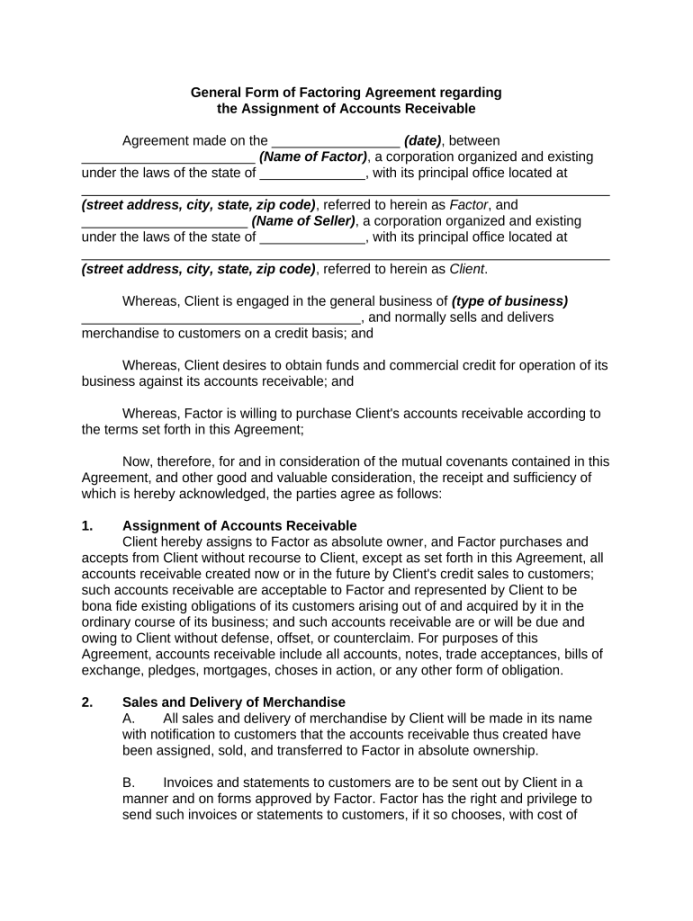

Invoice Discounting Agreement Template is a legal document that outlines the terms and conditions between a seller (you) and a factor (a financial institution) for the purchase of your outstanding invoices at a discount. This agreement provides a structured framework for both parties, ensuring clarity and transparency in the transaction.

Key Components of an Invoice Discounting Agreement Template:

1. Parties Involved:

Clearly identify the seller and the factor.

2. Recitals:

Briefly summarize the purpose of the agreement, including the intent to factor invoices.

3. Definitions:

Provide precise definitions for key terms used throughout the agreement, such as “invoice,” “factor,” “discount rate,” “collateral,” and “default.”

4. Invoice Eligibility Criteria:

Outline the specific criteria that invoices must meet to be eligible for factoring.

5. Discount Rate and Fees:

Clearly state the discount rate that will be applied to the factored invoices.

6. Factoring Process:

Describe the step-by-step process of factoring invoices.

7. Collateral and Security:

Outline any collateral or security that the seller may be required to provide.

8. Default and Remedies:

Specify what constitutes a default under the agreement.

9. Governing Law and Jurisdiction:

Indicate the governing law that will apply to the agreement.

10. Notices and Communications:

Establish the procedures for giving notices and communicating under the agreement.

11. Entire Agreement and Amendments:

State that the agreement constitutes the entire understanding between the parties.

12. Assignment and Delegation:

13. Force Majeure:

Specify events beyond the control of either party that may excuse performance under the agreement.

14. Severability:

15. Counterparts:

Design Elements for a Professional Invoice Discounting Agreement Template:

Clear and concise language: Avoid legal jargon and use plain language that is easy to understand.

By carefully considering these components and design elements, you can create a professional and effective Invoice Discounting Agreement Template that protects your interests and establishes a clear framework for your factoring transactions.