Effective communication is the cornerstone of any successful organization, whether in the corporate sector, a non-profit foundation, or a community-driven initiative. Among the myriad forms of professional correspondence, the acknowledgement letter holds a unique and significant position. It serves not merely as a formality but as a vital instrument for building and maintaining strong relationships, fostering goodwill, and ensuring operational transparency. This article delves into the critical role of a well-crafted in kind donation acknowledgement letter template, exploring its purpose, benefits, and best practices for its implementation.

For non-profit organizations, educational institutions, and various charitable entities, receiving an in-kind donation is a common and highly valued occurrence. These contributions, which include goods, services, or property rather than cash, require precise and professional acknowledgement for both ethical and legal reasons. A robust in kind donation acknowledgement letter template provides the structured framework necessary to honor donors, comply with IRS regulations (particularly for US-based entities), and maintain impeccable records, thereby benefiting the organization, its donors, and ultimately, its mission.

The Importance of Professional Documentation in Business and Philanthropy

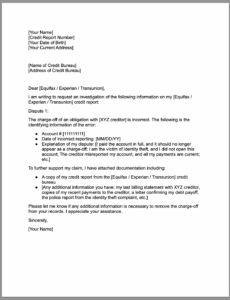

Written communication stands as an enduring pillar of professionalism and accountability. In an era dominated by rapid digital exchanges, the formal correspondence of a meticulously drafted letter retains unparalleled authority and clarity. It establishes an undeniable record of interactions, decisions, and transactions, serving as an official record that can be referenced for legal, financial, or historical purposes.

For organizations engaged in philanthropic endeavors, professional documentation transcends mere administrative necessity; it reflects an organization’s integrity and commitment to its mission. A business letter, when carefully constructed, conveys respect to the recipient, whether they are a client, partner, or donor. This meticulous attention to detail reinforces trust and fosters a positive perception of the entity. Robust documentation practices ensure consistency across all communications and provide a clear audit trail for internal review and external scrutiny.

Key Benefits of Using Structured Templates for In Kind Donation Acknowledgements

Implementing structured message templates for routine communications, particularly for acknowledgements, offers a multitude of advantages. Specifically, a well-designed in kind donation acknowledgement letter template ensures that every donor receives a consistent, professional, and compliant response. This consistency is crucial for maintaining brand identity and demonstrating organizational efficiency.

The primary benefit of employing such a layout is the immediate elevation of professionalism. Each letter emanating from the organization will project a uniform tone and appearance, reinforcing a dependable and organized image. This consistency in communication is not only aesthetically pleasing but also contributes to greater clarity, as recipients become accustomed to the organization’s communication style and format. Furthermore, the use of a template significantly enhances operational efficiency by streamlining the drafting process, allowing staff to focus on personalized content rather than formatting and boilerplate language, ensuring prompt delivery of crucial acknowledgements.

Customizing the Template for Various Acknowledgment Scenarios

While the core purpose of an acknowledgement letter remains constant, the specifics of the donation—and thus the content of the correspondence—can vary widely. A versatile template is designed to accommodate these nuances, ensuring that each communication is both standard and suitably personalized. Customization is not about rewriting the entire document; rather, it involves tailoring specific sections to reflect the unique details of each in-kind contribution.

This adaptation might include specifying the exact nature of the donated goods or services, detailing the date of receipt, and outlining the valuation as required by IRS guidelines. For instance, acknowledging a pro-bono service will differ slightly from recognizing a donated piece of equipment or a historical artifact. The letter should clearly articulate the organization’s gratitude while providing all necessary information for the donor’s record-keeping, especially concerning tax deductions. Effective customization ensures that while the framework remains consistent, the message delivered is precise, relevant, and genuinely appreciative of the specific contribution made.

When Using an In Kind Donation Acknowledgement Letter Template Is Most Effective

The strategic deployment of a predefined document layout like this one maximizes its impact and efficiency. It is most effective in scenarios where timely, accurate, and compliant communication is paramount.

