Navigating the ebb and flow of household finances can feel like sailing an unchartered ocean without a map. Many of us know the feeling of opening a bank statement with a mix of anticipation and dread, or wondering where all the money went by the middle of the month. It’s a common challenge, but it doesn’t have to be a permanent state of financial uncertainty. Imagine having a clear, actionable guide that not only tracks your income and expenses but also helps you visualize your financial future.

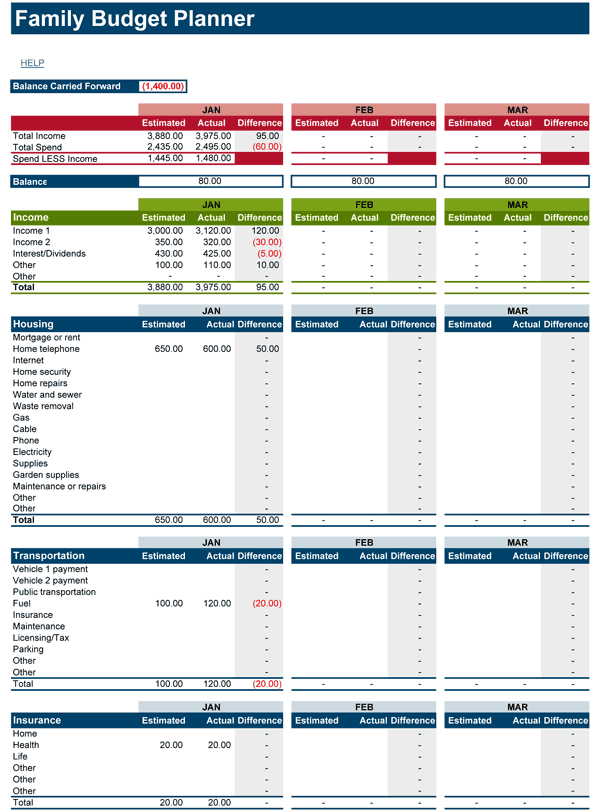

This is precisely where a powerful tool like a family budget template comes into play. It’s not about restriction or deprivation; it’s about empowerment, clarity, and intentionality. Designed for busy families, individuals striving for financial independence, small business owners, or anyone who desires a firmer grip on their cash flow, this organizational lifesaver transforms abstract numbers into tangible insights, paving the way for smarter financial decisions and reduced stress.

The Importance of Organized Financial Planning and Record-Keeping

In the fast-paced rhythm of modern life, our financial lives can quickly become a tangled mess if left unmanaged. Unorganized finances often lead to anxiety, missed opportunities, and a constant feeling of playing catch-up. Without a clear picture of your income and outflow, it’s incredibly difficult to set meaningful financial goals or even understand where your money is truly going.

Effective financial planning starts with meticulous record-keeping. A well-structured expense tracker helps you identify spending patterns, uncover areas of overspending, and celebrate smart savings. It’s more than just logging numbers; it’s about creating a living document that reflects your financial reality, allowing you to move from reactive spending to proactive wealth building. This proactive approach cultivates financial discipline and provides a solid foundation for achieving long-term security and freedom.

Key Benefits of Using Structured Templates, Planners, or Spreadsheets for Budgeting

Embracing a structured approach to your finances, whether through a physical planner or a digital spreadsheet, offers a wealth of benefits beyond simple tracking. One of the most significant advantages is the immediate clarity it provides regarding your cash flow. You’ll gain an accurate understanding of your monthly expenses versus your income, which is the cornerstone of any effective financial organizer.

Moreover, these tools act as an invaluable savings planner, helping you allocate funds toward specific goals, from a down payment on a house to a child’s education fund or a well-deserved vacation. By categorizing your costs, this sheet illuminates where your money is truly going, making cost management significantly easier. It empowers you to make informed decisions, curb impulsive spending, and develop a sustainable budgeting system that supports your financial aspirations. It shifts your perspective from seeing money as a finite resource to a powerful tool for building the life you want.

How This Template Can Be Adapted for Various Purposes

The beauty of a well-designed financial spreadsheet lies in its inherent adaptability. While it’s perfect for managing personal and household finances, its underlying structure—tracking income against expenses—is universally applicable. The layout can be easily customized to suit a diverse range of financial management needs, proving its versatility far beyond just monthly bills.

