Navigating the complexities of financial obligations often presents unforeseen challenges, and occasionally, an individual or business may encounter circumstances that lead to a delayed payment. While such occurrences are regrettable, the manner in which they are addressed can significantly impact relationships, credibility, and future opportunities. Proactive and transparent communication is paramount in mitigating negative consequences and preserving professional standing when a payment cannot be made on time.

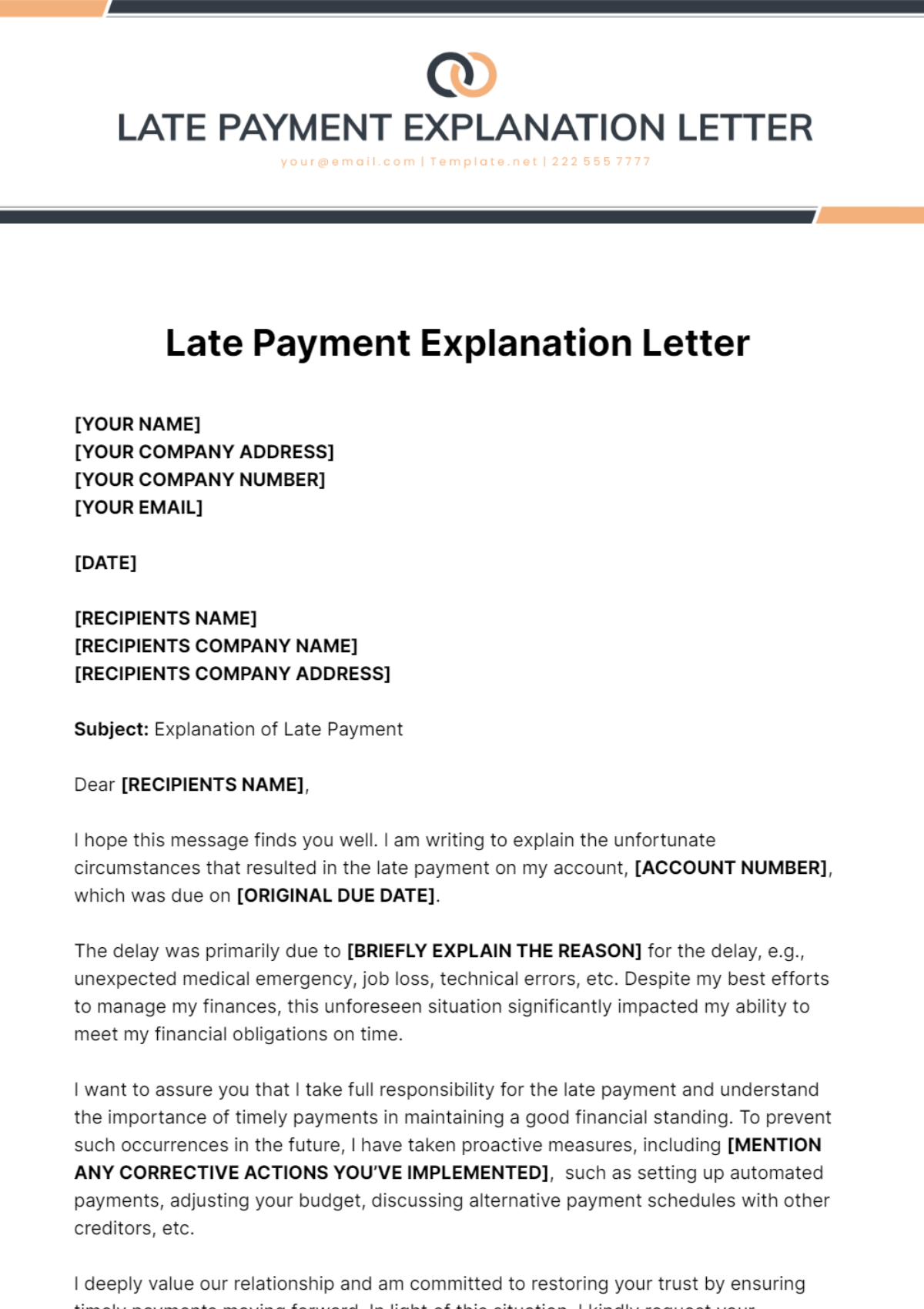

This article introduces the critical utility of a structured late payment explanation letter template. This invaluable tool serves as a professional conduit for conveying reasons behind a delay, offering assurance of future payment, and upholding integrity in financial dealings. Designed for both individuals and businesses, the template provides a clear framework for delivering sensitive information with clarity and professionalism, ensuring that all parties involved receive accurate and timely updates regarding payment schedules.

The Imperative of Professional Written Communication

In both personal and professional spheres, effective communication forms the bedrock of trust and accountability. Written communication, in particular, offers a level of formality, permanence, and detail that verbal exchanges often lack. For sensitive matters such as financial delays, a meticulously crafted formal correspondence becomes an indispensable record, documenting the interaction and the steps taken to resolve the issue.

Professional documentation establishes clear expectations and provides an undeniable reference point should any disputes arise. It demonstrates a commitment to transparency and responsibility, reinforcing the sender’s integrity. Unlike ephemeral conversations, a well-composed business letter or notice letter ensures that the message is consistently conveyed, free from misinterpretations, and accessible for future review by all relevant parties.

Core Advantages of a Structured Late Payment Explanation Template

The adoption of a specialized template for explaining payment delays offers a multitude of benefits, streamlining a potentially awkward or difficult conversation into a professional exchange. Primarily, utilizing a well-designed late payment explanation letter template ensures a consistent and professional tone across all communications, irrespective of who drafts the letter. This consistency reinforces the sender’s reliability and commitment to established protocols.

