Navigating the world of professional services often means dealing with a fair bit of paperwork. For anyone in the accounting field—whether you’re a seasoned firm owner, a bustling solo practitioner, or a freelance bookkeeper—one document stands out as foundational: the accounting service agreement template. This isn’t just a formality; it’s a vital tool for clarity, protection, and setting the stage for successful client relationships. Think of it as your professional blueprint, ensuring everyone is on the same page from day one.

Understanding the value of an accounting service agreement template goes beyond just having a signed document. It’s about proactive communication, managing expectations, and creating a framework that supports your productivity and professional image. For clients, it offers peace of mind, knowing exactly what services they’ll receive, at what cost, and under what terms. For you, it minimizes misunderstandings, streamlines operations, and provides a clear point of reference should any questions arise down the line. It’s an essential piece of any smart business communication strategy.

The Cornerstone of Professional Documentation: Clarity, Legality, and Trust

In the fast-paced business environment, organized planning and meticulous professional documentation aren’t just good practices; they’re non-negotiable. A well-crafted service agreement brings an unparalleled level of clarity to your professional engagements. It meticulously outlines the scope of work, deliverables, timelines, and payment structures, leaving no room for ambiguity. This upfront clarity is invaluable, preventing costly disputes and misunderstandings that can erode trust and waste precious time.

Beyond clarity, the legal backbone provided by a robust document is paramount. A comprehensive legal contract protects both parties by explicitly stating rights, responsibilities, and dispute resolution mechanisms. It serves as a legally binding record of the agreement, essential for compliance and potential legal challenges. In an increasingly litigious world, having a detailed business documentation like this isn’t just wise; it’s a strategic necessity. It reinforces your credibility and demonstrates a professional commitment to ethical business practices, fostering deeper trust with your clients.

Key Benefits of Structured Templates and Agreement Layouts

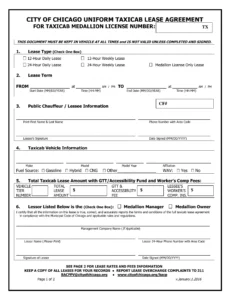

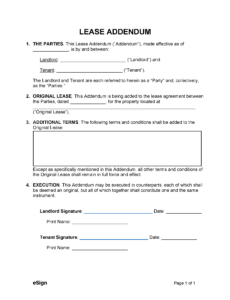

Embracing structured templates, forms, or agreement layouts offers a wealth of advantages for any service-based business. Primarily, they champion efficiency. Instead of drafting each new contract from scratch, a well-designed template allows you to quickly populate client-specific details, saving hours of administrative time. This consistency ensures that no critical clauses or terms are accidentally omitted, providing a safety net for your operations.

Furthermore, using a professional layout ensures uniformity across all your client interactions. This not only enhances your brand image but also helps in maintaining a high standard of communication. A good contract template acts as a compliance record, ensuring that all necessary legal and professional standards are consistently met. It simplifies the process of document signing, making it smoother for both you and your clients, and ultimately contributes to a more organized and productive workflow.

Adapting This Template for Diverse Professional Needs

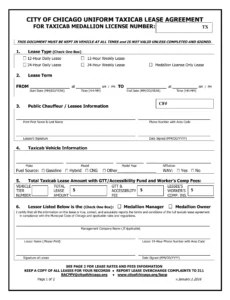

While the focus here is specifically on accounting services, the underlying principles of a strong service agreement are universally applicable. The structured framework provided by a comprehensive business file can be adapted for a wide array of professional needs. Whether you’re a freelance graphic designer, a marketing consultant, an IT service provider, or even a landlord drafting a rental agreement, the core components remain consistent.

The adaptability of this document means you can modify its sections to suit various business contracts. For example, the sections on scope of work, payment terms, and confidentiality can be tailored for a business partnership, a detailed memorandum of understanding, or even specific terms of service for a new digital product. It’s about understanding the fundamental elements of a robust legal contract and then customizing them to fit the unique nuances of your industry and specific client relationships. This flexibility makes a well-thought-out agreement a powerful asset in your professional toolkit.

When Using an Accounting Service Agreement Template is Most Effective

Leveraging an accounting service agreement template is particularly effective in several key scenarios, streamlining your processes and safeguarding your professional interests.

- Initial Client Onboarding: This is the absolute best time to introduce the agreement. It sets clear expectations right from the start, defining the scope of services, fees, and responsibilities for both parties before any work commences.

- Defining the Scope of Work: For projects with specific deliverables, or when clients have unique needs, the template helps to precisely outline what will and won’t be covered, preventing "scope creep" and ensuring fair compensation for additional work.

- Establishing Payment Terms: Clearly stating billing cycles, due dates, late payment policies, and preferred payment methods prevents awkward conversations and ensures timely remuneration for your services.

- Ensuring Legal Compliance and Risk Mitigation: The template includes critical clauses regarding confidentiality, data privacy, intellectual property, and dispute resolution, protecting both your business and your client’s sensitive information.

- Engaging Freelancers or Subcontractors: If you’re a firm bringing on independent contractors, adapting this contract template ensures that their responsibilities, payment, and intellectual property rights are clearly defined, mirroring the professional standards you apply to your clients.

- Transitioning Between Service Levels: When a client upgrades or downgrades their service package, a modified agreement clearly documents the changes, avoiding any confusion about ongoing services or pricing adjustments.

- Facilitating Professional Communication: The act of reviewing and signing the agreement prompts important discussions, ensuring both parties have a shared understanding of the engagement.

Tips for Better Design, Formatting, and Usability

Creating a highly functional and professional agreement isn’t just about the legal jargon; it’s also about its design, formatting, and overall usability. A well-designed document reflects your professionalism and makes the entire process smoother for everyone involved.

Firstly, prioritize readability. Use clear, concise language, avoiding overly complex legalistic terms where simpler alternatives exist. Employ generous white space, legible fonts (like Arial or Calibri at 10-12pt), and distinct headings and subheadings (<h3> can be useful here) to break up the text. This professional layout guides the reader and makes the document less intimidating.

For digital versions, consider implementing interactive elements. Fillable PDF forms can make data entry quick and error-free. Integrate e-signature solutions for seamless document signing, which dramatically speeds up the agreement process and provides an audit trail. Ensure the document is responsive and easily viewable on various devices, from desktops to tablets.

When it comes to print, ensure that margins are sufficient for binding or filing, and that the text is dark enough to be easily photocopied. Including version control (e.g., "Version 1.2 – August 2023") at the footer helps track changes over time, especially when amendments are made. Finally, always include a clear table of contents for longer documents, allowing quick navigation to specific clauses or sections.

The Enduring Value of a Smart Business File

Ultimately, having a comprehensive service agreement isn’t about being overly cautious; it’s about being strategically smart and professional. It’s a powerful tool that serves as the foundation for strong, transparent, and mutually beneficial business relationships. By investing time in creating or customizing a robust contract template, you’re not just preparing a legal record; you’re building a framework for peace of mind, operational efficiency, and sustained growth.

This essential business file empowers you to communicate your value clearly, manage client expectations effectively, and protect your practice from potential misunderstandings. It transforms what could be a point of friction into a catalyst for trust and collaboration. In a world where clarity is currency, the value of such a precisely articulated agreement simply cannot be overstated. It’s truly a time-saving, legally clear, and highly professional communication tool that every service provider should have in their arsenal.