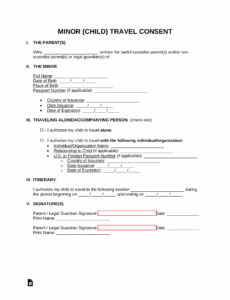

Examples of when leveraging this specific template is most effective include:

- Receipt of Goods: When an organization receives tangible items such as office supplies, furniture, electronics, or equipment. The letter should detail the items received and, if applicable, provide a non-cash contribution receipt.

- Donated Services (Pro-Bono Work): For professional services provided voluntarily, such as legal counsel, accounting, marketing, or IT support. The correspondence should acknowledge the service, its nature, and the estimated value (though organizations typically don’t value services for the donor’s tax purposes, only acknowledge them).

- Use of Property: When a donor allows the temporary use of their property, such as a venue for an event or land for a project. The notice letter should clearly state the period of use and the nature of the donation.

- Donated Expertise/Consultation: For individuals offering specialized knowledge or guidance without charge. This type of communication reinforces the value of intellectual contributions.

- High-Volume In-Kind Donations: During fundraising campaigns or disaster relief efforts where numerous in-kind items are received. The template ensures every donor gets a timely and accurate acknowledgement without significant administrative overhead.

- IRS Compliance: Whenever the donation is substantial enough to warrant a formal acknowledgement for the donor’s tax records. The letter must adhere to IRS Publication 526 guidelines regarding substantiation requirements for non-cash contributions.

- Building Donor Relationships: Immediately after receiving any non-monetary gift, to express prompt gratitude and strengthen the bond between the donor and the organization, fostering future engagement.

Tips for Formatting, Tone, and Usability

The efficacy of any message template hinges on its design and how it is ultimately used. For this type of formal correspondence, meticulous attention to formatting, tone, and usability for both print and digital versions is crucial.

Formatting:

