Embarking on a home construction project, whether it’s building from the ground up, tackling a major renovation, or adding a significant extension, is an incredibly exciting journey. It’s also one of the largest financial undertakings many of us will ever face. The dream of a new space can quickly become overwhelming if the financial aspects aren’t managed with precision and foresight. That’s where a robust financial tool like a home construction budget template becomes not just helpful, but absolutely essential.

Imagine navigating a complex project with a clear, birds-eye view of every dollar spent and every dollar still available. This isn’t just about tracking receipts; it’s about strategic financial planning that empowers you to make informed decisions, avoid costly surprises, and ultimately, bring your vision to life without unnecessary financial stress. This article is your guide to understanding the profound benefits of such a system, helping you gain clarity and control over your construction finances, and extending its usefulness far beyond just building projects.

The Indispensable Role of Organized Financial Planning and Record-Keeping

In the world of personal finance and project management, clarity is king. Whether you’re managing household finances, a small business, or a multi-stage construction project, having an organized approach to your money offers unparalleled peace of mind. Without a clear system, expenses can quickly snowball, leading to stress, missed payments, and even project delays. Effective record-keeping acts as your financial compass, guiding every decision.

A well-structured financial organizer helps you track where your money goes, identify potential areas for savings, and ensure you stay within your allocated funds. It’s the difference between guessing your financial standing and knowing it definitively. For a construction project, this means being able to confidently approve invoices, negotiate better deals with contractors, and allocate funds precisely where they’re needed most. This proactive approach helps in managing cash flow efficiently, preventing those late-night panics about whether you have enough funds for the next contractor payment.

Furthermore, meticulous record-keeping provides an invaluable historical record. Should any discrepancies arise, or if you need to revisit past decisions, all the information is at your fingertips. This level of detail is crucial for tax purposes, warranty claims, and even future property valuations. It moves you from reactive crisis management to proactive, confident control over your financial destiny, turning what could be a chaotic experience into a structured and manageable process.

Key Benefits of Using Structured Templates, Planners, or Spreadsheets for Budgeting

When it comes to managing complex financial undertakings, relying on structured templates, planners, or spreadsheets isn’t just a matter of preference; it’s a strategic advantage. These tools offer a myriad of benefits that streamline the budgeting process, reduce errors, and foster better financial habits. They provide a clear framework that breaks down large, daunting figures into manageable, actionable categories, making financial planning less intimidating.

