Have you ever found yourself mid-project, squinting at a jumble of receipts, wondering where all your money went? Or perhaps you’ve launched into a new personal goal – say, a home renovation or a big travel adventure – only to feel the creeping anxiety of uncontrolled spending. It’s a common scenario, and frankly, it’s exhausting. We all strive for organization in our lives, especially when it comes to our finances, but sometimes the tools we use just aren’t cutting it.

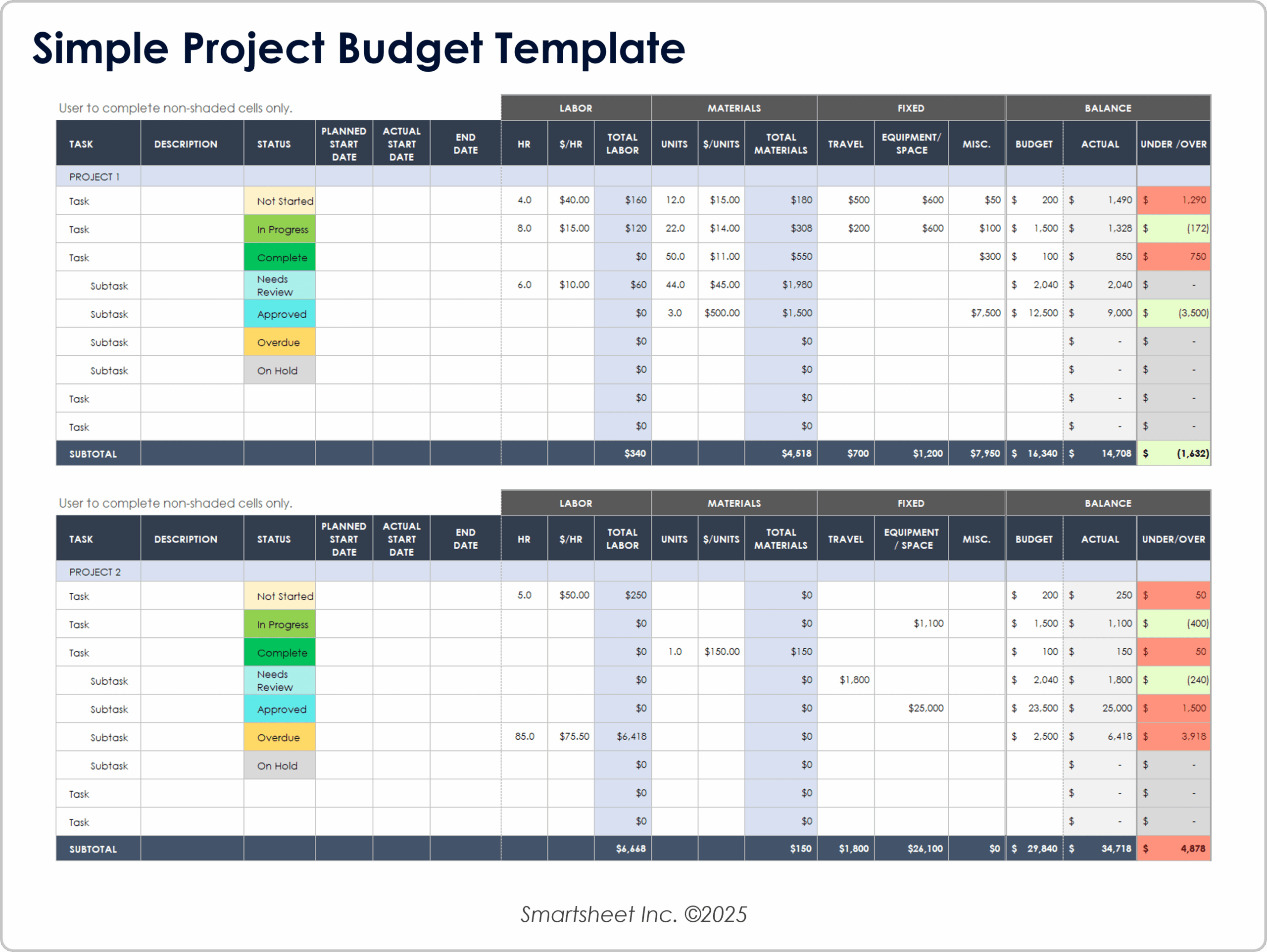

That’s where a meticulously designed project management budget template comes into play. Imagine a world where you never second-guess your spending, where every dollar has a purpose, and where financial surprises are a thing of the past. This isn’t just about spreadsheets; it’s about empowering yourself with clarity and control, turning financial chaos into calm, and transforming your aspirations into achievable realities. Whether you’re a small business owner, an individual planning a major life event, or simply someone who cares deeply about smart financial planning and productivity, this guide will show you how this indispensable tool can revolutionize the way you manage your money.

The Indispensable Value of Organized Financial Planning

In today’s fast-paced world, staying on top of our finances feels like a constant battle. Bills, subscriptions, unexpected costs – they all vie for our attention and our dollars. Without a clear system, it’s easy for spending to spiral, leading to stress, missed opportunities, and even debt. This is precisely why organized financial planning and meticulous record-keeping aren’t just good practices; they’re essential for peace of mind and true financial control.

Think of your finances as the lifeblood of any project, big or small. Just as a project manager needs a clear roadmap, you need a precise financial organizer. Knowing your income log, understanding your monthly expenses, and tracking every single outflow allows you to make informed decisions rather than guessing. It helps you identify where your money is truly going, spot areas for potential savings, and ensure you’re always operating within your means. This level of clarity provides an unparalleled sense of control, empowering you to allocate resources strategically and avoid the dreaded "money mystery" that so often plagues our budgets.

Key Benefits of Using Structured Templates for Budgeting

Stepping up your budgeting game with structured templates, planners, or spreadsheets offers a wealth of benefits that extend far beyond simply tracking numbers. These tools are designed to streamline your financial management, turning what could be a daunting task into an intuitive process. One of the most significant advantages is the immediate visual overview they provide. You can instantly see your cash flow, understand your expense tracker categories, and get a realistic picture of your financial health.

