Navigating the complexities of personal finance and debt resolution often culminates in a pivotal moment: the successful settlement of an outstanding obligation. This critical juncture demands meticulous documentation, not only to affirm the agreement but also to safeguard the financial standing of all parties involved. A debt settlement letter paid in full template serves as an indispensable tool in this process, providing a structured, verifiable record that an agreed-upon debt has been successfully resolved and fully satisfied. It is more than just a piece of paper; it is an official record confirming the cessation of a financial liability, protecting the debtor from future claims and ensuring accurate credit reporting.

This specialized form of formal correspondence is designed for individuals who have negotiated a settlement with a creditor and have subsequently fulfilled the terms of that agreement. Its primary purpose is to secure written confirmation that the debt is considered fully paid and discharged, thereby preventing any future disputes or misunderstandings. Both debtors and creditors benefit immensely from the clarity and finality provided by such a document, establishing a clear professional communication trail that is vital for accurate record-keeping and peace of mind.

The Indispensable Role of Formal Written Communication

In both personal and professional spheres, the significance of clear, precise, and professional communication cannot be overstated. Written communication, especially in the form of official documentation, offers a tangible, undeniable record of events, agreements, and directives. Unlike verbal exchanges, which can be subject to misinterpretation or forgotten details, a business letter or any other form of formal correspondence stands as an objective reference point, accessible for review at any time. This foundational principle is particularly crucial in financial matters, where accuracy directly impacts creditworthiness, legal standing, and personal liability.

Effective written communication fosters transparency, minimizes disputes, and upholds accountability. Whether it’s a contract, an internal memorandum, or a notice letter to a client, the act of putting information into a structured, written format elevates its credibility and ensures consistency in message delivery. This adherence to professional documentation standards not only reflects positively on the sender’s attention to detail but also provides a legally defensible account should any misunderstandings arise. In an era where digital interactions are common, the reliability of a well-crafted written record remains paramount, serving as an enduring testament to financial and business transactions.

Core Advantages of a Structured Debt Settlement Letter Paid In Full Template

Employing a structured template for your debt settlement letter paid in full offers a multitude of benefits, streamlining what could otherwise be a cumbersome and ambiguous process. Foremost among these advantages is the assurance of consistency. A pre-designed layout ensures that all essential information is included every time, eliminating the risk of omitting crucial details that could lead to future complications. This consistency applies not only to the content but also to the tone, which remains professional and authoritative, reflecting the serious nature of the financial resolution.

Furthermore, using a template significantly enhances clarity. The organized structure guides the reader through the pertinent information in a logical flow, making it easy to understand the letter’s purpose and verify its contents. This clarity is vital for creditors, who process numerous such requests, and for debtors, who need unequivocal confirmation of their financial standing. Such a formal correspondence also serves as an official record, acting as irrefutable proof of the settlement and payment. This document layout ensures legal protection, offering a robust defense against any subsequent collection attempts or negative credit reporting issues. It simplifies record-keeping for both parties, making it an efficient and reliable communication tool.