Furthermore, a structured message template fosters clarity by guiding the sender to include all necessary information, such as account details, the specific period of delay, the reason for the late payment, and the proposed resolution. This systematic approach reduces ambiguity and ensures that recipients receive a comprehensive overview without needing further clarification. The inherent document layout of a template also aids in quick comprehension, presenting information in an organized, easy-to-digest format. It saves valuable time by providing a ready-made structure, allowing the sender to focus on customizing the specific details rather than creating a document from scratch.

Tailoring the Document for Diverse Scenarios

While the fundamental purpose of the correspondence remains consistent—to explain a payment delay—the versatility of a template allows for significant customization to suit a myriad of situations. Whether the delay pertains to an individual’s personal mortgage payment, a small business struggling with cash flow to pay a vendor, or a formal notification to a service provider about an impending invoice delay, the core structure can be adapted. This flexibility ensures that the message remains relevant and impactful, regardless of the specific context.

For employment-related financial obligations, such as explaining a late submission for a benefits payment, the template can be adjusted to reflect a more internal, yet equally formal, tone. In business-to-business dealings, the professional communication needs to be tailored to include specific contract references and commercial terms. Even for a written request concerning a temporary financial hardship, the layout provides a solid foundation, allowing for the insertion of empathetic yet professional language. The key is to maintain the integrity of the professional communication while personalizing the content to address the unique circumstances and recipient of the notice letter.

Optimal Scenarios for Utilizing This Template

Understanding when to deploy a late payment explanation letter template maximizes its effectiveness and can significantly mitigate potential negative repercussions. Proactive communication is always superior to reactive damage control, making the template an essential tool for foresight and responsibility.

Consider the following scenarios where the use of this template is most effective:

- Personal Credit Accounts: When facing a delay in paying a mortgage, car loan, or credit card bill, informing the lender proactively can prevent penalties, protect your credit score, and demonstrate good faith.

- Business Invoices: If a business is unable to pay a vendor invoice by the due date, sending this correspondence explains the situation, offers a revised payment schedule, and maintains a healthy supplier relationship.

- Rent Payments: Notifying a landlord in advance about a delayed rent payment can prevent late fees, maintain a positive tenant-landlord relationship, and avoid potential eviction notices.

- Loan Applications or Credit Reviews: When a past late payment appears on a credit report, a detailed explanation letter can provide context, showcasing a responsible attitude and helping to mitigate negative impressions during future financial assessments.

- Contractual Agreements: For any situation involving contractual obligations where a payment delay impacts a partnership or agreement, this official record serves to formally acknowledge the issue and propose a resolution.

- Payment Discrepancies: If a payment was made but not correctly processed or if there’s a dispute over the amount due, this template can be adapted into a notice letter to clarify the situation and request investigation, preventing it from being incorrectly flagged as a late payment.

- Utility or Service Bills: Informing utility companies or other service providers about an unavoidable delay ensures continued service and avoids potential disconnections or additional charges.

Crafting Your Correspondence: Formatting, Tone, and Usability

The effectiveness of any formal correspondence hinges not only on its content but also on its presentation and underlying tone. When utilizing the template, meticulous attention to formatting and the chosen voice ensures the message is received as intended—professional, sincere, and proactive.

Formatting for Clarity and Professionalism

Adhere to standard business letter format. This includes a clear header with your contact information, the date, the recipient’s contact information, a formal salutation, well-structured body paragraphs, a professional closing, and your signature. Use clear, legible fonts and ensure adequate white space to enhance readability. Bullet points can be employed within the body of the letter to present specific details or proposed solutions in an easily digestible manner. For a digital file, ensure it is saved in a universally accessible format, such as PDF, to preserve the document layout and prevent unauthorized alterations, making it a reliable official record.

Maintaining a Professional and Empathetic Tone

The tone of the letter should always be formal, respectful, and, where appropriate, apologetic without being overly self-deprecating. It is crucial to be transparent about the reason for the delay, but avoid excessive details that may seem like excuses. Focus on taking responsibility, explaining the situation concisely, and outlining the steps being taken to rectify the payment. Maintain a tone that conveys seriousness and commitment to resolving the issue. The goal is to inform, reassure, and propose a solution, not to elicit sympathy or assign blame. This approach ensures the professional communication maintains its integrity.

Usability for Print and Digital Platforms

Consider how the letter will be transmitted and received. For print versions, use quality paper and ensure all contact details are correct. If sending digitally, verify that the email address is accurate and consider attaching the letter as a PDF to maintain its intended document layout and prevent formatting issues across different email clients or operating systems. Ensure the file name is clear and descriptive (e.g., "Account #[Your Account Number] – Late Payment Explanation – [Date]"). Regardless of the medium, proofread meticulously for any grammatical errors or typos, as these can detract from the professionalism of the message template.

In essence, the template provides the structural integrity, but it is the careful application of these formatting and tonal guidelines that transforms the document into a truly impactful piece of professional communication, effectively serving as a credible written request or official record.

The judicious use of a well-crafted explanation can significantly mitigate potential penalties, preserve essential relationships, and safeguard an individual’s or organization’s reputation. It serves not merely as a notice letter of delay, but as a demonstration of accountability and a commitment to resolving financial obligations honorably.

Leveraging this template transforms a potentially awkward or damaging disclosure into an exercise in professional communication and responsible financial management. By providing a clear, concise, and structured explanation, the sender reinforces trust and facilitates a smoother path toward resolution. This ensures that the message template continues to be an indispensable asset for effective and reliable communication in all financial interactions.