Hey there, fellow productivity enthusiasts and smart money managers! Let’s talk about something truly transformative for your financial life: getting a handle on your money with a clear, organized system. If you’re anything like me, you appreciate tools that simplify complex tasks and put you in control. That’s precisely what a well-crafted bi weekly budget template excel can do for you. It’s not just about tracking where your money goes; it’s about gaining clarity, reducing stress, and actively working towards your financial goals, whether that’s saving for a dream vacation, paying off debt, or building a robust emergency fund.

This isn’t just another dry financial document. Think of it as your personal financial co-pilot, designed to navigate the ebbs and flows of your income and expenses, particularly for those on a bi-weekly pay cycle. It’s perfect for anyone who wants to move beyond guesswork and truly understand their cash flow, from busy professionals juggling multiple responsibilities to new graduates taking their first steps in independent financial management. By providing a structured framework, this template empowers you to see the big picture and make informed decisions, transforming your financial planning from a chore into an empowering habit.

The Power of Organized Financial Planning

In a world full of financial distractions and temptations, maintaining clarity and control over your money is more critical than ever. Organized financial planning isn’t just a suggestion; it’s a cornerstone of peace of mind and long-term security. When you meticulously track your income and outgoings, you stop wondering where your money went and start understanding exactly how it’s being used. This understanding is the first step towards mastering your finances rather than letting them master you.

Think of your financial life like a garden. Without regular tending, weeding, and planning, it can quickly become overgrown and chaotic. A structured budgeting system acts as your garden planner, helping you cultivate growth, identify problem areas, and ensure everything is getting the resources it needs to thrive. It’s about proactive management – anticipating upcoming expenses, spotting opportunities for savings, and ensuring your financial resources are aligned with your personal values and aspirations. This diligent record-keeping forms the backbone of any robust financial organizer, allowing you to quickly assess your situation at a glance.

Why a Structured Template is Your Financial Best Friend

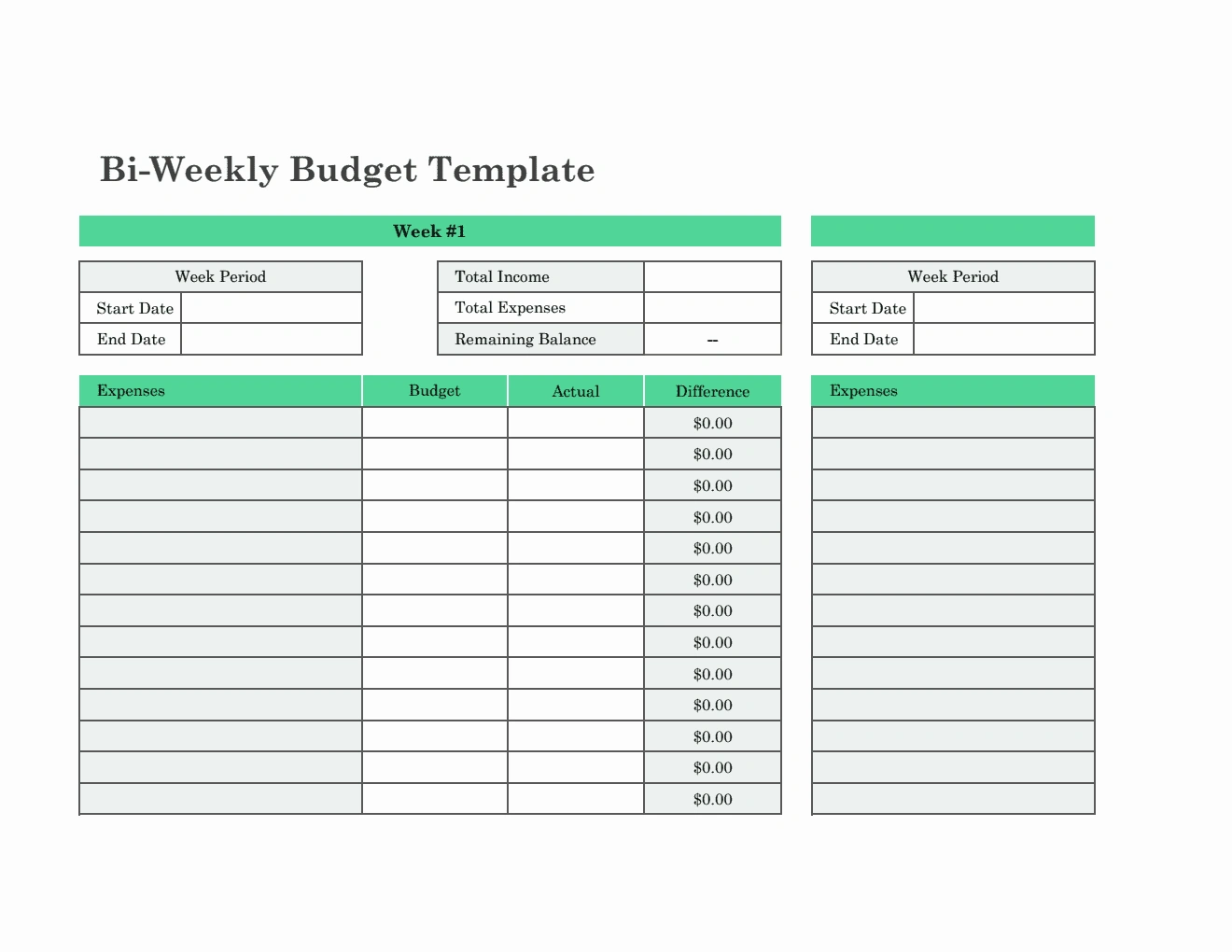

While the idea of budgeting might conjure images of restrictive practices, using a structured template, planner, or financial spreadsheet is actually incredibly liberating. It takes the guesswork out of money management, providing a clear roadmap for your spending and saving habits. Instead of manually tallying numbers or guessing at your remaining funds, a well-designed template automatically calculates balances, flags overspending, and gives you real-time insights into your financial health.

