In the contemporary professional landscape, the manner in which an employee departs an organization can significantly impact their reputation and future career prospects. A well-crafted resignation is not merely a formality; it is a strategic act of professional communication that reinforces positive relationships and preserves one’s standing in the industry. This is precisely where an appreciative resignation letter template becomes an indispensable tool, offering a structured and courteous way to conclude an employment relationship.

This comprehensive guide is designed for professionals across various sectors who seek to navigate the sensitive process of resignation with grace and efficacy. It provides a foundational understanding of why a formal, appreciative departure is crucial and offers a versatile framework for drafting such a letter. By adopting a pre-designed appreciative resignation letter template, individuals can ensure their final correspondence is both professional and positive, leaving a lasting impression that reflects well on their character and work ethic.

The Indispensable Role of Written Communication in Professional Settings

Effective written communication is the bedrock of all successful business operations. Beyond verbal exchanges, formal correspondence provides a tangible, verifiable record of interactions, decisions, and agreements. In an era where digital communication is prevalent, the ability to articulate thoughts clearly, concisely, and professionally in writing remains a highly valued skill, demonstrating attention to detail and a commitment to clarity.

Official records, such as contracts, policy documents, and internal memos, all rely on precise written communication to convey critical information without ambiguity. This extends to personal professional interactions, where a carefully composed business letter or email can prevent misunderstandings, establish credibility, and foster trust. The structured nature of written communication ensures that essential details are not overlooked and that all parties have a consistent understanding of the message.

Moreover, professional documentation serves as a historical archive, allowing organizations and individuals to trace past events, commitments, and notifications. This is vital for legal compliance, audit purposes, and strategic planning. A well-maintained system of written records reinforces transparency and accountability, crucial elements for any reputable enterprise.