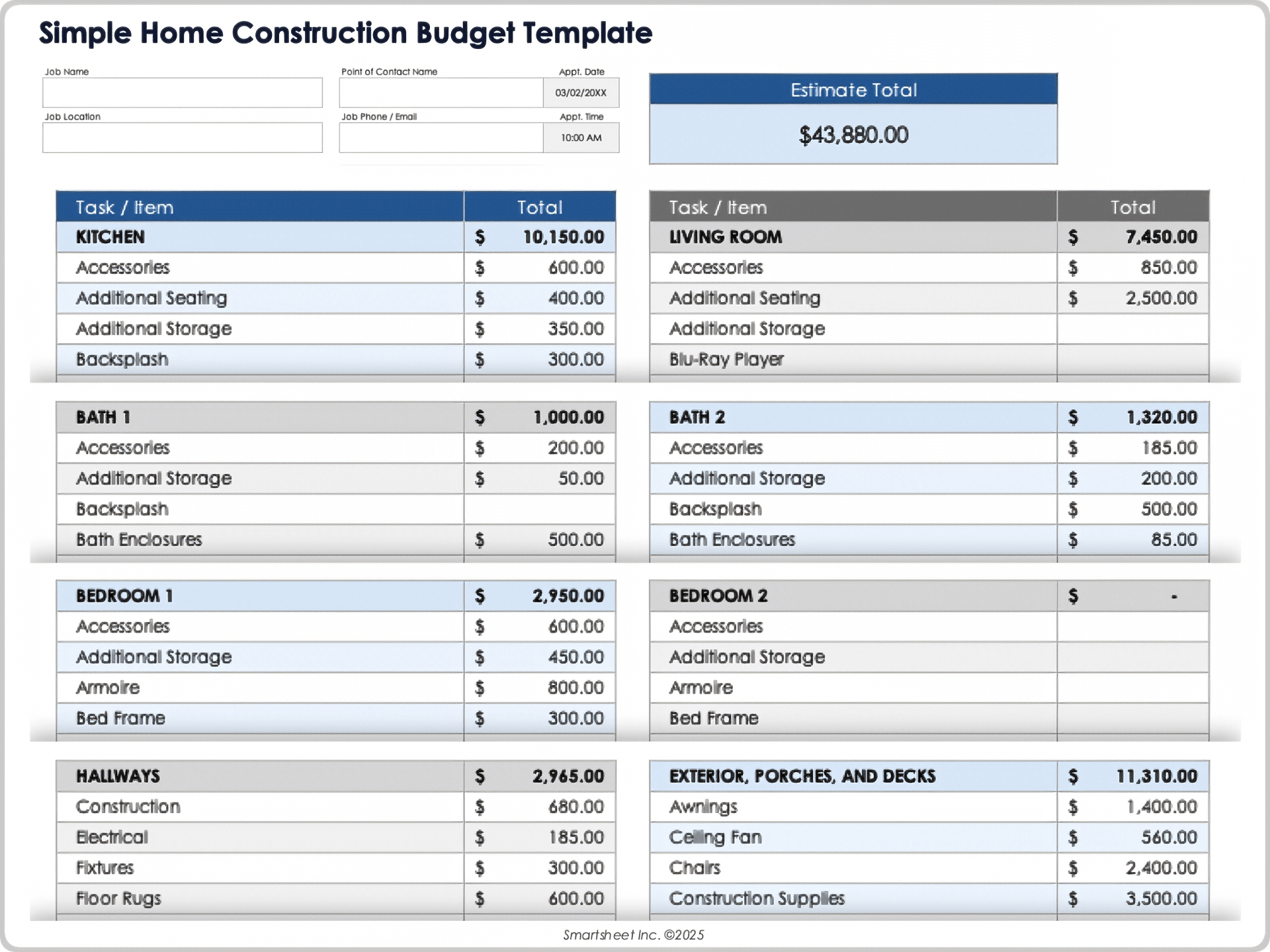

One of the primary benefits is simplification. A well-designed financial spreadsheet takes the guesswork out of where to put what. It pre-organizes categories, prompts you for essential information, and often includes built-in formulas to automatically calculate totals, track remaining balances, and highlight overages. This automation significantly reduces the potential for human error that can occur with manual calculations or haphazard note-taking. It transforms a jumble of numbers into a coherent expense tracker that reveals your true financial picture.

Beyond simplification, these structured tools enable better decision-making. By clearly visualizing your income and outgoings, you can identify trends, forecast future needs, and make proactive adjustments. For instance, if you see that one category is consistently over budget, you can either reallocate funds from another area or seek more cost-effective solutions. This forward-looking perspective is vital for cost management and ensuring the long-term viability of your project or financial goals. Moreover, using a consistent budgeting system allows for easy comparisons over time, helping you learn from past projects and refine your approach for future endeavors, ultimately leading to greater financial intelligence and control.

How This Template Can Be Adapted for Various Purposes

While the focus here is on a home construction budget template, the underlying principles and structure of such a document are remarkably versatile. The beauty of a well-designed template lies in its adaptability. Once you understand the core mechanics of tracking income, expenses, and savings, you can easily repurpose this framework for a multitude of financial planning needs, making it a valuable asset in many areas of your life.

Think beyond bricks and mortar. For personal finance, the same layout can transform into a comprehensive savings planner, helping you track progress towards a down payment, a new car, or a dream vacation. You can categorize your monthly expenses, log your income log, and monitor your overall balance sheet, providing a complete overview of your financial health. This systematic approach demystifies where your money goes and where it needs to go to achieve your personal goals.

Small businesses can leverage a similar structure to manage project budgets, track operational costs, or even build a sales forecast. Event planners can adapt it to meticulously manage every cost associated with a wedding, conference, or party, ensuring nothing is overlooked. Even for routine household management, a modified version can track groceries, utilities, and entertainment, giving you control over your everyday spending. The core idea — categorizing, tracking, and comparing against a plan — remains constant, proving that a robust financial planning tool is a universal asset for anyone serious about productivity, organization, and smart financial planning.

