Embarking on a journey toward better financial health often feels like navigating a dense forest without a compass. For many, the sheer volume of daily expenditures, especially those related to food, can be overwhelming. We buy groceries, grab coffee, order takeout, and dine out, sometimes without a clear understanding of where all that money goes. This article is your guide to bringing clarity and control to your food spending, transforming a often-chaotic category into an organized, manageable part of your financial life.

This article is crafted for anyone who values productivity, organization, and smart financial planning – whether you’re a busy professional, a meticulous household manager, or a small business owner looking to streamline expenses. We’ll explore the practical benefits of using a structured approach, specifically a food budget worksheet template, to track, analyze, and optimize your spending habits. This isn’t about deprivation; it’s about empowerment, helping you make informed decisions, reduce waste, and free up funds for other important goals.

The Power of Organized Financial Planning

In the realm of personal finance, organization isn’t just about neat spreadsheets; it’s about clarity, control, and peace of mind. When your financial records are disorganized, it’s incredibly difficult to make informed decisions about your money, leading to uncertainty and stress. A well-structured system provides a clear picture of your income and outflow, revealing spending patterns and opportunities for savings that might otherwise go unnoticed.

Thinking of your finances as a coherent system, rather than a collection of random transactions, empowers you to take charge. Implementing a reliable expense tracker and a dedicated savings planner ensures that every dollar has a purpose. This proactive approach helps you understand your cash flow, identify potential bottlenecks, and ensure you’re always living within your means, or even better, actively growing your net worth. It’s about shifting from reacting to financial surprises to strategically planning for your future.

Effective financial management also extends beyond mere tracking to a deeper understanding of your financial health. A well-maintained budgeting system provides the data needed for a personal balance sheet, offering a snapshot of your assets and liabilities. This kind of overview is essential for setting realistic financial goals, whether it’s saving for a down payment, an emergency fund, or an early retirement. It’s the foundation upon which all sound financial decisions are built.

Unlocking Benefits with Structured Templates

Using structured templates for budgeting offers a multitude of advantages over ad-hoc tracking methods. Firstly, they save you valuable time. Instead of reinventing the wheel each month, a pre-designed layout guides you through the process, ensuring you capture all necessary information efficiently. This consistency is key to accurate record-keeping and reliable analysis over time, turning a potentially tedious task into a quick, routine check-in.

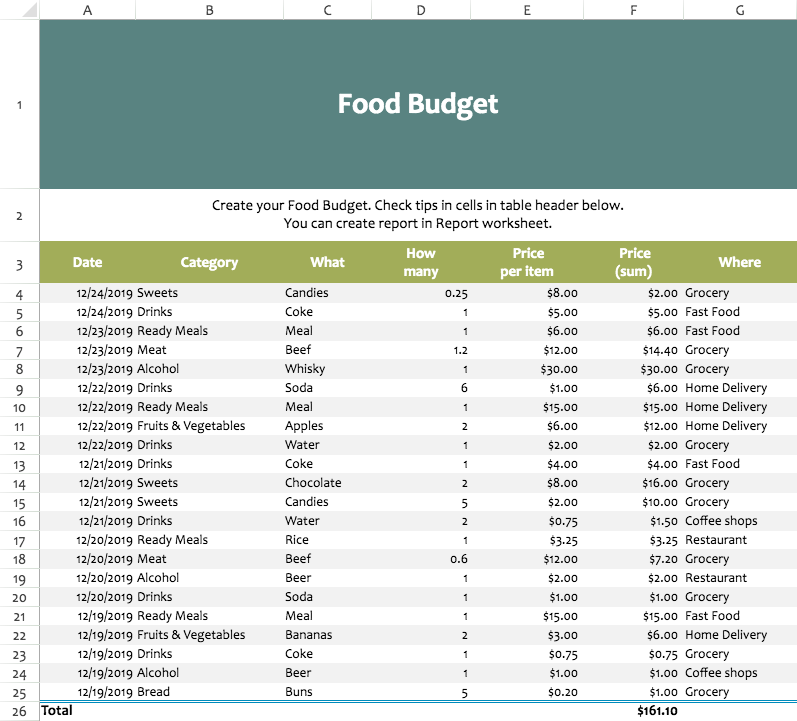

These dedicated financial spreadsheets also provide invaluable visual insights into your spending habits. By categorizing expenses and totaling them, you can easily identify where your money is truly going, pinpointing areas of overspending or opportunities for optimization. This visual clarity supports better decision-making, enabling you to set realistic spending targets and achieve them with greater ease. It transforms abstract numbers into actionable intelligence, making goal-setting more tangible.

Beyond the numbers, a well-designed template serves as a powerful financial organizer, reducing mental clutter and stress. Knowing exactly where your financial information resides and that it’s up-to-date brings immense psychological relief. It frees up cognitive space, allowing you to focus on other important aspects of your life, rather than constantly worrying about your budget. It’s not just about managing money; it’s about managing your peace of mind.

Adapting Your Food Budget Worksheet Template for Diverse Needs

While its name suggests a singular focus, a well-designed food budget worksheet template is remarkably versatile and can be adapted for a wide array of financial tracking purposes. The underlying principles of categorizing income and expenses, tracking specific spending, and analyzing patterns are universally applicable. It’s truly a foundational document that can serve as a robust framework for various financial planning scenarios.

