In the highly competitive landscape of professional employment, particularly within the security sector, a well-crafted cover letter serves as an essential bridge between an applicant’s resume and a potential employer. This introductory document is not merely a formality; it is a critical instrument that can distinguish a candidate from a vast pool of applicants, articulating qualifications and enthusiasm in a personalized and compelling manner. For individuals seeking positions that demand vigilance, responsibility, and a meticulous approach, presenting a professional and thoughtfully organized application package is paramount.

This article aims to provide a comprehensive guide to understanding and utilizing a robust cover letter template for security job applications. It is designed for job seekers, recruiters, and human resources professionals who value clarity, consistency, and efficacy in formal correspondence. By adhering to a structured format, applicants can ensure that their communication is always professional, persuasive, and aligned with industry expectations, ultimately enhancing their prospects in a demanding field.

The Indispensable Role of Professional Written Communication

Effective written communication forms the bedrock of successful operations across all professional domains, and its significance is particularly pronounced in sectors where precision, accountability, and clarity are non-negotiable. Whether conveying critical information, making formal requests, or documenting decisions, a well-structured written piece ensures that the message is accurately received and understood, leaving no room for ambiguity. This foundational principle extends to personal settings as well, where clear documentation can resolve disputes or simplify complex processes.

Professional documentation, such as business letters, formal correspondence, and official records, serves multiple vital functions. It establishes a verifiable timeline of events, provides evidence of agreements, and upholds organizational standards. In the context of employment, an applicant’s cover letter is often the first tangible representation of their communication skills and attention to detail. It reflects their ability to articulate thoughts coherently and present themselves professionally, attributes highly valued in security roles where clear reporting and precise instruction following are daily necessities.

Advantages of a Structured Cover Letter Template For Security Job

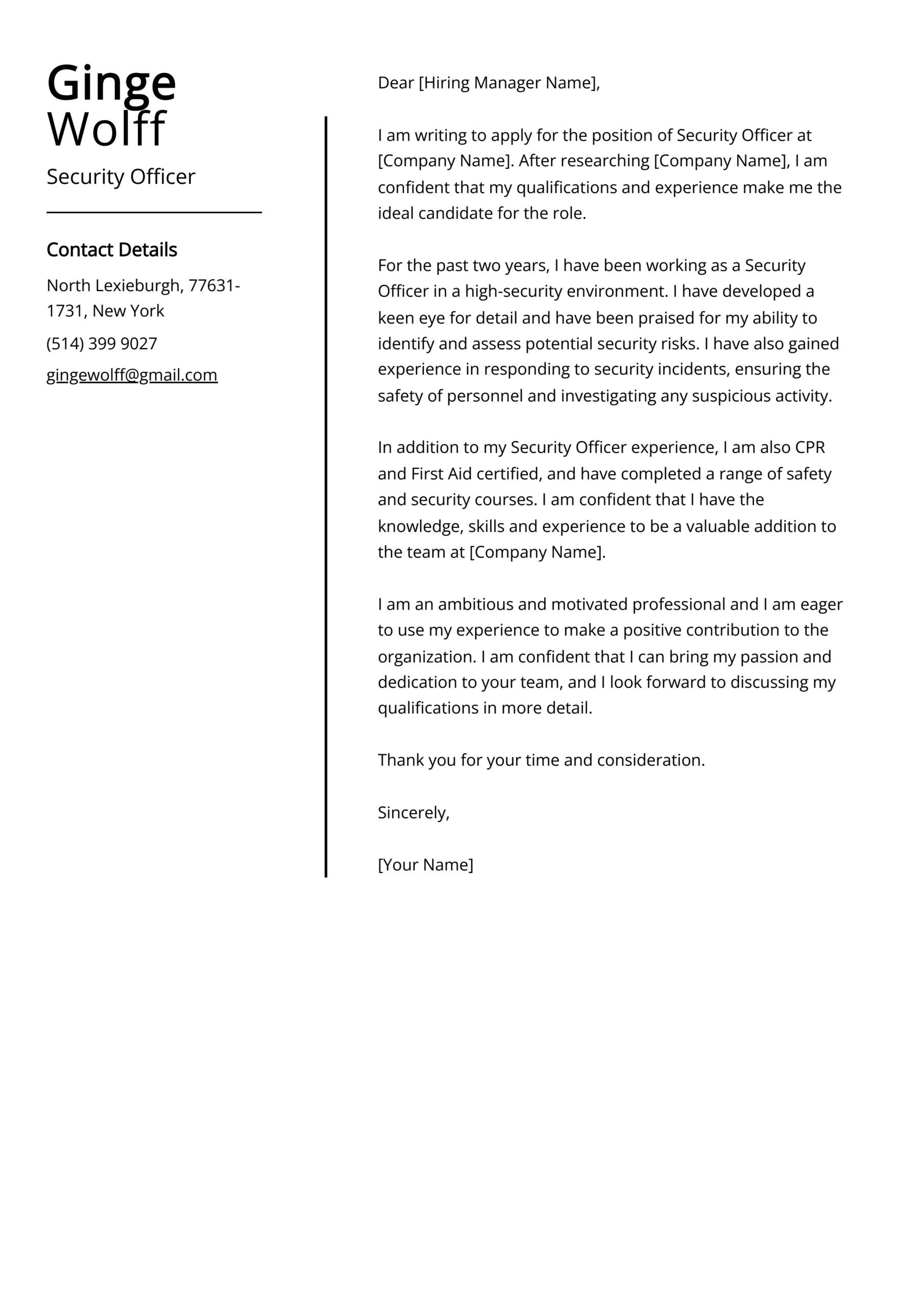

Employing a structured cover letter template for security job applications offers numerous strategic benefits for job seekers. This foundational framework ensures that every essential component of a professional letter is consistently present and logically organized, from contact information to a compelling call to action. Such a systematic approach not only saves time during the application process but also significantly enhances the overall quality and impact of the submission.