Key Benefits of Utilizing a Structured Template for Resignation

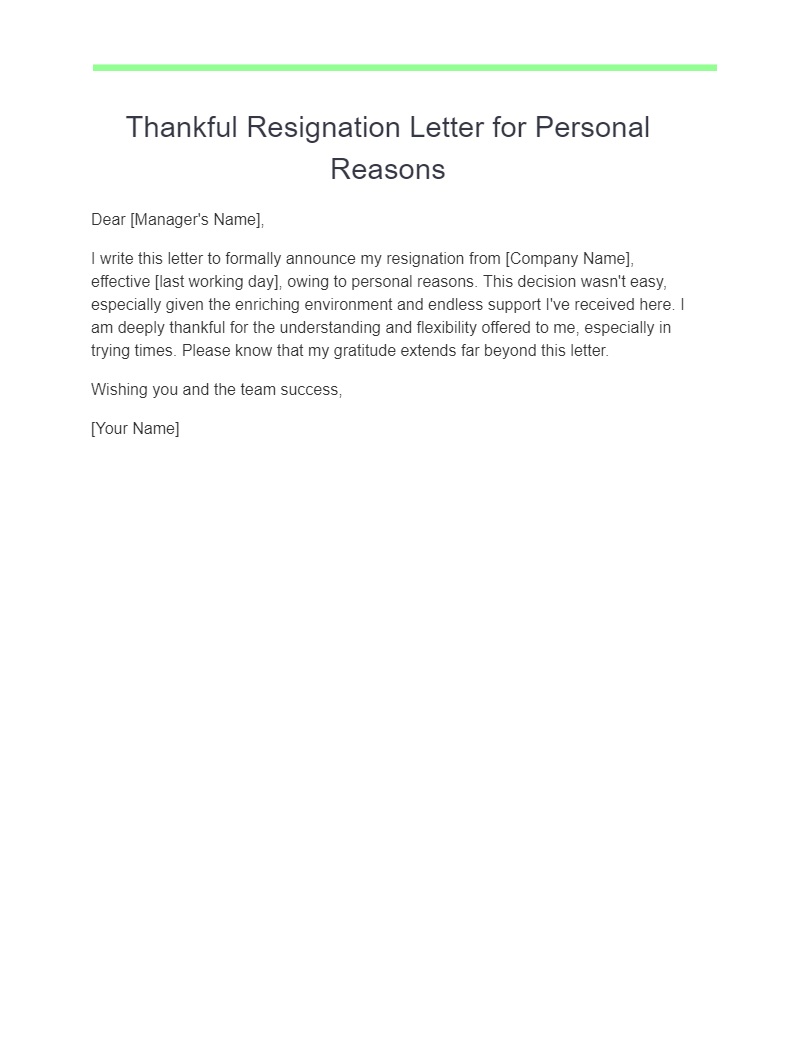

The act of resigning, while sometimes challenging, presents an opportunity to solidify professional relationships and demonstrate maturity. Employing a structured Appreciative Resignation Letter Template provides numerous advantages that extend beyond mere convenience. It ensures that your departure is handled with the utmost professionalism, reflecting positively on your character and work ethic.

Firstly, consistency in communication is paramount. A template ensures that all critical information – such as the effective date of resignation, an expression of gratitude, and an offer to assist with transition – is consistently included. This prevents accidental omissions that could lead to confusion or unnecessary complications during your notice period. The standardized layout enhances clarity, making the correspondence easy for the recipient to process and file.

Secondly, a pre-designed layout inherently promotes a professional tone. Resignation can be an emotional process, but this type of letter helps maintain objectivity and courtesy. It guides the writer to focus on appreciation and positive sentiments, rather than any grievances, which is crucial for preserving your professional reputation. This approach helps to avoid burning bridges, which is particularly important in interconnected industries where references and networks play a significant role in career progression.

Finally, using this document saves valuable time. Instead of drafting a letter from scratch, individuals can quickly populate a pre-formatted structure with their specific details. This efficiency ensures that the notice letter is delivered promptly, adhering to standard notice periods and allowing for a smooth transition for both the employee and the organization. It minimizes stress during a potentially sensitive time, allowing the departing individual to focus on future endeavors.

Customizing This Template for Diverse Formal Notifications

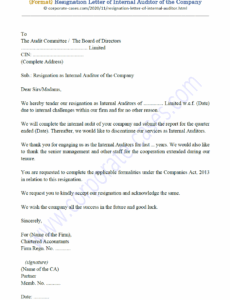

While primarily designed for employment departures, the principles underpinning this appreciative resignation letter template are highly adaptable across various formal notifications. The core elements – a clear statement of intent, an expression of gratitude, and an offer of assistance for transition – are universally beneficial when concluding any formal relationship or request. This versatility makes the template a valuable asset for maintaining professionalism in a multitude of contexts.

For instance, in a business-to-business relationship, this form can be adapted to formally terminate a service contract or partnership. It can express appreciation for the collaboration while clearly stating the terms of disengagement and offering a smooth handover of responsibilities. Similarly, students or volunteers might use this correspondence to step down from a position or withdraw from a program, acknowledging the experience gained and thanking the organizers.

The adaptability of the document extends to scenarios requiring a written request or formal notification where a gracious exit or clear communication is desired. Whether it’s declining an offer, withdrawing an application, or discontinuing a membership, the underlying structure of a grateful and professional message template ensures that your communication is well-received and your integrity maintained. The key lies in adjusting the specific details and expressions of gratitude to match the particular context, while retaining the overall respectful and clear tone.

When Using an Appreciative Resignation Letter Template is Most Effective

The strategic deployment of this document can significantly enhance professional interactions, ensuring a graceful and impactful exit from various situations. Knowing precisely when to leverage this type of formal correspondence can solidify your reputation and maintain crucial professional networks.

Using this template is particularly effective in scenarios such as:

- Employment Resignation: This is the primary and most common use. It ensures a professional departure from a job, thanking the employer for the opportunity and offering assistance during the transition period.

