Effective communication stands as a cornerstone of robust corporate governance and transparent investor relations. Among the myriad forms of official correspondence a company issues, the dividend letter to shareholders holds particular significance. This critical document serves not merely as a notification but as a direct affirmation of a company’s financial health and its commitment to returning value to its owners.

A well-structured dividend letter to shareholders template is an indispensable tool for publicly traded companies, private corporations with investor bases, and even certain cooperative structures. It ensures that vital information regarding dividend declarations, payment schedules, and associated details is conveyed clearly, consistently, and professionally to all stakeholders. Adopting such a standardized framework benefits legal compliance, bolsters investor confidence, and streamlines the administrative burden associated with large-scale shareholder communications.

The Imperative of Professional Written Communication

In the intricate landscape of business operations, professional written communication is not merely a formality; it is a strategic imperative. Documents such as formal correspondence, business letters, and official notices serve as binding records, convey critical information, and significantly shape perceptions of an organization’s professionalism and reliability. They establish a clear chain of communication, which is vital for accountability and transparency.

Whether it is a contractual agreement, an internal memorandum, or a public announcement, the precision and clarity of written communication minimize ambiguities and prevent misunderstandings. This meticulous approach is especially crucial in fields subject to stringent regulatory oversight, where every communication can have legal ramifications. Maintaining a repository of professional communication ensures that all parties are consistently informed and that a verifiable record of interactions exists.

Furthermore, in an era where digital interactions are prevalent, the principles of well-structured formal correspondence remain paramount. A professionally crafted written request or notice letter, whether physical or digital, projects an image of competence and trustworthiness. It underscores an organization’s commitment to clarity and its respect for the recipient, reinforcing positive relationships with employees, partners, and, critically, shareholders.

Core Advantages of a Structured Template for Shareholder Dividends

Implementing a structured template, particularly for sensitive communications like dividend notifications, offers a multitude of advantages that extend beyond mere convenience. Such a framework for a dividend letter to shareholders template ensures absolute consistency in messaging across all recipients, eliminating discrepancies that could lead to confusion or mistrust among the investor base. It is a proactive step towards maintaining clear and equitable communication.

The primary benefits include enhanced professionalism, which conveys an image of an organized and responsible entity committed to its shareholders. Consistency in format and content promotes clarity, making it easier for investors to quickly locate and understand essential information such as dividend per share, record dates, and payment dates. This efficiency saves considerable time and resources for the issuing company by standardizing the drafting process and reducing the likelihood of errors.

Moreover, a predefined document layout ensures adherence to legal and regulatory compliance requirements, safeguarding the company from potential legal challenges or penalties associated with inadequate disclosure. Every dividend letter issued becomes an an official record, easily retrievable for audits, investor inquiries, or historical analysis. This systematic approach to investor communication significantly contributes to positive investor relations, fostering loyalty and confidence in the company’s management and financial stewardship.

Adaptability and Customization for Diverse Communication Needs

While the focus here is specifically on dividend letters, the foundational principles embedded within such a structured message template are remarkably adaptable across various business communication needs. The discipline of constructing a clear, concise, and compliant formal notification or business letter can be applied to a wide array of official correspondence. This ensures that the expertise gained in developing one specific template can inform the creation of others.

The underlying framework—comprising sender and recipient details, clear subject lines, a direct and informative body, and appropriate closings—forms the backbone of almost any professional communication. For instance, the systematic approach used in detailing dividend information can be repurposed for employment-related documents, such as offer letters or official termination notices, ensuring all necessary legal and procedural details are consistently included.

Similarly, for general business correspondence, be it contractual notices, official policy announcements, or responses to formal requests, the discipline of using a structured file guarantees completeness and professional presentation. This versatility demonstrates that investing time in developing robust communication templates, such as for shareholder updates, yields broad benefits across an organization’s entire documentation strategy, fostering a cohesive and efficient communication ecosystem.

Effective Scenarios for Utilizing a Dividend Letter to Shareholders

The utility of this specific form of correspondence is most pronounced in situations demanding unequivocal clarity and formal notification to investors. Employing a robust letter ensures all shareholders receive consistent and accurate information, critical for maintaining trust and regulatory compliance. Here are key scenarios where the template proves invaluable:

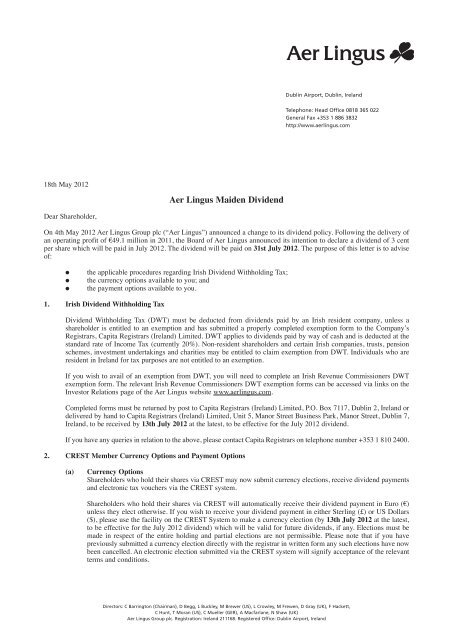

- Declaration of Regular Cash Dividends: Announcing the standard quarterly or annual cash dividend, including the dividend amount per share, declaration date, record date, and payment date. This is the most common use of the letter.

