In the intricate landscape of modern business and legal proceedings, clear, concise, and professionally structured communication is paramount. A subrogation demand letter template serves as a critical tool for entities seeking to recover funds or assert rights from a third party responsible for a loss. This document is typically employed by insurance companies, self-insured businesses, or even individuals who have paid out a claim or incurred a loss that should rightfully be borne by another party. Its primary purpose is to formally notify the responsible party of the subrogated claim, detail the basis of the demand, and request restitution.

The structured approach offered by such a template significantly streamlines the recovery process, ensuring that all necessary information is consistently included and presented in a legally sound manner. For legal departments, claims adjusters, and financial administrators, having a standardized subrogation demand letter template minimizes the potential for errors, accelerates processing times, and enhances the overall efficiency of recovery efforts. It transforms a potentially complex and time-consuming task into a predictable and manageable operation, reinforcing the integrity of the demand and strengthening the likelihood of a successful outcome.

The Importance of Written Communication and Professional Documentation

The foundation of effective business operations and legal compliance rests heavily on robust written communication and professional documentation. In any formal setting, verbal agreements or informal exchanges rarely hold the same weight or provide the same level of protection as a meticulously drafted document. Written correspondence provides an indisputable record, minimizing ambiguities and serving as a reliable reference point for all parties involved. It ensures that expectations are clearly set, obligations are understood, and any potential disputes can be resolved with factual evidence rather than subjective interpretations.

Professional communication, such as a formal correspondence or a business letter, reflects an organization’s commitment to precision, accountability, and ethical conduct. Documents like official records are essential for demonstrating due diligence, complying with regulatory requirements, and safeguarding an entity’s interests in legal or financial matters. They establish a professional tone, convey authority, and are fundamental for maintaining transparency and trust among stakeholders, whether internal or external. Without a solid paper trail, businesses expose themselves to significant risks, including misunderstandings, financial losses, and legal liabilities.

Key Benefits of Using Structured Templates for Subrogation Demand Letters

Utilizing a robust subrogation demand letter template offers numerous advantages that extend beyond mere convenience. Foremost among these is the assurance of professionalism and consistency across all outgoing correspondence. Every letter sent using the template will adhere to a uniform format, tone, and informational structure, projecting an image of organizational competence and reliability. This consistency is vital in high-volume environments, where maintaining a high standard of communication can impact reputation and efficacy.

Furthermore, a well-designed template ensures clarity in communication by guiding the author to include all essential elements of a subrogation claim. It acts as a checklist, prompting the inclusion of details such as the incident date, parties involved, financial loss incurred, legal basis for subrogation, and the specific amount demanded. This systematic approach reduces the likelihood of omitting crucial information, which could otherwise weaken the claim or necessitate additional follow-up correspondence. The document also promotes efficiency, as staff can quickly populate predefined fields, saving significant time compared to drafting each letter from scratch. This enhanced accuracy and completeness contribute directly to higher recovery rates and reduced administrative overhead, making the template an invaluable asset for any organization managing subrogation claims.

Customization for Diverse Applications

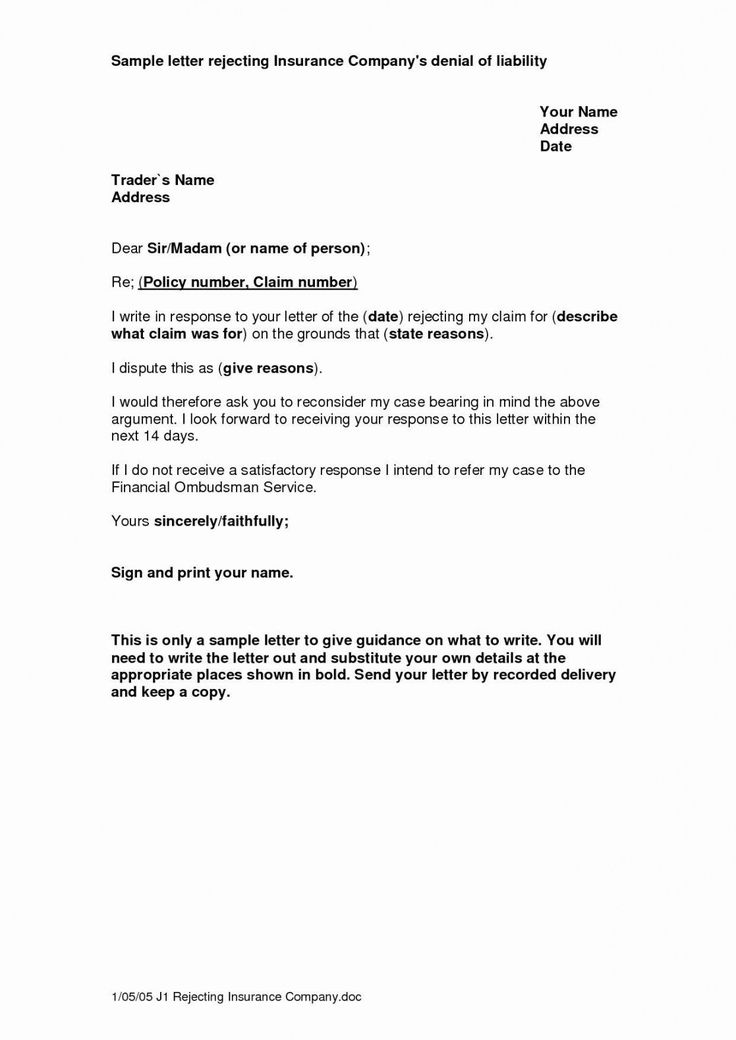

While the core principles of a demand letter remain constant—to formally request action or payment—the underlying structure of this form is remarkably adaptable for a myriad of purposes beyond subrogation. The fundamental layout and formal tone can be effectively customized for various business, employment, or personal situations requiring official written notification or a specific request. For instance, the general framework of setting out facts, citing grounds, and demanding a resolution can be modified for an employment context, such as a formal notice letter regarding a policy violation or a written request for salary adjustment.

