Let’s be honest, the idea of budgeting can sometimes feel a bit like wading through treacle. It’s not always the most exciting activity, but it’s undeniably one of the most crucial for financial well-being. If you’ve ever felt a pang of anxiety when checking your bank balance, or simply wished you had a clearer picture of where your money actually goes, you’re certainly not alone. The good news is, getting a handle on your finances doesn’t have to be complicated or overwhelming.

In fact, with the right tools, it can become a remarkably empowering and even enjoyable process. That’s where a thoughtfully designed home budget worksheet template comes in. This isn’t just about cutting costs; it’s about gaining clarity, control, and confidence in your financial decisions. Whether you’re a recent grad navigating your first independent budget, a growing family managing increasing expenses, or simply someone keen to optimize their financial habits, a structured template can be your guiding light.

The Power of Organized Financial Planning

Think of your financial life as a journey. Without a map or a compass, you’re likely to wander aimlessly, perhaps hitting some unexpected detours or even running out of fuel before you reach your destination. Organized financial planning, much like a well-drawn map, provides direction, helps you anticipate challenges, and ensures you’re on the most efficient path to your goals. It’s about proactive management rather than reactive firefighting.

Effective record-keeping is the backbone of this planning. When you consistently log your income and track your expenses, you create an invaluable database of your spending habits. This transparency reveals patterns, highlights areas where you might be overspending, and uncovers opportunities for savings. It moves your financial picture from an abstract concept to concrete, actionable data, giving you the clarity and control needed to make smart choices.

Why a Structured Budget Template is Your Best Friend

In a world full of apps and digital tools, you might wonder why a "worksheet template" still holds such value. The truth is, a structured template provides a foundational framework that many digital tools build upon, and it offers a level of personal customization and understanding that generic apps sometimes miss. It’s not just a collection of numbers; it’s a living document that reflects your unique financial reality.

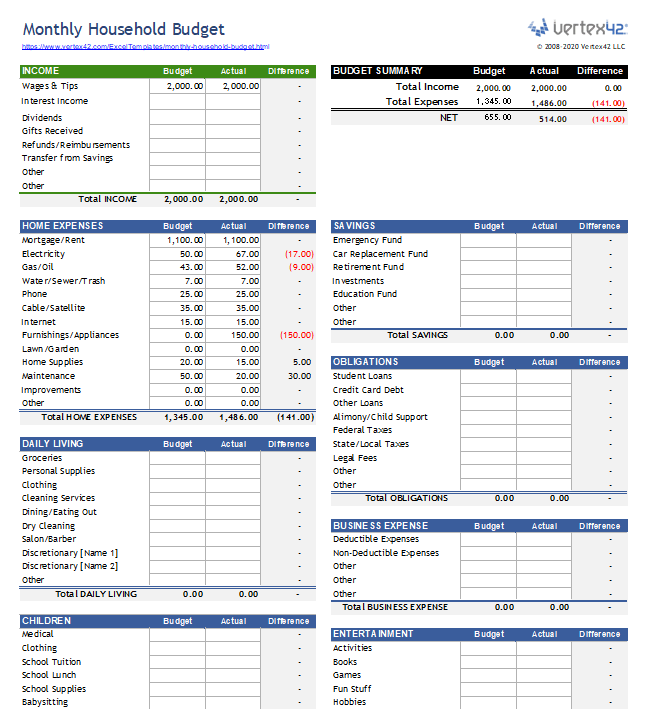

Key benefits of using such a structured approach are manifold. Firstly, it offers a visual representation of your cash flow, showing exactly how money comes in and goes out. This visual clarity is incredibly powerful for identifying spending trends and potential problem spots. Secondly, it acts as an expense tracker, ensuring no penny goes unaccounted for, whether it’s a recurring bill or an impulse purchase. Thirdly, it supports goal setting, allowing you to allocate funds specifically for a savings planner, debt repayment, or a special purchase. Moreover, it cultivates discipline; the regular act of updating the document reinforces good financial habits.

Beyond Personal Finance: Adapting Your Budgeting Tool

While the primary focus might be on your household finances, the inherent flexibility of a well-designed budgeting template means its utility stretches far beyond just tracking monthly expenses. The underlying principles of income log, expense categorization, and balance sheet reconciliation are universally applicable to various organizational needs. This adaptability makes the template an incredibly versatile tool.

