Navigating the complexities of professional relationships, whether with clients, partners, or service providers, can often feel like walking a tightrope. Every interaction, every project, and every commitment carries the potential for misunderstanding if not clearly defined. That’s where the invaluable role of a well-crafted business management agreement template comes into play. It’s not just a piece of paper; it’s your blueprint for clarity, protection, and operational efficiency, designed to set expectations right from the start.

For entrepreneurs, small business owners, project managers, and even freelancers, having a reliable business management agreement template at your fingertips is an absolute game-changer. It transforms vague verbal agreements into concrete, actionable plans, minimizing risk and maximizing productivity. Think of it as your secret weapon for smart communication, ensuring everyone involved is on the same page, understands their roles, and knows what to expect, every step of the way.

The Indispensable Value of Professional Documentation

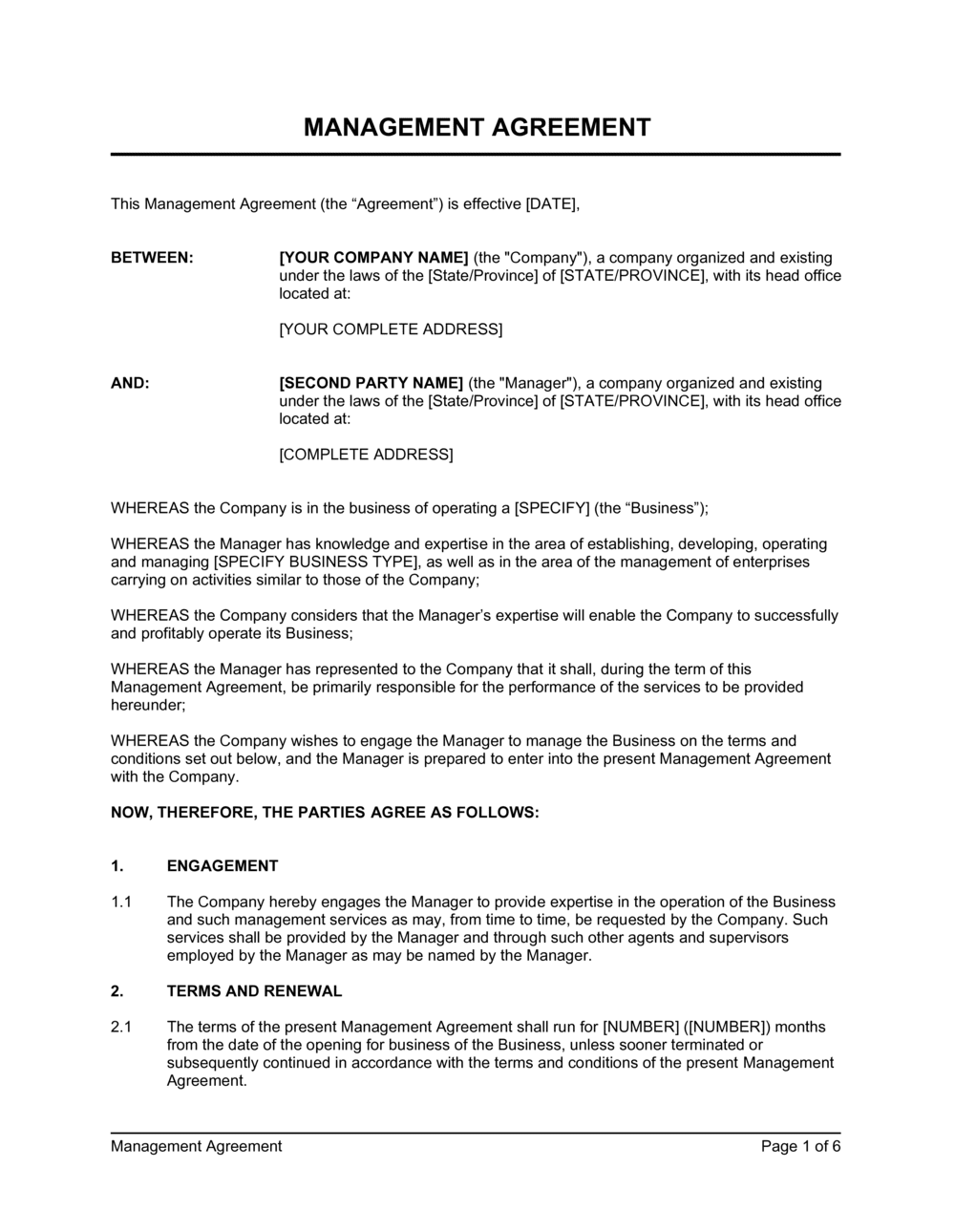

In today’s fast-paced business world, organized planning and meticulous documentation aren’t just good practices; they’re essential for survival and growth. Without clear records, even the simplest agreements can spiral into disputes, costing valuable time, money, and reputation. Professional documentation, like a comprehensive legal contract or service agreement, serves as a cornerstone for building trust and ensuring accountability.

Such detailed records provide a clear, unambiguous reference point for all parties involved. They outline responsibilities, deliverables, timelines, and payment structures, leaving little room for misinterpretation. From a legal standpoint, properly executed business documentation acts as a compliance record, offering crucial protection should any disagreements arise. It solidifies your position, providing tangible proof of agreed-upon terms and conditions.

