Effective communication is the cornerstone of successful business operations and maintaining professional relationships, both commercial and personal. In an environment where clarity and precision are paramount, the ability to articulate concerns and requests formally can significantly influence outcomes. This article delves into the critical role of structured communication, particularly within the realm of financial discrepancies, by examining the utility of a late payment dispute letter template. Such a template serves as an indispensable tool for individuals and organizations seeking to address billing errors or unwarranted charges with accuracy and professionalism.

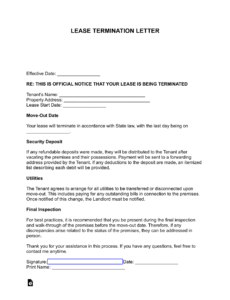

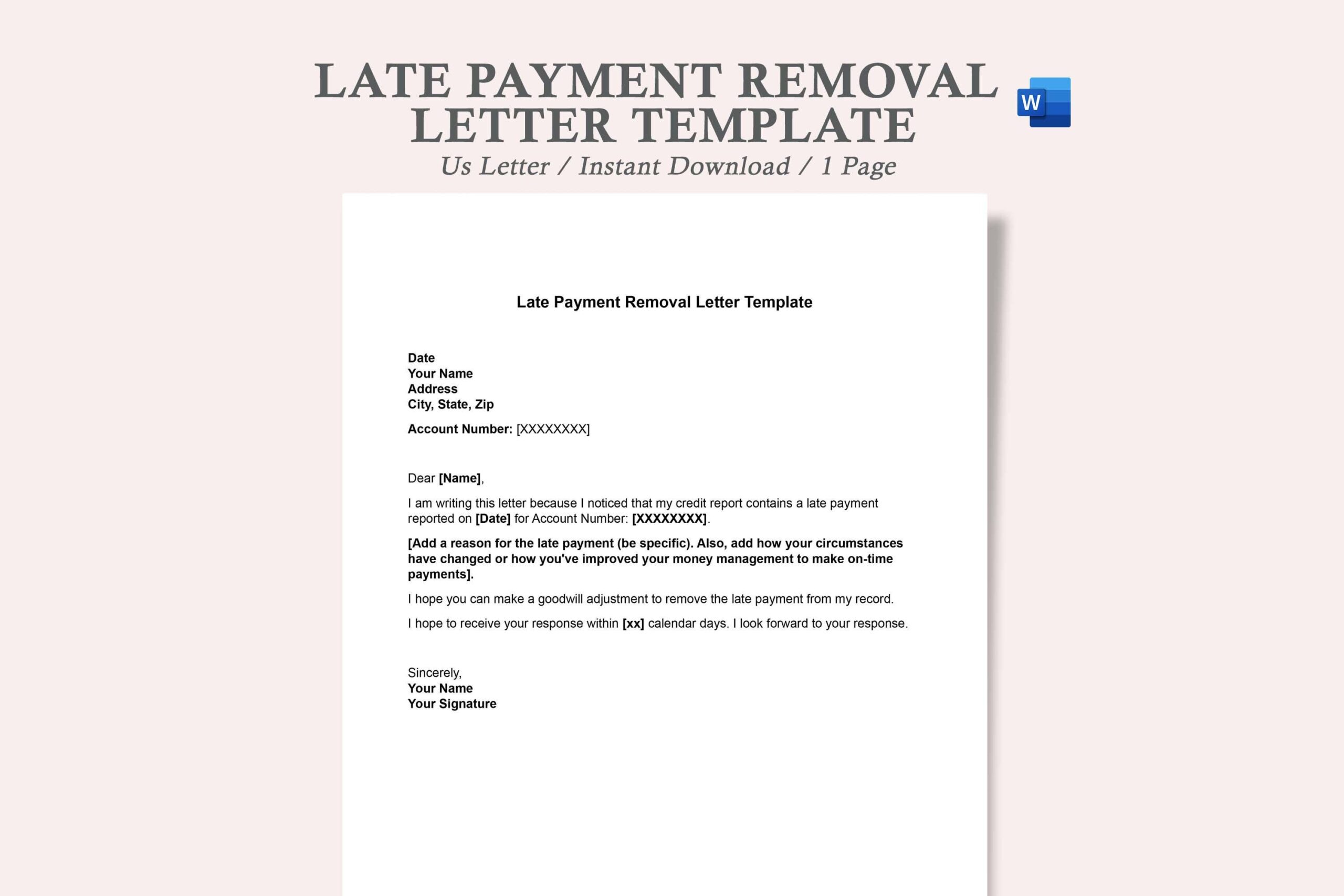

The primary purpose of a late payment dispute letter template is to provide a standardized, yet adaptable, framework for challenging a payment record that incorrectly indicates a late payment. This document is crucial for protecting one’s credit history, disputing erroneous fees, or simply correcting an administrative oversight. Beneficiaries include consumers who find an incorrect late payment on their credit report, businesses disputing a supplier’s charge, and anyone needing to formally record a challenge to a financial statement. Utilizing a structured template ensures that all necessary information is included, the message is conveyed clearly, and a professional tone is consistently maintained, thereby increasing the likelihood of a swift and favorable resolution.

The Indispensable Nature of Written Communication and Professional Documentation

In an increasingly digital age, the value of formal written correspondence remains undiminished, serving as an authoritative record of interactions and agreements. Professional documentation, whether in business or personal settings, provides an incontrovertible account of events, decisions, and disputes. Unlike verbal exchanges, which can be subject to misinterpretation or forgotten details, a written record offers a clear, verifiable timeline and content for all parties involved. This clarity is especially vital when addressing financial matters or legal obligations, where precise language and documented proof can prevent future misunderstandances or mitigate potential liabilities.

Written communication elevates the level of discourse, compelling senders to articulate their thoughts with greater precision and consideration. It establishes a professional tone, signaling respect for the recipient and the gravity of the subject matter. In the context of official records, well-crafted documents like a business letter or a notice letter contribute to an organization’s credibility and commitment to transparency. Furthermore, such documentation can serve as essential evidence in arbitration, legal proceedings, or internal audits, underscoring its pivotal role in risk management and accountability across all sectors.

Key Benefits of Using Structured Templates for Financial Disputes

