In both personal and professional spheres, the necessity for clear, verifiable documentation cannot be overstated. Among the various forms of official correspondence, a proof of insurance letter serves as a crucial document, affirming that an individual or entity maintains specific insurance coverage. This letter is often required by third parties to mitigate risk, fulfill contractual obligations, or comply with regulatory mandates. A well-structured proof of insurance letter template simplifies the process of generating this essential verification, ensuring accuracy and consistency across all communications.

The primary purpose of such a document is to provide undeniable evidence of an active insurance policy, detailing coverage types, policy periods, and insured parties. Whether for a new landlord, a lending institution, a business partner, or an employer, presenting this official record promptly and accurately is vital for establishing trust and facilitating transactions. Utilizing a standardized template not only streamlines the creation of these letters but also ensures that all necessary information is consistently presented in a professional and easily digestible format, benefiting both the sender and the recipient by removing ambiguity.

The Imperative of Professional Written Communication

Effective communication is the bedrock of all successful interactions, particularly in business and legal contexts. Professional written communication, characterized by its clarity, precision, and formal tone, establishes credibility and fosters a reliable environment. Documents such as a business letter or official record transcend mere information exchange; they represent a commitment to professionalism and adherence to established protocols.

In an era where digital interactions are prevalent, the ability to produce a formal correspondence that is both accurate and comprehensive remains paramount. Such documentation acts as an official record, often carrying legal weight and serving as tangible proof of agreements, notifications, or verified facts. This meticulous approach to written requests and formal notifications minimizes misunderstandings, supports accountability, and helps maintain a professional reputation for all parties involved.

Advantages of a Standardized Template for Proof of Insurance

The adoption of a standardized proof of insurance letter template offers numerous strategic advantages for individuals and organizations alike. Firstly, it ensures an unparalleled level of consistency in communication. Every letter generated will present information in the same logical order and professional tone, thereby reinforcing an image of reliability and attention to detail. This consistency is particularly valuable for businesses that frequently issue such documentation, as it establishes a uniform standard.

Secondly, utilizing a pre-designed layout significantly enhances efficiency. Instead of drafting each letter from scratch, which is time-consuming and prone to errors, users can simply populate predefined fields with specific policy details. This not only saves valuable administrative time but also reduces the likelihood of omitting critical information. The clear structure of such a message template facilitates quicker processing for the recipient, as they can readily locate the required data without sifting through unstructured text. Ultimately, this approach bolsters professional communication and streamlines administrative workflows.

Customizing the Template for Diverse Applications

While the core structure of a proof of insurance template remains consistent, its adaptability for various scenarios is one of its key strengths. This form can be readily customized to meet the specific requirements of different situations, ensuring that the correspondence remains relevant and targeted. For instance, the details required for an employment verification, such as workers’ compensation coverage, might differ from those needed for a landlord requesting renter’s insurance.

Businesses might adapt the letter to confirm general liability coverage for a vendor agreement, while individuals could modify it to verify auto insurance for vehicle registration or a loan application. The key is to retain the foundational elements—policy holder, policy number, coverage dates, and insurer details—while adjusting the specific policy types and any supplementary information. This flexibility allows the template to serve as a versatile tool for a wide array of official requests, from formal notifications to detailed compliance declarations.

Practical Scenarios for Employing a Proof Of Insurance Letter Template

The utility of a well-crafted proof of insurance letter extends across numerous practical situations. Having a readily available template ensures that you can respond promptly and professionally to requests for coverage verification. Here are several common scenarios where this form proves invaluable:

- Mortgage Applications and Refinancing: Lenders invariably require proof of homeowner’s insurance to protect their investment in the property.

- Vehicle Registration and Lending: Auto insurance verification is mandatory for vehicle registration in most states and is often a prerequisite for obtaining auto loans.

- Contractor and Vendor Agreements: Businesses frequently demand that their contractors, subcontractors, or vendors provide proof of general liability, professional liability, or workers’ compensation insurance to mitigate risk.

