Navigating the world of professional documentation can feel like a labyrinth, especially when it involves significant life decisions like property acquisition. For anyone focused on productivity, organization, and smart business communication, understanding a mortgage contract agreement isn’t just about legal compliance; it’s about clarity, control, and confidence. This foundational document, often perceived as daunting, is essentially a roadmap, outlining the terms and conditions between a lender and a borrower. Getting to grips with its structure, purpose, and implications empowers you to make informed choices and ensure a smooth transaction.

This article isn’t just for those buying a home; it’s for anyone who values well-structured professional communication and robust business documentation. Whether you’re a freelancer drafting a service agreement, a small business owner formalizing a partnership, or simply someone who believes in the power of organized planning, the principles behind a solid legal contract are universally beneficial. We’ll explore how these principles translate into actionable strategies for managing all your important agreements, ensuring they serve as pillars of trust and clarity rather than sources of confusion.

The Cornerstone: Organized Planning and Professional Documentation

In any professional endeavor, whether personal or business-related, organized planning and meticulous documentation are non-negotiable. They are the bedrock upon which clarity, legality, and trust are built. A well-crafted legal contract, for instance, removes ambiguity, setting clear expectations for all parties involved. This proactive approach minimizes misunderstandings and disputes down the line, saving invaluable time and resources that would otherwise be spent on conflict resolution.

Professional documentation also serves as a critical compliance record. It provides an undeniable paper trail, essential for audits, legal challenges, or simply recalling specific terms years later. For businesses, this means protecting assets, intellectual property, and client relationships. For individuals, it means safeguarding investments and ensuring that life’s major agreements, like a home loan, stand on firm legal ground. The peace of mind that comes from knowing your agreements are solid and accessible is a productivity booster in itself.

Key Benefits of Using Structured Templates and Agreement Layouts

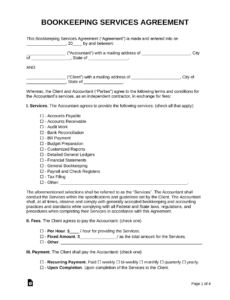

Think of a structured contract template as your secret weapon for efficiency and consistency. Instead of starting from scratch every time you need a new agreement, a pre-designed professional layout provides a reliable framework. This isn’t about cutting corners; it’s about smart resource allocation and ensuring every essential clause is considered and included.

The benefits are manifold. First, it ensures consistency across all your agreements, maintaining a professional brand image and reducing errors. Second, it significantly speeds up the drafting process, allowing you to focus on the unique details of each situation rather than the boilerplate language. Third, a well-structured form ensures legal clarity, reducing the risk of vital terms being overlooked. Finally, using a standardized format enhances readability for all parties, making the document signing process smoother and more transparent.

Adapting This Template for Various Professional Purposes

While we began discussing the mortgage contract, the underlying principles of a well-organized agreement are incredibly versatile. The same thoughtful approach to structure, clarity, and comprehensive detail can be applied to a multitude of other professional scenarios. This adaptability makes understanding robust contract templates a superpower for anyone managing multiple relationships or transactions.

For example, a freelancer can adapt the core structure to create an ironclad service agreement with clients, outlining deliverables, payment terms, and intellectual property rights. Business partnerships thrive on clear expectations, making a detailed memorandum of understanding or partnership agreement essential. Service providers can use these templates to define their terms of service, protecting both their business and their clients. Even rental agreements can benefit from a professional layout that clearly specifies responsibilities and conditions for both landlords and tenants, preventing future disputes. The ability to customize and re-use a foundational record empowers you to communicate effectively and safeguard your interests across all your ventures.

When a Structured Mortgage Contract Agreement is Most Effective

A comprehensive mortgage contract agreement is a complex yet vital legal instrument. It outlines the specific terms under which a lender provides funds for a property purchase, detailing repayment schedules, interest rates, and the rights and responsibilities of both parties. Understanding when this level of structured documentation is most effective goes beyond just the legal requirement; it’s about strategic clarity and risk mitigation.

Here are some instances where leveraging a robust mortgage contract agreement can simplify things:

- First-Time Home Buyers: For individuals new to property ownership, a clear and well-organized document demystifies the process, making complex legal and financial terms more understandable. It acts as an educational tool as much as a legal one.

- Complex Loan Structures: When dealing with adjustable-rate mortgages, interest-only loans, or other non-traditional financing options, the specific clauses and calculations must be meticulously detailed. A strong document ensures all nuances are transparently recorded.

- Property Investments: For investors purchasing multiple properties or using a property as collateral for other ventures, having a thoroughly defined contract protects against future liabilities and clearly delineates asset ownership and responsibilities.

- Refinancing or Loan Modifications: When altering an existing mortgage, a new or amended document ensures all changes to interest rates, repayment terms, or collateral are legally binding and clearly understood by both parties.

- Dispute Resolution: In the unfortunate event of a dispute, a comprehensive, unambiguous legal contract is the primary tool for legal teams to refer to, streamlining resolution and minimizing prolonged litigation.

- Estate Planning: A detailed record of a mortgage agreement is crucial for estate planning, ensuring that beneficiaries and executors understand the deceased’s financial obligations and property rights, facilitating a smoother transition.

Tips for Better Design, Formatting, and Usability

Creating a professional document isn’t just about the words; it’s also about how those words are presented. Good design and formatting significantly enhance usability, whether the document is printed or accessed digitally. A poorly formatted legal contract, no matter how legally sound, can be difficult to read, leading to confusion and errors.

Firstly, prioritize readability. Use clear, legible fonts (like Arial or Calibri) in a comfortable size (10-12pt). Break up long blocks of text with clear headings and subheadings (using H2 and H3 tags effectively, for instance). Employ bullet points and numbered lists to present complex information in an easily digestible format, as demonstrated throughout this article. Ensure adequate line spacing and margins to avoid a cramped appearance.

For digital versions, consider using interactive elements. A table of contents with clickable links can help users navigate long documents with ease. Fields for electronic signatures streamline the document signing process, making it more efficient and secure. Always include clear version control and date stamps, especially if the document undergoes revisions. For print, ensure high-quality paper and a professional binding if applicable. Finally, always include a disclaimer encouraging legal review – it’s a mark of professionalism and responsibility.

The Practical Value of Your Professional Documents

Ultimately, mastering the art of professional documentation, from a mortgage agreement to a simple project brief, boils down to practical value. These aren’t just bureaucratic hurdles; they are powerful tools for saving time, fostering clarity, and ensuring legal compliance. By embracing structured templates and thoughtful design, you transform potentially intimidating legal forms into efficient communication instruments that protect your interests and strengthen your professional relationships.

Think of your well-crafted agreements as silent partners in your success. They speak volumes about your professionalism, meticulousness, and commitment to transparent communication. They free up your mental bandwidth, allowing you to focus on core business strategies or personal goals, rather than untangling ambiguities. In a fast-paced world where efficiency is king, a well-organized business file, or any robust professional record, is an invaluable asset that underpins trust and facilitates smoother operations.

Embrace the power of well-structured documentation. It’s a foundational skill for anyone aiming for peak productivity, superior organization, and impeccable business communication. The investment in creating clear, comprehensive, and user-friendly documents pays dividends in peace of mind, reduced risk, and enhanced professionalism.