Employing a structured template, such as a late payment dispute letter template, offers numerous advantages, particularly in situations requiring clear and consistent communication regarding financial discrepancies. One of the foremost benefits is the inherent consistency it provides. By ensuring that every dispute letter adheres to a pre-defined format and includes all critical information, the template eliminates the risk of omitting vital details that could hinder the resolution process. This uniformity is crucial for maintaining a professional image and ensuring that all correspondence reflects an organized approach.

Furthermore, leveraging this type of letter significantly enhances clarity. The pre-arranged sections guide the writer to present facts logically and succinctly, reducing ambiguity and ensuring the recipient easily understands the core message. This structured approach helps maintain professionalism throughout the dispute, even when emotions might run high. It communicates a serious, organized intent to resolve the issue based on facts, rather than mere frustration. The efficiency gained from not having to draft each letter from scratch also saves considerable time and resources, allowing individuals and businesses to address multiple disputes promptly without sacrificing quality.

Customizing This Template for Diverse Formal Notifications

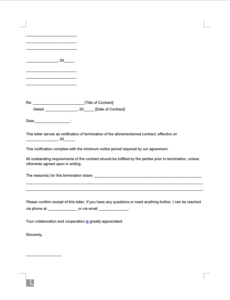

While the immediate focus might be on financial discrepancies, the underlying principles of a well-structured document are universally applicable to various formal notifications. The robust design of a dispute letter, with its emphasis on clarity, official record-keeping, and professional tone, makes it highly adaptable. For instance, the core structure can be repurposed as a formal request for information, a notice letter for contract termination, or even a detailed follow-up on a service complaint. The ability to customize this framework is where its true value as a message template shines.

To adapt this form for different contexts, one would typically adjust the body paragraphs to reflect the specific nature of the dispute or request. For an employment-related issue, the letter might address a discrepancy in a pay stub or a disagreement over a policy. In a business scenario, it could challenge an invoice from a vendor or dispute terms of a service agreement. The layout remains effective for any situation demanding a written request or official record, allowing users to tailor the content while benefiting from the consistent professional communication standard provided by the initial template. This flexibility underscores the utility of a well-designed document layout beyond its primary designation.

When Using the Late Payment Dispute Letter Template Is Most Effective

The strategic application of a late payment dispute letter template is crucial for maximizing its effectiveness in resolving financial inaccuracies. This particular correspondence tool is best utilized in specific scenarios where a formal, documented challenge is necessary. Understanding these situations can help ensure that the effort put into drafting and sending the letter yields the desired outcome.