In a broader business setting, the template’s structure can be repurposed for a cover letter accompanying a proposal, a demand for payment for unpaid invoices, or a formal notification of a contract breach. The key is to retain the formal correspondence elements—clear recipient and sender information, a concise subject line, a logical flow of arguments, and a precise call to action—while tailoring the specific content. This versatility makes the underlying message template an indispensable tool for any individual or organization committed to clear and authoritative communication, serving as a reliable official record for a wide array of interactions.

When a Subrogation Demand Letter Template is Most Effective

A precisely crafted subrogation demand letter template proves most effective in situations where a third party is responsible for a financial loss that has been initially borne by another entity. Its utility spans various sectors and scenarios, providing a clear path for recovery.

- Insurance Claims (Auto, Property, Health): When an insurance company pays out a claim to its policyholder due to an incident caused by a negligent third party (e.g., a car accident, property damage from a faulty product, medical expenses from another’s negligence), the template is essential for formally demanding reimbursement from the at-fault party or their insurer.

- Breach of Contract: If one party to a contract suffers a financial loss because another party failed to uphold their contractual obligations, the template can be adapted to demand compensation for the damages incurred.

- Unpaid Debts or Services: While primarily for subrogation, the structure of a formal demand for payment can be applied when an entity is owed money for goods or services rendered, and initial informal requests have gone unanswered.

- Property Damage: Beyond insurance, if an individual or business directly incurs property damage due to another’s actions (e.g., a contractor causing damage to a client’s property), the letter can be used to seek direct restitution.

- Professional Negligence: In cases where a professional’s negligence leads to financial harm for a client, a demand letter can formally initiate the process of seeking compensation.

- Recovery of Overpayments: When an organization accidentally overpays an vendor, employee, or beneficiary, this correspondence can be used to formally demand the return of the excess funds.

In each of these instances, the consistency and clarity provided by the template ensure that the demand is presented professionally, legally, and with the necessary detail to facilitate a prompt resolution or lay the groundwork for further legal action.

Tips for Formatting, Tone, and Usability

To maximize the impact and effectiveness of any formal communication, particularly a demand letter, meticulous attention to formatting, tone, and usability is crucial. These elements collectively contribute to the document’s professionalism and its ability to achieve its intended outcome.

Formatting Best Practices

The physical or digital presentation of the letter should convey professionalism and clarity.

- Clear Headings and Structure: Utilize clear headings for sections to guide the reader through the document. Ensure a standard business letter format, including sender’s and recipient’s addresses, date, and a concise subject line.

- Standard Fonts and Sizes: Opt for professional, legible fonts like Times New Roman, Arial, or Calibri, typically in 10-12 point size for body text and slightly larger for headings.

- Professional Letterhead: If applicable, use company letterhead for printed versions to reinforce authenticity and authority.

- Consistent Margins and Spacing: Maintain standard 1-inch margins on all sides and use single spacing for paragraphs with a double space between paragraphs for readability.

- Contact Information and Reference Numbers: Clearly state the sender’s contact details and include any relevant claim or reference numbers to facilitate easy identification and tracking.

- Attachment Indicators: If supporting documents are included, clearly list them at the end of the letter using an "Enclosures" or "Attachments" notation.

Maintaining an Appropriate Tone

The tone of the letter is paramount for achieving its objective without alienating the recipient.

- Formal and Professional: Always maintain a formal and professional tone. Avoid casual language, slang, or emojis.

- Firm but Objective: Be firm in stating the demand and the basis for it, but remain objective. Present facts clearly and avoid emotional language, accusations, or threats.

- Clear and Concise: Get straight to the point. State the purpose of the letter, the relevant facts, the legal or contractual basis for the claim, and the specific demand in a clear and succinct manner.

- Action-Oriented: Clearly articulate what action is expected from the recipient and by when. The call to action should be unambiguous.

- Respectful: Even in an adversarial context, maintain a respectful demeanor. This can help prevent unnecessary escalation and encourage cooperation.

Ensuring Usability (Print and Digital)

Consider how the letter will be consumed, whether in print or digitally.

- Print Version: For printed copies, ensure high-quality paper and printing. The file should be easily printable without layout issues.

- Digital Version: When sending digitally, PDF format is almost always preferred. PDFs preserve formatting, prevent unauthorized alterations, and are universally viewable. Ensure the file name is descriptive (e.g., "Subrogation Demand – [Claim Number] – [Date]").

- Accessibility: For digital files, consider basic accessibility, such as ensuring the text is selectable and searchable.

By adhering to these guidelines, any correspondence issued, whether it’s a subrogation demand or another type of formal notification, will be perceived as credible, authoritative, and ultimately more effective in achieving its intended purpose.

In the complex tapestry of modern organizational communication, the value of a meticulously designed and consistently utilized template cannot be overstated. The subrogation demand letter template, and its adaptable brethren, stand as testament to the power of structured documentation in navigating intricate financial and legal landscapes. This crucial tool not only streamlines operations but also fortifies an organization’s position, ensuring that demands are articulated with clarity, authority, and professionalism.

By providing a reliable and efficient communication framework, this correspondence minimizes the inherent risks associated with informal exchanges and incomplete records. It fosters a proactive approach to recovery and resolution, transforming potential disputes into manageable processes with clear pathways to resolution. Ultimately, leveraging such a sophisticated message template is not merely about convenience; it is a strategic imperative for any entity committed to effective business practice, robust risk mitigation, and unwavering professional communication.