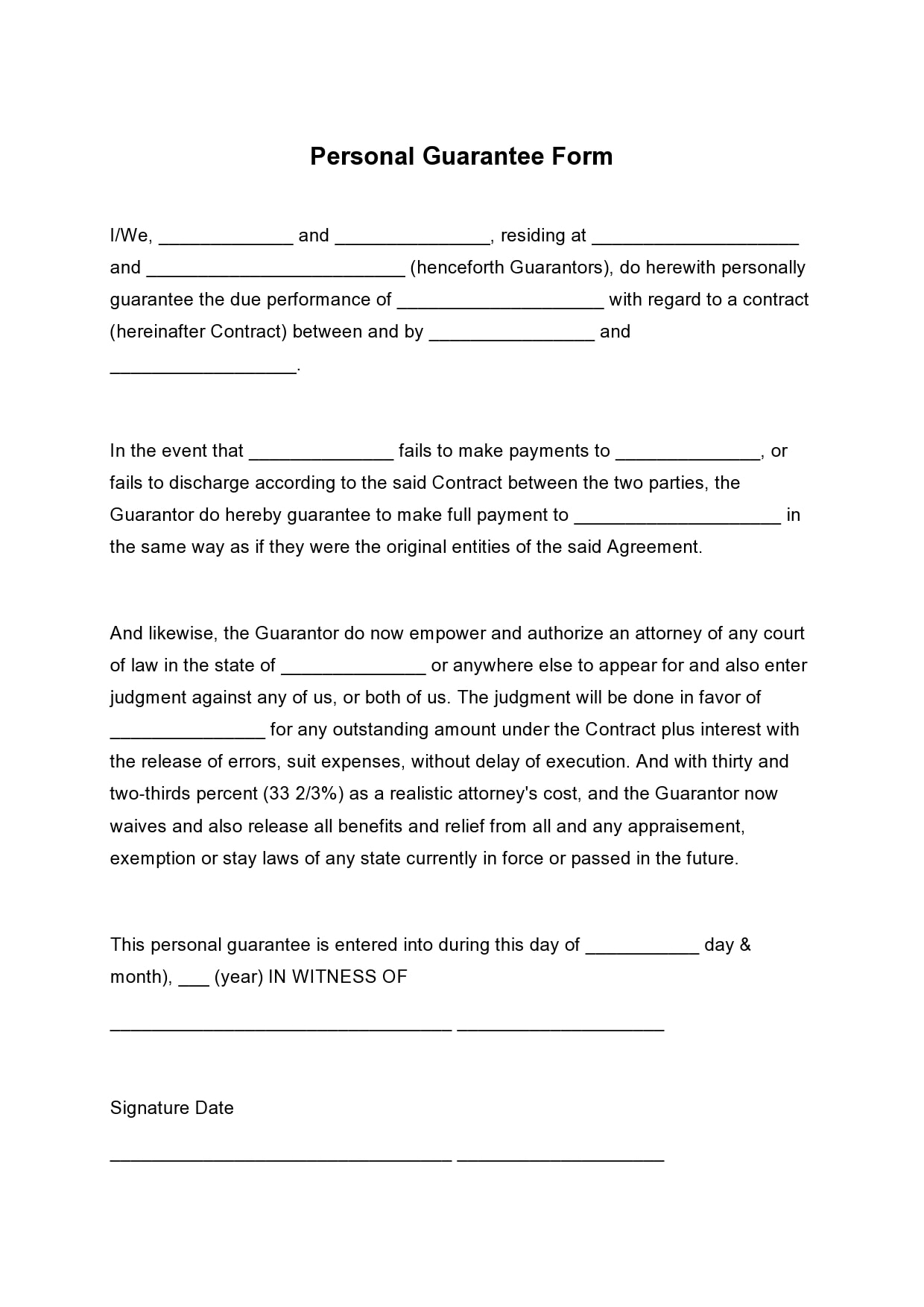

In the intricate landscape of financial transactions and contractual agreements, a personal guarantee often serves as a pivotal instrument, providing an additional layer of security for lenders or creditors. This critical document binds an individual to assume responsibility for a debt or obligation if the primary debtor, typically a business entity, defaults. Crafting such a legally significant document demands precision, clarity, and adherence to established legal standards. Utilizing a personal guarantee letter template provides a structured and reliable starting point, ensuring all essential clauses and legal considerations are appropriately addressed from the outset.

