Navigating the world of personal finance can often feel like trying to solve a complex puzzle with missing pieces. We all want to feel in control of our money, to know where it’s going, and to ensure we’re making progress toward our financial goals. Yet, for many, the reality is a mix of guessing games and reactive spending. This is where a well-structured monthly budget template becomes an absolute game-changer, transforming financial ambiguity into clear, actionable insights.

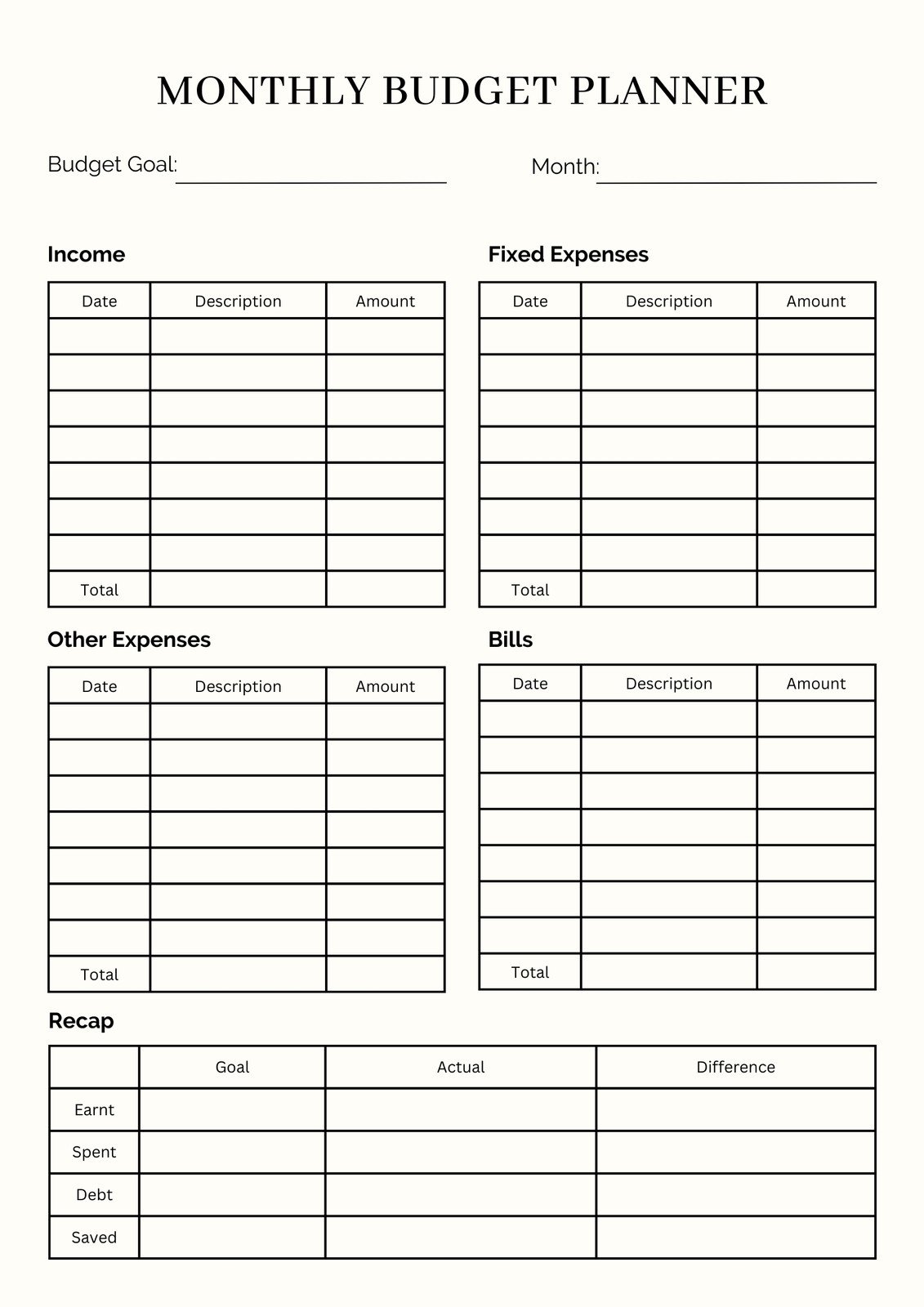

Forget the intimidating spreadsheets and complex accounting software; this isn’t about becoming a financial guru overnight. Instead, it’s about adopting a practical, user-friendly tool designed to simplify your financial life. A robust monthly budget template offers a clear overview of your income and expenses, empowering you to make informed decisions, identify spending patterns, and proactively plan for your future. Whether you’re saving for a down payment, paying off debt, or simply striving for financial peace of mind, this document is your steadfast ally.

The Importance of Organized Financial Planning for Clarity and Control

Think of your finances as the engine of your life’s ambitions. Without proper maintenance and clear gauges, you’re driving blind. Organized financial planning is the maintenance schedule and dashboard you need, providing unparalleled clarity and control over your monetary journey. It’s not just about crunching numbers; it’s about fostering a mindful relationship with every dollar that enters and leaves your wallet.

