In today’s fast-paced world, managing our finances effectively is more crucial than ever. Whether you’re a seasoned professional, a small business owner, or simply trying to get a handle on your personal spending, the backbone of good financial health lies in organized record-keeping. It’s not just about knowing how much money you have, but understanding where it goes, and how it can be optimized for your goals. This proactive approach saves not only money but also invaluable time and mental energy.

That’s where a well-designed financial tool comes into play. Far beyond just tracking receipts, a truly comprehensive system provides clarity, fosters accountability, and empowers smart decision-making. We’re talking about a tool that can transform a chaotic pile of papers into a clean, actionable overview of your financial life. Imagine having everything you need, precisely when you need it, whether for tax season, budget reviews, or just peace of mind.

The Indispensable Role of Organized Financial Planning and Record-Keeping

Think about the last time you felt overwhelmed by a stack of bills or struggled to recall a specific expense. This isn’t just an inconvenience; it’s a drain on your productivity and a source of unnecessary stress. Organized financial planning and diligent record-keeping provide a crystal-clear lens through which you can view your financial landscape, giving you a sense of clarity and control that’s truly empowering. It means knowing your current financial position at a glance, allowing you to anticipate future needs and make informed choices.

Establishing a solid system for tracking your income and expenses is the bedrock of intelligent financial management. It helps you identify spending patterns, uncover areas where you might be overspending, and pinpoint opportunities for savings. This clarity isn’t just for big corporations; it’s fundamental for individuals, families, and even small side hustles looking to thrive. An effective financial organizer can make all the difference, moving you from reactive money management to proactive financial stewardship, ensuring every dollar works smarter for you.

Key Benefits of Using Structured Templates, Planners, or Spreadsheets for Budgeting

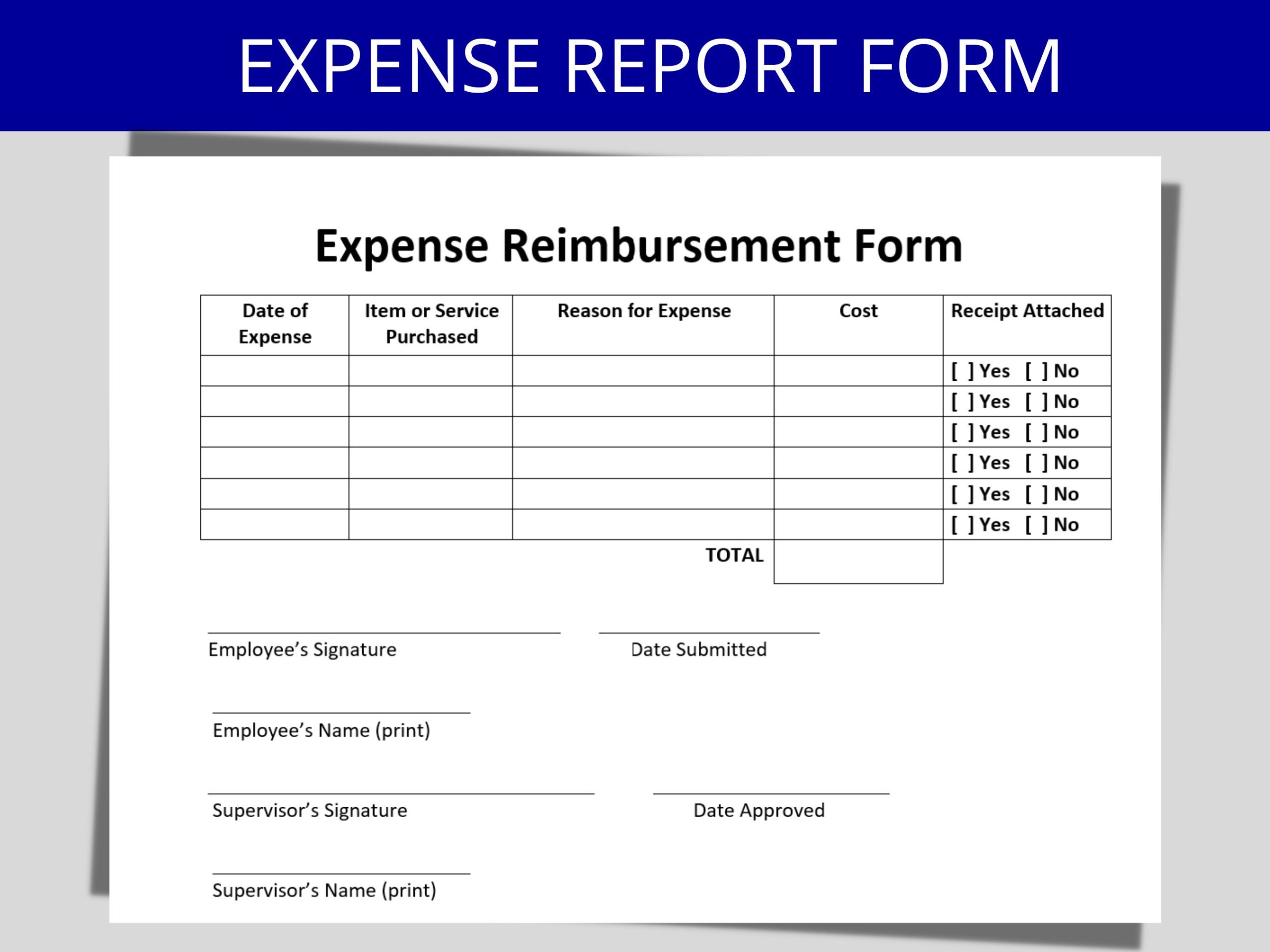

Embracing structured templates, planners, or spreadsheets for your budgeting and expense tracking offers a multitude of advantages that go far beyond simple data entry. These tools provide a consistent framework, ensuring that no essential detail is overlooked and all information is categorized uniformly. This consistency is vital for accurate reporting, especially when dealing with compliance or annual reviews. Utilizing an employee expense report sheet to HR template, for example, streamlines the often-tedious process of submitting and reviewing financial claims.

