Managing money, whether for a personal goal, a business venture, or a household, can often feel like navigating a complex maze without a map. Financial planning is one of those tasks that many of us know is crucial, yet it’s easy to let it slide, leading to stress, missed opportunities, and sometimes, unexpected financial hiccups. The good news is that achieving financial clarity and control doesn’t require a finance degree; it simply requires organization and the right tools.

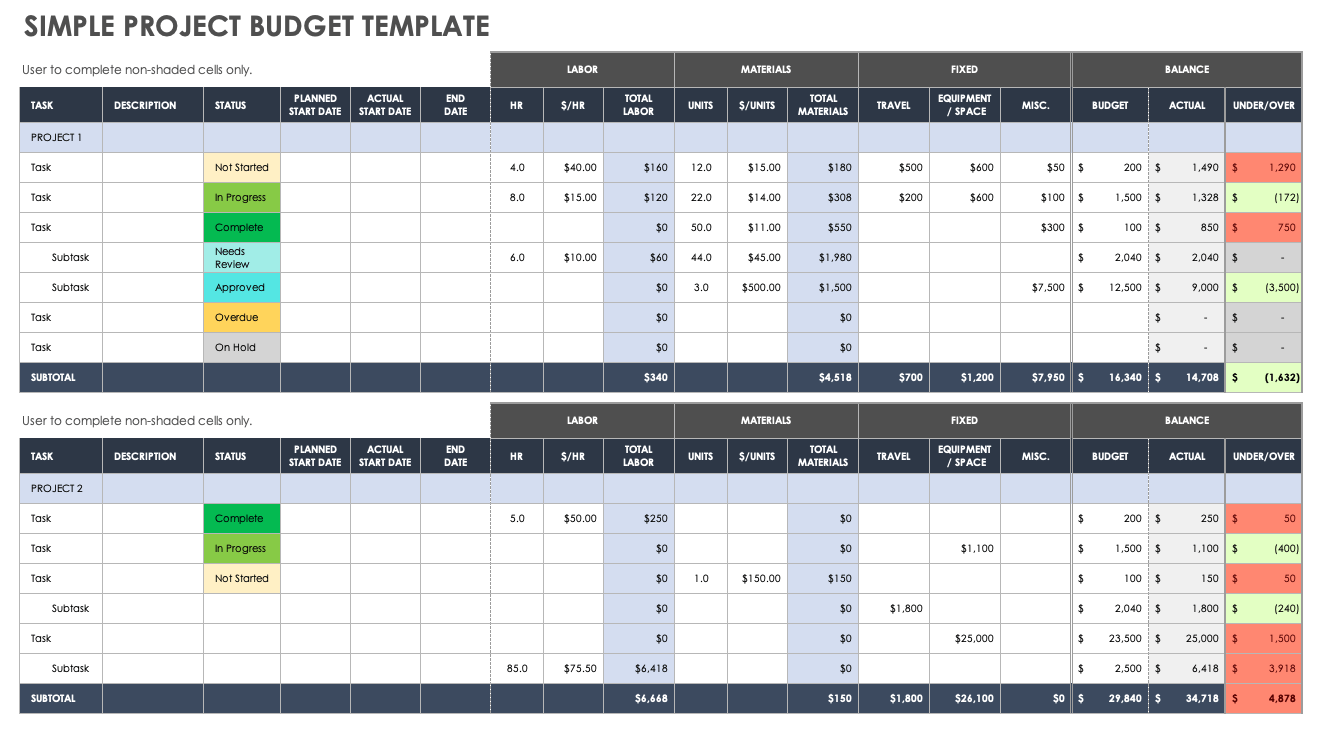

This is where a well-structured project budget template steps in. It’s more than just a spreadsheet; it’s your personal financial compass, designed to guide you through any project, big or small. This comprehensive planner helps you track income, monitor expenses, and visualize your financial landscape, making it an invaluable asset for anyone committed to smart financial planning, increased productivity, and genuine peace of mind.

The Power of Financial Clarity and Control

Think about the last time you felt truly in control of your finances. It’s a liberating feeling, isn’t it? Organized financial planning and meticulous record-keeping are the cornerstones of this control. When you have a clear picture of your income and outflow, you eliminate guesswork, reduce financial anxiety, and can make informed decisions rather than reactive ones.

Having a dedicated expense tracker and an income log is like having X-ray vision into your financial health. You can easily spot where your money is going, identify areas for potential savings, and ensure your cash flow remains positive. This level of transparency not only enhances your ability to manage monthly expenses but also empowers you to confidently plan for future investments and unexpected costs, transforming uncertainty into a proactive strategy.