- Voluntary Program Withdrawal: When leaving a volunteer position, a mentorship program, or an educational course, this template allows you to express gratitude for the experience while clearly stating your departure.

- Contractual Relationship Termination (Individual): If you, as an individual contractor or consultant, are concluding a project or agreement, the letter can formally notify the client of your completion and appreciation for the business.

- Declining a Job Offer: While not strictly a "resignation," adapting this template to respectfully decline a job offer allows you to express gratitude for the opportunity while maintaining a positive relationship with the prospective employer.

- Stepping Down from a Board or Committee: For individuals serving on a board of directors or a committee, a formal, appreciative notice letter ensures a dignified exit, acknowledging the work done and the privilege of serving.

- Discontinuing a Professional Association Membership: When deciding to no longer renew a membership with a professional body, this correspondence can be used to inform them, express thanks for past benefits, and state your decision clearly.

- Formal Notification of Relocation: In situations where relocation necessitates a change in an ongoing professional or personal commitment, this template provides a polite way to inform relevant parties and explain the circumstances.

In each of these instances, the structured and courteous approach inherent in the letter helps to preserve positive relationships, ensuring that your final communication reflects professionalism and respect.

Tips for Formatting, Tone, and Usability

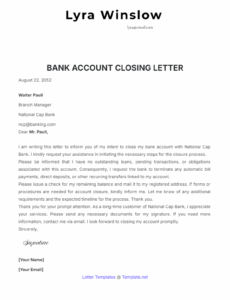

To maximize the impact and clarity of your formal correspondence, meticulous attention to formatting, tone, and usability is essential. Whether delivered in print or digitally, the overall presentation of the letter significantly influences how your message is perceived. Adhering to established professional standards ensures that your message is taken seriously and treated with the respect it deserves.

For formatting, consistency is key. Use a clean, professional font such as Times New Roman, Arial, or Calibri, typically in 10-12 point size. Maintain standard one-inch margins on all sides. The document layout should include your contact information, the date, the recipient’s contact information, a clear subject line, a salutation, the body of the letter, a closing, and your signature. Ensure paragraphs are single-spaced with a double space between paragraphs for readability. For print versions, use quality paper and ensure the physical signature is clear. For digital versions, a PDF format is highly recommended to preserve the layout and prevent unintended edits.

The tone of the letter must remain consistently formal, professional, and appreciative. Even if your departure is prompted by dissatisfaction, this is not the forum to air grievances. Focus on positive aspects, express genuine gratitude for the opportunities provided, and offer constructive assistance during your transition. Avoid overly casual language, emojis, or jargon. The language should be clear, concise, and respectful, reinforcing your professional image. Review the notice letter thoroughly for any grammatical errors or typos, as these can detract from its professionalism.

Usability considerations apply to both print and digital forms. Ensure that the file name for digital submissions is clear and descriptive (e.g., "YourName_ResignationLetter_Date"). For print, make sure the letter is neatly folded (if applicable) and placed in a professional envelope. The goal is for the recipient to easily read, understand, and file the correspondence. A well-formatted and thoughtfully worded letter demonstrates your attention to detail and commitment to effective communication, leaving a positive lasting impression.

The Enduring Value of Professional Communication Tools

In conclusion, the careful application of professional communication tools, such as the template discussed, underscores an individual’s commitment to maintaining high standards in all professional interactions. It transforms what could be a perfunctory act into an opportunity to reinforce positive relationships and leave a legacy of professionalism. This proactive approach to formal correspondence is a testament to an individual’s respect for their past employers and colleagues, and it significantly contributes to their professional reputation.

Ultimately, mastering the art of the appreciative resignation through a structured message template is an investment in one’s future. It ensures that every transition is handled with dignity and grace, providing a reliable and efficient communication tool that serves individuals well throughout their careers. By embracing clarity, organization, and a professional demeanor in all written communication, professionals can navigate their career paths with confidence and integrity.