Let’s be honest: money management, especially when planning something as exciting (and sometimes daunting) as an event, can feel like navigating a maze blindfolded. From the moment an idea sparks – be it a dream wedding, a milestone birthday, a community fundraiser, or even just a grand family vacation – the financial considerations begin to pile up. It’s a universal truth that without a clear roadmap, even the most well-intentioned plans can quickly spiral into stress, overspending, and regret. That’s where an invaluable tool like an event budget template excel comes into play.

This isn’t just about crunching numbers; it’s about empowerment. It’s about gaining clarity, exerting control, and transforming potential financial anxiety into a confident, organized approach. For anyone who values productivity, organization, and smart financial planning, understanding and utilizing a robust budgeting system is a non-negotiable. This article will guide you through how a well-structured spreadsheet can become your most trusted co-pilot, not just for events, but for bringing order to a multitude of financial endeavors.

The Unseen Power of Organized Financial Planning

Think for a moment about the last time you felt truly in control of your finances. Perhaps it was after diligently tracking your monthly expenses, or successfully saving for a big purchase. That feeling of clarity and confidence stems directly from organized financial planning and meticulous record-keeping. Without a dedicated system, tracking income and outgoing funds is like trying to catch smoke – elusive and frustrating.

An organized financial record acts as your personal financial organizer, offering a transparent view of your cash flow. It empowers you to see exactly where your money is going, identify potential areas for savings, and make informed decisions that align with your financial goals. This level of oversight doesn’t just prevent overspending; it fosters a deeper understanding of your financial habits, paving the way for sustainable wealth-building and peace of mind.

