In the intricate landscape of modern business, precise and professional communication serves as the bedrock for successful operations and robust relationships. Among the many essential documents that facilitate smooth transitions and maintain clarity, the formal notification regarding a change in contractor status stands out. This article delves into the critical role and structure of a well-crafted "Change Of Contractor Letter Template," designed to ensure all parties are fully informed, compliant, and prepared for operational adjustments.

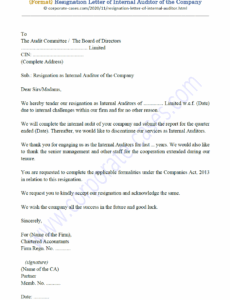

The primary purpose of such a standardized communication tool is to formally announce a transition concerning a contracted individual or entity. Whether this involves the engagement of a new contractor, the termination of an existing one, or a shift in responsibilities, clear documentation is paramount. Businesses, clients, project managers, and even the contractors themselves benefit immensely from this structured approach, as it preempts misunderstandings, establishes an official record, and supports legal and administrative compliance throughout the transition period.

The Importance of Written Communication and Professional Documentation

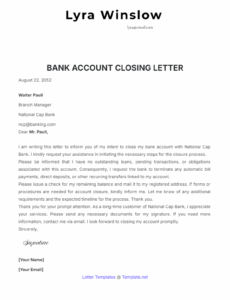

Effective communication is the linchpin of any successful enterprise, and nowhere is this more evident than in formal written correspondence. Unlike verbal agreements or casual emails, a meticulously drafted letter provides an undeniable record of information conveyed, decisions made, and expectations set. This level of professional documentation is crucial not only for internal organizational coherence but also for external stakeholder engagement.

In business and personal settings alike, written communication minimizes ambiguity, provides a tangible reference point, and serves as a vital safeguard against disputes. Official records, such as notice letters and formal correspondence, are indispensable for legal defensibility, auditing purposes, and demonstrating due diligence. They reflect an organization’s commitment to transparency, integrity, and operational excellence, thereby bolstering its reputation and fostering trust.

Key Benefits of Using Structured Templates for Contractor Change Notifications

Adopting a structured template for formal notifications, particularly a well-designed change of contractor letter template, offers a multitude of advantages. Firstly, it ensures consistency across all communications related to contractor transitions. This uniformity in presentation and content reinforces professionalism and ensures that no critical information is inadvertently omitted from any correspondence.

Secondly, a template streamlines the communication process, making it significantly more efficient. Instead of drafting each letter from scratch, authorized personnel can quickly populate pre-defined fields, saving valuable time and reducing the potential for errors. This efficiency is crucial in fast-paced environments where timely notifications are essential. Furthermore, it helps maintain clarity by guiding the sender to include all necessary details such as effective dates, reasons for the change (if appropriate), and contact information for new or outgoing parties. By leveraging such a message template, organizations uphold a high standard of professional communication, ensuring every stakeholder receives clear, unambiguous information.

Customizing the Template for Various Scenarios

While a "change of contractor letter template" provides a robust framework, its true value lies in its adaptability. This foundational document layout can be precisely tailored to fit a wide array of specific scenarios, ensuring the message is always relevant and impactful. Whether the notification pertains to employment, broader business operations, or specific requests, customization is key to effective communication.

For internal HR functions, the template might be adapted to notify employees about a change in a key vendor or service contractor that directly impacts their work or benefits. In client-facing scenarios, the correspondence could be modified to inform clients about a new contractor assigned to their project, assuring them of continuity and quality. For operational changes, it might serve as a formal notification to stakeholders regarding the commencement or termination of a significant contract, detailing handover procedures and new points of contact. The ability to customize this file allows organizations to address specific legal, operational, and relational nuances without sacrificing the professional structure of the original form, thereby enhancing the utility of the written request.