Why Structured Budgeting is a Game-Changer

The difference between a vague idea of your finances and a detailed financial spreadsheet is monumental. Structured budgeting, facilitated by a robust template, provides foresight and accountability. It forces you to think ahead, anticipate costs, and allocate resources wisely, laying a solid foundation for achieving your financial goals.

Using a well-designed financial organizer isn’t about restriction; it’s about empowerment. It helps you prioritize spending, identify your savings planner targets, and stay on track with your long-term aspirations. Whether you’re building a substantial emergency fund, saving for a down payment, or funding a business expansion, this consistent budgeting system helps you turn abstract dreams into achievable realities, fostering a powerful sense of accomplishment.

Tailoring Your Budget to Any Endeavor

One of the greatest strengths of a good budget template is its inherent adaptability. While the core principles of tracking income and expenses remain constant, the categories and details within the document can be completely customized to suit your unique needs. This flexibility makes it an incredibly versatile tool for almost any financial scenario you might encounter.

For personal finance, the spreadsheet can become a detailed roadmap for a wedding, a major home renovation, or even a college fund. Small businesses can adapt the layout to manage a new product launch, a marketing campaign, or general operating expenses, providing a clear balance sheet view of their financial health. Event planners might use the record to meticulously track every cost from venue hire to catering, ensuring every dollar is accounted for, while households can rely on it for managing monthly expenses, vacation planning, or keeping tabs on ongoing household projects.

When to Reach for Your Budget Planner

This adaptable planner is incredibly effective in a multitude of situations, helping you maintain clarity and control. Here are some key scenarios when making a project budget template your go-to financial organizer proves most valuable:

- Launching a Small Business: From initial setup costs to ongoing operational expenses, it provides a comprehensive overview of your startup capital and projected revenue, crucial for managing cash flow effectively.

- Planning a Major Life Event: Whether it’s a wedding, a significant anniversary celebration, or a milestone birthday party, this sheet helps you allocate funds for venue, catering, decor, and entertainment, preventing overspending.

- Undertaking Home Renovations: Keep track of contractor fees, material costs, permits, and unexpected expenditures to ensure your project stays within financial bounds.

- Saving for a Big Purchase: For a new car, a down payment on a house, or a dream vacation, the template helps you visualize savings goals and monitor progress, acting as a dedicated savings planner.

- Managing Monthly Household Expenses: Track utilities, groceries, rent/mortgage, transportation, and discretionary spending to identify areas for cost management and optimize your budget.

- Executing a Marketing Campaign: For businesses, it helps outline advertising spend, content creation costs, and promotional activities, allowing for precise ROI calculation.

- Freelance Project Management: Track income per client, allocate for software subscriptions, training, and self-employment taxes, ensuring profitability and accurate tax planning.

- Planning Educational Expenses: From tuition and books to living costs and extracurriculars, use the document to plan for college or other educational pursuits.

Designing for Success: Tips for Your Budget Document

The effectiveness of any budgeting system hinges on its usability. A poorly designed spreadsheet can quickly become a deterrent, while a thoughtfully crafted one encourages consistent engagement. Here are some tips to ensure your budget document serves you well, whether in print or digital format:

Firstly, focus on clear categories. Break down your income and expenses into logical groups like "Income," "Fixed Costs" (rent, insurance), "Variable Costs" (groceries, entertainment), and "Savings/Debt Repayment." This structure makes it easy to input data and quickly assess your financial situation.

Secondly, integrate formulas if you’re using a digital spreadsheet. Basic sum functions for categories, net income calculations, and percentage breakdowns of your budget against actual spending can provide instant insights. This automation saves time and reduces the chance of manual errors, making the financial spreadsheet a powerful analytical tool.

For a visually appealing and user-friendly experience, consider color-coding different categories or using conditional formatting to highlight overspending or approaching deadlines. Ensure the layout is clean, with adequate spacing and readable fonts. If you plan to print the template, ensure it fits neatly on standard paper sizes and that the key information isn’t cut off.

Finally, include a “Notes” or “Remarks” section. This allows you to add context to specific transactions, remind yourself of upcoming bills, or record important financial decisions. This seemingly small detail can add significant value, making the record a more complete and useful financial organizer.

Embrace Your Financial Future with Confidence

Adopting a structured approach to budgeting, especially with a well-designed template, is one of the most impactful steps you can take toward financial independence and clarity. It’s more than just an accounting exercise; it’s an investment in your peace of mind, your future goals, and your ability to navigate life’s financial complexities with grace and confidence.

By regularly engaging with this essential financial organizer, you’ll not only save time by having all your financial data in one accessible place but also significantly reduce the stress associated with money matters. It empowers you to proactively manage your resources, make informed decisions, and ultimately, achieve your financial aspirations, turning what might once have been a daunting task into an empowering daily habit.