Customizing the Template for Specific Scenarios

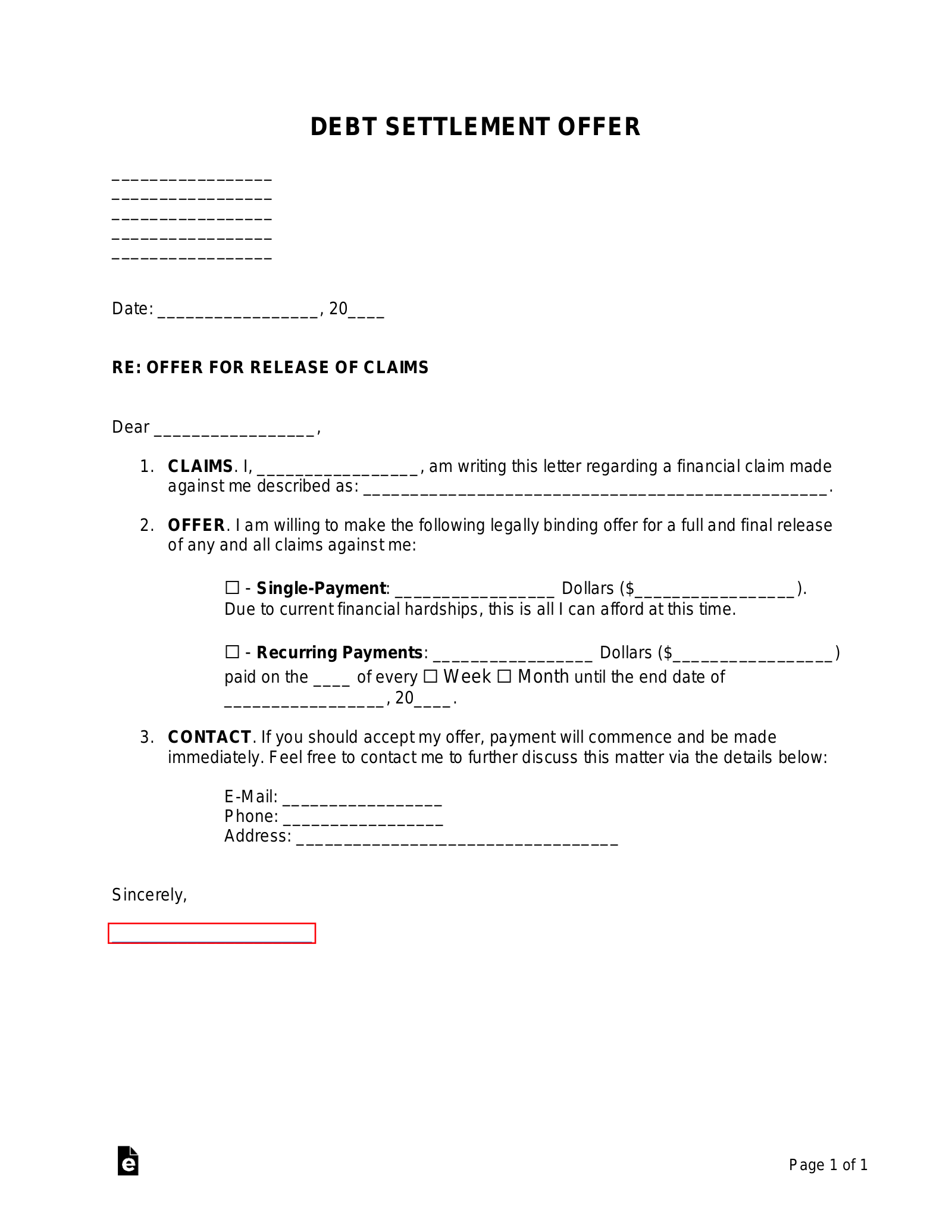

While the core purpose of a debt settlement letter paid in full template is specific—to confirm the complete resolution of a debt—the underlying principles of its structured design allow for significant customization. This adaptability is key to making any message template truly effective across diverse situations. For a debt settlement letter, customization often involves tailoring specific details to match the unique terms of the agreement, the identities of the parties, and the specifics of the debt itself.

The document can be modified to address different creditors, whether they are original lenders, collection agencies, or debt buyers. The exact settlement amount, the original debt amount, and the specific account numbers must be accurately reflected. Payment dates and methods, along with any conditions stipulated in the initial settlement agreement, should be clearly stated. Beyond financial matters, the fundamental concept of using a robust message template extends to other forms of professional communication. The disciplined approach to a document layout can be adapted for a formal request for information, a notice letter detailing a policy change, or a general business letter establishing terms with a new vendor. The key is to retain the template’s structured integrity while adjusting the variable content to suit the specific context, ensuring that every piece of formal correspondence maintains a high standard of clarity and completeness.

Optimal Use Cases for a Debt Settlement Letter Paid In Full Template

The deployment of a debt settlement letter paid in full template is most effective in specific scenarios where documented financial closure is paramount. These situations typically involve the final stages of debt resolution, requiring a formal, undeniable record for all involved parties.

- Upon Full Payment of a Settled Debt: This is the primary use case. After an agreed-upon reduced amount has been paid to a creditor or collection agency, this letter formally requests confirmation that the account is considered closed with a zero balance.

- Preventing Future Collection Attempts: A robust paid-in-full letter serves as a legal deterrent against any subsequent attempts by the original creditor or a third-party collector to demand further payment on the same debt.

- Ensuring Accurate Credit Reporting: This formal correspondence is essential for disputing incorrect credit report entries. If a settled debt is still inaccurately reported as outstanding or partially paid, the letter provides proof to credit bureaus for correction.

- When Dealing with Debt Buyers: If a debt has been sold multiple times, securing a paid-in-full letter from the current holder of the debt is crucial to avoid future claims from unknown entities.

- For Legal and Personal Record-Keeping: Maintaining a personal archive of this document is vital for future financial audits, legal defenses, or simply for personal peace of mind regarding resolved financial obligations.

- To Confirm Release of Liens or Garnishments: In cases where the debt resulted in a lien on property or wage garnishment, the letter should confirm the release of these actions upon full settlement.

- Resolving Disputes Over Payment: If there’s any ambiguity about whether the final payment has been received or processed, the template facilitates a clear written request for confirmation, averting potential disputes.

Best Practices for Formatting, Tone, and Usability

Crafting any professional communication, especially one as critical as a formal correspondence confirming debt settlement, demands adherence to best practices in formatting, tone, and usability. The layout of the document should be clean, logical, and easy to read. Standard business letter formatting, including clear headings, proper spacing, and a professional font (e.g., Times New Roman, Arial), enhances readability and conveys professionalism. Essential elements such as the date, sender’s and recipient’s contact information, a clear subject line, and account numbers must be prominently displayed.

The tone of the letter must remain consistently formal, professional, and courteous, yet firm. Avoid overly casual language, emotional appeals, or accusatory statements. The objective is to convey facts clearly and unequivocally, requesting confirmation of the debt’s resolution. While expressing gratitude for cooperation is acceptable, the primary focus should be on the undisputed facts of the settlement and payment.

For usability, whether in print or digital format, the document should be easily digestible. In a digital context, a PDF version ensures that the formatting remains consistent across different devices and operating systems. For print, using high-quality paper and clear printing enhances the official nature of the document. Always include specific instructions or requests, such as asking for a signed copy of the letter back, to ensure a complete and reciprocal exchange of official records. This meticulous approach guarantees that the file serves its purpose effectively and efficiently.

The comprehensive nature of a meticulously structured message template provides an invaluable resource for managing and resolving financial obligations. It transcends being merely a boilerplate; it is a critical tool for ensuring transparency, preventing future disputes, and establishing a clear, undeniable record of financial closure. This form is a testament to the power of professional communication, transforming potentially ambiguous financial resolutions into clear, verifiable agreements.

In an increasingly complex financial landscape, leveraging a reliable communication tool like this is not merely a convenience—it is a strategic necessity. It empowers individuals with the means to assert their financial clarity and protect their interests, while simultaneously providing creditors with a clear record of account resolution. By embracing the principles of structured, professional correspondence, all parties can navigate the intricate path of debt settlement with confidence, efficiency, and assured finality, solidifying a positive step towards financial stability and accurate documentation.