The primary advantage of using such a template is the maintenance of unwavering professionalism. It dictates a standard layout, appropriate tone, and necessary content, ensuring that the correspondence always meets the high expectations of the hiring manager. Consistency in presentation across multiple applications reinforces the candidate’s commitment to detail and organized thought. Furthermore, a well-structured cover letter aids in clarity, guiding the reader through the candidate’s qualifications and enthusiasm without unnecessary distractions. This structured layout ensures key information is easily identifiable, facilitating quicker and more effective evaluation by busy recruiters.

Customizing the Template for Diverse Professional Needs

While a standardized cover letter template for security job applications provides an excellent starting point, its true power lies in its adaptability and capacity for customization. This versatility allows the core document to be tailored not just for employment purposes, but also for a broader spectrum of professional communications. The fundamental structure—header, salutation, body paragraphs, closing—is universally applicable and can be modified to suit various specific contexts.

For instance, beyond job applications, the layout can be repurposed as a formal notification, a written request for information, or a business letter addressing a vendor or client. The clear, concise format makes it ideal for official correspondence where precision is key. Customization involves not only altering the content but also adjusting the tone and specific sections to match the objective of the communication. This adaptability ensures that the document remains a valuable tool for effective business communication across different scenarios, providing a reliable message template for various official records.

Effective Application Scenarios for the Template

The utility of a well-designed cover letter or message template extends far beyond a singular purpose. Its structured nature makes it exceptionally effective in numerous professional scenarios where clear, formal correspondence is required. Here are some examples of when using this template is most effective:

- Job Applications: Primarily for applying to security roles, but adaptable for any professional position requiring a formal introduction and a compelling summary of qualifications.

- Formal Requests: When formally requesting information, a meeting, an extension, or any official action from a professional entity or individual.

- Official Notifications: For providing notice of resignation, policy changes, incident reports, or any communication that needs to be officially documented.

- Business Inquiries: When initiating contact with potential partners, suppliers, or clients, introducing a company or service with a professional tone.

- Follow-Up Correspondence: After interviews, networking events, or initial meetings, to reiterate interest or confirm understandings.

- Submitting Proposals: As an introductory letter accompanying a business proposal, grant application, or project brief, setting the context for the attached documents.

- Complaint or Feedback Letters: When formally registering a complaint or providing structured feedback to an organization, ensuring the message is taken seriously.

These diverse applications underscore the value of having a reliable document layout that can be quickly adapted to maintain a high standard of professional communication in various contexts.

Optimizing Your Template: Formatting, Tone, and Usability

To maximize the effectiveness of any professional correspondence, particularly a cover letter, meticulous attention to formatting, tone, and overall usability is crucial. These elements collectively determine how a reader perceives the message and the sender. Optimizing these aspects ensures that your communication is not only professional but also highly engaging and easy to process.

Formatting Tips:

- Clean Layout: Utilize standard margins (1-inch all around) and a professional font (e.g., Arial, Calibri, Times New Roman) in a readable size (10-12 point).

- Consistent Spacing: Employ single-spacing within paragraphs and double-spacing between paragraphs and sections for visual clarity.

- Professional Header: Include your contact information, the date, and the recipient’s contact information in a clear, block format at the top.

- Paragraph Length: Keep paragraphs concise, ideally 2-4 sentences, to maintain readability and prevent the reader from feeling overwhelmed.

- PDF Conversion: For digital submissions, always convert the final letter to a PDF to preserve formatting across different systems and prevent unauthorized alterations.

Tone Considerations:

- Formal and Respectful: Maintain a respectful and formal tone throughout the letter, avoiding slang, overly casual language, or excessive enthusiasm.

- Confident and Assertive: Project confidence in your abilities and experience without sounding arrogant. Use active voice to convey directness and capability.

- Concise and Direct: Get straight to the point, clearly stating your purpose and relevant qualifications. Avoid unnecessary jargon unless it’s standard industry terminology.

- Enthusiastic but Professional: Show genuine interest in the role and the organization, but temper it with professionalism.

Usability for Both Print and Digital Versions:

- Accessibility: Ensure the document is easily readable on screens of various sizes and when printed. High contrast between text and background is essential.

- File Naming: Use a professional and descriptive file name (e.g., "JohnDoe_CoverLetter_SecurityManager.pdf") for digital submissions.

- Conciseness: Aim for a single-page letter for most applications. Recruiters often scan documents quickly, and brevity enhances the impact.

- Proofreading: Thoroughly proofread the letter multiple times to eliminate any grammatical errors, typos, or factual inaccuracies. Even minor mistakes can detract from your professionalism.

By adhering to these guidelines, applicants can ensure that their cover letter, whether printed or digital, consistently presents them in the best possible light, reinforcing their professional image and enhancing their chances of securing an interview.

In conclusion, the strategic use of a structured document like a cover letter template for security job applications is more than a mere convenience; it is a critical component of effective professional communication. It ensures that every interaction is conducted with precision, clarity, and professionalism, which are foundational requirements in the security sector and indeed, across all professional landscapes. By providing a consistent framework, this kind of template empowers individuals to present their qualifications and intentions with confidence and impact.

This versatile tool stands as a testament to the enduring value of organized thought and meticulous presentation in the professional realm. Whether used for seeking new employment opportunities, making formal requests, or issuing official notifications, the template provides a reliable blueprint for crafting impactful messages. Embracing such a systematic approach elevates the quality of formal correspondence and strengthens one’s professional standing, making it an indispensable asset in today’s interconnected business world.