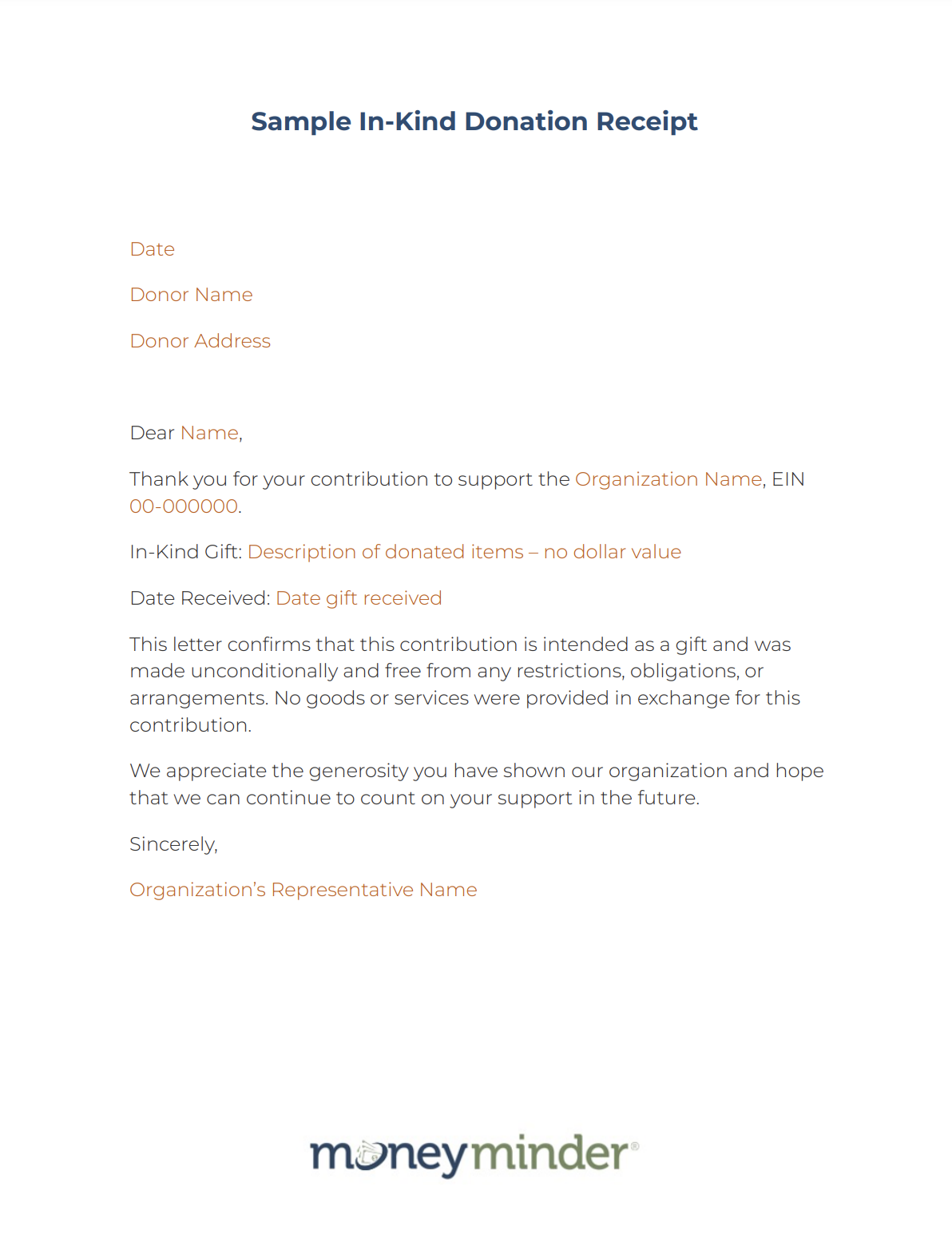

- Clear Header: Include your organization’s full legal name, address, and contact information prominently.

- Date: Always include the date the letter is issued.

- Recipient Information: Ensure the donor’s full name and address are accurately placed.

- Subject Line: A concise subject line, such as "Acknowledgement of Your Generous In-Kind Donation," immediately clarifies the purpose of the letter.

- Body Paragraphs: Use short, focused paragraphs (2-4 sentences) to enhance readability.

- Itemization: Clearly list the donated items or services. For tangible goods, include descriptions, quantities, and condition if relevant. Avoid assigning a monetary value to the donation unless specifically required by IRS for certain goods (e.g., vehicles, boats, aircraft over $500), and even then, often only stating the good faith estimate or relying on the donor for valuation.

- IRS Statement: Include the legally required IRS statement if no goods or services were provided in return for the donation, or if they were, specify their value. Consult IRS Publication 1771 for precise wording.

- Signature: A professional closing (e.g., "Sincerely," "Warm regards,") followed by the name and title of the authorized signatory.

- Digital Considerations: For email versions, ensure the document layout is mobile-responsive and accessible. Use clear fonts and avoid overly complex graphics. PDF attachments are often preferred for formal digital records.

Tone:

- Gratitude: The tone should be overtly appreciative and sincere, expressing genuine thanks for the contribution.

- Professionalism: Maintain a formal, respectful, and polite demeanor throughout the entire letter.

- Clarity: Use clear, unambiguous language. Avoid jargon where possible, or explain it simply.

- Warmth: While formal, the letter can still convey a sense of warmth and appreciation, strengthening the human connection.

Usability (Print and Digital):

- Accessibility: Ensure the letter is easily accessible and readable by all, including those who may use assistive technologies.

- Print Readiness: Design the template to print cleanly on standard letter paper, with appropriate margins and sufficient white space.

- Digital Adaptability: Ensure the file can be easily converted to PDF for secure digital distribution. Consider incorporating fillable fields in the digital template for quick data entry.

- Consistency: Train staff on how to use the template consistently, ensuring that all correspondence maintains the organization’s high standards.

Concluding Thoughts on Essential Communication

In conclusion, the strategic implementation of a high-quality in kind donation acknowledgement letter template is not merely a bureaucratic exercise; it is an indispensable component of effective business communication and robust donor relations. This professional communication tool streamlines operations, ensures compliance, and profoundly impacts an organization’s reputation and financial health. By consistently delivering clear, courteous, and compliant acknowledgements, entities reinforce their commitment to transparency and gratitude.

Ultimately, this reliable message template stands as a testament to an organization’s professionalism and its dedication to honoring those who support its mission. It transforms a routine administrative task into a powerful opportunity to cultivate lasting partnerships and inspire continued generosity. Adopting and diligently utilizing such a document is a hallmark of organizational excellence, fostering trust and ensuring the long-term success of any endeavor reliant on community support and philanthropic contributions.