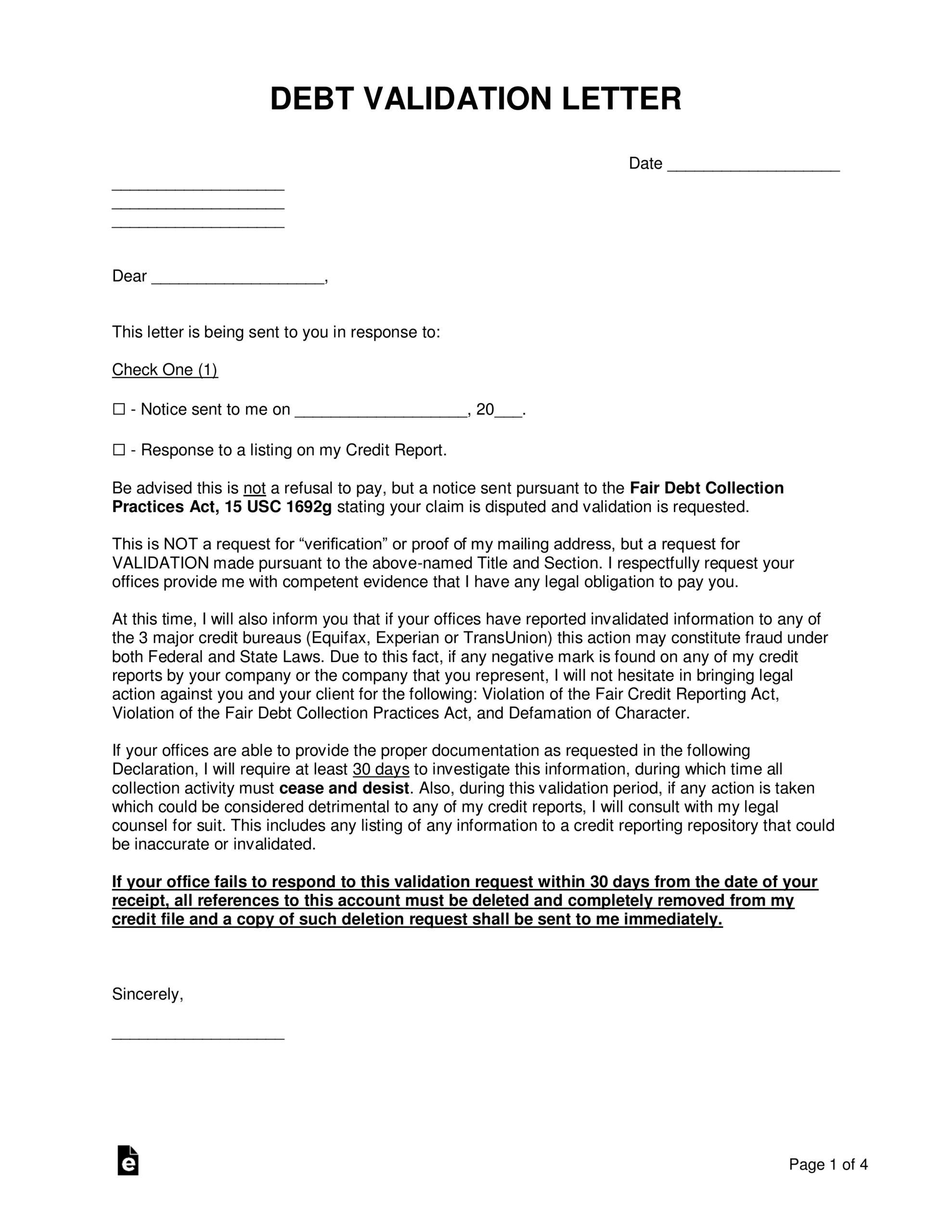

In the complex landscape of personal finance and debt management, clear, formal, and legally sound communication is paramount. The debt validation letter template serves as a critical instrument for individuals seeking to verify the legitimacy and accuracy of alleged debts. This document empowers consumers by providing a structured, professional means to exercise their rights under the Fair Debt Collection Practices Act (FDCPA), specifically the right to request verification of a debt within a specified timeframe.

Utilizing a well-crafted debt validation letter template is not merely about sending a formal request; it is about establishing an official record, demanding accountability from debt collectors, and safeguarding one’s financial integrity. For anyone who receives a collection notice or believes a debt claim is erroneous, understanding the purpose and proper application of this correspondence is an indispensable step towards effective resolution and protection against unlawful collection practices.

The Importance of Written Communication and Professional Documentation

In both business and personal affairs, the significance of written communication cannot be overstated. Unlike verbal exchanges, which can be subject to misinterpretation or outright denial, written documents provide a tangible, indisputable record of communication. This permanence is particularly vital when dealing with financial obligations or legal entitlements, where precision and verifiable facts are essential.

Professional documentation serves multiple critical functions: it clarifies intent, establishes timelines, and provides evidence should disputes arise. Whether it is a formal correspondence with a financial institution, a contractual agreement, or a notice letter to a third party, the act of putting information in writing transforms transient communication into an official record. This practice underpins transparency and accountability, laying a clear foundation for all parties involved.

In scenarios involving debt, relying solely on phone calls can leave an individual vulnerable, with no verifiable proof of what was discussed or agreed upon. A professionally structured letter, conversely, creates an audit trail. It allows for a systematic review of all interactions, which is invaluable in maintaining accuracy and protecting one’s rights against potential discrepancies or abuses.

Key Benefits of Using Structured Templates for Debt Validation

The strategic deployment of a structured template, specifically for a debt validation letter, offers a multitude of advantages that transcend mere convenience. Foremost among these is the immediate establishment of professionalism. A well-formatted letter signals to the recipient, typically a debt collector or agency, that the sender is informed, organized, and serious about their request.

