An invoice register template is a vital tool for businesses of all sizes. It provides a centralized location to track and manage invoices, making it easier to stay organized and ensure timely payments. By creating a professional invoice register template, you can enhance your business’s reputation and streamline your accounting processes.

Key Elements of a Professional Invoice Register Template

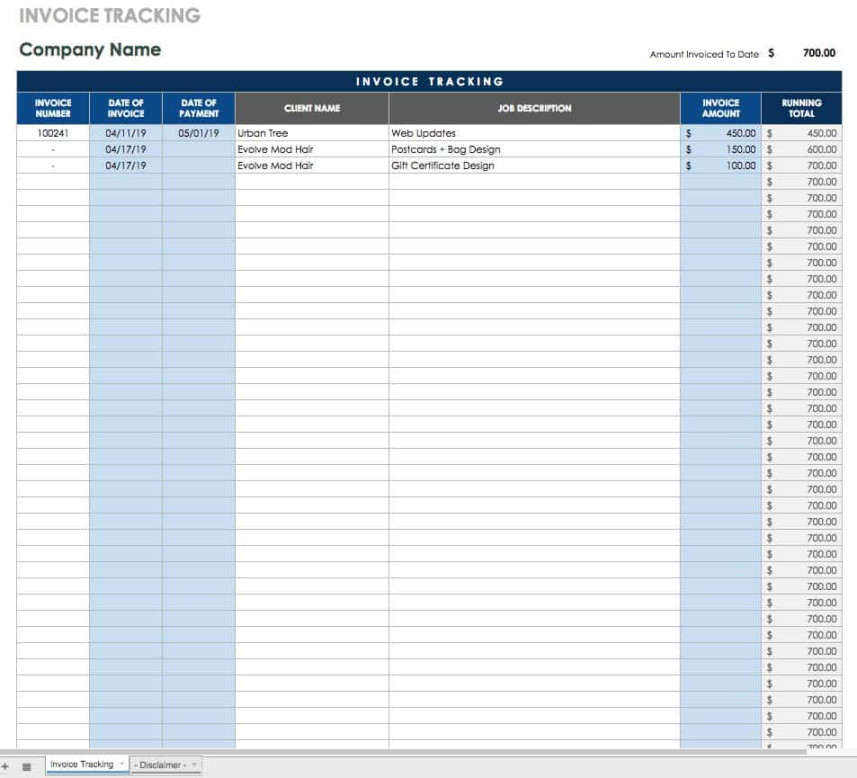

To create a professional invoice register template, you should include the following essential elements:

Header

The header should be visually appealing and include the following information:

Company Name: Clearly display your company name at the top of the template.

Date Range

Include a section where you can specify the date range for the invoices included in the register. This will help you track invoices issued and received within specific time periods.

Invoice Number

Create a column for the invoice number. This is a unique identifier for each invoice.

Invoice Date

Include a column for the invoice date, indicating when the invoice was issued.

Invoice Amount

Provide a column for the total amount of the invoice, including taxes and fees.

Due Date

Add a column for the due date, specifying when the payment is expected.

Customer Name

Include a column for the customer’s name or company name.

Customer Contact Information

Provide a column for the customer’s contact information, including their address, phone number, and email address.

Payment Status

Create a column to track the payment status of each invoice. This can be indicated as “Paid,” “Unpaid,” or “Partially Paid.”

Payment Date

If the invoice has been paid, include a column for the payment date.

Notes

Provide a section for additional notes or comments regarding the invoice, such as payment terms or special instructions.

Design Considerations for a Professional Invoice Register Template

To create a professional and visually appealing invoice register template, consider the following design elements:

Layout: Choose a clean and organized layout that is easy to read and navigate.

Additional Tips for Creating a Professional Invoice Register Template

Customization: Consider customizing the template to meet your specific business needs.

By following these guidelines and incorporating the essential elements, you can create a professional invoice register template that enhances your business operations and maintains a positive impression with your customers.