The application of such a template extends beyond mere convenience; it is a strategic tool for risk management and clear communication. Both the guarantor and the beneficiary — whether a financial institution, a supplier, or a landlord — benefit immensely from the standardized approach it offers. It clarifies expectations, defines responsibilities, and establishes a robust framework for financial commitments, thereby mitigating potential disputes and safeguarding the interests of all parties involved in the agreement. This ensures that the formal correspondence accurately reflects the serious nature of the undertaking.

The Indispensable Role of Written Communication in Professional Contexts

Effective communication forms the bedrock of all successful business and personal interactions, particularly when financial obligations are concerned. Written communication, through documents like official notices or a formal business letter, offers unparalleled clarity and permanence compared to verbal agreements. It eliminates ambiguity by clearly stating terms, conditions, and commitments, leaving little room for misinterpretation.

Furthermore, professionally drafted documents serve as an immutable official record, providing undeniable proof of agreements and intentions. In instances of dispute or legal challenge, such documentation becomes invaluable, offering concrete evidence of what was agreed upon. This foundational principle underscores why robust professional communication is not merely good practice but a critical safeguard in any substantive transaction.

The legal weight attributed to written agreements further accentuates their importance. Contracts, letters of intent, and guarantee letters are not just communicative tools; they are legally binding instruments. Their meticulous drafting ensures enforceability and provides a clear pathway for legal recourse should obligations not be met. This underscores the necessity of using precise language and a well-structured document layout.

Key Benefits of Utilizing a Structured Personal Guarantee Letter Template

The adoption of a structured template for a personal guarantee letter brings a multitude of advantages, significantly enhancing the efficiency and reliability of the agreement process. Firstly, it ensures an unwavering level of professionalism and consistency across all instances where such a guarantee is required. A standardized format projects an image of meticulousness and seriousness, fostering trust among all parties.

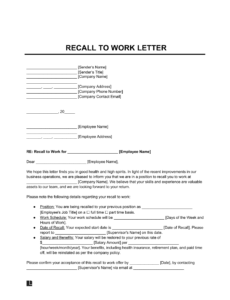

Secondly, a well-designed template inherently promotes clarity, which is paramount in legal documentation. It guides the user to include all necessary information, such as the identities of the guarantor and debtor, the nature and amount of the debt, and the specific conditions under which the guarantee will be invoked. This comprehensive approach helps in avoiding crucial omissions that could invalidate the guarantee or lead to future complications.

Moreover, leveraging a specific template for this type of critical letter dramatically boosts drafting efficiency and accuracy. Instead of starting from scratch each time, users can populate pre-defined fields, significantly reducing the time and effort involved. This also minimizes the risk of typographical errors or omissions, ensuring that the final file is legally sound and free from avoidable inaccuracies. The template essentially functions as a reliable message template, ensuring that every essential element is included without fail.

Customizing the Template for Diverse Applications

While the foundational structure of a personal guarantee letter is critical for its efficacy, its true strength lies in its adaptability. A robust template, while providing a standardized framework, is designed to be highly customizable, allowing it to be tailored to the unique specifics of various financial agreements. This flexibility ensures that the document remains relevant and legally sound across different scenarios.

For instance, the document can be readily adjusted for business loans, where the guarantor might be a company owner securing credit for their enterprise. It can also be modified for supplier credit arrangements, ensuring a vendor has recourse if their client business defaults on payments for goods or services. Furthermore, landlords often require personal guarantees for commercial property leases, and the layout of this form can be updated to reflect such tenancy-specific clauses.

Specific clauses within the letter often require modification to align with the precise nature of the guarantee. This might include specifying the exact amount of the guaranteed debt, defining the duration of the guarantee (e.g., for a specific loan term or ongoing credit), or outlining conditions under which the guarantee can be terminated. The template provides placeholders and guidance, enabling users to insert or amend these critical details without compromising the overall legal integrity of the correspondence. This meticulous customization is crucial for the template’s broad utility.

