Navigating the complexities of personal finance can often feel like trying to solve a puzzle with half the pieces missing. Many of us find ourselves wishing for more clarity, less stress, and a clearer path to achieving our financial dreams, whether that’s saving for a down payment, an epic vacation, or simply building a comfortable emergency fund. The good news is that creating a robust household budget template isn’t just a good idea, it’s a game-changer – offering a tangible way to organize your financial life, gain control, and move confidently towards your goals.

This comprehensive household budget template serves as your personal financial compass, designed for anyone who craves structure in their money management. If you’re a productivity enthusiast, a meticulous organizer, or simply someone ready to take charge of their financial future, this guide is for you. It’s about more than just tracking expenses; it’s about understanding your money’s flow, making informed decisions, and transforming abstract financial concepts into actionable steps that lead to real-world results.

The Importance of Organized Financial Planning and Record-Keeping

In the fast-paced world we live in, it’s easy for money to slip through the cracks. Without a clear system, tracking where your income goes can feel like chasing a moving target, leading to financial anxiety and missed opportunities. Organized financial planning and diligent record-keeping provide an invaluable foundation for peace of mind, allowing you to see your financial landscape with crystal clarity.

A well-maintained financial organizer acts as your personal financial historian, documenting every transaction and giving you an accurate picture of your past, present, and projected future. This level of detail empowers you to identify spending patterns, uncover areas for potential savings, and make strategic adjustments to your cash flow. It moves you from reacting to financial surprises to proactively managing your resources, ensuring your money works for you.

Key Benefits of Using Structured Templates, Planners, or Spreadsheets for Budgeting

Embracing structured financial tools like templates, planners, or spreadsheets offers a myriad of benefits that extend far beyond simply knowing your bank balance. These systems bring order to chaos, providing a systematic approach to what can often feel like an overwhelming task. They transform abstract numbers into actionable insights, making financial management accessible and even enjoyable.

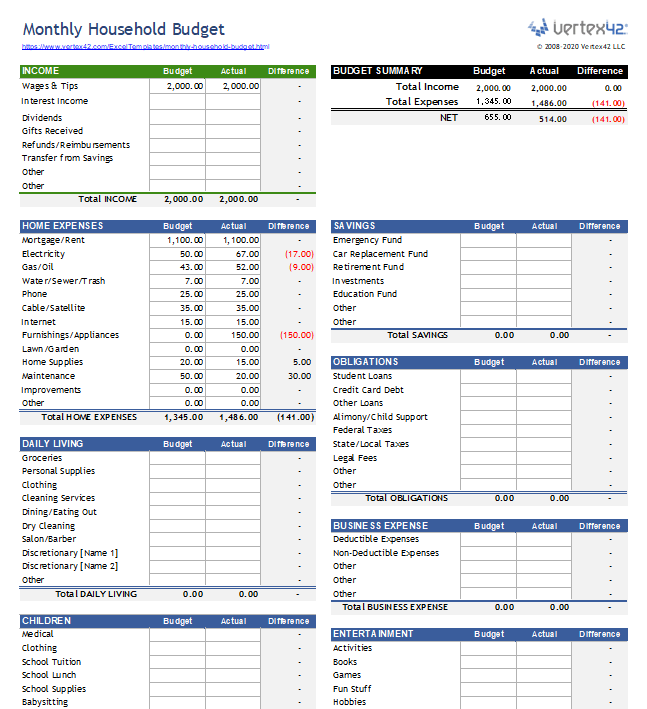

One primary benefit is the unparalleled clarity they provide. A well-designed financial spreadsheet lays out your income log against your expense tracker, creating an immediate visual representation of your financial health. This clarity is crucial for effective cost management, allowing you to quickly spot trends, identify potential overspending, and pinpoint areas where you can trim back without feeling deprived. Furthermore, these tools foster consistency; by inputting data regularly, you develop a habit of financial awareness that builds over time. They simplify the process of reviewing your monthly expenses, making tax season less daunting and long-term savings planning much more attainable.

How This Template Can Be Adapted for Various Purposes

The beauty of a robust budgeting system, especially one designed with flexibility in mind, is its inherent adaptability. While its core function is managing household finances, the underlying principles of tracking income versus outgoing expenses are universal. This means that with a few tweaks, the same structured approach can be applied to a surprisingly wide array of financial management tasks, proving its value beyond personal budgeting.

