In the fast-paced world of business, efficiency, clarity, and legal soundness are not just buzzwords – they are the bedrock of success. For professionals who manage client relationships, especially in the nuanced field of financial guidance, a well-structured investment advisory agreement template can be a game-changer. It’s more than just a piece of paper; it’s a foundational tool that streamlines communication, establishes clear expectations, and protects all parties involved.

This article isn’t about the dry, legalistic jargon often associated with contracts. Instead, it’s about understanding the power of smart documentation for productivity-minded individuals and organizations. Whether you’re an independent financial advisor, a wealth management firm, or even a professional in a tangential industry looking to shore up your documentation, mastering the art of the agreement template is an essential skill for modern business communication. It brings organization to complex dealings and fosters trust through transparent, professional interactions.

The Unsung Hero of Professional Documentation

Think of professional documentation as the silent partner in every successful business transaction. It underpins clarity, legality, and trust, preventing misunderstandings before they even arise. In a world where ambiguity can lead to costly disputes and wasted time, investing in well-organized planning and robust files isn’t just a good idea—it’s imperative. A strong legal contract provides a crystal-clear framework, detailing roles, responsibilities, and expected outcomes, which is invaluable for both service providers and their clients.

For those committed to productivity, the value of professional documentation lies in its ability to automate clarity. Instead of crafting unique explanations or terms for every single client, a standardized, yet adaptable, service agreement ensures consistency. This approach not only saves countless hours but also reduces the cognitive load of managing diverse client relationships. It elevates your professional image, demonstrating an unwavering commitment to transparency and meticulousness.

Unlocking Efficiency: Benefits of Structured Templates

The primary allure of structured templates, forms, or agreement layouts is their incredible power to unlock efficiency. Imagine the time saved when you’re not starting from scratch for every new client or partnership. A well-designed contract template provides a ready-made structure, allowing you to focus on tailoring specific details rather than reinventing the wheel. This dramatically reduces drafting time, freeing you up for higher-value tasks and client engagement.

Beyond time savings, these templates bring a crucial level of consistency and error reduction to your operations. They act as a checklist, ensuring no critical clauses or disclosures are accidentally omitted. This consistency not only builds a reputation for professionalism but also significantly mitigates legal risks by guaranteeing that all necessary terms and conditions are included across your client base. Ultimately, standardized business documentation fosters a more streamlined, reliable, and professional client experience.