Examples of When Using a Home Construction Budget Template is Most Effective

A detailed financial planner comes into its own during specific phases and scenarios of a construction project. Its effectiveness is magnified when used consistently from inception to completion, providing a continuous loop of data and control. Here are some examples of when deploying a home construction budget template is most impactful:

- During the Initial Planning and Design Phase: Before any dirt is moved, this is where you input preliminary quotes from architects, designers, and various contractors. It helps you set realistic expectations for your overall project cost and allocate funds to major categories like permits, structural work, finishes, and landscaping.

- For Detailed Contractor Bids and Negotiations: When receiving bids, populating the template with each contractor’s proposal allows for easy comparison. You can line-item costs, identify discrepancies, and negotiate more effectively, ensuring you’re getting the best value without compromising quality.

- Throughout the Construction Phase for Progress Payments: As work progresses, the template becomes your live

expense tracker. You’ll record all progress payments to contractors, material purchases, and unforeseen costs. This real-time update ensures you always know your remaining budget and can approve invoices confidently. - Managing Change Orders and Contingencies: Construction projects are rarely without surprises. The template provides dedicated sections for a contingency fund, allowing you to track how much of it is used for unexpected issues (like discovering old plumbing or structural repairs). It helps manage change orders by comparing proposed extra costs against your available budget.

- For Tracking Material Purchases and Subcontractor Costs: Detailed line items for individual materials (lumber, tiles, fixtures) and specific subcontractors (electricians, plumbers, painters) ensure you stay on top of granular spending, preventing any single category from blowing your overall budget.

- At Project Completion for Final Reconciliation: Once the dust settles, the document is invaluable for reviewing actual costs against projected costs. This final reconciliation helps you understand exactly where your money went, providing critical insights for future projects and potentially revealing areas for tax deductions or warranty claims.

Tips for Better Design, Formatting, and Usability

Creating a highly functional and user-friendly budget template, whether for print or digital use, involves more than just listing numbers. Thoughtful design and formatting enhance usability, reduce eye strain, and encourage consistent engagement. The goal is to make managing your finances as intuitive and error-free as possible.

For digital versions, particularly in spreadsheet software like Excel or Google Sheets, consider these tips: Use clear, descriptive column headers. Employ conditional formatting to highlight critical information, such as overdue payments or categories nearing their budget limit (e.g., green for good, yellow for warning, red for over-budget). Utilize data validation to create dropdown menus for frequently used categories or payment statuses, which minimizes typing errors and speeds up data entry. Freeze panes so your headers are always visible as you scroll. Integrate simple formulas for automatic calculations (sums, differences, percentages) to reduce manual effort and ensure accuracy. Finally, protect certain cells or sheets to prevent accidental deletion of formulas or critical data, especially if multiple people will be accessing the spreadsheet.

If you prefer a print-friendly version, design the layout with readability in mind. Use larger fonts, ample white space, and clear section breaks. Consider a landscape orientation to fit more information across the page. Implement simple shading or borders to distinguish rows and columns, making it easier to follow lines of data. Ensure there’s enough space for handwritten notes and receipts to be stapled or cross-referenced. Regardless of format, consistently back up the record digitally (cloud storage is ideal) to protect against data loss. A well-designed financial organizer is one that you’ll actually use consistently, making its design as important as its content.

Embracing Financial Empowerment with Your Construction Budget Template

Ultimately, the power of a comprehensive financial template, whether it’s a dedicated home construction budget template or a repurposed savings planner, extends far beyond mere number-crunching. It’s about taking control, reducing anxiety, and empowering yourself with clear, actionable insights into your financial landscape. This document transforms what can feel like an overwhelming torrent of expenses into a manageable stream, allowing you to enjoy the process of building or renovating, rather than being constantly worried about the bottom line.

By consistently utilizing the template, you’re not just tracking money; you’re building a habit of financial discipline that serves you in all aspects of life. It’s a time-saving marvel, eliminating hours of sifting through papers or trying to recall where funds were allocated. It’s a stress-reducing shield, guarding against unexpected financial shocks by providing a clear picture of your readiness. And most importantly, it’s a financially empowering tool that puts you firmly in the driver’s seat, enabling you to make smart, informed decisions that align with your long-term goals. Embrace this level of organization, and you’ll find that managing complex finances becomes not just possible, but genuinely liberating.