Key Benefits of Using Structured Templates

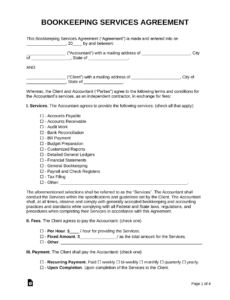

Embracing structured templates, forms, or agreement layouts offers a wealth of benefits that directly impact your productivity and peace of mind. Firstly, it introduces a level of standardization across all your professional interactions. This consistency ensures that every new engagement begins with the same foundational elements, saving you the exhaustive effort of drafting a unique document from scratch each time.

Beyond saving time, using a pre-designed contract template significantly reduces the likelihood of overlooking critical details. These templates are typically designed to include all necessary clauses and sections, guided by best practices, ensuring a thorough and comprehensive agreement. This systematic approach contributes to higher quality documentation, professional layout, and ultimately, stronger business relationships built on clear expectations. It’s about working smarter, not harder, by leveraging proven frameworks for your operational needs.

Adapting the Template for Diverse Business Needs

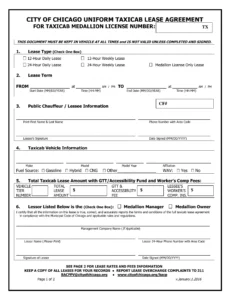

The beauty of a robust business management agreement template lies in its inherent adaptability. While its core structure is designed to establish clear terms, it can be easily customized to fit an extensive range of scenarios, making it a versatile asset for any organization. Whether you’re engaging a new service provider, forming a strategic business partnership, or outlining terms of service for your customers, the underlying principles remain invaluable.

This flexible framework can serve as the backbone for various types of agreements. It can be transformed into a detailed service agreement for contractors, a memorandum of understanding for collaborative projects, or even a comprehensive rental agreement for commercial properties. By tailoring specific clauses and fields, the template becomes a powerful tool for managing different facets of your business, ensuring every relationship is governed by a clear, mutually understood legal contract. Whether you’re drafting a simple service agreement or a complex business partnership, a well-structured business management agreement template provides the essential framework for a successful engagement.

When Using a Business Management Agreement Template is Most Effective

There are numerous situations where leveraging a structured template can provide immediate and significant advantages. These instances often involve establishing new relationships, formalizing existing ones, or setting clear guidelines for project execution. Using this document ensures professionalism and clarity from the outset, protecting all parties involved.

Here are some examples of when employing a business management agreement template is most effective:

- Onboarding New Clients: Clearly outlining scope of work, payment terms, deadlines, and intellectual property rights for new projects. This creates a solid foundation for client-vendor relationships.

- Engaging Freelancers or Contractors: Defining deliverables, compensation, project timelines, and confidentiality agreements to ensure both parties understand their roles and responsibilities.

- Forming Business Partnerships: Documenting the roles, responsibilities, profit-sharing, decision-making processes, and dispute resolution mechanisms between partners.

- Entering into Service Agreements: Specifying the services to be provided, service level agreements (SLAs), duration of service, and conditions for termination with any service provider.

- Licensing Agreements: Setting out the terms under which intellectual property or software can be used, including duration, scope, and royalty structures.

- Memoranda of Understanding (MOUs): Establishing preliminary agreements or understanding between two or more parties before a formal contract is drawn up, indicating mutual intent and commitment.

- Project-Based Work: Detailing project milestones, budgets, review processes, and acceptance criteria for complex projects to keep everyone aligned and accountable.

- Confidentiality and Non-Disclosure Agreements (NDAs): Protecting sensitive information by outlining what information is confidential and the obligations of the receiving party.

Tips for Better Design, Formatting, and Usability

Creating a truly effective agreement goes beyond just having the right content; its design and usability are equally crucial for clarity and adoption. Whether you intend for print or digital versions, a well-thought-out professional layout enhances readability and ensures that important details are not missed. Focus on a clean, uncluttered presentation that guides the reader through the document logically.

For print versions, use clear headings, consistent fonts, and ample white space to prevent text from feeling overwhelming. Incorporate bolding or italics sparingly to highlight key terms without creating visual clutter. For digital versions, optimize the layout for screen reading, ensuring it’s responsive and easily navigable on various devices. Consider adding fillable fields for easier data entry and incorporating digital signature capabilities for efficient document signing. Always include a version control system to track changes, ensuring everyone is working with the most current version of the record. Clear, concise language is paramount, avoiding jargon where possible, or clearly defining it if necessary.

Ultimately, embracing a robust business management agreement template isn’t just about paperwork; it’s about smart business strategy. It equips you with the tools to communicate effectively, mitigate risks, and build lasting, trust-based relationships. By investing in a well-structured framework, you’re not just creating a contract; you’re building a foundation for consistent success and professional integrity.

Think of this document as your trusted ally in the intricate dance of modern business. It streamlines your processes, offers legal clarity, and frees up your valuable time, allowing you to focus on what you do best: innovating and growing your enterprise. With a reliable template in hand, you transform potential complications into smooth, predictable outcomes, demonstrating your commitment to organization and smart business communication.