So, you’re looking forward to catching your favorite band live, or perhaps planning a whole weekend music festival. The excitement is palpable! But before you dive headfirst into ticket purchases and travel arrangements, let’s talk about something less glamorous but absolutely essential: your budget. This isn’t just about saving money; it’s about maximizing your experience, reducing financial stress, and ensuring you can enjoy every beat without a hint of buyer’s remorse later on.

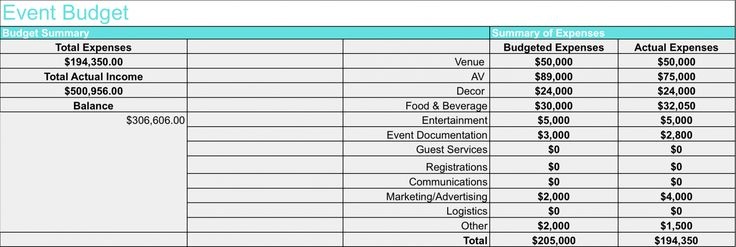

This article introduces the concept of a dedicated music concert budget worksheet template, a powerful tool designed to bring clarity and control to your concert-going expenses. Whether you’re a seasoned concert-goer, an occasional attendee, or even someone organizing a small local gig, understanding where your money is going is key. For those who care about productivity, organization, and smart financial planning, this template isn’t just a spreadsheet; it’s your personal financial organizer, transforming potential budget anxiety into a well-managed, enjoyable event.

The Importance of Organized Financial Planning for Clarity and Control

Financial planning often feels like a chore, but it’s genuinely one of the most empowering habits you can cultivate. When it comes to something as specific as a music concert, having a clear expense tracker in place means you’re not just guessing about costs; you’re making informed decisions. It puts you in the driver’s seat, allowing you to allocate funds strategically and see your financial landscape with crystal clarity.

Without proper record-keeping, it’s all too easy for hidden costs to creep up. That extra t-shirt, the pricey venue food, or an unexpected surge fare home can quickly derail even the best intentions. A structured budgeting system helps you anticipate these expenditures, providing a complete overview of your cash flow. This proactive approach not only prevents overspending but also builds confidence in your financial management skills, translating into less stress and more enjoyment.

Key Benefits of Structured Budgeting Tools

Why bother with a structured template when a mental tally might seem sufficient? The simple answer is accuracy and foresight. Relying on memory or scribbled notes often leads to inaccuracies, forgotten expenses, and ultimately, a skewed view of your financial health. A financial spreadsheet, on the other hand, provides a consistent, reliable framework for all your budgeting needs.

Using a dedicated planner or spreadsheet offers numerous advantages. It allows you to visualize your savings planner goals, track monthly expenses diligently, and compare actual spending against your initial projections. This level of detail is invaluable for both short-term event planning and long-term financial health. Moreover, these tools serve as an excellent income log, helping you see how much you need to set aside and whether your current spending habits align with your overall financial objectives. They bring order to potential chaos, making cost management feel less daunting.

Adapting Your Financial Planning Template for Diverse Needs

While our focus today is on concert budgeting, the beauty of a well-designed financial template is its inherent adaptability. The core principles of tracking income and expenses, categorizing spending, and monitoring your balance sheet are universal. This means the very same layout you use for concert planning can be easily modified for a multitude of other financial tasks.

Think of it as a versatile blueprint for financial organization. Whether you’re managing personal finance, tracking household management expenses, planning for a wedding, or even overseeing a small business’s project budget, the underlying structure remains highly effective. It’s about creating a reusable asset that empowers you across various aspects of your financial life, proving that smart organization isn’t just a one-off task but a continuous, rewarding practice.

When is a Music Concert Budget Worksheet Template Most Effective?

A robust budgeting sheet comes into its own during several key scenarios, ensuring you stay on track and maximize your enjoyment without financial strain. Here are some instances where employing a music concert budget worksheet template proves incredibly effective:

- Planning for Multiple Concerts or a Festival: When you have several events on your calendar, a centralized record helps you see the cumulative cost and save accordingly. It prevents "concert creep," where individual small spends add up to a big hit.

- Saving for a High-Demand Concert or VIP Experience: If you’re eyeing a pricy ticket or an exclusive package, the planner becomes your savings guide, helping you track progress towards your goal.

- Traveling for a Show: Beyond the ticket, travel involves transportation, accommodation, and food. This sheet helps account for all these variables, often the hidden costs.

- Group Outings: When attending with friends, the layout can be used to track shared expenses, making it easy to settle up fairly and avoid awkward "who owes what" conversations later.

- Assessing Overall Entertainment Spending: Even for casual attendees, having a record of how much you spend on live music throughout the year can be illuminating for your broader personal finance goals.

- Comparing Different Event Options: Before committing, you can use the template to model costs for various concerts or festivals, helping you choose the best value for your budget.

Designing Your Budgeting Sheet for Optimal Usability

A budget template is only as good as its usability. To truly make this sheet work for you, consider both its design and formatting, whether you prefer a print or digital version. The goal is to make it intuitive, easy to update, and quick to reference.

For a digital spreadsheet, clear column headers are essential: "Category," "Estimated Cost," "Actual Cost," "Difference," "Payment Method," and "Notes." Utilize formulas for automatic calculations like totals and variances, which instantly highlight over- or underspending. Conditional formatting, such as color-coding cells that exceed their budget, can provide immediate visual cues. Make sure the font is legible, and the layout isn’t overly cluttered. Consider adding a separate tab for income or savings goals related to your concert fund.

If you prefer a print version, focus on a clean, spacious design. Use clear lines to separate categories and ample space for writing in figures. Legibility is paramount, so avoid small fonts or overly complex tables. Pre-label sections for common expenses like "Tickets," "Travel," "Food & Drink," "Merchandise," and "Miscellaneous." A well-designed physical planner encourages consistent use, making the act of recording expenses a less cumbersome task. Regardless of format, the key is consistency and clarity, transforming the record into a truly valuable financial organizer.

Ultimately, whether digital or physical, the template should serve as a dynamic tool, not a static document. Regularly review and update the planner to ensure it reflects your current financial reality and concert-going plans.

The Practical Value of a Dedicated Budgeting Tool

In our fast-paced world, finding tools that genuinely save time and reduce stress is invaluable. A dedicated financial template like the one we’ve discussed does exactly that. It transforms what could be a source of financial anxiety into a well-managed, enjoyable experience. By providing a clear structure for your spending, it liberates you from guesswork and empowers you to make conscious financial choices, ensuring your entertainment budget truly enhances your life.

Embracing this level of financial organization isn’t just about managing money for a single concert; it’s about cultivating a mindset of financial mastery. It’s a practical step towards taking control of your financial destiny, one perfectly budgeted concert at a time. So, go ahead, plan that unforgettable musical experience, knowing you’ve got your financial record perfectly in tune.