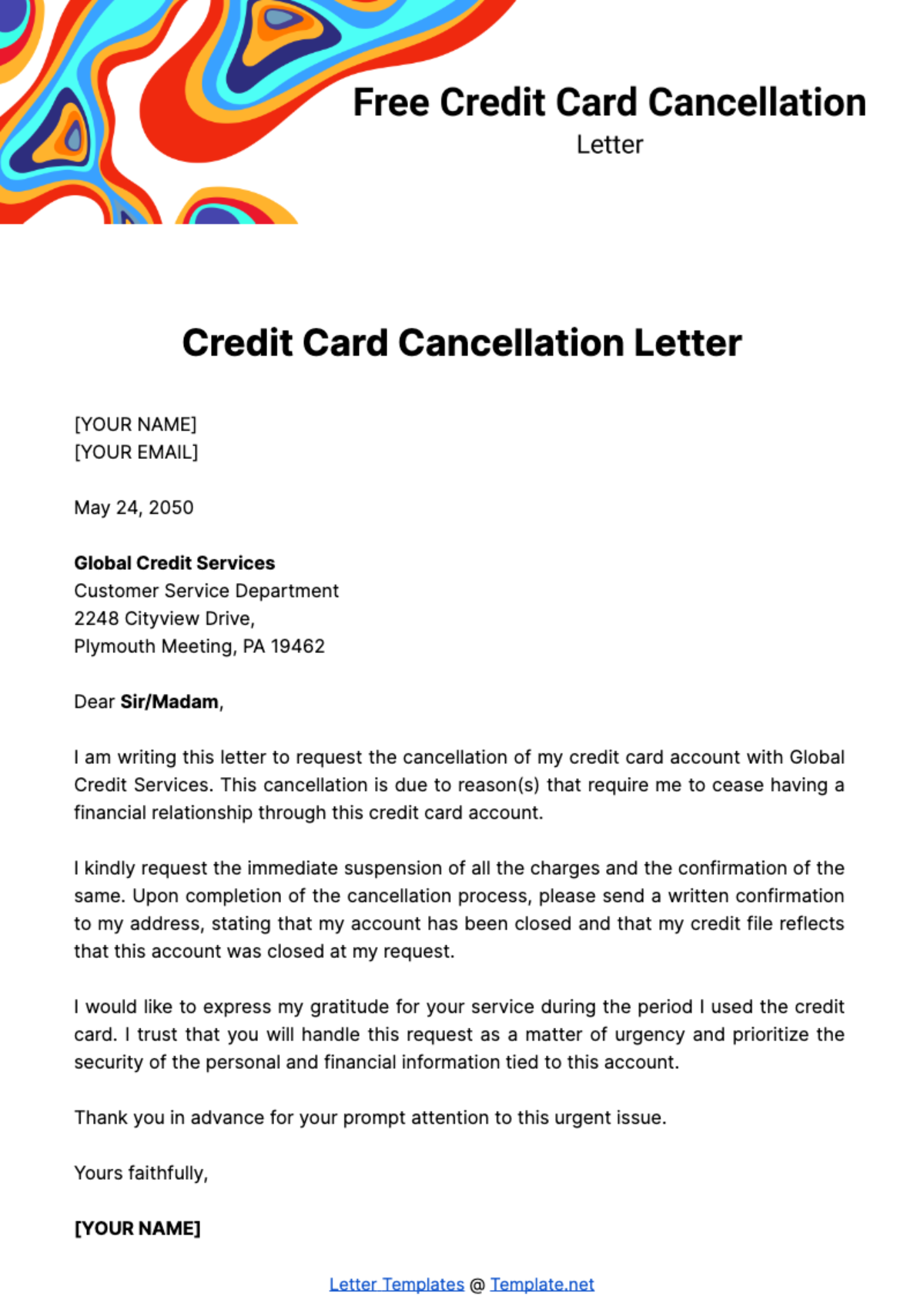

In an increasingly digital world, the importance of clear, unambiguous written communication remains paramount, especially concerning financial matters. When it comes to managing personal finances, formally documenting critical actions, such as closing an account, serves as a safeguard and an official record. This article delves into the utility of a meticulously crafted credit card cancellation letter template, designed to facilitate a smooth and secure closure process.

