Ever feel like your finances are a bit like a tangled ball of yarn? Or perhaps you’re embarking on a significant project, a life event, or a business venture, and the sheer number of costs and potential pitfalls feels overwhelming? That’s where a well-structured financial planning tool, like a robust construction budget template, comes into play. It’s not just for contractors building skyscrapers; it’s a powerful framework designed to bring clarity, control, and calm to any complex financial undertaking.

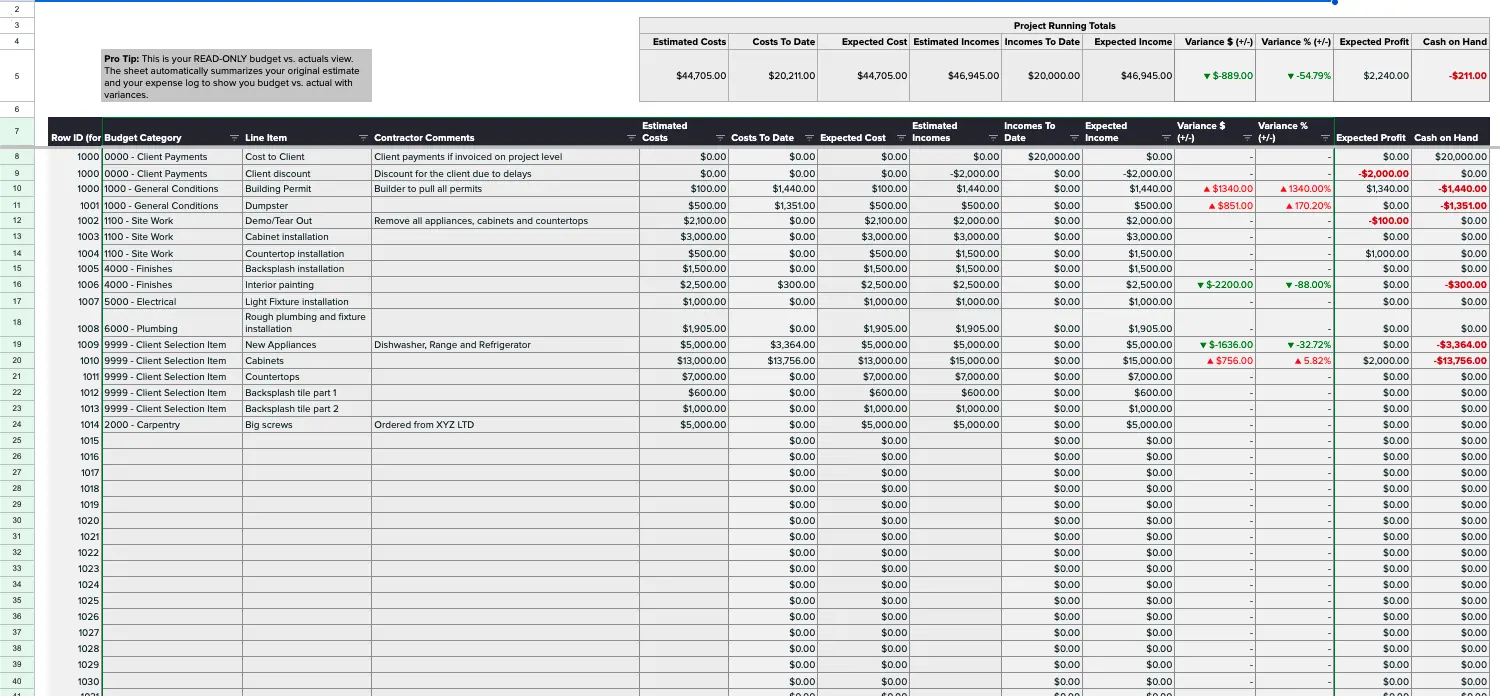

This isn’t about rigid rules; it’s about smart strategy. A good construction budget template, at its core, is an expense tracker and a savings planner rolled into one, allowing you to meticulously categorize every potential cost, track actual spending, and anticipate cash flow. Whether you’re planning a major home renovation, launching a new small business, funding a child’s education, or even orchestrating a dream wedding, the principles of detailed financial forecasting and tracking are universally beneficial. It’s for anyone who values productivity, organization, and making financially sound decisions.

Why Organized Financial Planning is Your Superpower

In our fast-paced world, financial clarity isn’t a luxury; it’s a necessity. Organized financial planning is the bedrock of achieving your goals, providing a clear roadmap of where your money is coming from and where it’s going. Without it, you’re essentially navigating a ship without a compass, susceptible to unexpected expenses, missed opportunities, and unnecessary stress.

Think of it as gaining ultimate control over your financial destiny. When you meticulously record your income and expenditures, you develop a deep understanding of your spending habits and financial health. This proactive approach empowers you to make informed decisions, identify areas for cost management, and confidently allocate resources towards what truly matters. It transforms vague financial anxieties into actionable insights, moving you from merely reacting to financial situations to strategically shaping your future.

The Undeniable Benefits of Structured Templates

Using a structured financial spreadsheet or a dedicated budgeting system offers a host of advantages that go far beyond simple arithmetic. Firstly, it ensures consistency and accuracy across all your financial records, drastically reducing the chances of oversight or errors that can derail a project or budget. You’re not guessing; you’re operating with data.

