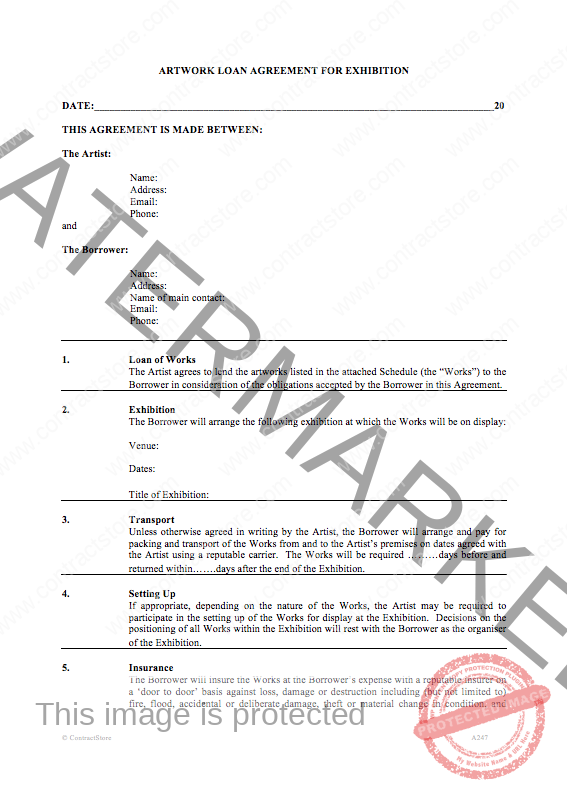

Navigating the world of art loans, whether you’re an artist lending your work, a gallery showcasing a special piece, or a collector sharing a valuable acquisition, often involves more than just a handshake. In an ideal world, mutual trust would be enough, but the reality of professional dealings—especially when significant value is involved—demands clear, structured communication. This is precisely where the beauty of a well-crafted art loan agreement template comes into play, transforming potential ambiguities into explicit, mutually understood terms.

For anyone who values organization, productivity, and smart business communication, having a reliable framework for agreements isn’t just good practice; it’s essential. This article dives deep into the practicalities and immense benefits of utilizing such a structured document. Whether you’re an artist, gallery, or collector, understanding the power of an art loan agreement template is key to protecting your interests, fostering professional relationships, and ensuring peace of mind. It’s about being proactive, not reactive, in your professional engagements.

The Indispensable Role of Professional Documentation in Business

In today’s fast-paced environment, the impulse might be to cut corners, but bypassing proper documentation is a risk no smart professional should take. Organized planning and professional documentation are the bedrock of clarity, legality, and trust in any endeavor. They serve as a roadmap, a historical record, and a legal safeguard all rolled into one. Without them, even the most straightforward arrangements can quickly devolve into misunderstandings or costly disputes.

Think of it as setting the stage for success. A clear legal contract outlines expectations, responsibilities, and contingencies before they become problems. This isn’t just about protecting yourself; it’s about demonstrating respect for the other party, ensuring all stakeholders are on the same page from the outset. This level of transparency builds trust, strengthens professional relationships, and ultimately contributes to a smoother, more productive experience for everyone involved.

Key Advantages of Structured Templates and Agreement Layouts

Using structured templates or standardized agreement layouts offers a wealth of benefits that extend far beyond simply filling in blanks. Firstly, they are incredible time-savers. Instead of drafting a new document from scratch for every single agreement, a robust template provides a ready-to-use framework. This efficiency allows you to focus on the specifics of the deal rather than the architecture of the document.

Secondly, consistency is key. A template ensures that critical clauses, legal language, and essential information are never overlooked. This reduces the risk of errors, omissions, or inconsistent terms across different agreements, which can be a significant liability. Furthermore, these forms project an image of professionalism and competence. Presenting a well-organized, comprehensive business file demonstrates your attention to detail and commitment to clear communication, fostering confidence in your partners and clients. It’s a proactive step towards risk mitigation and clear compliance records.

Adapting Templates for Diverse Professional Needs

While we’re focusing on the specifics of an art loan, the principles behind a well-designed agreement layout are universally applicable. The same thoughtful approach used to structure a detailed art loan agreement can be adapted for a myriad of other professional scenarios. This versatility makes understanding template design a valuable skill for any business owner, freelancer, or organization.

