In the complex landscape of financial interactions, both personal and professional, clear and undeniable communication is paramount. Establishing a formal record of financial obligations is not merely good practice; it is often a necessity for maintaining transparency, resolving disputes, and ensuring legal compliance. The proof of debt letter template 3 serves as a critical tool designed to facilitate this essential form of communication, offering a structured and professional approach to documenting financial claims.

This specific template is an invaluable resource for anyone needing to formally assert or confirm a debt, whether they are an individual, a small business, or a larger enterprise. It provides a foundational framework that helps all parties involved understand the nature of the obligation, the amount due, and the basis for the claim, thereby streamlining communication and reducing potential misunderstandings. By leveraging such a standardized form, users can ensure their interactions are consistently professional, precise, and easily comprehensible.

The Indispensable Role of Formal Written Communication

Effective communication forms the bedrock of all successful personal and business relationships. In matters of finance, the importance of written communication transcends mere convenience, evolving into a critical requirement for clarity, accountability, and legal enforceability. A well-documented exchange leaves no room for ambiguity, ensuring that all parties possess a shared understanding of agreements and obligations.

Professional documentation serves multiple vital functions, including establishing an official record, mitigating risks, and providing tangible evidence should disputes arise. Whether confirming terms of service, detailing payment schedules, or asserting outstanding balances, written records offer an authoritative reference point. This meticulous approach to correspondence not only protects the interests of the sender but also fosters trust and professionalism in all dealings.

Unlocking Efficiency: Benefits of a Structured Document Layout

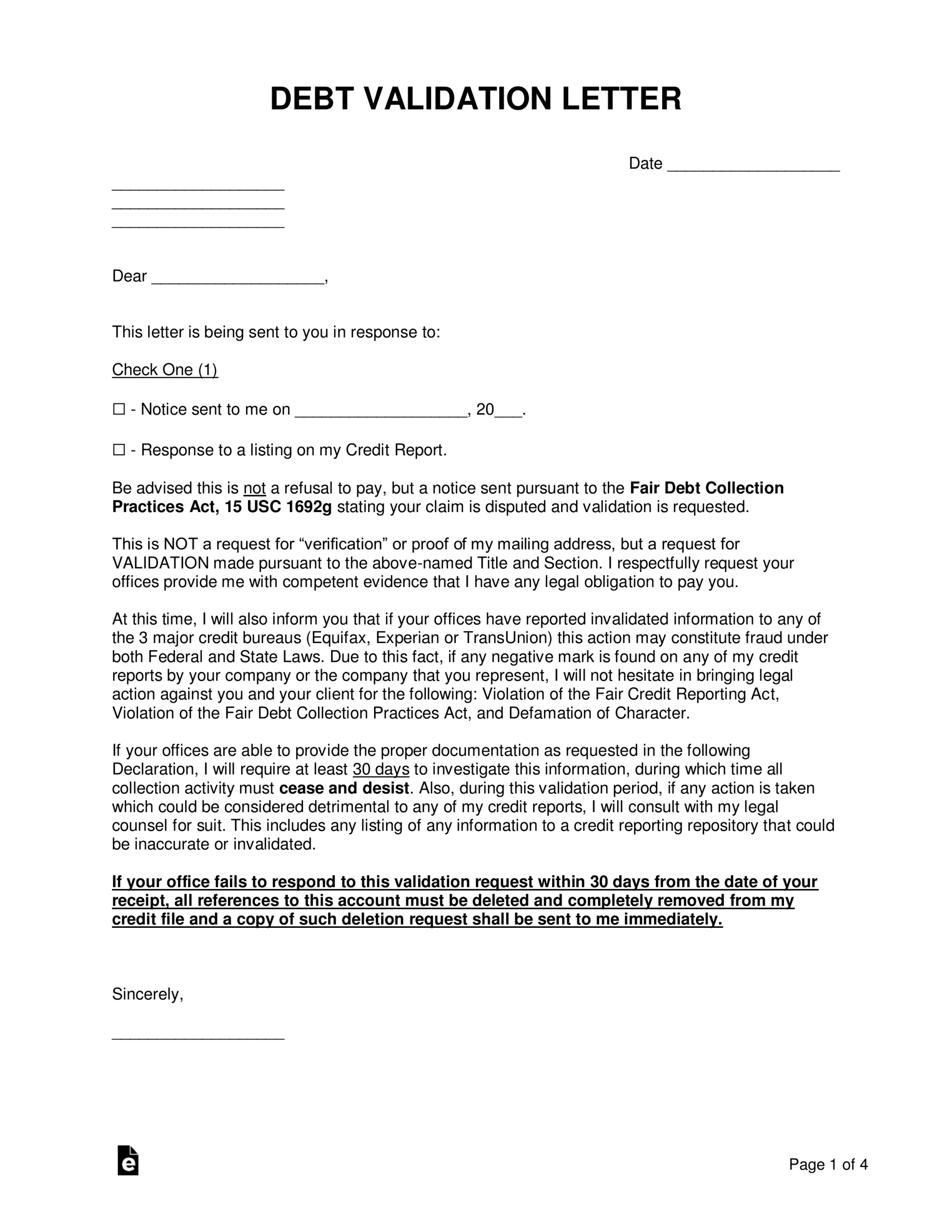

Adopting a structured template for formal correspondence, such as a proof of debt letter, offers substantial advantages over drafting each letter from scratch. A well-designed proof of debt letter template 3 provides a pre-formatted framework that ensures all essential information is included, consistently presented, and easy to locate. This consistency is vital for maintaining a professional image and for the clear conveyance of critical financial data.