The key benefits extend far beyond simple tracking. A robust expense tracker helps you categorize every dollar, revealing patterns you might not have noticed. A dedicated savings planner section allows you to set specific goals and monitor your progress, turning abstract dreams into tangible achievements. Furthermore, a consistent income log helps you verify payments and forecast your available funds. This holistic approach, encompassing all aspects of your financial life, fosters a deeper understanding of your cash flow, helping you make smarter decisions about debt repayment, investments, and future planning. It essentially acts as a dynamic balance sheet for your personal economy, helping you achieve true cost management.

Adapting Your Financial Command Center

One of the most powerful aspects of using an Excel-based financial tool is its incredible adaptability. While we’re talking about a bi weekly budget template excel today, the underlying principles and structure can be easily modified to suit a vast array of financial scenarios. It’s not a rigid, one-size-fits-all solution; it’s a flexible framework that you can mold to your specific needs.

- Personal Finance: Beyond bi-weekly tracking, you can adjust columns for monthly expenses, annual bills, or even project-specific savings. Add categories for "fun money," "education funds," or "charitable giving."

- Small Businesses: Adapt the layout to track revenue streams, operational costs, payroll, and profit margins. It can serve as a simple budgeting system for freelancers, sole proprietors, or even small teams managing project budgets.

- Event Planning: Managing a wedding, a big birthday party, or a community event? The spreadsheet can track deposits, vendor payments, guest lists, and remaining budget, ensuring you stay on track and avoid last-minute surprises.

- Household Management: Beyond just personal finances, use the record to track shared household expenses, utility bills, grocery spending, and even home improvement project costs. It’s excellent for roommates or families managing joint finances.

When a Bi Weekly Budget Template Excel Truly Shines

While useful for nearly anyone, a bi weekly budget template excel is particularly impactful in specific situations where its structured approach provides maximum benefit. Its design caters to common financial cycles and needs, making it an indispensable tool for proactive financial management.

- Bi-weekly Paychecks: This is the most obvious scenario. If you get paid every two weeks, this structure aligns perfectly with your income stream, making it incredibly intuitive to allocate funds as soon as they arrive.

- Managing Variable Income: Freelancers or those with fluctuating income can use the template to project conservative income and track actual earnings, helping to smooth out cash flow and plan for leaner periods.

- Aggressive Debt Repayment Goals: When you’re serious about tackling debt, this regular, detailed tracking helps you identify extra funds to put towards principal, accelerating your payoff journey.

- Saving for Specific Goals: Whether it’s a down payment on a house, a new car, or a grand adventure, the template allows you to earmark funds consistently, watching your savings grow with each pay cycle.

- Anyone Feeling Overwhelmed by Money: If you’re experiencing financial stress or just feel like your money slips through your fingers, this structured approach provides immediate clarity and a sense of control.

Designing for Success: Tips for Your Digital & Print Planner

A powerful financial tool doesn’t just work well; it’s also user-friendly and visually appealing. Whether you primarily use your budget digitally or print it out, a few design and formatting tips can significantly enhance its usability and your engagement with the process. Making your record easy to read and interact with encourages consistent use, which is key to financial success.

- Color-Coding: Use subtle color-coding to differentiate income from expenses, fixed from variable costs, or different spending categories. This creates visual cues that make the spreadsheet easier to scan and understand at a glance. For example, green for income, red for expenses, and yellow for savings goals.

- Clear Headings & Labels: Ensure all columns and rows have intuitive, descriptive labels. Avoid jargon where possible. For instance, instead of "Misc OpEx," use "Miscellaneous Operating Expenses."

- Automate with Formulas: Leverage Excel’s power! Set up formulas to automatically sum categories, calculate remaining balances, and track progress towards savings goals. Conditional formatting can also highlight overspending or low balances automatically.

- Data Validation: Use data validation for categories to create dropdown lists. This not only speeds up data entry but also ensures consistency, making your data cleaner and easier to analyze later.

- User-Friendly Layout: Keep the most important information easily accessible at the top or on a separate summary tab. Don’t overcrowd a single sheet; consider multiple tabs for different aspects like an income log, expense tracker, and savings planner.

- Printing Considerations: If you plan to print the template, ensure it’s formatted to fit standard paper sizes (e.g., Letter or A4). Adjust column widths, row heights, and font sizes for readability. Use print areas to prevent unwanted sections from appearing on your physical copy. Add clear spaces for manual notes if you prefer hybrid tracking.

- Graphs and Charts: Incorporate simple charts (pie charts for spending breakdown, line graphs for savings progress) to visualize your financial data. Visuals can often convey insights more effectively than raw numbers alone.

- Instructions Tab: Consider adding a simple "Instructions" or "How-To" tab within the document. This can explain how to use different sections, update formulas, or interpret the data, especially if you share the planner with others.

Embracing this well-designed financial spreadsheet as your personal budgeting system can genuinely transform your relationship with money. It’s more than just a place to log numbers; it’s a living, breathing document that reflects your financial journey and helps you steer it in the right direction. By investing a little time upfront in setting up and customizing the document, you’re setting yourself up for lasting financial clarity and control.

Ultimately, this financial organizer is a powerful ally in your quest for financial wellness. It’s a tool that reduces stress by illuminating your financial landscape, allowing you to make proactive decisions rather than reactive ones. With its structured approach, it becomes a dependable partner, guiding you toward your financial aspirations, whether they’re short-term savings or long-term wealth building. Start taking control today, and watch as this simple spreadsheet empowers you to achieve incredible things with your money.