- Apartment Rentals: Landlords often require tenants to show proof of renter’s insurance to protect against damage to personal property or liability claims.

- Employment Verification: Employers may request proof of certain types of insurance, such as workers’ compensation, especially for specific roles or independent contractors.

- School Enrollment: Some educational institutions, particularly for certain activities or international students, may request proof of health or travel insurance.

- Event Planning: Organizers of events, whether corporate or personal, often need to provide proof of liability insurance to venue owners.

- Business Licensing and Permits: Certain industries or business operations may require proof of specific insurance types to obtain or renew licenses and permits.

- Loan Applications (Other than Mortgage/Auto): Various personal or business loans might necessitate insurance verification related to collateral or business operations.

Best Practices: Formatting, Tone, and Usability

To maximize the effectiveness of any official document, meticulous attention must be paid to its formatting, tone, and overall usability. When utilizing a proof of insurance letter template, adherence to these best practices ensures that the correspondence is not only informative but also reflects a high degree of professionalism.

Formatting for Clarity and Readability

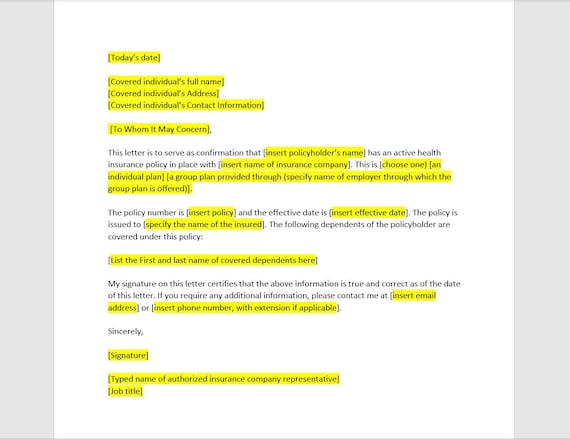

The document layout should follow a standard business letter format. This includes clear sender and recipient addresses, the current date, a professional salutation, and a concise body. Use a legible font (e.g., Arial, Times New Roman, Calibri) in a standard size (10-12pt). Headings and subheadings, if applicable, should be used to break up text and guide the reader. Ensure ample white space around paragraphs and margins for a clean, uncluttered appearance. Key details, such as the policy holder’s name, policy number, effective dates, and types of coverage, should be prominently featured and easy to locate. Including the insurance provider’s contact information further enhances the letter’s utility.

Maintaining a Professional Tone

The tone of the letter must be formal, factual, and unambiguous. Avoid overly casual language, jargon where plain language suffices, or any emotional expressions. The purpose of the correspondence is to convey verified information directly and respectfully. Maintain a respectful closing, such as "Sincerely" or "Respectfully," followed by the sender’s name and title. The goal is to present information with authority and clarity, ensuring the recipient understands the details without needing further clarification.

Ensuring Usability Across Platforms

For both print and digital versions, the letter should be easily accessible and understandable. If distributing digitally, saving the file as a PDF is often preferred, as it preserves formatting and prevents unauthorized edits. Ensure that the digital version is compatible with common operating systems and devices. For print, use high-quality paper and ensure that all text and signatures are clear. The ease with which the recipient can read, understand, and verify the information in the file directly contributes to its effectiveness as an official record.

In conclusion, the strategic implementation of a proof of insurance letter template represents a cornerstone of efficient and reliable professional communication. This specialized message template empowers individuals and organizations to quickly generate accurate, consistent, and formally structured documentation. By standardizing the presentation of critical insurance information, it significantly reduces administrative overhead, minimizes errors, and fosters an environment of clarity and trust in diverse transactional and compliance-driven settings.

The inherent value of this document layout lies not just in its ability to save time, but also in its capacity to uphold professional standards and legal requirements across a multitude of applications. From securing essential financial agreements to ensuring compliance in contractual relationships, this official record stands as an indispensable tool. Embracing a well-designed template for this critical correspondence is a proactive step towards exemplary business communication and robust documentation practices.