Furthermore, structured templates act as a proactive cost management system. They help you anticipate costs, plan for contingencies, and make adjustments before you run into trouble. This foresight is invaluable, whether you’re overseeing a business initiative or a personal goal. By clearly defining income sources and categorizing expenditures, these tools enable you to identify potential overspending before it occurs, fostering a discipline that supports your savings planner goals. Ultimately, a well-designed budgeting system helps you stay accountable, stick to your limits, and work towards your financial objectives with confidence and precision.

Adapting This Template for Various Purposes

The beauty of a robust project management budget template lies in its remarkable versatility. While its name suggests a focus on formal projects, the underlying principles of tracking income, categorizing expenses, and monitoring cash flow are universally applicable. This means you can easily adapt this powerful financial spreadsheet for virtually any scenario that requires thoughtful financial planning.

For instance, if you’re tackling personal finance, this document can become your go-to savings planner, helping you map out goals for a down payment, retirement, or a dream vacation. Small businesses can leverage the layout to manage operating expenses, track revenue, and monitor profit margins, serving as a simplified balance sheet. Event planning, from weddings to community gatherings, benefits immensely from a detailed breakdown of costs for venues, catering, entertainment, and marketing. Even household management, often a complex web of utilities, groceries, and sundry items, becomes a breeze with a dedicated record to log monthly expenses and allocate funds efficiently. The core structure is adaptable, providing a flexible framework for anyone seeking better financial organization, regardless of the specific venture.

When Using the Template is Most Effective

While a comprehensive budgeting system is always beneficial, certain situations practically demand the structured approach offered by such a detailed template. These are moments when financial precision isn’t just helpful, but absolutely critical for success and peace of mind.

Using the template is most effective when you are:

- Launching a New Business Venture: From initial capital outlay to recurring operational costs, a detailed financial spreadsheet ensures every dollar is accounted for, providing a clear path to profitability.

- Planning a Major Personal Event: Whether it’s a wedding, a significant anniversary, or a milestone birthday, event planning involves numerous vendors and expenses that need careful tracking to avoid exceeding your budget.