A detailed expense tracker allows you to pinpoint exactly where your money is going, often revealing surprising habits or subscriptions you might have forgotten. This visibility is the first step toward reclaiming control. When you systematically record your income log and track your monthly expenses, you build a comprehensive financial picture that highlights opportunities for saving and areas for adjustment. This proactive approach alleviates financial stress, replacing anxiety with confidence in your ability to manage your cash flow effectively.

Key Benefits of Using a Structured Monthly Budget Template

Adopting a structured template for your budgeting process brings a wealth of advantages far beyond simple tracking. It provides a consistent framework, ensuring that no financial stone is left unturned each month. This systematic approach is crucial for anyone serious about productivity and smart financial planning.

One primary benefit is the significant time savings. Instead of reinventing the wheel each month, you have a pre-designed layout ready to populate. This consistency makes it easier to compare month-over-month data, spotting trends and making adjustments to your savings planner or spending habits with greater ease. Moreover, a dedicated financial spreadsheet acts as a centralized financial organizer, consolidating all your critical information in one accessible place. This not only simplifies tax preparation but also provides a ready reference for making significant financial decisions, from large purchases to investment planning. It’s a foundational element of any effective budgeting system.

How This Template Adapts for Various Purposes

The beauty of a well-designed monthly budget template lies in its inherent flexibility. While its core function is managing personal finance, its adaptable structure makes it incredibly useful for a diverse range of applications. It’s not just a personal tool; it’s a versatile financial record that can serve many roles.

For households, this sheet transforms into a powerful household management tool, allowing families to pool income, allocate funds for shared expenses, and track joint financial goals. Small businesses, too, can benefit immensely by adapting the layout to monitor operational costs, track revenue streams, and manage cash flow, providing a simplified balance sheet perspective without the need for complex accounting software. Even for specific events, like planning a wedding or a large vacation, the planner can be customized to manage event-specific budgets, ensuring every cost management detail is accounted for. Its modular design means you can add, remove, or rename categories to fit any unique financial scenario.

Examples of When a Monthly Budget Template is Most Effective

A monthly budget template shines brightest in specific situations where clarity, control, and foresight are paramount. Leveraging this tool at these opportune moments can significantly impact your financial outcomes and overall peace of mind.

Consider employing the monthly budget template when:

- Starting a New Financial Goal: Whether it’s saving for a down payment, a child’s education, or an early retirement, this document helps you allocate specific amounts toward your goal each month and track your progress.

- Managing Significant Debt: For those tackling credit card debt, student loans, or a mortgage, the template provides a clear picture of how much income can be directed towards principal payments, accelerating your debt-free journey.

- Experiencing Income Fluctuations: If you’re a freelancer, commission-based employee, or have variable income, the template allows you to plan for lean months by setting aside funds during high-income periods, creating a financial buffer.

- Undergoing Major Life Changes: Moving to a new city, getting married, having a baby, or changing jobs all come with new financial considerations. This sheet helps you adjust to new expenses and income levels seamlessly.

- Struggling with Overspending: If you constantly wonder where your money goes, the record forces accountability, highlighting spending leaks and empowering you to make conscious choices to curb unnecessary expenditure.

- Preparing for a Large Purchase: Planning to buy a car, take a dream vacation, or invest in home improvements? The spreadsheet helps you save consistently and ensures you have the necessary funds without incurring unexpected debt.

Tips for Better Design, Formatting, and Usability

To truly unlock the power of your budgeting system, pay attention to its design and usability. Whether you prefer a digital financial organizer or a print-friendly version, a thoughtful layout can make all the difference in adherence and clarity. Remember, the goal is to make cost management feel less like a chore and more like an empowering daily practice.

For digital versions, consider using conditional formatting to highlight overspent categories in red or savings goals met in green. Utilize dropdown menus for expense categories to ensure consistency and speed up data entry. Create separate tabs within the template for different aspects of your financial life, such as a "Debt Payoff Tracker" or "Savings Goals," linked to your main cash flow sheet. If you prefer a print version, ensure the fonts are legible, lines are clear, and there’s ample space for writing. Design it with a clean, uncluttered aesthetic, perhaps using a consistent color scheme for different income and expense types. Both digital and print versions should include a clear summary section that provides an instant overview of your financial health at a glance. Regularly review and refine the layout based on your evolving needs and feedback on what works best for your personal flow.

In a world where financial well-being is increasingly tied to effective planning, having a robust system in place is no longer a luxury but a necessity. The consistent application of a well-designed record empowers you to take control of your financial narrative, moving from a reactive stance to a proactive strategy. It’s a tool that respects your time, streamlines your efforts, and most importantly, puts you firmly in the driver’s seat of your financial future.

Embrace the simplicity and power of this foundational financial document. It’s more than just lines and numbers; it’s a living reflection of your financial aspirations and a roadmap to achieving them. By investing a little time each month into updating this planner, you’re not just tracking expenses; you’re building a habit of financial mindfulness that pays dividends in reduced stress, increased savings, and ultimately, greater financial freedom.