- Announcement of Special Dividends: Notifying shareholders of an extraordinary, one-time dividend payment, often resulting from exceptional earnings or asset sales. Such announcements require clear context and specific financial details.

- Stock Dividends and Stock Splits: Explaining the issuance of additional shares to existing shareholders, either as a percentage of their current holdings (stock dividend) or as a division of existing shares into multiple new shares (stock split). The communication must clarify the impact on share count and value.

- Changes in Dividend Policy: Informing investors about any modifications to the company’s long-term dividend strategy, such as increases, decreases, or suspensions. These changes typically carry significant implications and require careful explanation.

- Dividend Reinvestment Plan (DRIP) Details: Providing information on how shareholders can enroll in or manage their participation in a DRIP, which allows dividends to be automatically reinvested into additional shares of the company.

- Tax Implications and Reporting: Offering essential guidance regarding the tax treatment of dividends, including relevant tax forms (e.g., Form 1099-DIV) and instructions for shareholders during tax season.

- Proxy Statement Reminders: While not a dividend letter directly, such a communication can accompany a dividend payment or declaration, serving as a reminder for shareholders to review upcoming proxy statements and annual meeting information.

In each of these instances, the correspondence serves as an official record, documenting the company’s adherence to corporate governance principles and its commitment to transparent financial reporting. The structured layout ensures that no critical piece of information is overlooked, reinforcing investor confidence and facilitating smooth financial administration.

Best Practices for Formatting, Tone, and Usability

To maximize the effectiveness of any formal communication, especially one as important as a dividend notification, meticulous attention to formatting, tone, and overall usability is essential. These elements contribute significantly to how the information is received and understood by the recipients. A thoughtfully designed document layout reinforces the message’s importance and clarity.

Formatting for Clarity and Professionalism

Adhering to standard business letter format is paramount. This includes a clear header with the company’s logo and contact information, the date, the recipient’s name and address, a formal salutation, well-organized body paragraphs, a professional closing, and the sender’s signature and title. Within the body of the letter, utilize clear headings and subheadings (e.g., “Dividend Details,” “Payment Information,” “Tax Considerations”) to break down complex information into digestible sections. Employ a professional, legible font (e.g., Arial, Calibri, Times New Roman) at a comfortable size (10-12pt) with appropriate line spacing to enhance readability. Crucially, ensure all key data—such as dividend per share, record date, payment date, and any relevant tax identification numbers—are prominently displayed and easy to locate.

Maintaining an Appropriate Tone

The tone of the letter must be formal, respectful, and transparent. It should be authoritative yet approachable, reflecting the company’s professionalism while also valuing its shareholders. Avoid overly casual language, jargon that is not clearly explained, or promotional rhetoric. The language should be concise, direct, and unambiguous, leaving no room for misinterpretation. Even when delivering potentially unwelcome news, such as a dividend reduction, the tone should remain objective, factual, and reassuring, emphasizing the company’s long-term strategy and commitment to shareholder value.

Ensuring Usability Across Platforms

For print versions, use high-quality paper and professional printing to reflect the importance of the communication. Ensure ample margins for ease of reading and potential filing. For digital distribution, typically via email or a secure investor portal, the template should be rendered as a PDF document to maintain formatting integrity across various devices and operating systems. Consider accessibility features for visually impaired shareholders. Email correspondence should utilize clear, informative subject lines (e.g., “Important Dividend Announcement from [Company Name]”) to ensure the message is opened and recognized immediately. Furthermore, all versions, whether print or digital, should be easily archivable as an official record for both the company and the shareholder, supporting long-term compliance and historical reference.

The Enduring Value of a Structured Communication Tool

In conclusion, the strategic deployment of a meticulously crafted letter for shareholder dividend notifications is far more than a mere administrative task; it is a critical component of effective corporate communication and investor relations. This reliable and efficient communication tool serves as a tangible expression of a company’s commitment to transparency, financial stability, and good governance. It ensures that every shareholder receives a clear, consistent, and professional update, which is foundational to building and sustaining trust.

By standardizing the process through a robust message template, organizations can significantly reduce the potential for errors, enhance operational efficiency, and maintain an impeccable official record of all shareholder interactions. This consistency not only streamlines internal workflows but also fortifies the company’s reputation as a reliable and responsible entity in the financial markets. The inherent structure and clarity of the correspondence make it an invaluable asset for compliance, auditing, and future reference.

Ultimately, investing in the development and consistent application of such a professional document layout is an investment in strategic communication. It underpins strong investor confidence, supports regulatory compliance, and reinforces the long-term value proposition of the company. It stands as a testament to an organization’s dedication to its shareholders, ensuring that every financial announcement is conveyed with the professionalism and precision it deserves.