For instance, a small business could adapt the template to track startup costs, project budgets, or monitor quarterly cash flow. Entrepreneurs can use it to keep a keen eye on operational expenses and revenue streams, ensuring their ventures remain profitable. Similarly, event planners can utilize the document to meticulously manage budgets for weddings, corporate functions, or family reunions, ensuring every dollar is accounted for. Even for simple household management tasks like planning home renovations or tracking recurring maintenance costs, the planner provides an indispensable framework for organization and foresight. Its flexible design means it can evolve with your needs, serving as a reliable record for any financial endeavor.

When Using a Family Budget Template Is Most Effective

While a budget is beneficial at any stage of life, certain situations particularly highlight the transformative power of implementing a family budget template. It’s during these pivotal moments that a structured approach can provide the most clarity, control, and peace of mind.

- Starting a New Financial Goal: Whether you’re saving for a down payment on a home, planning for retirement, or aiming to launch a new business, a detailed budget helps you allocate funds effectively and monitor progress towards your aspirations.

- Experiencing a Major Life Change: A new baby, a job change, a move to a new city, or even a marriage can significantly alter your financial landscape. This is the ideal time to re-evaluate your income and expenses and adjust your financial spreadsheet accordingly.

- Feeling Overwhelmed by Debt: If credit card statements or loan repayments are causing stress, the document provides a clear picture of your debt and helps you devise a concrete plan for repayment, prioritizing high-interest obligations.

- Wanting to Teach Kids About Money: Involving older children in the budgeting process, even in a simplified way, can instill valuable financial literacy skills from a young age, turning abstract concepts into practical lessons.

- Seeking More Financial Clarity: Sometimes, you just feel disconnected from your money. The record offers an objective look at your spending habits, revealing where your money truly goes and empowering you to make conscious choices.

- Planning a Significant Purchase: Before investing in a new car, a major appliance, or a family vacation, using the template to assess affordability and save purposefully prevents financial strain down the road.

Tips for Better Design, Formatting, and Usability

Creating an effective budgeting system goes beyond just having the right categories; it also involves thoughtful design and formatting to enhance usability and consistency. Whether you prefer a digital spreadsheet or a printed planner, a few key considerations can make your financial organizer much more impactful.

For digital versions, leverage the power of automation. Set up formulas for automatic calculations of totals, subtotals, and projected balances. Use conditional formatting to highlight overspending in red or savings goals met in green, providing immediate visual cues. Clear, concise headings for income, fixed expenses, variable expenses, and savings categories are crucial for navigation. Consider adding an income log and a separate section for recurring monthly expenses.

When designing for print, ensure ample space for writing, especially if you prefer to jot down daily spending. Use a clean, readable font and a logical flow from income to expenses, and finally to your balance sheet. Large categories can be broken down into sub-categories for more granular tracking—for example, "Groceries" might include "Dining Out" and "Coffee Shops" if those are separate spending areas for you. Both digital and print versions benefit from consistent use of colors or bolding to differentiate sections. Most importantly, ensure the template is easily accessible and regularly reviewed. Consider backing up digital versions to a cloud service and storing print versions in a designated, secure binder. Make reviewing your record a consistent habit, perhaps weekly or bi-weekly, to stay on top of your cost management efforts.

Your Path to Financial Empowerment

Ultimately, managing your money doesn’t have to be a source of stress or confusion. Embracing a tool like this financial planner is a proactive step toward gaining unparalleled clarity and control over your financial life. It transforms abstract numbers into actionable insights, helping you to not only track where your money goes but also to intentionally direct it toward your most important goals and values.

Think of it as your personal financial GPS, guiding you through every spending decision and savings opportunity. It’s a time-saving solution that reduces stress by illuminating your financial landscape, empowering you to make informed choices rather than guessing. By consistently utilizing and adapting this budgeting system, you’re investing in your peace of mind and building a strong foundation for lasting financial security and freedom. Start small, be consistent, and watch as this simple, organized approach empowers you to take charge of your financial destiny.