Key Benefits of Using Structured Templates and Planners

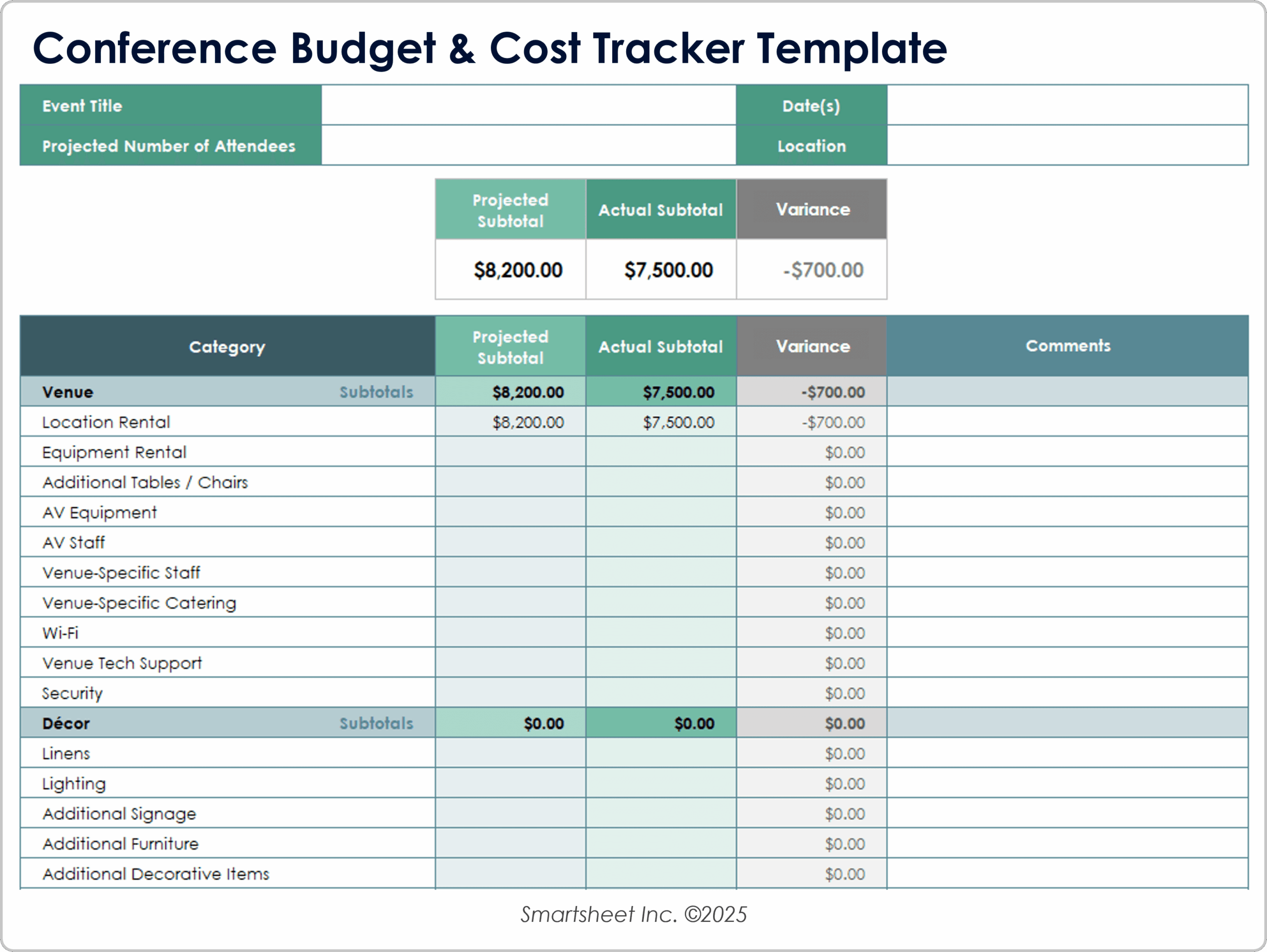

While a blank spreadsheet offers limitless possibilities, a structured template takes the guesswork out of setup. It provides a pre-designed framework, saving you valuable time and ensuring you don’t overlook crucial categories. Using an event budget template excel can transform a chaotic collection of receipts and estimates into a streamlined, easily digestible financial overview.

The benefits extend far beyond initial setup ease. These pre-formatted planners often include built-in formulas, automating calculations and minimizing human error. They serve as a dynamic expense tracker, allowing real-time adjustments as plans evolve. Furthermore, a good budgeting system acts as a constant point of reference, making it simple to compare actual costs against projected figures, providing invaluable insights for future planning.

Adapting the Template for Various Financial Journeys

The beauty of a well-designed financial spreadsheet, like the robust framework an event budget template excel provides, lies in its incredible adaptability. While its name suggests a specific use, the underlying principles of tracking income and expenses, setting limits, and monitoring cash flow are universal. This means you can easily tailor the document to suit a myriad of financial purposes beyond just event planning.

For personal finance, it can evolve into a comprehensive savings planner, helping you map out goals like a down payment on a home or a child’s education fund. Small businesses can transform it into a sophisticated income log and cost management tool, invaluable for analyzing profitability and managing a healthy balance sheet. For household management, this sheet becomes an essential tool for tracking monthly expenses, helping families stay within their budget and plan for future needs. The core layout offers a flexible foundation that can be customized with categories pertinent to your specific financial landscape, making it an indispensable financial spreadsheet for virtually any planning need.

When Using This Spreadsheet is Most Effective

While highly versatile, there are specific scenarios where leveraging the planner truly shines, offering unparalleled clarity and control. This powerful spreadsheet becomes an indispensable ally when you need to meticulously plan and track significant expenses, ensuring every dollar is accounted for and aligned with your objectives.

Here are some examples of when this budget planner is most effective:

- Wedding Planning: From venue deposits and catering costs to floral arrangements and attire, a wedding budget can quickly become overwhelming. This template allows you to itemize every single expense, track payments, and visualize your total spend against your initial budget.

- Large-Scale Corporate Events: Conferences, product launches, or company retreats involve multiple vendors, complex logistics, and often, significant budgets. The spreadsheet helps manage vendor contracts, track marketing spend, and ensure all departmental budgets are adhered to.

- Home Renovation Projects: Whether it’s a kitchen remodel or a full home overhaul, renovation costs can skyrocket. Use the document to list materials, labor, permits, and contingency funds, keeping your project on track and preventing unexpected financial surprises.

- Family Vacations: Planning a dream trip requires careful allocation of funds for flights, accommodation, activities, food, and souvenirs. This sheet helps optimize your travel budget, ensuring a stress-free and enjoyable experience.