Scenarios Where a Personal Guarantee Letter is Most Effective

A personal guarantee letter serves as a potent financial instrument in numerous situations where an added layer of security is deemed necessary. Its application is particularly effective when the primary debtor’s creditworthiness needs bolstering or when specific risks need to be mitigated.

- Securing Business Loans: When a new business or a business with insufficient credit history seeks a loan, banks often require a personal guarantee from the principal owners. This ensures the loan is repaid even if the business itself falters.

- Obtaining Lines of Credit from Suppliers: Many suppliers extend credit to businesses for the purchase of raw materials or inventory. A personal guarantee provides the supplier with assurance that they will be paid, fostering better trade terms.

- Leasing Commercial Property: Landlords frequently demand a personal guarantee from business owners leasing commercial space. This protects the landlord against rent defaults, particularly if the business is new or financially unproven.

- Entering into Significant Contractual Agreements: For large-scale projects or contracts where the financial stakes are high, a personal guarantee can provide a necessary layer of assurance to the counterparty, indicating serious commitment.

- Extending Credit or Loans to Smaller Entities: In situations where an individual or a larger entity extends a significant loan or credit to a smaller, less established entity, a personal guarantee offers vital protection for the creditor.

Best Practices for Formatting, Tone, and Usability

To maximize the effectiveness of a personal guarantee, meticulous attention must be paid to its formatting, tone, and overall usability. These elements collectively contribute to the document’s professionalism, clarity, and legal enforceability, ensuring it serves its intended purpose without ambiguity.

Formatting for Clarity and Professionalism

The visual presentation of the letter significantly impacts its perception and readability. Adhering to standard business letter format is paramount, including professional letterheads, clear date lines, appropriate recipient and sender address blocks, and a formal salutation and closing. The body of the document should feature clear headings and subheadings that break down complex information into manageable sections, such as "Guaranteed Obligation" or "Conditions of Guarantee." Logical flow and ample white space enhance readability, preventing the document from appearing dense or intimidating. Furthermore, choosing a professional, legible font (e.g., Times New Roman, Arial, Calibri) and ensuring consistent sizing for both print and digital versions is crucial for maintaining a polished appearance.

Maintaining an Appropriate Tone

The tone of any official record must be formal, unambiguous, and legally precise. It is imperative to avoid any emotional language, colloquialisms, or jargon that is not universally understood or legally defined. The language should be direct, factual, and objective, focusing solely on the legal and financial commitments being made. Every sentence should convey clear intentions and responsibilities, leaving no room for subjective interpretation. Given the serious implications of a personal guarantee, the tone must reflect the gravity of the undertaking, instilling confidence in its legal validity and enforceability.

Ensuring Usability and Accessibility

A well-designed template is not only comprehensive but also user-friendly. It should be easy for the relevant parties to complete, comprehend, and execute. This involves clear, concise instructions on how to fill in the necessary details, identify signatories, and witness signatures. For digital versions, ensuring compatibility across various platforms and providing fillable fields can greatly enhance usability. For printed documents, ensuring sufficient space for signatures and dates is essential. The objective is to create a message template that minimizes friction in its completion and ensures all parties can easily understand their commitments and the implications of the form.

The personal guarantee letter template stands as an indispensable asset in the realm of financial and contractual agreements. Its structured format and inherent adaptability ensure that complex financial commitments are articulated with precision, professionalism, and legal robustness. By serving as a clear and consistent official record, the letter mitigates risks, fosters transparency, and provides all parties with the assurance needed to proceed with significant undertakings.

Embracing such a meticulously designed template not only streamlines the document creation process but also fortifies the foundation of trust between individuals and entities. It underscores the value of formal correspondence, transforming what could be a convoluted legal process into a clear, actionable, and legally sound agreement. This proactive approach to professional communication safeguards interests and promotes successful collaborations.

Ultimately, the utility of this template extends beyond mere administrative convenience; it empowers users to navigate intricate financial landscapes with confidence and clarity. By offering a reliable and efficient communication tool, it ensures that every personal guarantee is a testament to meticulous planning and responsible engagement, cementing its place as an essential component of modern business and legal documentation.