Ever found yourself staring at a mountain of receipts, wondering where your money went? Or maybe you’re embarking on a new project – be it a home renovation, launching a small business, or even just planning a big vacation – and the thought of managing the finances feels like navigating a dense fog. The truth is, staying on top of your money doesn’t have to be a Herculean task, nor does it require a finance degree. It simply needs a good system, and that’s where a well-crafted project budget template excel comes in.

This isn’t just about tracking numbers; it’s about gaining clarity, reducing stress, and making informed decisions that align with your financial goals. Whether you’re a seasoned entrepreneur, a busy parent, a student managing your allowance, or anyone looking to take control of their financial narrative, having a dedicated financial spreadsheet can transform how you perceive and interact with your money. It empowers you to move from reactive spending to proactive planning, giving you the confidence to tackle any financial challenge that comes your way.

The Power of Organized Financial Planning

Think of financial planning as the GPS for your money. Without it, you might wander aimlessly, hit unexpected detours, or even run out of gas before reaching your destination. Organized financial planning, especially through detailed record-keeping, provides a clear roadmap. It allows you to see not just where you are, but where you’re going and what resources you’ll need to get there.

This level of organization isn’t just for big corporations; it’s profoundly beneficial for individuals and small operations too. It helps demystify your cash flow, pinpoint areas of overspending, and highlight opportunities for savings. An expense tracker that’s meticulously maintained gives you an undeniable sense of control, turning abstract financial concepts into tangible data you can act upon. Ultimately, it’s the foundation for achieving any financial aspiration, from building an emergency fund to saving for retirement.

Unlocking Clarity and Control: Benefits of a Structured Budget

Using a structured budgeting system, like a dedicated financial organizer, brings a multitude of advantages beyond just knowing your balances. It cultivates financial discipline and awareness, helping you understand the true cost of things and the impact of every financial decision. This isn’t about deprivation; it’s about intentionality and making your money work smarter for you.

A well-designed spreadsheet acts as a comprehensive balance sheet of your financial life. It allows for an income log that can be easily compared against your monthly expenses, providing a vivid picture of your financial health. Key benefits include improved decision-making, as you have real-time data at your fingertips, and the ability to set realistic savings goals and track your progress against them. It’s a powerful savings planner that keeps you accountable and motivated.

Versatility in Action: Adapting Your Financial Template

One of the beautiful things about a robust financial spreadsheet is its inherent adaptability. While the core structure of an income versus expense tracker remains constant, the categories and details can be completely customized to fit your unique needs. This flexibility means that a single, well-designed template can serve a myriad of purposes, evolving with your financial journey.

