Navigating the waters of personal finance can often feel like charting an unknown ocean – overwhelming, complex, and full of potential pitfalls. Whether you’re a seasoned financial planner or just starting to take control of your money, the sheer volume of transactions, bills, and savings goals can easily become a tangled mess. This is precisely why diving into an annual budget sheet template isn’t just a good idea; it’s a foundational step towards financial clarity and peace of mind. It transforms a daunting task into a manageable journey, providing a clear roadmap for your money.

Think of this document not as a restrictive chore, but as your personal financial assistant, ready to bring order and insight to your spending and saving habits. It’s a tool for busy individuals, growing families, budding entrepreneurs, and anyone who wants to optimize their financial resources. This article will explore why having a robust annual budget sheet template in your financial toolkit is a game-changer, helping you understand where your money goes, where it could go, and how to make it work harder for you.

The Core of Financial Clarity: Why Organization Matters

Unorganized finances are a silent source of stress, often leading to missed payments, unexpected shortfalls, and a general feeling of being out of control. Without a clear overview, it’s nearly impossible to make informed decisions about your money, whether it’s planning for a vacation, saving for a down payment, or simply understanding your monthly expenses. Organized financial record-keeping, at its heart, is about gaining clarity and control.

When you consistently track your income log and maintain an accurate expense tracker, you start to see patterns and areas for improvement that were previously hidden. This isn’t just about knowing how much you spend; it’s about understanding why you spend it and its impact on your financial goals. A well-structured system reduces financial anxiety, empowers better decision-making, and lays the groundwork for long-term financial health and freedom. It transforms guesswork into a strategic approach to your money.

Unlocking Potential: Key Benefits of Structured Budgeting Tools

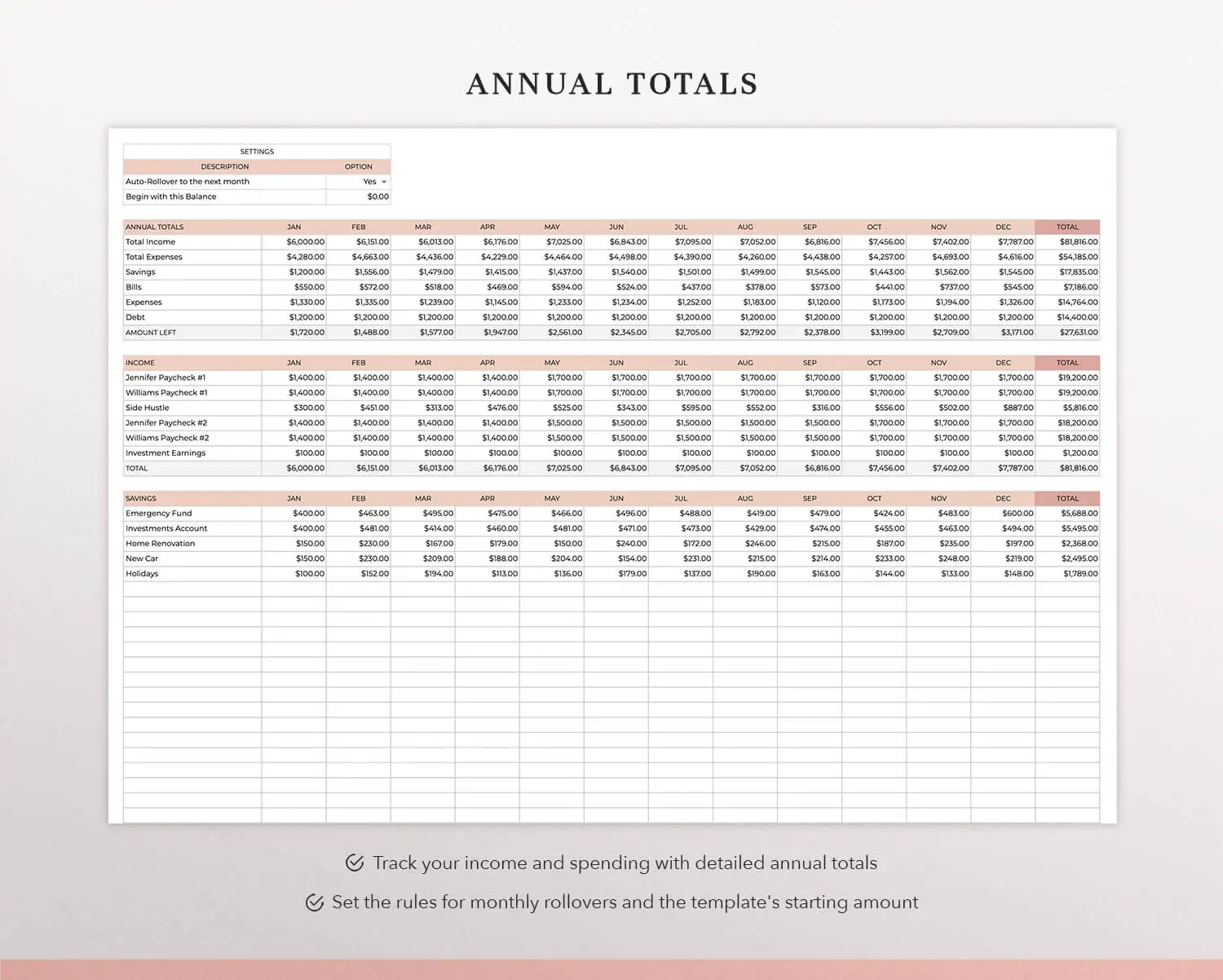

The true power of a structured financial organizer lies in its ability to reveal insights and facilitate strategic planning. By meticulously detailing your financial inflows and outflows, you unlock a myriad of benefits that extend far beyond simply knowing your bank balance. A well-designed financial spreadsheet offers a bird’s-eye view of your entire financial landscape, making it easier to identify where your money is truly going.

