insurance companies, and other relevant parties.

Specific instances where utilizing this form is most effective include:

- Gifting a vehicle to a family member: When a parent gifts a car to a child, or a spouse gifts one to another, a formal letter clearly documents the transfer, which is essential for registration, titling, and often for avoiding sales tax in some states.

- Donating a vehicle to a charity or non-profit organization: For charitable donations, this document serves as a crucial record for both the donor’s tax deduction purposes and the charity’s record-keeping, substantiating the non-monetary nature of the transfer.

- Transferring ownership after an inheritance or estate settlement (as a gift, not sale): In cases where a vehicle is bequeathed or gifted as part of an estate, the letter helps clarify the transfer process, especially if the recipient is not the direct heir or if the will does not explicitly detail the transfer as a gift.

- Gifting a vehicle to a friend or acquaintance: To prevent any future misunderstandings or legal challenges regarding ownership, particularly if the vehicle has significant value, a formal letter explicitly stating the gift nature is indispensable.

- Circumstances involving state-specific requirements for gift transfers: Many states have specific regulations regarding gifting vehicles to avoid sales tax or simplify title transfers. A comprehensive letter ensures all required information is present and accounted for, streamlining the administrative process.

- Any situation where proof of non-sale is critical: Whether for insurance claims, liability issues, or simply establishing a clear chain of ownership, having a signed, dated document stating the vehicle was a gift provides irrefutable evidence.

Tips for Formatting, Tone, and Usability

To maximize the effectiveness and professional impact of any official correspondence, including the car gift letter template, attention to formatting, tone, and usability is paramount. These elements collectively contribute to the document’s credibility and ease of processing by all stakeholders. Ensuring these aspects are carefully considered will significantly enhance the utility of the correspondence.

For formatting, consistency and clarity are key. Use a standard business letter format, including a professional font (e.g., Times New Roman, Arial, Calibri) in a readable size (10-12 points). Maintain clear headings, ample white space, and logical paragraph breaks to improve readability. Ensure that all critical information, such as VIN, make, model, year, donor, and recipient details, is prominently displayed and easy to locate. If including attachments (e.g., copy of title, bill of sale marked "zero value"), reference them clearly within the letter. For digital versions, ensure the file is saved in a universally accessible format like PDF to preserve layout and prevent unauthorized alterations.

The tone must remain formal, professional, and unambiguous. Avoid colloquialisms, jargon, or emotional language. The objective is to convey facts clearly and concisely. Employ precise terminology, particularly when describing the vehicle and the nature of the transaction. The language should be authoritative yet polite, reflecting the seriousness of the document. A neutral and objective stance prevents misinterpretation and reinforces the legal standing of the transfer.

Regarding usability, design the letter to be straightforward for both print and digital applications. For print versions, ensure ample margin space for signing and potential notary stamps. Provide clear lines for signatures, printed names, and dates for all involved parties. For digital versions, ensure the document is easily downloadable, printable, and compatible with common operating systems. Consider using fillable fields in a PDF if multiple instances of the document will be generated. Always include contact information for any follow-up questions. The goal is to make the process of completing, distributing, and verifying the letter as seamless as possible, minimizing hurdles for all entities involved.

Concluding Thoughts on Professional Documentation

In conclusion, the careful utilization of a well-structured document, such as a formal car gift letter, underscores the undeniable value of professional documentation in managing significant personal and financial transactions. This type of formal correspondence serves not only as a record of intent but also as a vital legal instrument that protects the interests of all parties involved—donors, recipients, and regulatory bodies alike. Its inherent clarity and precision help navigate the complexities of vehicle ownership transfer, ensuring compliance and peace of mind.

By consistently employing a meticulously designed template, individuals and organizations can significantly enhance the efficiency and reliability of their communications. The strategic application of such a document eliminates ambiguity, fosters transparency, and provides an authoritative reference point for any future inquiries or legal requirements. Embracing this disciplined approach to written communication is an indispensable practice for anyone seeking to conduct their affairs with utmost professionalism and integrity.