The primary purpose of such a template is to provide individuals with a structured, professional framework for communicating their intent to cancel a credit card. It ensures that all necessary information is conveyed accurately and completely to the financial institution, minimizing the potential for miscommunication or delayed processing. Both consumers and financial institutions benefit significantly from this standardized approach, as it streamlines administrative tasks, reduces the likelihood of future disputes, and provides a tangible record of the transaction. Utilizing a well-structured credit card cancellation letter template is an act of proactive financial management.

The Importance of Written Communication and Professional Documentation

In both business and personal realms, written communication stands as the bedrock of accountability and clarity. Unlike verbal exchanges, which can be prone to misinterpretation or forgotten details, written records offer a permanent and undeniable account of interactions and decisions. This is particularly crucial in formal settings, where precise language and documented intent are essential for legal, financial, and administrative purposes.

Professional documentation, such as official letters, memos, or emails, serves multiple vital functions. It establishes an indisputable record of communication, providing proof of actions taken or requests made. This official record can be indispensable in resolving disputes, fulfilling regulatory requirements, or simply ensuring that all parties are operating from the same understanding. For financial transactions, like closing a credit card account, the absence of a written record can lead to significant complications, including erroneous charges, ongoing account fees, or even negative impacts on one’s credit score. Therefore, adopting a disciplined approach to documentation is not merely a formality but a critical component of effective and responsible management.

Key Benefits of Using Structured Templates for Credit Card Cancellation

Employing a structured template for formal correspondence, particularly for a credit card cancellation letter template, offers a multitude of benefits that enhance professionalism, ensure consistency, and promote clarity in communication. The primary advantage lies in its ability to standardize the cancellation process, ensuring that every essential piece of information is included without fail. This reduces the risk of overlooking critical details that could otherwise delay or complicate the account closure.

A well-designed message template provides a consistent format, making the correspondence easy for the financial institution to process. It guides the sender to include necessary identifying information, such as the account number, the cardholder’s name, and the explicit request for cancellation. This systematic approach saves time for both parties and reduces the potential for errors that might arise from ad-hoc or incomplete requests. Furthermore, by using a professional communication layout, individuals project an image of competence and seriousness, reinforcing their intent and ensuring their request is treated with the appropriate urgency and attention. This type of business letter acts as a reliable tool, simplifying a potentially complex administrative task.

Customizing the Template for Various Formal Notifications

While the core focus is on a credit card cancellation letter, the underlying principles of a well-structured message template are universally applicable across a broad spectrum of formal notifications. The layout and organizational strategy employed in such a document can be easily adapted to suit various other communication needs, demonstrating its versatility as a foundational tool for professional communication. For instance, the same methodical approach can be used when drafting an employment notification, such as a resignation letter, ensuring all necessary dates and terms are clearly stated.

Similarly, businesses can leverage the structure to formulate official written requests or formal declarations, ensuring that all pertinent details are systematically presented. Whether it’s a request for information, a change in service, or a formal complaint, adapting the precise and clear nature of this template ensures that the message is conveyed effectively and authoritatively. This adaptability makes the document layout an invaluable asset for anyone regularly engaging in formal correspondence, providing a reliable framework that can be customized while maintaining a high standard of professional communication. It acts as a robust model for any notice letter requiring a detailed and formal approach.

When to Utilize a Credit Card Cancellation Letter Template Effectively

The application of a robust credit card cancellation letter template is most effective in several specific scenarios where a clear, written record of intent is paramount. These situations demand formal correspondence to ensure proper documentation and to safeguard the cardholder’s financial standing.

- Closing an Unused Card: When a credit card has become obsolete or is no longer needed, formally canceling it in writing ensures the account is properly closed, preventing potential annual fees or fraudulent activity on an unattended account.

- Following Up on a Dispute: If you’ve had a dispute with the issuer and have resolved it, sending a formal cancellation letter serves as a final, definitive step to close the account and confirm that the resolution also includes account closure.