When a Change Of Contractor Letter Template is Most Effective

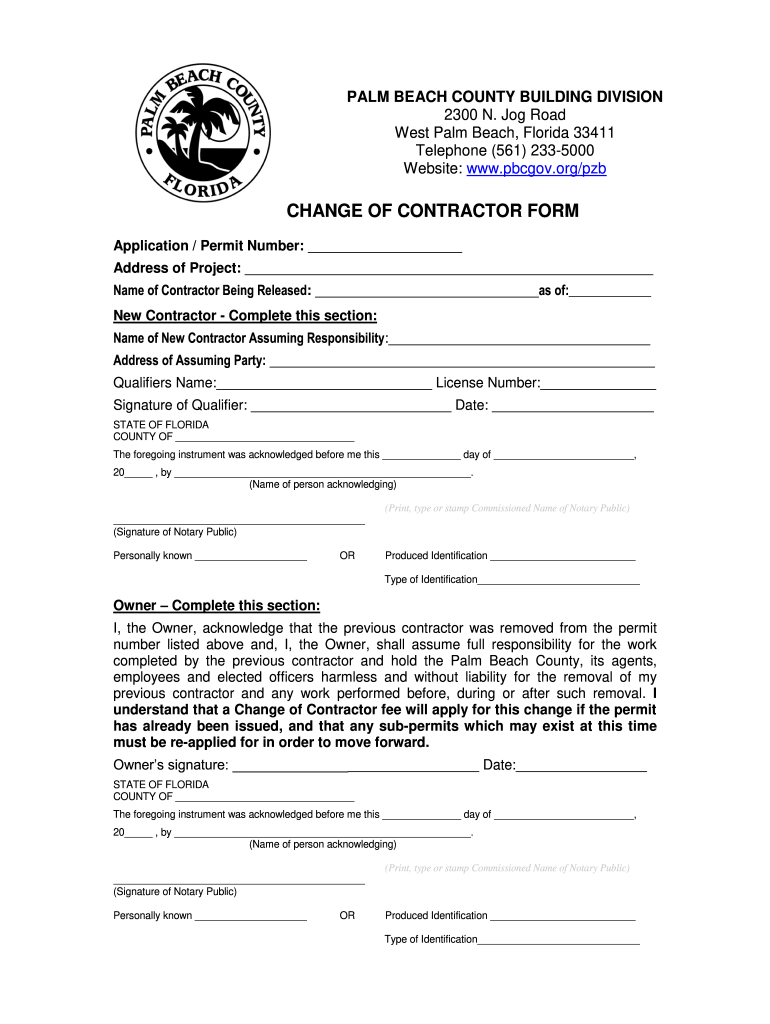

The strategic deployment of a dedicated "change of contractor letter template" ensures that critical transitions are handled with precision and professionalism. This type of official record is particularly effective in scenarios where clear, formal notification is paramount. Below are several instances where utilizing this template is highly recommended:

- Replacing a Primary Contractor: When an organization decides to replace a long-standing primary contractor, this letter formally communicates the decision, outlining the transition plan and introducing the new entity.

- Notifying Clients of a New Contractor: For service-based businesses, informing clients that a different contractor will be handling their project is crucial for maintaining trust and setting new expectations.

- Announcing the End of a Contractor’s Engagement: Whether due to project completion, contract termination, or other reasons, this formal correspondence serves as an official notice of the cessation of services.

- Internal Communication Regarding Contractor Changes: Informing internal departments (e.g., finance, legal, project management) about changes to a contractor’s status ensures all internal records are updated and aligned.

- Legal or Compliance Updates Requiring Formal Notification: Certain contractual agreements or regulatory requirements may mandate formal written notification for any changes involving service providers.

- Project Handover Procedures: When one contractor replaces another on an ongoing project, this document can detail the handover process, responsibilities, and key dates.

- Introducing a Sub-Contractor to a Main Contractor: In multi-layered projects, a formal letter can introduce a new sub-contractor to the main contractor, outlining their scope and points of contact.

Each of these examples underscores the necessity of a standardized, professional approach to communicating contractor changes, safeguarding relationships, and ensuring operational continuity.

Formatting, Tone, and Usability

The effectiveness of any formal correspondence, including a change of contractor notification, hinges significantly on its formatting, tone, and overall usability. Adhering to established business letter standards is crucial for conveying professionalism and ensuring the message is taken seriously.

Formatting Guidelines

A professional document layout typically includes the sender’s and recipient’s full contact information, a clear date, a concise subject line, a formal salutation, well-structured body paragraphs, and a professional closing. Margins should be standard (e.g., one inch on all sides), and a legible font (such as Arial, Calibri, or Times New Roman) in an appropriate size (10-12pt) should be used. For readability, paragraphs should be short, ideally 2-4 sentences each, with adequate spacing between them. When preparing the letter for print, ensure high-quality paper is used. For digital versions, saving the file as a PDF maintains its integrity, prevents accidental edits, and ensures universal compatibility across various operating systems and devices, making it a reliable official record.

Tone and Language

The tone of the letter must always remain formal, objective, and professional. It should be clear, concise, and devoid of emotional language. The aim is to inform, not to persuade or express personal opinions. Maintain a respectful tone towards all parties involved, regardless of the circumstances leading to the change. Use active voice to convey directness and avoid jargon where simpler terms suffice. The language should be unambiguous, leaving no room for misinterpretation of the message.

Usability Considerations

For internal use, especially if the template is part of a larger administrative process, ensure it is easy for authorized personnel to fill in the required details. Clear instructions or placeholder text can guide users. For external recipients, the letter should be easy to understand at first glance, with key information highlighted or presented clearly. Consider accessibility for digital versions; for instance, ensuring the PDF is text-selectable and screen-reader friendly if appropriate. A user-friendly template enhances efficiency and reduces the likelihood of errors in communication.

The Enduring Value of a Structured Communication Tool

In conclusion, the strategic implementation of a well-designed change of contractor letter template is an indispensable asset for any organization committed to excellence in professional communication. This standardized document transcends a mere formality; it is a critical instrument for maintaining transparency, ensuring compliance, and fostering positive relationships during periods of transition.

By providing a consistent, clear, and authoritative voice, this template minimizes ambiguity, mitigates potential disputes, and establishes a robust official record. It stands as a testament to an organization’s dedication to professional conduct and meticulous documentation, ensuring that every contractor transition is handled with the utmost care and precision. Ultimately, leveraging such a reliable and efficient communication tool safeguards operational continuity and strengthens the foundation of all business engagements.