One of the most significant benefits is the substantial time savings. Instead of manually creating categories or trying to remember past transactions, a well-designed template has pre-defined fields that guide your entries, making the process quick and efficient. This not only speeds up the input but also vastly improves data retrieval and analysis. A robust financial spreadsheet acts as an invaluable expense tracker, giving you immediate insights into your cash flow and helping you maintain a healthy balance sheet, leading to better cost management overall.

How This Template Can Be Adapted for Various Purposes

While the name might suggest a corporate HR focus, the underlying principles of the employee expense report sheet to HR template are remarkably versatile. Its structure – clear categories, date fields, descriptions, and monetary values – can be effortlessly adapted to a myriad of financial tracking needs. This isn’t just a corporate tool; it’s a robust framework ready for customization.

Consider its utility in personal finance. You can easily rename categories to track monthly expenses like groceries, utilities, entertainment, and transportation, effectively transforming it into a personal budgeting system or savings planner. For small businesses, it becomes an invaluable income log and expense tracker, helping monitor project costs, client billing, and operational overheads, providing a clear picture of profitability. Event planners can adapt it to manage budgets for weddings, conferences, or parties, ensuring every vendor payment and attendee cost is accounted for. Even for household management, it can track shared expenses, home renovation costs, or childcare expenditures, fostering transparency and accountability among family members. The core design is built for clarity and comprehensive data capture, making it a powerful financial organizer for almost any scenario where systematic cost management is required.

Examples of When Using the Employee Expense Report Sheet To Hr Template is Most Effective

The power of a well-structured expense tracking system truly shines in specific scenarios where clarity and accountability are paramount. Leveraging a comprehensive document like this becomes indispensable for a range of financial management tasks.

- Business Travel Reimbursements: For employees frequently on the road, detailing mileage, meals, lodging, and client entertainment becomes effortless, ensuring timely and accurate reimbursements.

- Project-Based Budgeting: Teams managing specific projects can track all associated costs – from materials and software licenses to contractor fees – against the allocated budget, providing real-time cost management insights.

- Charitable Donations for Tax Purposes: Individuals can systematically record all their charitable contributions, including cash, in-kind donations, and volunteer mileage, making tax preparation a breeze.

- Medical Expense Tracking: For families managing significant healthcare costs, this record helps log co-pays, prescriptions, specialist visits, and insurance claims, crucial for maximizing deductions or understanding out-of-pocket maximums.

- Freelancer or Contractor Expense Reporting: Self-employed individuals can precisely track business-related expenses like office supplies, professional development, and travel, vital for calculating net income and tax liabilities.

- Home Renovation or Improvement Projects: Homeowners can diligently document all expenditures related to a renovation – materials, labor, permits – essential for budgeting, insurance claims, and potential future property valuation.

- Educational Expense Management: Students or parents can track tuition fees, books, supplies, and other education-related costs, which can be important for financial aid applications or tax credits.

- Event Planning and Budgeting: Whether for a wedding, a corporate retreat, or a large family gathering, tracking every expenditure from venue hire to catering, decorations, and entertainment ensures the event stays within budget.

Tips for Better Design, Formatting, and Usability

Creating a truly effective financial record isn’t just about the data; it’s about the design and ease of use. A well-formatted template is intuitive, reduces errors, and encourages consistent use. When you’re crafting your own financial spreadsheet or adapting an existing layout, think about the user experience first. Start with clear, logical column headers such as "Date," "Category," "Description," "Amount," and "Receipt #." These simple labels prevent confusion and ensure consistent data entry.

Consider using color-coding for different expense categories or statuses (e.g., "pending," "approved," "reimbursed"). This visual cue allows for quick scanning and identification of key information. For digital versions, leverage features like dropdown menus for common categories, automatically calculating sums, and conditional formatting to highlight over-budget items or missing details. Ensure that totals are prominently displayed, perhaps at the bottom of each category or section, providing an immediate overview of your spending or income.

For both print and digital versions, make sure the font is legible and the spacing is generous enough to avoid a cluttered look. If it’s a digital spreadsheet, protect cells that contain formulas to prevent accidental deletion or modification, while leaving input cells easily editable. Include instructions or a small "legend" on a separate tab for more complex fields or specific company policies. Finally, consider creating separate tabs for different months, projects, or categories within the same file for a truly comprehensive financial organizer, making navigation simple and data analysis straightforward for your entire budgeting system.

The Practical Value of a Smart Financial Tool

In an age where financial complexity often leads to stress, having a reliable and intuitive tool like this becomes a significant advantage. It transcends being merely an administrative chore; it evolves into a powerful ally in your quest for financial mastery. By simplifying the often-daunting task of expense tracking and financial organization, it frees up valuable mental space and time, allowing you to focus on more strategic aspects of your life or business.

Ultimately, the practical value of a meticulously maintained financial record lies in its ability to empower you. It transforms abstract financial data into concrete, actionable insights, helping you make smarter decisions about your money. This isn’t just about recording past transactions; it’s about proactively shaping your financial future, reducing stress, and building a stronger, more secure financial foundation for yourself or your organization. Embrace the clarity and control it offers, and watch your financial well-being flourish.