For personal finance, beyond just groceries and dining out, this sheet can track overall household management expenses, incorporating categories like cleaning supplies, pet food, and even small household repairs. It provides a granular view of every dollar spent on keeping your home and family running smoothly, which is crucial for overall budget adherence. You can modify it to include all monthly expenses, creating a comprehensive income log and expense tracker.

Small businesses can greatly benefit by adapting the layout to monitor supply costs, catering expenses for meetings, or even client entertainment. For a small cafe, for instance, it could meticulously track ingredient costs, helping to optimize menu pricing and identify waste. This granular cost management is essential for maintaining healthy profit margins and understanding operational overhead.

Event planning, whether for a wedding, a corporate retreat, or a large family gathering, often involves significant food-related expenditures. The template can be modified to track catering invoices, beverage costs, snack provisions, and even decorative food items, ensuring you stay within your event budget. It transforms chaotic planning into a structured overview, providing clarity on where every dollar is allocated.

Finally, for household management, especially in multi-person households, this template becomes an indispensable tool. It can help allocate shared grocery bills, track individual preferences, and manage meal planning costs effectively. This ensures transparency and fairness among household members, making shared financial responsibilities much smoother and reducing potential conflicts. It essentially acts as a mini-balance sheet for your daily consumables.

When a Food Budget Worksheet Template Shines Brightest

There are specific junctures and situations where pulling out a well-structured food budget worksheet template can make an immediate and significant impact. These are the moments when clarity and organized tracking are not just helpful, but absolutely essential for maintaining financial equilibrium and making smart decisions.

- Starting a New Budget: If you’re new to budgeting or restarting after a period of lax tracking, this sheet provides a clear, manageable entry point. Focusing on food, a universal expense, makes the process less intimidating and helps build momentum.

- Identifying Overspending in Groceries or Dining Out: Often, people are surprised by how much they spend on food. Using this record for a month or two can quickly highlight where the excesses are, empowering you to adjust habits and save hundreds.

- Planning for a Large Event or Holiday: Whether it’s Thanksgiving dinner, a birthday party, or a summer barbecue, food costs can balloon. The planner helps allocate funds for ingredients, catering, and drinks, preventing budget blowouts.

- Monitoring Monthly Expenses Consistently: For those committed to ongoing financial discipline, integrating this spreadsheet into your routine ensures regular check-ins. It helps in maintaining a balanced cash flow and proactively adjusting spending.

- Teaching Financial Literacy: For teenagers or young adults learning about money management, using this straightforward template is an excellent practical lesson. It makes abstract concepts like "budgeting" tangible and relevant to their daily lives.

- Reducing Food Waste: By tracking purchases and consumption, you can identify patterns of unused ingredients or excessive takeout, leading to more mindful shopping and cooking, which ultimately saves money and helps the environment.

Designing for Success: Tips for Usability and Clarity

Beyond merely listing numbers, the effectiveness of any budgeting system hinges on its design and usability. Whether you prefer a digital spreadsheet or a physical printout, thoughtful formatting makes the document a pleasure to use, not a chore. The goal is to make your financial organizer intuitive, clear, and actionable.

For a digital version, leverage the power of automation. Utilize formulas to automatically calculate totals, subtotals, and remaining budget amounts. Conditional formatting can highlight categories that are over budget in red, or those under budget in green, providing instant visual feedback. Consider cloud-based options like Google Sheets or Excel Online for easy access from multiple devices and collaboration with household members. Ensuring the financial spreadsheet is password-protected or secured is also vital for sensitive data.

If you prefer a print version, focus on a clean, legible layout. Use clear headings and sufficient white space to prevent the sheet from looking cluttered. Ensure there’s ample room to write entries, especially in the "notes" or "description" sections. Printing on slightly heavier paper can make it feel more substantial and durable, enduring daily use throughout the month. Laminating often-used sections or creating a binder system for monthly records can also enhance its longevity.

Regardless of format, certain elements are crucial for any effective expense tracker. Always include columns for the date, specific item or service, quantity (if applicable), unit cost, total amount, payment method, and a category. A "notes" section is invaluable for adding context, such as "dinner with friends" or "stock-up groceries." Ensure there are clear sections for monthly totals and cumulative totals to quickly assess your cost management. Customization is also key; feel free to add or remove columns to make the planner truly reflect your unique spending habits and goals.

Beyond the Numbers: The Enduring Value of Your Budgeting System

Implementing a structured approach to your food budget, or any area of your finances, is a profound step toward greater financial awareness and freedom. What begins as a simple tracking exercise quickly evolves into a powerful habit of mindful spending. This document, whether it’s a digital spreadsheet or a printed template, becomes more than just a list of transactions; it transforms into a living record of your financial journey, guiding you toward your goals.

The practical value of such a detailed financial organizer extends far beyond saving a few dollars here and there. It’s a time-saving tool, freeing you from endless mental calculations and guesswork. It’s a stress-reducing mechanism, replacing financial anxiety with confidence and control. Most importantly, it’s a financially empowering instrument, giving you the insights and foresight to make strategic decisions that impact your long-term wealth and well-being. By understanding your cash flow and managing your monthly expenses effectively, you pave the way for future financial successes.

So, take the plunge. Start with the simplicity of tracking your food spending, and allow this habit to expand to other areas of your financial life. This template isn’t just about cutting costs; it’s about cultivating a healthier relationship with your money. It’s about taking intentional steps, one transaction at a time, to build the financial future you envision. Your journey to greater organization, productivity, and financial peace begins now, with the practical power of your very own budgeting system.