Secondly, a well-designed template saves you invaluable time. Instead of starting from scratch every time you face a new financial challenge, you have a proven layout ready to adapt. This efficiency allows you to focus more on the strategic aspects of your planning and less on the mechanics of building a spreadsheet. Furthermore, such a financial organizer improves communication, whether you’re working with a spouse, business partner, or a team, ensuring everyone is on the same page regarding financial expectations and realities. It becomes a central record, a single source of truth for your financial journey.

More Than Just Bricks and Mortar: Adapting This Template

While the name might suggest building a house, the underlying principles of a construction budget template are incredibly versatile. It teaches you to break down large projects into manageable line items, account for labor and materials, plan for contingencies, and track progress against a baseline. These are universal truths for any complex financial endeavor.

Consider its application to personal finance: planning for a significant life event like a wedding benefits immensely from detailed cost categories for venue, catering, attire, and unforeseen expenses. For small businesses, a new product launch or a marketing campaign can be mapped out with the same precision, detailing development costs, advertising spend, and anticipated revenue streams. Event planning, from a large corporate conference to a family reunion, similarly benefits from a structured approach to venue hire, catering, entertainment, and logistics. Even household management, especially for large-scale home improvements or multi-year savings goals, can be streamlined using this project-oriented financial organizer.

When to Deploy Your Construction Budget Template

While invaluable for any structured financial planning, there are specific scenarios where leveraging the rigor of a construction budget template truly shines. These are moments when detailed foresight and robust tracking can make all the difference, transforming potential chaos into controlled progress.

- Major Home Renovation: Whether it’s a kitchen remodel, bathroom update, or adding a new wing, tracking material costs, contractor fees, permits, and unexpected expenses is crucial.

- New Business Startup or Significant Expansion Project: From initial legal fees and inventory to marketing spend and operational costs, a detailed budget ensures you allocate capital wisely and understand your burn rate.

- Planning a Wedding or Large Family Event: Managing vendors, guest lists, venue costs, and catering requires meticulous organization to stay within your desired spending limits.

- Fundraising for a Non-Profit Initiative: Tracking projected donations against operational costs and program expenses is vital for transparency and achieving your mission.

- Managing a Complex Personal Savings Goal: For instance, planning for a sabbatical year, a major investment, or funding a child’s college education over several years, requires careful planning of inputs and outputs.

- Developing a New Product or Service (for small businesses): Itemizing research and development, prototyping, testing, manufacturing, and launch costs will keep your project on track financially.

Designing for Success: Tips for Your Budget Document

A great budget document isn’t just about the numbers; it’s about usability and clarity. When designing or adapting your financial spreadsheet, prioritize a clean, intuitive layout. Use clear headings, readable fonts, and consistent formatting to make navigation easy, whether you’re viewing it on a screen or a printed version. Think about color-coding categories or using conditional formatting to highlight over-budget items at a glance, transforming the data into immediate insights.

Customization is key. Don’t be afraid to tailor the categories and line items in your planner to precisely match the nuances of your specific project. Every venture has unique cost drivers, and your budget should reflect that. Also, implement version control; save different iterations of the sheet as "V1," "V2," etc., especially after major changes or updates. This allows you to look back at previous estimates and understand how your projections evolved. And never forget the "contingency" line item! Financial planning is rarely linear, and allocating a percentage (e.g., 10-15%) for unexpected expenses is a hallmark of smart financial planning. Remember, this sheet is a living record; it needs to be reviewed and updated regularly to remain an effective tool for cost management.

Making the Most of Your Financial Organizer

Once you have your budget template set up, the real work—and the real value—begins. First, ensure you break down your project into distinct phases or categories. This allows for granular tracking. Instead of a single "materials" entry, differentiate between "framing lumber," "electrical wiring," and "plumbing fixtures." The more detailed your line items, the more control you gain over your monthly expenses and overall spending.

Next, diligently track your actual expenditures against your budgeted amounts. This "actual vs. budget" comparison is perhaps the most critical feature of any financial spreadsheet. It’s where you learn, adjust, and make informed decisions. If you’re consistently over budget in one area, it prompts you to investigate why and make necessary corrections. Consider automating parts of the process. Utilize formulas within the spreadsheet for sums, percentages, and basic calculations to reduce manual errors and save time. Conditional formatting can automatically flag when an actual cost exceeds its budget. Finally, commit to regular reviews of your financial record. Set aside specific time, perhaps weekly or monthly, to update all actuals, reassess remaining budgets, and make any necessary adjustments to your financial plan. This consistent engagement ensures that the template remains a powerful and accurate tool throughout the duration of your project.

In the end, whether you’re orchestrating a multi-million-dollar build or simply revamping your personal finances for a big life goal, the principles of organized financial planning are universal. The detailed, proactive approach embodied by a robust budgeting system is your secret weapon against financial ambiguity. It’s a time-saving, stress-reducing, and financially empowering tool that puts you firmly in the driver’s seat.

Embrace the clarity and control that comes with having a meticulously planned and tracked financial record. It allows you to transform abstract goals into concrete plans, anticipate challenges before they become crises, and make every dollar work smarter for you. Start building your financial future with the same precision and foresight that goes into building anything truly great.