One of the primary advantages is the ability to spot spending patterns and categories where you might be overspending, allowing you to make conscious adjustments. This optimization of savings isn’t just wishful thinking; it becomes a tangible goal supported by real data. Furthermore, a detailed budgeting system provides a clear picture of your cash flow, helping you anticipate future needs and avoid last-minute financial surprises. It empowers you to set realistic savings goals, plan for major purchases, and even strategize debt reduction. The template streamlines the entire process, minimizing errors and maximizing your financial insights.

Versatility in Practice: Adapting Your Financial Template

One of the most remarkable aspects of a well-designed financial planning document is its inherent adaptability. While the core structure remains consistent – tracking income and expenses – the specific categories and level of detail can be tailored to suit a wide array of financial needs. This flexibility makes the template an indispensable tool for diverse situations.

For personal finance, the document can serve as a comprehensive household budget, meticulously tracking monthly expenses for groceries, utilities, entertainment, and transportation. Small businesses, on the other hand, can adapt the layout to monitor operational costs, project-specific budgets, and ultimately, their profit and loss statements, providing crucial insights into their financial health. For event planning, whether it’s a wedding, a major home renovation, or a dream vacation, the sheet becomes a cost management tool, ensuring you stay within your allocated funds. Even for simple household management, it can facilitate tracking shared expenses among roommates or managing a pet care budget. The beauty of this sheet is that it’s a living document, ready to evolve with your changing financial landscape and specific goals.

Examples of When Using an Annual Budget Sheet Template is Most Effective

While a budget template is beneficial at any time, certain life moments and financial goals particularly highlight its power. Here are some instances where incorporating an annual budget sheet template into your routine can provide maximum impact:

- Beginning of a New Year: A fresh start is the perfect time to reset your financial habits, set new goals, and outline a spending plan for the next 12 months. This allows for proactive financial planning rather than reactive adjustments.

- Planning a Major Purchase: Whether it’s a car, a home down payment, or a significant investment, the planner helps you save consistently and understand the true cost over time. It breaks down the larger goal into manageable monthly savings targets.

- Starting a Small Business: Beyond personal finances, the template can be adapted to track initial investments, operational costs, revenue streams, and cash flow, providing a critical overview for new entrepreneurs.

- Navigating Life Changes: Marriage, welcoming a new baby, relocating, or a career change all impact your finances significantly. The spreadsheet helps integrate new income and expense variables into a cohesive financial strategy.

- Developing a Debt Reduction Strategy: If you’re tackling credit card debt or student loans, the record allows you to allocate specific funds towards accelerated repayment, showing your progress and motivating consistency.

- Saving for Retirement or Long-Term Investments: By clearly delineating how much you can contribute regularly, the layout becomes a vital component of your overall savings planner, ensuring your long-term goals remain on track.

Designing for Success: Tips for a User-Friendly Budget Template

A budget template is only as effective as its usability. To truly make this tool work for you, focus on thoughtful design and formatting, whether you prefer a print version or a digital financial spreadsheet. The goal is to create a financial organizer that is intuitive, comprehensive, and easy to maintain.

Structure and Content

Start by clearly defining your income categories, including salary, freelance income, or other sources. Next, categorize your expenses into fixed costs (rent, insurance, loan payments) and variable costs (groceries, entertainment, dining out). Don’t forget to include dedicated sections for savings goals and debt tracking, which are crucial components of any robust financial plan. A good layout should also feature a summary section that provides a quick overview of your net income and total expenses, making it easy to gauge your financial health at a glance.

Formatting for Clarity

Visual clarity significantly enhances usability. Use clear labels and consistent formatting throughout the template. Color-coding can be incredibly effective for distinguishing between income, expenses, and savings, or for highlighting areas of concern. Ensure a logical flow from income to expenses to savings, making it easy to follow your money’s journey. Bold headings and subheadings improve readability, while well-placed lines or borders can segment different sections, preventing information overload. The objective is to make information easy to find and understand without unnecessary clutter.

Digital vs. Print

When designing for a digital financial spreadsheet, leverage its power for automation. Incorporate formulas for automatic calculations of totals, balances, and percentages, significantly reducing manual effort and potential errors. Features like conditional formatting can automatically flag when you’re nearing a budget limit or highlight overspending. For a print version, ensure ample space for manual entries and notes, as well as clear sections for monthly totals. Consider a clean, minimalist design that doesn’t consume too much ink, and ensure that the structure is intuitive enough for quick reference without digital aids. Regardless of the format, the aim is to create a tool that simplifies cost management and empowers informed financial decisions.

A comprehensive annual budget sheet template isn’t just a document for tracking numbers; it’s a powerful statement of intent. It signifies your commitment to understanding your financial landscape, taking control of your resources, and actively working towards your goals. This planner becomes a trusted ally in reducing financial stress, saving you precious time usually spent worrying or scrambling to figure out where your money went. It transforms abstract financial goals into concrete, actionable steps, turning aspirations into achievements.

By embracing the discipline of regular updates, this sheet evolves from a static document into a dynamic financial organizer that grows with you. It provides invaluable insights, helps you adapt to unforeseen circumstances, and celebrates your progress. The practical value extends beyond mere bookkeeping; it instills a sense of empowerment, fostering financial literacy and confidence that permeates all aspects of your life.

Ultimately, by integrating a well-designed financial record into your routine, you’re not just managing money; you’re cultivating a healthier relationship with it. This leads to greater peace of mind, clearer decision-making, and the satisfaction of knowing you are actively shaping your financial future. Start today, and unlock the immense potential within your financial journey.