- Undertaking a Home Renovation or Improvement Project: Materials, labor, permits, and unexpected costs can quickly escalate. This sheet allows you to track spending against estimates, keeping your project on track financially.

- Managing a Complex Work Project with a Defined Budget: For professionals, this is a no-brainer. It helps ensure project milestones are met without financial overruns, pleasing stakeholders and ensuring project success.

- Saving for a Large Purchase or Financial Goal: If you’re working towards a specific savings target, like a new car, a house down payment, or a substantial investment, the planner provides a clear roadmap and progress tracker.

- Dealing with Significant Income or Expense Fluctuations: For freelancers, seasonal workers, or those with variable incomes, a robust budgeting system helps smooth out financial ebbs and flows, ensuring stability.

- Taking on a New Hobby with Upfront Costs: From photography equipment to starting a small garden, new interests often require initial investment. The document helps you budget for these expenditures responsibly.

- Preparing for Tax Season: Having a meticulously maintained record of income and expenses throughout the year simplifies tax preparation immensely, ensuring you don’t miss deductions or overpay.

Tips for Better Design, Formatting, and Usability

A fantastic budgeting template isn’t just about the numbers; it’s also about its design, formatting, and overall usability. A well-designed planner should be intuitive, visually clear, and easy to maintain, whether you prefer print or digital versions. Thoughtful design can significantly enhance your commitment and consistency in using the system.

For digital versions (think Excel, Google Sheets, or dedicated budgeting apps):

- Use Clear Categories and Subcategories: Organize your expense tracker with main categories like "Housing," "Transportation," "Food," and then drill down with subcategories such as "Rent/Mortgage," "Utilities," "Groceries," "Dining Out." This granularity provides more insight.

- Automate Where Possible: Leverage formulas for automatic calculations of totals, remaining budget, and cash flow. Conditional formatting can highlight overspending or nearing budget limits in red, or savings goals met in green.

- Create Separate Tabs for Different Sections: One tab for an income log, another for monthly expenses, a third for a savings planner, and perhaps even an annual summary or balance sheet. This keeps the spreadsheet tidy and navigable.

- Incorporate Data Validation: Use dropdown menus for frequently used categories or payment methods to ensure consistency and speed up data entry.

- Add Visualizations: Charts and graphs (pie charts for expense distribution, bar charts for month-over-month spending) can offer powerful insights at a glance, making financial trends easier to spot.

For print versions (for those who prefer pen and paper):

- Clear Headings and Columns: Ensure ample space for entries, with distinct sections for date, description, category, amount (in/out), and running balance.

- Use Color-Coding: Assign a different color to income and expense entries or specific categories to make scanning the record easier.

- Provide Dedicated Space for Notes: A section for remarks, reminders, or special circumstances can be incredibly useful for context.

- Design for Readability: Choose a clean font and adequate line spacing. Avoid cramming too much information onto one page.

- Bind or Organize: Use a binder, folder, or notebook that allows for easy addition of new pages and keeps your financial organizer in one place.

Regardless of your preferred medium, consistency is key. Schedule regular times to update the template – weekly or bi-weekly – to keep your financial picture current and accurate. The easier and more pleasant the layout is to use, the more likely you are to stick with it, transforming your financial habits for the better.

Empowering Your Financial Journey

At the end of the day, managing money isn’t just about numbers; it’s about freedom, peace of mind, and the ability to pursue your goals without financial stress holding you back. A well-constructed budget template isn’t just another document to fill out; it’s a powerful ally in your journey towards financial empowerment. It transforms abstract financial worries into concrete, manageable tasks, giving you a clear lens through which to view your financial landscape.

By embracing this structured approach, you’re not just tracking expenses; you’re actively engaging in smart financial planning. You’re giving yourself the gift of foresight, equipping yourself to make confident decisions, and laying a solid foundation for your aspirations. The practical value of such a detailed record cannot be overstated – it’s a time-saving, stress-reducing, and financially empowering tool that will serve you well in every facet of your life.

So, take the leap. Invest a little time in setting up your ultimate budgeting system. You’ll quickly discover that the clarity and control it provides are invaluable, paving the way for a more organized, productive, and financially secure future.