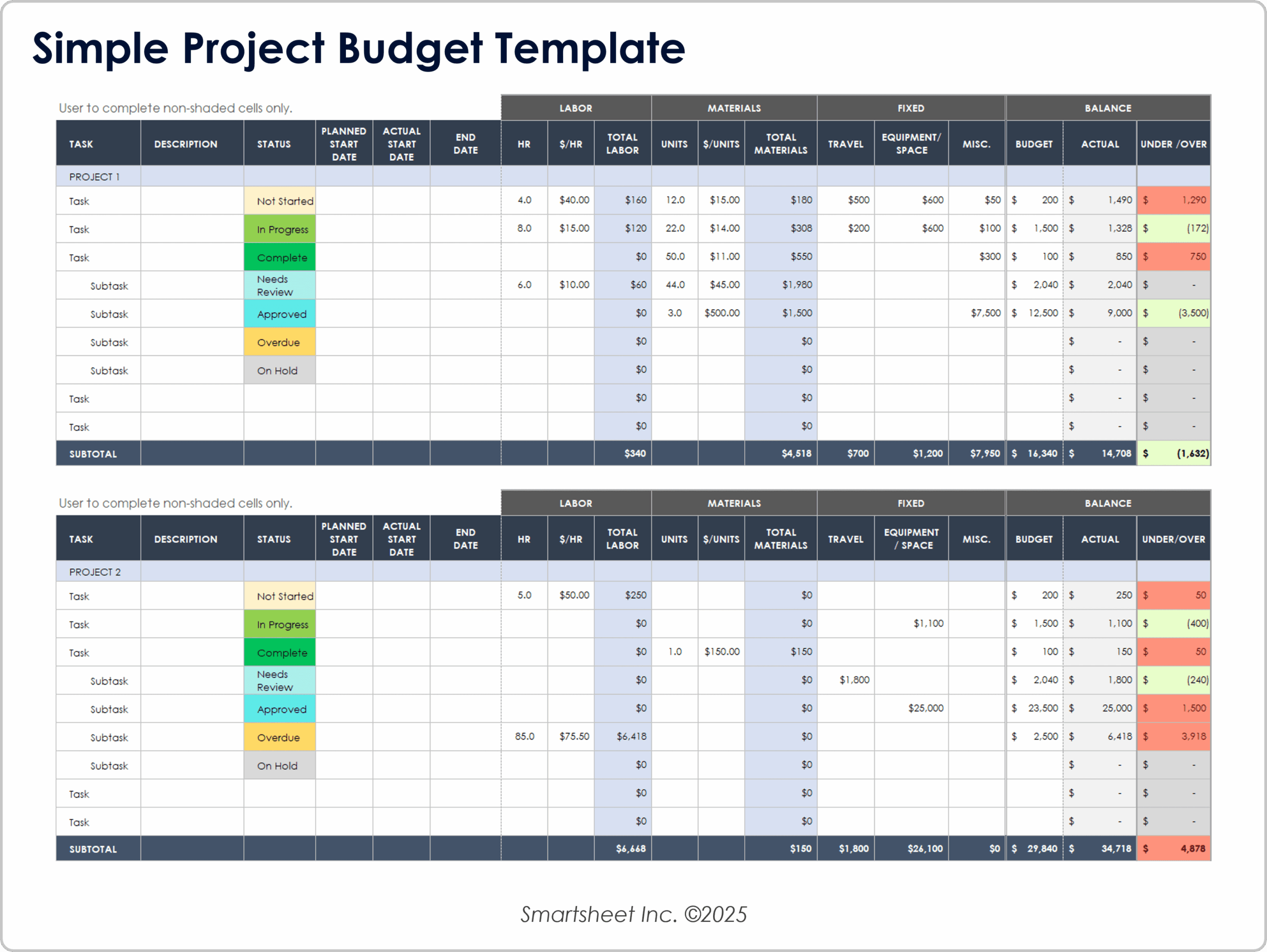

For personal finance, you might track daily spending, categorize bills, and plan for future investments. Small businesses can utilize it for cost management, tracking project-specific outlays, and forecasting revenue. Event planners can meticulously list every vendor, material, and logistical cost. Even for household management, this sheet can become invaluable for tracking groceries, utilities, and home maintenance, ensuring everyone is on the same page regarding shared financial responsibilities.

When a Project Budget Template Excel Shines Brightest

There are specific scenarios where deploying a project budget template excel can make all the difference, transforming potential chaos into structured success. These are moments when clear financial oversight isn’t just helpful, but absolutely critical for the outcome.

- Launching a New Business Venture: From initial capital outlay to operating expenses, marketing costs, and projected revenue streams, a detailed budget ensures you understand your burn rate and path to profitability. It helps secure funding and provides a realistic financial forecast.

- Planning a Major Home Renovation: Whether it’s a kitchen remodel or adding an extension, tracking material costs, labor fees, permits, and contingency funds is essential to avoid budget blowouts and keep the project on track.

- Organizing a Wedding or Large Event: Every detail, from venue rental and catering to décor and entertainment, comes with a price tag. This record helps manage vendor payments, stay within your overall budget, and prevent last-minute financial surprises.

- Undertaking a Personal Debt Repayment Plan: Clearly outlining all debts, interest rates, minimum payments, and extra payments you can afford allows you to visualize your progress and stay motivated on your journey to financial freedom.

- Managing Household Finances with Multiple Incomes/Outlays: For families, a centralized spreadsheet helps track shared expenses, individual contributions, and collective savings goals, fostering transparency and teamwork.

- Planning a Big Vacation or Travel Adventure: Estimating flights, accommodation, activities, food, and miscellaneous spending ensures you save adequately and don’t overspend while enjoying your trip.

- Managing Freelance Projects or Client Work: Tracking hours, material costs, and payment milestones for each client helps ensure accurate invoicing and profitability across multiple projects simultaneously.

Designing Your Ultimate Financial Organizer: Tips for Success

A good financial spreadsheet isn’t just about the numbers; it’s also about usability and clarity. A thoughtfully designed document can make daily tracking a breeze and monthly reviews insightful. Here are some tips to make your template truly effective, whether for digital use or print.

First, focus on clear categories. Don’t make them too broad or too granular. For instance, instead of just "Food," consider "Groceries," "Dining Out," and "Coffee/Snacks." This level of detail offers better insights into your spending habits. Use consistent formatting for dates, currencies, and numbers to maintain readability. Conditional formatting can be incredibly powerful; imagine automatically highlighting expenses that exceed a certain threshold or income cells in green and expenses in red.

Secondly, incorporate visual aids. Charts and graphs aren’t just pretty; they provide immediate understanding of your financial trends. A pie chart showing expense distribution or a line graph illustrating your savings growth can be incredibly motivating. For digital versions, ensure cells are locked where formulas exist to prevent accidental changes, and consider using data validation for specific fields to ensure data integrity. If you plan to print the template, ensure it’s set up for easy printing, perhaps with clear page breaks and a print area defined. Adding a "Notes" column for each entry can also be invaluable for remembering specifics about transactions, helping you categorize them accurately later.

The Practical Value of Your Financial Companion

In a world where financial complexities often lead to stress and uncertainty, having a reliable project budget template excel is more than just a tool; it’s a powerful ally. It removes the guesswork from money management, replacing it with clear data and actionable insights. This single document can be your expense tracker, your savings planner, your income log, and your cash flow statement all rolled into one, simplifying an otherwise daunting task.

Embrace the power of this structured budgeting system. It’s an investment in your financial well-being, designed to save you time, reduce stress, and ultimately empower you to achieve your most ambitious financial goals. By using this sheet regularly, you’re not just tracking money; you’re building a foundation for a more organized, less stressful, and financially empowered future.