A credit Card payment spreadsheet template is a valuable tool for businesses and individuals to track and manage their credit card transactions effectively. By organizing financial data in a structured format, this template can help you gain insights into spending habits, identify potential fraudulent activity, and make informed financial decisions.

Key Elements of a Professional Credit Card Payment Spreadsheet Template

1. Transaction Date: This column should be formatted as a date to accurately record the date of each transaction.

2. Transaction Description: Use this column to provide a detailed description of the purchase, including the vendor or merchant name and a brief description of the item or service.

3. Transaction Amount: This column should be formatted as currency to accurately record the total amount of each transaction, including taxes and fees.

4. Transaction Type: Indicate whether the transaction was a purchase, payment, or adjustment.

5. Payment Due Date: If applicable, this column can be used to track the due date for each credit card payment.

6. Payment Status: This column can be used to indicate whether the payment has been made, is pending, or is overdue.

7. Category: Categorize transactions based on spending habits or budgeting goals, such as “Groceries,” “Dining Out,” or “Utilities.”

8. Notes: This column can be used to add additional comments or notes about specific transactions, such as vendor contact information or dispute details.

Design Considerations for a Professional Credit Card Payment Spreadsheet Template

1. Formatting: Use consistent formatting throughout the template, including font size, font style, and alignment. Avoid excessive use of bold, italics, or underlining, as these can make the template difficult to read.

2. Layout: Organize the information in a logical and easy-to-follow layout. Consider using a table format with clear column headings and row labels.

3. Color Scheme: Choose a color scheme that is professional and easy on the eyes. Avoid bright or clashing colors that can be distracting.

4. Branding: If you are creating the template for a business, incorporate your company’s branding elements, such as logo, colors, and fonts.

5. Data Validation: Implement data validation rules to ensure that only valid data is entered into the spreadsheet. For example, you could use data validation to prevent users from entering negative amounts or invalid dates.

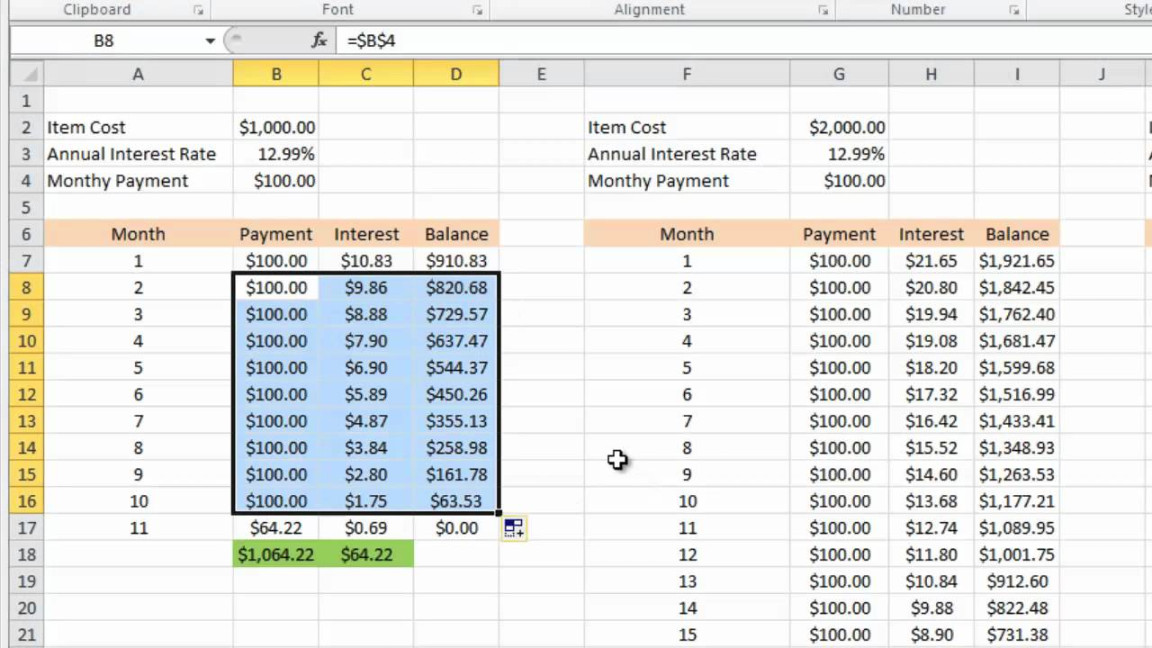

6. Formulas: Use formulas to automate calculations, such as calculating the total amount spent in each category or the remaining balance on the credit card.

7. Charts and Graphs: Consider creating charts or graphs to visualize your spending data and identify trends over time.

Benefits of Using a Credit Card Payment Spreadsheet Template

1. Improved Financial Organization: A well-designed credit card payment spreadsheet template can help you stay organized and on top of your finances.

2. Enhanced Budgeting: By tracking your spending habits, you can identify areas where you can cut back and create a more effective budget.

3. Fraud Detection: A spreadsheet can help you identify potential fraudulent activity by comparing transactions to your expected spending patterns.

4. Financial Analysis: By analyzing your spending data, you can gain valuable insights into your financial habits and make informed decisions about your future.

By following these guidelines and incorporating the key elements discussed above, you can create a professional credit card payment spreadsheet template that is both functional and visually appealing. This template will serve as a valuable tool for managing your finances and achieving your financial goals.