Beyond Investment: Adapting This Template for Versatile Needs

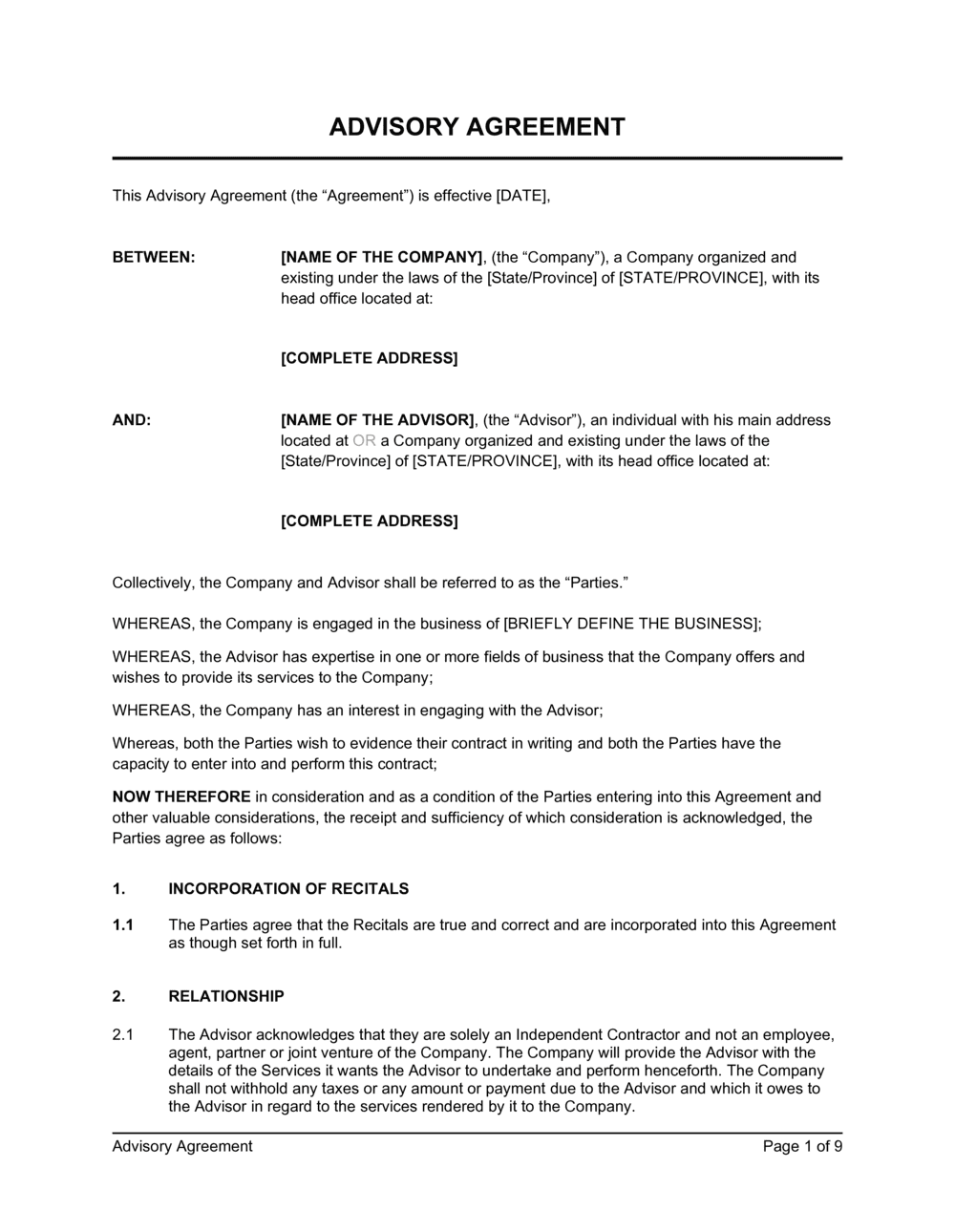

While the focus might be on financial services, the principles behind a robust Investment Advisory Agreement Template are remarkably versatile. The core concept of a well-defined service agreement can be adapted to almost any professional context where clear terms and conditions are paramount. Think about the common elements: identification of parties, scope of services, compensation, duration, termination clauses, and dispute resolution.

This foundational structure can be easily modified to create a business partnership agreement, an engagement letter for freelancers, terms of service for a digital product, or even a detailed memorandum of understanding for collaborative projects. Its adaptable nature makes it an invaluable asset for solo entrepreneurs, small businesses, and larger corporations alike. The underlying philosophy—setting clear expectations in writing—transcends specific industries, making it a powerful tool for various legal and operational needs.

When an Investment Advisory Agreement Template Shines Brightest

Understanding when to deploy a specialized template is key to maximizing its benefits. While general contract template forms are useful, there are specific scenarios where a finely tuned investment advisory agreement template becomes indispensable for professionals in the financial sector. It’s in these moments that the meticulous detail and sector-specific clauses truly prove their worth, ensuring compliance and clarity in complex financial arrangements.

Here are some examples of when using an investment advisory agreement template is most effective:

- Onboarding New Clients: When taking on a new individual or institutional client, this form meticulously outlines the advisory relationship, fee structure, and scope of investment advice provided from day one, preventing future disputes.

- Regulatory Compliance: For firms operating under strict financial regulations (e.g., SEC or state-level), the document serves as a critical

compliance record, ensuring all required disclosures and terms are present and easily auditable. - Defining Specific Service Offerings: If your firm offers different tiers of service—from basic portfolio management to comprehensive financial planning—the template can be customized to reflect the specific

service agreementfor each unique offering. - Clarifying Roles and Responsibilities: In situations where the client might be working with multiple advisors or professionals (e.g., an accountant and an investment advisor), the record clearly delineates the advisor’s role, avoiding overlap or gaps in service.

- Mitigating Risk: By explicitly detailing limitations of liability, arbitration clauses, and confidentiality agreements, the layout is a powerful tool for risk management for both the advisor and the client.

Mastering the Art of Document Design and Usability

Creating a highly functional template goes beyond merely inputting legal clauses; it also involves thoughtful design and a focus on usability. For both print and digital versions, a professional layout enhances readability and ensures that critical information is easily digestible. Use clear, concise language, avoiding unnecessary jargon whenever possible. Headings and subheadings, along with bullet points, help break up dense text, making the document far less intimidating for clients to review.

Consider the user experience for document signing. Integrating digital signature fields can significantly streamline the process, allowing for efficient and secure execution of the agreement. Ensure the template is designed to be easily filled out, whether through an online form or a printable version with clear spaces for information. Incorporate branding elements like your company logo and consistent typography to reinforce professionalism. Finally, think about version control – having a system to track changes and revisions is vital, especially for business documentation that evolves over time.

The Enduring Value of a Smart Template

In the grand scheme of running a smart, productive business, the value of a well-crafted investment advisory agreement template cannot be overstated. It stands as a testament to your commitment to organization, legal clarity, and professional communication. This isn’t just about ticking a box; it’s about building strong, transparent client relationships founded on mutual understanding and explicit terms. By leveraging such a comprehensive contract template, you empower your business to operate with greater efficiency and less friction.

Ultimately, embracing a robust compliance record like this is an investment in your business’s future. It frees up valuable time, minimizes potential disputes, and ensures that every client interaction begins on a clear, professional footing. In an environment where details matter, having a meticulously designed business file that serves as both a legal safeguard and a communication aid is an undeniable advantage, allowing you to focus on what you do best: providing exceptional advice and service.