Consider how a robust contract template can be modified for various needs: a comprehensive service agreement for freelancers outlining project scopes and payment terms; a detailed business partnership agreement defining roles, responsibilities, and profit sharing; or even terms of service for online platforms. The core elements—identification of parties, clear definitions, terms and conditions, responsibilities, dispute resolution, and signatures—remain consistent. It’s about taking a solid foundation and tailoring it with specific clauses relevant to the unique nature of each agreement, creating a reliable memorandum of understanding for any situation.

When an Art Loan Agreement Template is Most Effective

Having a ready-to-go, adaptable document is invaluable in numerous scenarios involving the temporary transfer of art. This ensures all parties understand their obligations and the conditions of the loan.

Here are specific instances when utilizing an art loan agreement template is particularly effective:

- Gallery Exhibitions: When a gallery borrows a piece from an artist or collector for a public exhibition, this form clearly defines the loan period, insurance coverage, display conditions (light, temperature, security), and responsibilities for transportation and handling.

- Museum Collections: Museums often borrow significant works for special exhibitions or research. The document specifies conservation requirements, environmental controls, and even public relations aspects related to the artwork.

- Private Collections Display: If a collector wishes to display a piece from another private collection, the template can formalize the agreement, detailing responsibilities for care and potential return conditions.

- Corporate or Public Art Programs: Organizations that temporarily display art in their lobbies or public spaces can use the template to outline liability, maintenance, and the duration of the loan.

- Artist Showcases or Fairs: For artists participating in shows where their work might be handled by third parties, the record establishes clear guidelines on presentation, sales commissions, and the safe return of unsold pieces.

- Educational Institutions: Universities or schools borrowing artwork for educational purposes benefit from this document to specify handling by students or faculty, ensuring the artwork’s integrity.

- Consignment for Sale: While often part of a separate consignment agreement, a loan agreement can precede a sale arrangement, defining the interim period of possession.

- Valuable Pieces: Any situation where a valuable piece requires a formal art loan agreement template for protection, documenting its condition upon receipt and return, and establishing insurance responsibilities.

Tips for Designing, Formatting, and Usability

Creating a document that is not only legally sound but also user-friendly and visually appealing is crucial for smart business communication. Here are some tips to enhance the design, formatting, and usability of your template, whether for print or digital document signing:

- Clarity and Simplicity: Avoid overly complex legal jargon where simpler terms will suffice. Use clear, concise language. Break down complex clauses into shorter, more digestible paragraphs.

- Logical Flow: Organize the sections logically, moving from general information (parties, definitions) to specific terms and conditions. Use clear headings and subheadings (

<h2>,<h3>) to guide the reader. - Visual Hierarchy: Employ different font sizes, bolding, and bullet points to highlight important information and create a visual hierarchy. This makes the record scannable and helps readers quickly grasp key details.

- Whitespace: Don’t overcrowd the page. Ample whitespace improves readability and makes the document less intimidating.

- Branding: Incorporate your logo, company colors, or specific branding elements to give the template a professional and personalized touch. This reinforces your brand identity.

- Fillable Fields (Digital): For digital versions, use fillable PDF forms or word processor fields to make it easy for users to input their information. This streamlines the document signing process.

- Version Control: Always include a version number and date on the document. This is critical for tracking revisions and ensuring everyone is working with the most current professional layout.

- Instructional Notes: For complex sections, consider adding brief instructional notes within the template (e.g., "[Insert full legal name of borrower here]"). Remember to remove these before finalization.

- Review and Test: Before widespread use, have multiple people review the template for clarity, completeness, and ease of use. Test the digital fillable fields to ensure they function correctly.

- Accessibility: Ensure the template is accessible. For digital files, this might mean using appropriate tagging for screen readers. For print, ensure legible font sizes and good contrast.

Ultimately, a well-designed template is one that minimizes questions, maximizes understanding, and facilitates a smooth agreement process.

Embracing Clarity and Professionalism with Your Document

In the fast-paced world of art and business, every minute counts, and every agreement carries weight. Utilizing a professionally crafted document, whether it’s for an art loan, a service agreement, or a business partnership, is not just about ticking a box; it’s about investing in clarity, protecting your interests, and fostering strong, trust-based relationships. This structured approach empowers you to manage your professional interactions with confidence and efficiency, dramatically reducing potential friction points down the line.

The practical value of such a template extends beyond mere legal compliance; it’s a powerful communication tool. It ensures that expectations are aligned, responsibilities are clear, and contingencies are considered from the outset, providing a solid foundation for any collaboration. Embrace the power of well-organized documentation and elevate your business communication, saving valuable time, ensuring legal clarity, and projecting an image of undeniable professionalism in all your endeavors.