For instance, a small business can adapt the layout to manage operational costs, revenue streams, and project-specific budgets, providing a simplified balance sheet for internal tracking. Event planners can use it to meticulously monitor every expenditure from venue hire to catering, ensuring they stay within client budgets. Even managing a complex home renovation project benefits immensely from this sheet, allowing you to track contractor payments, material costs, and unexpected overruns against your allocated funds. The core logic of categorizing, tracking, and analyzing financial data makes the template a versatile record for any scenario requiring diligent financial oversight.

Examples of When Using a Household Budget Template Is Most Effective

While a household budget template is a valuable tool for anyone seeking financial clarity, certain life stages and situations particularly highlight its indispensable nature. It provides a foundational structure that simplifies complex financial landscapes and empowers users to make confident decisions.

Here are some scenarios where a household budget template proves invaluable:

- Starting a New Chapter: Whether you’re moving out for the first time, getting married, or blending two households, establishing a clear financial picture from the outset prevents future disagreements and sets a strong foundation for shared goals.

- Debt Reduction: When tackling credit card debt, student loans, or a mortgage, the planner helps you identify surplus funds that can be strategically allocated towards accelerated repayment, visualizing your progress and motivating consistency.

- Saving for a Major Goal: Planning for a down payment on a home, a child’s education, or a dream vacation becomes tangible. The spreadsheet allows you to allocate specific amounts to a savings planner, track contributions, and project completion dates.

- Navigating Income Fluctuations: For freelancers, commission-based earners, or those with seasonal work, the record helps anticipate leaner months by encouraging careful planning during peak income periods, ensuring financial stability year-round.

- Retirement Planning: While not a comprehensive retirement plan, the document serves as a crucial input, helping you determine how much disposable income you can consistently contribute to retirement accounts, making your long-term goals more achievable.

- Managing High Monthly Expenses: If you feel like your money vanishes without a trace, this sheet will illuminate exactly where every dollar goes, helping you pinpoint subscription services, dining out habits, or other areas where cost management can be improved.

- Preparing for Parenthood: Welcoming a new family member brings new expenses. The template allows you to estimate and budget for diapers, childcare, and other baby-related costs well in advance, reducing financial stress during an exciting time.

Tips for Better Design, Formatting, and Usability

A budget is only as good as its usability. To ensure your financial spreadsheet becomes a trusted companion rather than a neglected chore, paying attention to its design, formatting, and overall user experience is key. Whether you prefer a digital file or a printed planner, thoughtful construction will dramatically enhance its effectiveness and your engagement with it.

For digital versions, leverage the power of spreadsheet software. Utilize clear, concise labels for categories like "Income (Net)," "Housing (Rent/Mortgage)," "Utilities," "Groceries," and "Transportation." Employ formulas to automatically sum your monthly expenses, calculate your remaining balance, and project your cash flow. Conditional formatting can be incredibly helpful, perhaps highlighting categories that exceed their allocated budget in red or showing savings contributions in green. Keep the layout clean and uncluttered; excessive colors or fonts can be distracting. Consider creating separate tabs for different months or for specialized tracking, like a dedicated savings planner.

If you lean towards a printable budget, focus on ample writing space and intuitive flow. Use consistent headings and clear distinctions between income and spending sections. Large, legible fonts and well-defined lines make for easier data entry and review. A minimalist aesthetic often works best for a physical financial organizer, as it allows your numbers to stand out. Incorporate sections for notes or reflections, as these qualitative insights can be as valuable as the quantitative data. Regardless of the format, ensure the categories are logical and align with your actual spending habits, making the record a true reflection of your financial life.

Empowering Your Financial Future with This Essential Tool

Taking control of your finances doesn’t have to be a daunting task. With a meticulously designed and consistently utilized budgeting system, you transform abstract financial anxiety into concrete steps towards security and prosperity. This template isn’t just a static document; it’s a living, breathing blueprint for your financial journey, evolving as your life and goals do. It provides the clarity to make informed decisions, the structure to build healthy habits, and the confidence to pursue your most ambitious dreams.

Ultimately, consistently utilizing a well-designed household budget template transforms financial uncertainty into clarity, empowering you to chart a course that aligns with your values and aspirations. It’s an investment in yourself, your peace of mind, and your future. By embracing this powerful financial organizer, you’re not just tracking dollars and cents; you’re building a foundation for lasting financial freedom and a life lived by design, not by default. Start today, and watch as your financial picture becomes sharper, clearer, and much more within your control.