Here are examples of when using the document is most effective:

- Incorrect Reporting to Credit Bureaus: If a credit report inaccurately reflects a late payment that was actually made on time or was due to an administrative error by the creditor. Sending the template to both the creditor and the credit bureau is essential.

- Disputed Charges on Statements: When a bank statement, credit card bill, or utility invoice includes a late fee for a payment that the consumer or business believes was submitted punctually. The letter provides a formal record of the challenge.

- Post-Dated Payments Processed Early: If a payment was post-dated but processed earlier than intended, leading to a late fee despite funds not being available until the later date. The template helps explain the discrepancy.

- Technical Glitches or System Errors: When a payment was initiated through an online portal or automated system, but a technical fault prevented its timely receipt, resulting in an unjustified late charge.

- Payments Sent but Not Posted: In cases where proof of payment (e.g., a tracking number for a mailed check, a transaction ID for an online payment) exists, but the recipient claims non-receipt or late posting.

- Disagreement Over Due Dates: If there’s a dispute about the actual due date of a payment, perhaps due to a change in terms not properly communicated, or an initial misunderstanding.

- Administrative Errors by the Creditor: When the late payment notification is clearly a mistake on the part of the service provider or creditor, such as misapplying a payment or incorrect record-keeping.

In each of these instances, the structured approach of the template ensures that all relevant details—account numbers, dates, payment amounts, and supporting evidence—are systematically presented, bolstering the credibility of the dispute and facilitating a quicker resolution. The file serves as an official record of the communication, which can be invaluable if further action is required.

Tips for Formatting, Tone, and Usability

Optimizing the formatting, maintaining an appropriate tone, and ensuring usability are paramount for any professional communication, especially for critical documents like a late payment dispute letter. The visual presentation and linguistic style significantly impact how the message is received and acted upon. Adhering to established standards for formal correspondence enhances credibility and professionalism.

Formatting for Clarity and Readability

For both print and digital versions, consistent formatting is key. Use a standard, readable font like Times New Roman or Arial in a 10-12 point size. Employ standard letter margins (typically 1 inch on all sides). Ensure adequate line spacing (1.0 or 1.15) and paragraph breaks to improve readability. Include clear headings and bullet points where appropriate, especially when listing supporting documents or specific dates. For digital versions, ensure the document is saved in a universally accessible format like PDF to preserve its layout across different devices and operating systems. This practice ensures that the document layout remains consistent regardless of the viewing platform.

Maintaining a Professional and Assertive Tone

The tone of the letter should be formal, professional, and assertive, yet never aggressive or overly emotional. The goal is to convey facts clearly and firmly, demonstrating a rational approach to the dispute. Avoid accusatory language. Instead, focus on presenting the discrepancies and the desired resolution objectively. For example, instead of stating "You incorrectly charged me," opt for "Our records indicate a discrepancy regarding the late payment charge on [Date]." This approach encourages cooperation and problem-solving rather than fostering antagonism.

Usability for Print and Digital Versions

Consider the usability aspects for both physical and electronic delivery. For print, include all necessary contact information for both sender and recipient at the top, along with the date. Leave space for a physical signature. For digital versions, ensure all clickable links (if any) are functional. Attach supporting documents as separate, clearly labeled files rather than embedding them directly, making it easier for the recipient to review. Always retain a copy of the letter and any supporting documents for your own records, whether it’s a physical copy or a digital backup. This practice ensures that you always have access to the official record of your correspondence.

Conclusion: The Enduring Value of a Reliable Communication Tool

In an intricate financial landscape, the ability to communicate discrepancies clearly and professionally is not merely an advantage; it is a necessity. A precisely crafted document, such as the template discussed, stands as a testament to the power of structured communication. It transcends its initial purpose by providing a reliable framework that instills confidence in the sender and fosters an environment conducive to resolution. By standardizing the process of disputing inaccuracies, this form equips individuals and businesses with an efficient and authoritative means to protect their financial standing and ensure fairness.

Ultimately, the utility of this particular correspondence extends far beyond correcting a single error. It represents a commitment to diligence, accuracy, and professional conduct in all dealings. By providing a clear, concise, and documented method for addressing concerns, the letter simplifies complex interactions and reinforces the importance of maintaining an official record. Its inherent adaptability further solidifies its position as an invaluable tool, ensuring that critical messages are delivered with impact and integrity, thereby contributing to smoother operations and stronger relationships in any professional or personal context.