- After Fraudulent Activity: In cases of reported fraud, while the issuer will often close the account, providing a formal letter confirms your explicit instruction to cancel the card, establishing an official record from your side.

- Upon Debt Repayment: Once a credit card balance has been fully paid off, especially after a period of financial hardship, sending this form guarantees that the account is indeed closed and no further charges can accrue.

- Consolidating Accounts: When streamlining finances by consolidating multiple credit cards into one, formally canceling the old accounts with this document helps ensure a clean transition and prevents any lingering obligations.

- Protecting Your Credit Score: While simply cutting up a card might seem like cancellation, only a formal notice ensures the account is reported as "closed by consumer" to credit bureaus, which is generally more favorable than an inactive but open account.

In each of these instances, the letter serves as an official record of the request, providing tangible proof should any discrepancies arise in the future.

Formatting, Tone, and Usability Guidelines

To maximize the effectiveness of any formal correspondence, including the cancellation of a credit card, meticulous attention to formatting, tone, and usability is essential. Adhering to established standards ensures that the letter is perceived as professional and its message is clearly understood.

Formatting:

The physical or digital presentation of the letter should follow a standard business letter format. This typically includes:

- Sender’s Information: Your full name, address, phone number, and email at the top.

- Date: The exact date the letter is written.

- Recipient’s Information: The financial institution’s name and relevant department address.

- Salutation: A formal greeting (e.g., "Dear [Bank Name] Customer Service,").

- Body Paragraphs: Clear, concise statements of intent and relevant details.

- Closing: A professional closing (e.g., "Sincerely," or "Respectfully,").

- Signature: Your handwritten signature (for print) or a typed name (for digital).

- Attachments: Mention any enclosed documents, such as a copy of your ID.

Use a clean, legible font such as Arial or Times New Roman, at a readable size (10-12 points). Maintain consistent spacing and clear paragraph breaks to enhance readability. For digital submissions, converting the file to a PDF ensures that the formatting remains intact across different systems.

Tone:

The tone of the correspondence must be consistently formal, professional, and respectful. Avoid emotional language, colloquialisms, or aggressive phrasing. The objective is to convey information clearly and directly, focusing on facts and actions. State your intent explicitly and provide all necessary details without superfluous commentary. A concise and polite tone ensures that your request is taken seriously and processed efficiently.

Usability:

A good template is inherently user-friendly. It should guide the user through the process, prompting for all necessary information. Key elements for usability include:

- Clear Prompts: Indicate where the user needs to insert their account number, name, and specific requests.

- Checklist of Information: A brief internal checklist can help ensure all details are included, such as the full account number, the last four digits of the card, the desired effective cancellation date, and a request for a confirmation of closure.

- Proofreading: Always proofread the final document for any grammatical errors, typos, or factual inaccuracies before sending it. Errors can undermine the professionalism of the letter and potentially lead to confusion.

- Keeping a Copy: Always retain a copy of the sent letter, along with any confirmation numbers or correspondence from the financial institution, for your personal records.

By adhering to these guidelines, individuals can ensure their formal correspondence, regardless of its specific purpose, is effective, professional, and contributes positively to their administrative and financial management. This attention to detail transforms a simple message into an official record of intent.

In conclusion, the strategic use of a credit card cancellation letter template transcends mere formality; it represents a commitment to organized financial management and effective business communication. By providing a clear, structured framework, this document minimizes ambiguity, ensures all critical information is conveyed, and establishes an invaluable official record of your request. It is a testament to the power of well-drafted correspondence in safeguarding personal interests and streamlining administrative processes.

Ultimately, whether you are closing an unused account, following up on a dispute, or consolidating your financial portfolio, relying on a robust message template like this ensures that your intentions are unequivocally understood by financial institutions. This meticulous approach not only fosters professionalism but also provides peace of mind, knowing that your financial affairs are handled with precision and accountability. This type of business letter stands as an essential tool for anyone seeking to maintain clarity and control over their financial landscape, proving the enduring value of proper formal correspondence in today’s complex world.