- Fundraising Galas & Community Events: For non-profits or community organizers, transparent financial planning is crucial. The record aids in managing donations, sponsorship funds, and event-related expenses, ensuring accountability and maximizing impact.

- Startup Business Launch: Initial investments for a new business, covering everything from legal fees and inventory to marketing and office supplies, demand precise budgeting. This layout provides a clear financial roadmap for your entrepreneurial journey.

- Personal Financial Goal Tracking: Beyond events, adapt this template as your personal financial organizer to track savings goals, debt repayment plans, or simply to monitor your monthly expenses and income, fostering better financial habits.

In each of these scenarios, the template provides a systematic approach to cost management, ensuring you maintain a clear overview and can make proactive financial decisions.

Tips for Better Design, Formatting, and Usability

Creating an effective budget spreadsheet isn’t just about listing numbers; it’s about designing a tool that’s intuitive, easy to read, and genuinely helpful. Whether you plan to use the template digitally or print it out, a thoughtful approach to design and formatting can dramatically enhance its usability.

Structure and Categories

Start by creating logical sections. Group similar expenses together (e.g., "Venue," "Catering," "Decor," "Marketing"). Use clear, concise labels for each category and sub-category. Consider adding columns for "Estimated Cost," "Actual Cost," "Difference," and "Notes." This structure helps at a glance comparisons and clarifies budget variances. For more complex projects, you might also include columns for "Payment Due Date" and "Paid (Yes/No)" to track your cash flow and manage deadlines effectively.

Formatting for Clarity

- Color-Coding: Use subtle color-coding to differentiate categories or highlight critical information. For instance, you could use green for income, red for over-budget items, or yellow for items pending payment. Avoid overly bright or clashing colors that can make the sheet hard to read.

- Font Choice and Size: Opt for clean, readable fonts like Arial or Calibri. Maintain a consistent font size throughout the document, using slightly larger fonts for headings to improve hierarchy.

- Borders and Shading: Apply light borders to cells or rows to improve readability and break up large blocks of data. Shading alternate rows can also make tracking across the sheet easier on the eyes, especially for print versions.

- Conditional Formatting: Leverage Excel’s conditional formatting features. For example, set rules to automatically turn cells red if "Actual Cost" exceeds "Estimated Cost," providing instant visual alerts for budget overruns. This is an incredible feature for quick cost management.

Formulas and Automation

Don’t be afraid of simple formulas. Sum functions (=SUM(A1:A10)) are essential for calculating totals for categories and overall expenses. If you’re comfortable, explore IF statements for more advanced tracking, like calculating remaining budget or indicating if a payment is overdue. Locking cells with formulas prevents accidental changes, preserving the integrity of your calculations.

Usability for Digital and Print

- Digital Version: Ensure your spreadsheet is saved in a cloud service (Google Drive, OneDrive) for easy access and collaboration. Consider adding data validation to certain cells (e.g., a drop-down list for payment status) to maintain data consistency. Create separate tabs for different phases of an event or different budget years for personal finance, keeping the main sheet clean.

- Print Version: Before printing, use the "Print Preview" function to adjust page breaks and scaling. Ensure all columns fit on a single page if possible, or that breaks occur at logical points. A clean, uncluttered printout is vital for quick reference during meetings or on-the-go. Adding a "Print Date" or "Version Number" in a header/footer can be helpful for record-keeping.

By investing a little time in the design and formatting of your financial spreadsheet, you create a powerful, user-friendly tool that serves as a robust expense tracker and a reliable budgeting system. It transforms a simple sheet of numbers into an intelligent financial organizer.

In the end, whether you’re meticulously planning an extravagant wedding or simply aiming to get a tighter grip on your monthly expenses, having a clear and accessible financial record is truly invaluable. The goal isn’t just to track money; it’s about making informed decisions, reducing stress, and ultimately achieving your financial aspirations with confidence.

Embrace the power of organization. Leverage a well-designed financial template, adapt it to your unique needs, and watch as your financial clarity and control transform. This isn’t just a spreadsheet; it’s your personal pathway to smarter financial planning and a less stressful journey, no matter the event or financial goal ahead.