Consistency is another paramount benefit. Templates ensure that all necessary information is included in every instance, preventing critical omissions that could weaken the validity of the request. This systematic approach guarantees that the core elements of a formal request for debt validation—such as the explicit demand for verification, the account number, and the clear statement of intent—are always present, fostering clarity in communication from the outset.

Furthermore, using a message template significantly enhances clarity. The pre-defined structure guides the writer to present information logically and concisely, reducing ambiguity. This clarity is crucial when dealing with legal and financial matters, where misinterpretation can lead to adverse outcomes. It also helps in standardizing the communication process, making it more efficient and less prone to errors than drafting each letter from scratch.

Customizing the Template for Specific Applications

While the primary application of this particular discussion focuses on a debt validation letter, the foundational principles of effective template usage are broadly applicable across various forms of professional communication. A robust document layout, clear subject lines, and a formal tone are universal requirements for any impactful formal correspondence, whether it’s a business letter, a written request, or an official notice letter.

For instance, an individual might adapt the structural discipline learned from crafting a precise debt validation request to develop a template for a formal job application cover letter, an employment verification request, or a general business inquiry. The ability to customize a standard file allows users to maintain a consistent brand or personal professional image across all outgoing documents. This involves not only content adaptation but also subtle adjustments in tone and specific legal references, depending on the context.

Understanding how to modify and repurpose a well-designed message template for different scenarios ensures that an individual or organization can quickly generate high-quality, professional documents for a range of purposes. This adaptability transforms a simple layout into a versatile tool for managing diverse communication needs efficiently and effectively, always ensuring that the core objective of the communication is achieved with precision.

When Using This Template is Most Effective

Employing a debt validation letter is a strategic decision that offers significant protection and leverage in specific scenarios involving alleged debts. Its effectiveness is maximized when deployed at opportune moments:

- Upon First Contact: When a debt collector first contacts you, especially if you do not recognize the debt or believe it to be inaccurate. Sending this form within 30 days of receiving the initial communication is crucial to invoking your FDCPA rights.

- Disputing Unfamiliar Debts: If you receive notice of a debt you do not recall incurring, or if the details provided seem inconsistent with your financial history. The correspondence demands the collector provide tangible proof of ownership and accuracy.

- Questioning the Amount or Origin: When there are discrepancies regarding the principal amount, interest, fees, or the original creditor. The letter requests a detailed breakdown and history of the alleged debt.

- Before Payment or Acknowledgment: Prior to making any payment or acknowledging responsibility for a debt you are unsure about. Sending the document ensures you have all necessary information before proceeding.

- After Negative Credit Report Entries: If an unknown or disputed debt appears on your credit report, this form can be an initial step to challenge the entry and demand verification from the reporting entity or collector.

- To Cease Collection Activity (Temporarily): Once the letter is sent, debt collectors must cease collection activities until they provide validation. This can offer a temporary reprieve from persistent calls and notices.

- To Preserve Legal Rights: Actively using the template ensures you are formally asserting your rights under the FDCPA, creating an official record of your due diligence.

Tips for Formatting, Tone, and Usability

Effective business communication relies not only on content but also on its presentation. When utilizing this particular template, meticulous attention to formatting, tone, and usability is paramount to ensure its impact and professionalism.

Formatting Best Practices

Adhere to standard business letter format. This includes placing your contact information, the date, and the recipient’s contact information clearly at the top. Use a concise subject line that immediately identifies the purpose of the letter, such as “Debt Validation Request – Account [Your Account Number].” Employ professional, easily readable fonts like Times New Roman, Arial, or Calibri, typically in 10-12 point size. Maintain adequate margins (typically 1 inch on all sides) and ensure paragraphs are short and focused, generally 2-4 sentences each, to enhance readability. The overall document layout should convey order and seriousness.

Maintaining a Professional Tone

The tone of the letter should be formal, assertive, and objective, devoid of emotional language or accusatory statements. Your objective is to request specific information, not to engage in an argument. State your request clearly and refer to your rights under the FDCPA. Avoid informal language, slang, or any phrases that could undermine the seriousness of your communication. The goal is to project a knowledgeable and decisive posture, indicating you understand your rights and expect compliance.

Ensuring Usability (Print and Digital)

For print versions, use high-quality paper and ensure the ink is clear and legible. Always retain a physical copy for your records. Crucially, send the letter via Certified Mail with a Return Receipt Requested. This provides undeniable proof that the letter was sent and received, along with the date of receipt, establishing a vital official record. For digital versions, if you need to email the letter (though certified mail is usually preferred for initial validation), convert it to a PDF to preserve its original document layout and prevent unauthorized alterations. If a digital signature is appropriate and legally binding in your jurisdiction, ensure it is properly applied. Otherwise, print, sign, scan, and save the file.

The Enduring Value of a Structured Communication Tool

In conclusion, the debt validation letter template stands as an indispensable tool within an individual’s financial toolkit. Its structured approach transforms a potentially overwhelming situation into a manageable and legally defensible process. By leveraging such a professionally designed form, individuals can confidently navigate interactions with debt collectors, assert their rights, and demand the transparency and accountability required by law. It reinforces the principle that all financial transactions, particularly those involving collection efforts, must be predicated on verifiable facts and legitimate claims.

This commitment to formal correspondence not only protects the consumer but also streamlines the resolution process by clearly outlining expectations and legal obligations for both parties. The consistent application of a well-defined letter ensures that every communication is precise, legally robust, and contributes to a comprehensive official record. Ultimately, the template serves as a testament to the power of organized, professional communication in safeguarding personal finances and promoting equitable financial practices.