The primary benefits of utilizing such a message template include significant time savings, reduced risk of error, and enhanced clarity. By eliminating the need to recreate the document layout for each new correspondence, users can focus on the specific details of the debt rather than the structural elements. This not only streamlines the communication process but also reinforces a professional and organized approach to financial management, ensuring the formal correspondence always reflects a high standard of business acumen.

Adapting the Template for Diverse Communication Needs

While the core purpose of a proof of debt letter remains consistent, the specific circumstances under which it is deployed can vary widely. This robust message template is designed with flexibility in mind, allowing for careful customization across a spectrum of situations—from employment-related matters to complex business transactions and general formal notifications. Its adaptable nature makes it an essential tool for varied communication requirements.

For instance, in an employment context, this form might be used by an employer to confirm an outstanding loan repayment from an employee, or by an employee to request formal confirmation of outstanding wages. Within business operations, the template can be tailored for use as a business letter to a client for unpaid invoices, or as a formal request to a supplier regarding an overpayment. The adaptability of the document ensures that it can function effectively as a written request, a notice letter, or even a supplementary cover letter to other financial documents, always maintaining a clear and professional tone suitable for an official record.

Practical Applications: When to Utilize This Formal Correspondence

Understanding the specific scenarios where leveraging a formal proof of debt letter is most effective can significantly enhance its utility. This formal correspondence should be considered whenever a clear, undeniable written record of a financial obligation is required to prevent disputes or facilitate resolution. Its application spans various sectors and personal circumstances.

Specific scenarios where this template is highly recommended include:

- Confirming Outstanding Invoices: When a client or customer has an overdue payment, a formal letter can serve as a professional reminder and a basis for further action.

- Requesting Loan Repayment: For personal or business loans, this

official recordclearly outlines the amount owed, repayment terms, and the basis of the debt. - Documenting Overpayments: If an individual or entity has mistakenly paid too much, the template can be adapted to formally request a refund, detailing the discrepancy.

- Insurance Claims: Providing formal proof of debt to an insurance company for losses incurred can expedite the claims process.

- Estate Management: Executors or administrators of an estate may use this

document layoutto formally notify beneficiaries or creditors of outstanding obligations or entitlements. - Contractual Breaches: In cases where a party has failed to uphold a financial clause in a contract, the letter can serve as formal notification of the debt arising from that breach.

- Dispute Resolution: As a foundational piece of evidence, it can support arbitration or mediation efforts by clearly articulating the financial claim.

- Pre-Legal Action: Before initiating formal legal proceedings, sending such

professional communicationoften serves as a necessary preliminary step, demonstrating attempts at amicable resolution. - Verification for Third Parties: When a third party (e.g., a financial institution, credit agency) requires verification of a debt, this

lettercan provide authoritative confirmation. - Employee-Employer Financial Agreements: Documenting outstanding balances related to company loans, advances, or outstanding expense reimbursements.

Crafting Effective Correspondence: Formatting, Tone, and Usability

The impact of any formal communication is significantly influenced by its presentation and underlying tone. When utilizing a message template for financial matters, adherence to best practices in formatting, tone, and usability ensures that the message is not only received but also understood and respected. A well-structured document layout enhances readability and professionalism.

For formatting, ensure that the letter includes a clear header with sender and recipient contact information, a professional salutation, a concise body articulating the debt details, and a formal closing. Use consistent fonts and spacing. The tone should remain formal, professional, and objective; avoid emotional language, personal accusations, or aggressive demands. Instead, focus on factual information, clearly stating the amount, the basis of the debt, and any relevant dates or account numbers. Usability considerations include making the correspondence easy to read, whether in print or digital format, by using clear language and straightforward sentence structures. Ensure all necessary attachments are referenced and provided, making the document a complete official record for all parties involved.

Conclusion: The Enduring Value of Meticulous Documentation

The judicious application of a structured proof of debt letter template is more than just administrative diligence; it is a strategic element of sound financial management and robust professional communication. This comprehensive template provides a consistent, clear, and authoritative method for articulating financial obligations, thereby fostering transparency and significantly reducing the likelihood of misunderstandings or disputes.

By ensuring that all formal correspondence is meticulously documented and professionally presented, individuals and organizations alike can uphold their reputation, protect their interests, and facilitate smoother financial interactions. The clarity and consistency offered by such a standardized letter are invaluable assets, serving as a reliable official record that can support fair and efficient resolution in various scenarios.

Ultimately, investing in the careful preparation and utilization of a proof of debt letter reinforces a commitment to accountability and ethical practices. It empowers users to communicate financial facts with confidence and precision, establishing a firm foundation for all subsequent actions and discussions. This ensures every financial interaction is handled with the professionalism and clarity it demands.