Consider small businesses, for example. A simplified version of this sheet can be an effective cost management tool, tracking revenue against operational expenditures without the need for complex accounting software. For event planning, whether it’s a wedding, a major family reunion, or a community fundraiser, the layout helps in allocating funds, monitoring deposits, and keeping track of vendor payments. Even for household management, separate sections can be used for tracking home improvement projects, vacation savings, or even managing grocery lists and meal planning budgets. The core structure provides a clear financial organizer for almost any endeavor requiring careful resource allocation.

When is a Home Budget Worksheet Template Most Effective?

A robust budgeting system isn’t just for when things feel tight. It’s a tool for all seasons, offering invaluable insights and control, whether you’re thriving or trying to navigate a challenging financial period. Here are some specific scenarios where having a detailed home budget worksheet template truly shines:

- Starting a New Financial Chapter: Whether you’re moving out for the first time, starting a new job, or getting married, a fresh template helps you establish healthy financial habits from day one.

- Tackling Debt: If you’re working to pay down credit cards, student loans, or other debts, this spreadsheet provides a clear view of how much extra you can realistically allocate each month.

- Saving for a Major Goal: Planning for a down payment on a house, a new car, or a dream vacation becomes tangible when you can see your savings planner progress month after month.

- Managing Variable Income: For freelancers, commission-based earners, or those with seasonal work, the template helps smooth out financial peaks and valleys by tracking income fluctuations and setting aside funds for leaner months.

- Regular Financial Health Checks: Even if you feel financially stable, reviewing your record quarterly or annually helps identify potential areas for improvement, ensures you’re on track with long-term goals, and adapts to life changes.

- Prepping for Tax Season: A well-maintained expense tracker makes gathering information for tax deductions and income reporting significantly easier and less stressful.

- Teaching Financial Literacy: It’s an excellent tool for involving family members, especially teenagers, in understanding household finances and the value of money management.

Design, Formatting, and Usability: Making Your Template Work for You

The true power of any financial tool lies in its usability. A complex or confusing document will quickly be abandoned. Therefore, a good home budget worksheet template should be intuitive, clear, and easy to maintain. Think about how you’ll interact with it, whether digitally or as a printout.

For starters, clarity is king. Use clear headings for sections like "Income," "Fixed Expenses," "Variable Expenses," and "Savings Goals." Categorize your expenses logically. Instead of a single "Shopping" category, break it down into "Groceries," "Clothing," "Household Goods," and "Entertainment." This granularity provides more meaningful data. Incorporate formulas (if using a spreadsheet) for automatic calculations of totals and remaining balances; this saves time and reduces errors. Don’t be afraid to use color-coding to highlight important information, such as bills due or categories that are over budget.

Tips for Digital & Print Versions

When crafting your ideal home budget worksheet template, consider whether you’ll primarily use it on a computer or prefer a physical, pen-and-paper approach. Each has its own advantages and specific design considerations.

For digital versions, particularly in spreadsheet software like Excel or Google Sheets, leverage its capabilities. Use conditional formatting to automatically highlight cells based on values (e.g., green for positive cash flow, red for negative). Create separate tabs for different months or for an annual summary balance sheet. Include dropdown menus for expense categories to ensure consistency. Password protect sensitive information if others have access to the file. Remember to regularly back up your spreadsheet to avoid data loss. A digital template also allows for easy generation of charts and graphs, providing a visual overview of your financial trends and cash flow.

If you lean towards a printable format, focus on spaciousness and legibility. Ensure there’s enough room to write comfortably in each field. Use clear, simple fonts. Consider a landscape orientation if you need more columns. Include checkboxes for paid bills or tasks completed. A binder with dividers for different sections (income, expenses, savings, receipts) can keep your printed financial organizer neat and accessible. A physical template offers a tactile experience that some find more engaging, fostering a deeper connection with their financial record. Whichever method you choose, the key is consistency and commitment to regularly updating the sheet.

Ultimately, whether you’re striving for financial freedom, aiming to build a substantial savings nest egg, or simply seeking peace of mind, a well-implemented home budget worksheet template is an indispensable ally. It transforms abstract financial worries into concrete, manageable data points. It’s more than just an expense tracker; it’s a personal financial organizer that empowers you to take charge of your money, reduce stress, and make informed decisions that propel you towards your financial goals.

By investing a little time upfront to set up and regularly maintain this powerful document, you’re not just tracking numbers; you’re building a foundation for a more secure, organized, and prosperous future. This simple, yet profound, tool offers clarity, fosters discipline, and ultimately puts you firmly in the driver’s seat of your financial destiny.